Ezra Acayan/Getty Images News

Investment Thesis

With a presence in 119 countries, McDonald’s (NYSE:MCD) is surely one of the most recognized QSR brands globally. The company is very efficient in its operations and has peer-leading operating as well as net profit margins. A strong brand and efficient operations have driven the company’s, and its stock’s, growth over decades.

McDonald’s has an excellent dividend payment record which makes its stock attractive for income investors. It has good growth prospects with healthy near-term store opening plans. Further, it has some leeway to pass-on rising costs due to inflation to consumers through price increases.

Being in the low-priced QSR segment makes the restaurant better insulated from economic slowdowns than dine-in restaurants. So, this is a stock that you can confidently buy, even amidst fears of an impending recession.

About

McDonald’s operates under a company-owned as well as a franchise model. The majority of its restaurants are franchised (around 93%). The franchise model makes the company asset-light and easier to manage and grow.

Under the conventional franchise arrangement, the company generally owns or secures a long-term lease on the land and building for the restaurant. This ownership of real estate enables McDonalds to have performance levels that are among the highest in the industry. I’ll discuss how this happens later in the article.

The company has three segments-

- U.S. – the company’s largest single market

- International Operated markets – comprising of Australia, Canada, France, Germany, Italy, the Netherlands, Russia, Spain, and the U.K.

- International Development licensed Markets & Corporate – Comprised of developmental licensee and affiliate markets.

Diversified revenues

McDonald’s receives significant revenue from non-U.S. markets for both company-operated as well as franchised restaurants. This reduces its dependence on the domestic U.S economy. Additionally, the company has a healthy mix of franchise and company-operated restaurants revenue split. Company operated restaurants contribute 42.8% whereas franchised restaurants contribute 57.8% of the mix.

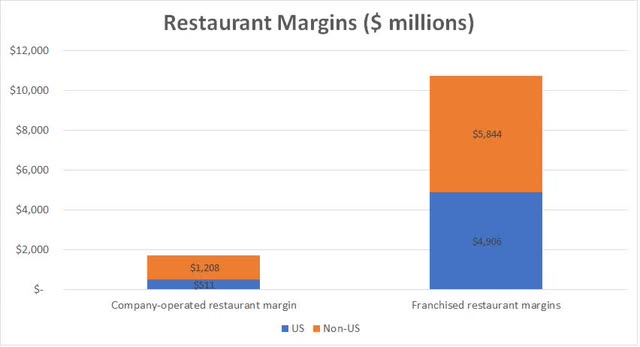

Franchised margins contribute nearly 85% of the restaurant margin dollar. Even in margins, the non-U.S. region contributes more than the U.S. Thus, the company has well balanced revenue between domestic and international markets.

In the first quarter, McDonald’s total revenue grew 10.6% YoY to $5.7 billion, driven by strong performance in France, U.K., and all International Development licensed markets, except China. Net income for the quarter fell 28% YoY, primarily due to a one-off item related to an international tax matter.

Global comparable sales increased 11.8%, driven by a 3% increase in the U.S., 20.4% increase in International Operated Markets, and 14.7% increase in International Development Licensed Market. Comparable sales in the U.S. grew due to strategic menu price increases, strong marketing promotions, and growth in digital channels.

In International operated markets, reduction in COVID-related restrictions led to positive comparable sales. International Development licensed Markets’ comp sales growth was driven by Japan and Brazil, partially offset by negative comparable sales in China due to continued COVID-19 resurgences and restrictions.

Overall, McDonald’s posted a strong performance in the first quarter.

Resilient in the face of inflation

As per a report by National Restaurants Association, by 2030, “Total employee compensation costs will increase as a percent of sales.” Likewise, commodity price inflation is already hurting restaurants’ margins. However, McDonald’s is relatively resilient to rising costs.

McDonald’s increased its menu prices by roughly 8% in the first quarter to pass-on a part of rising costs due to inflation to consumers. While rising prices generally hurt restaurant traffic, that isn’t largely the case for McDonald’s, as it operates in the value segment. The company believes that the impact of inflation on home-cooked meals is probably higher as compared to its menu price increases. So, the price increase may not hurt McDonald’s traffic.

