Tasos Katopodis

This article was researched and written by Waleed M. Tariq.

Investment Thesis

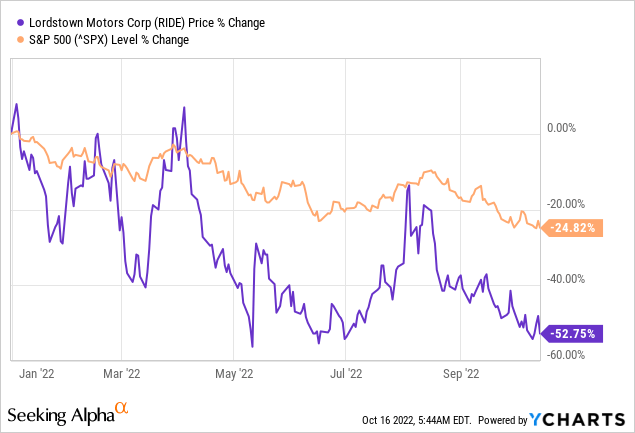

Lordstown Motors Corp. (NASDAQ:RIDE) stock price has halved from approximately $3 to $1.6 per share since I last covered it in February. Since then, noteworthy developments have occurred, including a press release stating that Lordstown will start commercial production of its flagship Endurance vehicles. However, the significant systemic and idiosyncratic risks push me to retain a sell rating.

At this point, I believe the stock is a gamble at best for shareholders despite its $260 million proceeds-generating agreement with Foxconn and the announcement to start production because of significant risks surrounding the company that outweigh any potential rewards, including the stringent market conditions, the high sector competitiveness, soaring inflation, and its strained liquidity.

Moreover, I believe the execution risks are very high as investors’ confidence has faltered after they did not get the full picture of pre-production orders. The company also faces production deadline delays, and the project’s commercial viability in the future is questionable due to strained funding.

The company is currently struggling with production and liquidity issues, which put the company’s survival at risk, making me bearish on the stock.

The Product

Lordstown started marketing its All-Electric Endurance pickup truck as a one of its kind vehicle but that is no longer the case. Rivian’s (RIVN) R1T, GM’s (GM) Hummer EV, and Ford’s (F) F-150 Lightning have already hit the market, with Tesla’s (TSLA) Cybertruck expected for production in 2023.

| Particulars | Endurance | R1T | Hummer EV | F-150 Lightning |

| Price | $52,500* | ~$70,000 | ~$110,000 | ~$40,000 |

| Range | ~250 mi | ~314 mi | ~329 mi | ~230 mi |

| HP | 600 | 600 | 1000 | ~450 |

| 2022 Production Units | ~50 | ~25000** | ~23,000*** | ~15,000 |

*Details removed from the website

**The company has already produced a little over 14,000 vehicles YTD

***The production ramp-up is slow because of its next-gen Ultium Batteries

According to the press release, the company has completed its crash tests and awaits EPA and CARB certifications, with 2 cars off the assembly line and a 3rd on its way. The production is “subject to full homologation testing and required certifications,” which are likely to be a positive catalyst for the stock if and when issued.

FMVSS crash testing has been completed successfully, and EPA and CARB applications have been submitted. We also continue to accumulate test miles on the vehicles, finalize other certifications, and complete software updates as we work to ensure the best experience for our customers. We expect to deliver approximately 50 units to customers in 2022 and the remainder of the first batch in the first half of 2023, subject to raising sufficient capital.

Relative to its competitors, Endurance has average specs, limited production, and a lack of resources to outcompete industry behemoths like GM and Ford. In my opinion, the removal of the pricing information from its website amid soaring inflation indicates that it’s likely the price will increase.

Liquidity Issues

The systemic risks posed by the inflated pre-recession market have shaken investor confidence across multiple industries, including the EV sector, with companies like Rivian and Lucid (LCID) reporting a stock price decline in response to the latest CPI numbers. The macroeconomy and competition are major factors that come into play when analyzing a stock, but Lordstown is inflicted with significant internal issues that need to be addressed before it can start competing.

The company held $235 million in cash at the end of Q2 & expects to end the current quarter with $195 million. The management expectations are currently about $110 million for the year-end. To carry out its targeted production of 500 vehicles in the first batch, it will need to raise a significant amount of cash either through debt, which will be extremely challenging because of the reasons mentioned below, or equity issuance, which will require significant market confidence in the stock.

The $100 million commitment received from Foxconn through the JVA consists of $55 million of capital injection and a $45 million loan, exclusively to fund its EV capital commitments, in the form of 7% 2025 notes, which have been secured against the following:

(i) all of Lordstown EV’s equity interests in the LLC, and (ii) personal property constituting the hub motor assembly lines, battery module assembly lines, and battery pack assembly lines.

This debt secured against essentially all of RIDE’s assets makes it unlikely that the company will be able to raise further debt. According to the company’s Q2 Form 10-Q, fundraising remains one of the largest risks to the company’s survival and future viability.

Even though the APA, the Contract Manufacturing Agreement, and the Foxconn Joint Venture Agreement (together, the “Foxconn Transactions”) were consummated, we will need additional funding to execute our 2022 business plan and to achieve scaled production of the Endurance due to the capital required to complete testing and validation, purchase the raw materials and vehicle components for saleable vehicles, invest in the hard tooling to lower our bill of materials cost and fund future engineering and corporate expenditures. As discussed above, the Company incurred debt to fund our investment in the Foxconn Joint Venture, and no assurance can be given that we will be able to raise sufficient capital or realize the potential benefits of the Foxconn Transactions.

The company has stated that the remainder of the 450 vehicles from the first batch will be produced in H1 2023, “subject to raising sufficient capital,” but raising capital in the current macroeconomic environment is not an easy task and quite a challenge for a pre-revenue company with no track record and significant execution risks.

One More Thing To Ponder!

The significantly low production volume also raises another concern regarding the company’s credibility pertaining to the “supply chain issues” that it keeps reciting. If the company has been planning to roll out the vehicles since 2020 and planned to produce 500 vehicles during 2022, of which only 2 have been assembled, and another 48 are expected before the year ends, how has it not been able to source the 1500 parts required per vehicle? This leads me to wonder whether the statements are inaccurate or whether there are issues with the performance of its supply chain team.

Conclusion

A contrarian view that the company is just starting production and is likely to capture a notable market share within the decade, leading to a stock upsurge, just like Tesla, can definitely be taken by investors with a high-risk tolerance. However, the facts and figures indicate that the possibility of that happening is quite low, and I believe that such an investment is likely to be nothing more than a gamble.

The above analysis doesn’t touch the fact that once the company produces the vehicles, it has to successfully sell them as well. Delayed production in a rapidly saturating market with competitors that are significantly larger in size has already cost the company a first-mover advantage and imposed significant future hurdles and challenges.

Overall, I am still bearish on the stock because the company’s non-existent executional track record does not provide any assurance toward its future. The significant risks surrounding the stock, which far outweigh the rewards, make me rate it as a “sell.”

Be the first to comment