At the same time, the company continues to move forward with its growth plans. This year, management aims to open over 1,800 restaurants globally, with a net restaurant addition of around 1,400. This translates to nearly 3.5% increase in store count. This coupled with various initiatives like drive-thrus, tie-ups with delivery partners, and loyalty program roll outs can help the company sustain its revenue growth in the coming years.

Massive operations

McDonald’s management reviews its performance based on data compiled by Euromonitor International. The company measures itself against the informal eating out, or IEO, segment. This segment includes limited-service restaurants, street stalls or kiosks, cafes, specialist coffee shops, self-service cafeterias, and juice/smoothie bars.

Based on Euromonitor data, the global IEO segment has approximately 10 million outlets and generated roughly $1 trillion in annual sales in 2020. McDonald’s’ systemwide restaurant business accounted for 0.4% of those outlets and 9.3% of those sales. McDonald’s seems to be far more efficient in generating revenue than the IEO segment, as its share of sales is significantly higher than the share of outlet count.

Based on the entire restaurant industry, including IEO segment defined above and all full-service restaurants, Euromonitor International estimates there are 19 million outlets and they generated $2 trillion in annual sales in 2020. McDonald’s systemwide restaurant business accounted for 0.2% of those outlets and 4.6% of those sales. This shows the massive scale of McDonald’s operations, which account for 4.6% of the total global restaurant sales.

There are several things that McDonald’s does to drive its sales. The company expects to complete the roll-out of its loyalty programs across the top six of its markets in the first half of 2022. Having loyalty programs keeps the customers engaged and increases repeat sales to the same customer.

The number of restaurants that offer delivery has also grown to over 33,000, which represents roughly 80% of McDonald’s’ restaurants. On the delivery front, the company has also entered long-term partnerships with UberEats and DoorDash. This surely will help boost its delivery capabilities.

Finally, the company believes drive thrus will become more critical with customer’s demand for flexibility and choice. Thereby, the majority of new restaurant openings will include a drive thru. The added convenience of drive thru helps people buy at McDonald’s even when they are short of time. This results in added revenue with negligible incremental real estate cost.

A solid franchise model

The benefits of McDonald’s owning the properties that it rents out to franchisees are well-documented. Let me still take a moment to highlight it for starters.

In 2021, McDonald’s’ revenue from franchised restaurants was $13.1 billion. Rents accounted for $8.4 billion, or 64% of this amount while royalties accounted for most of the remaining franchise revenue. McDonald’s conventional franchise arrangements usually include a lease and a license and provide for payment of an initial fee, as well as continuing rent and royalties to the company based on a percent of sales with minimum rent payments. The minimum rent payments are based on McDonald’s investment in owned sites and its underlying leases on properties that are leased.

What the above mean is that McDonald’s earns the difference between rent it charges and lease payments it pays irrespective of sales from the underlying restaurant. Additionally, there is a variable rent amount tied to sales, that it gets on top of the minimum rent amount. So, strong sales mean stronger rent revenue for McDonald’s, in addition to higher royalty payments.

A focus on returning value to shareholders

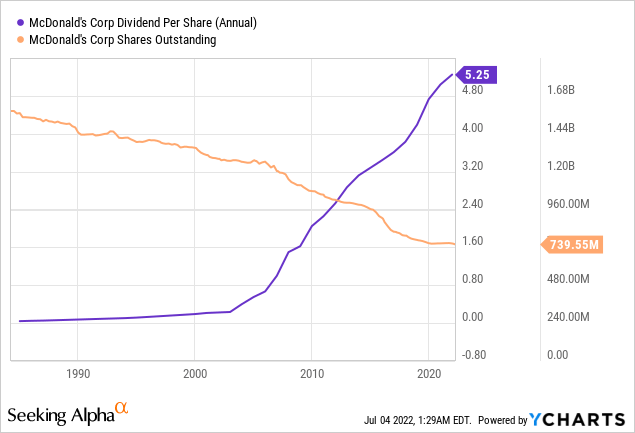

McDonald’s has a share repurchase program effective January 2020, that authorizes purchase of up to $15 billion of the outstanding stock with no specified expiration date. As of the end of 2021, shares worth $1.7 billion have been repurchased.

The company has an outstanding dividend track record of increasing dividends for 46 consecutive years. The dividend yield has largely been in the range of 2-3% in the last five years.

A long track record of dividend growth, a decent yield, and visibility for continued growth makes McDonald’s stock attractive for dividend investors.

Valuation

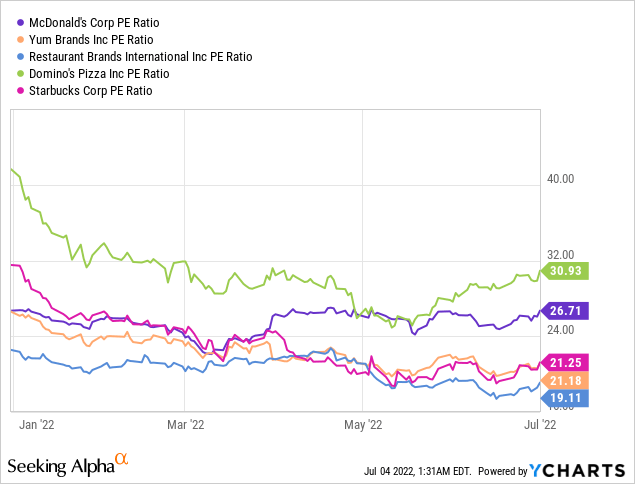

Compared to its peer group, McDonald’s stock is trading at a premium.

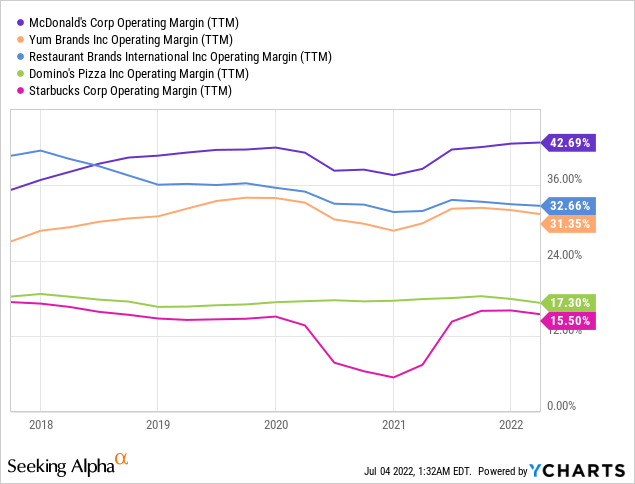

However, the stock has historically traded at a premium compared to its peers. McDonald’s has better operating profit and net profit margins that partly justify its premium valuation. McDonald’s operating margin of 42.9% is significantly higher than that of its peers.

Similarly, McDonald’s net profit margin is also on the upper side when compared with its peer group. In all, McDonald’s higher margins, strong growth history, scale of operations, and steady dividend growth justify the premium valuation of its stock compared to its peers.

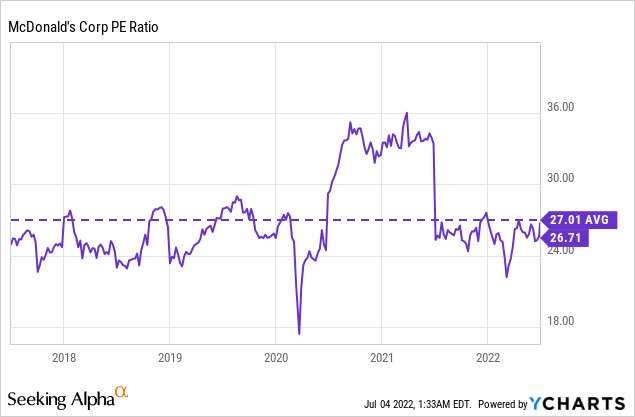

The stock is trading slightly below its own 5-year average PE ratio.

So, the stock’s valuation looks decent if you are planning to buy it right now.

Seeking Alpha’s proprietary Quant Ratings rate McDonald’s stock as “Hold.” The stock is rated low on valuation and growth factors, but high on profitability and momentum factors.

Conclusion

McDonald’s has a history of paying steadily growing dividends over the years. The stock’s P/E ratio is in-line with its 5-year average P/E ratio. Compared to peers, it is trading at a premium, however that premium looks justified.

A strong brand and efficient operations should help drive McDonald’s growth in the years to come. The company has a good pipeline of new restaurants opening in 2022. Being in the value segment of QSR market, McDonald’s will likely be less affected even if there is an economic slowdown. So, this is a stock that you can confidently buy, even amidst fears of an impending recession. Overall, McDonald’s stock looks an attractive buy right now.

Be the first to comment