mccawleyphoto

Shares of MetLife (NYSE:MET) have held in fairly well, essentially treading water over the past year during a period of significant market tumult. The insurance business is largely noncyclical, helping to insulate MetLife from some of the debate around the likelihood of the recession. While the stock is inexpensive, I would rather be in an insurer that either trades below book value or has a shorter duration investment portfolio, like AIG (AIG).

In the company’s second quarter, MetLife had a lot going on, and it was a reminder that insurance accounting has certain unique attributes that are crucial to understand when evaluating financial results. Adjusted earnings excluding one-time items were $1.55 billion or $1.90 per share, down 17% from last year as investment returns moderated but underwriting improved. Overall, premiums rose 23% year over year to $13.8 billion while unadjusted investment income dropped a third.

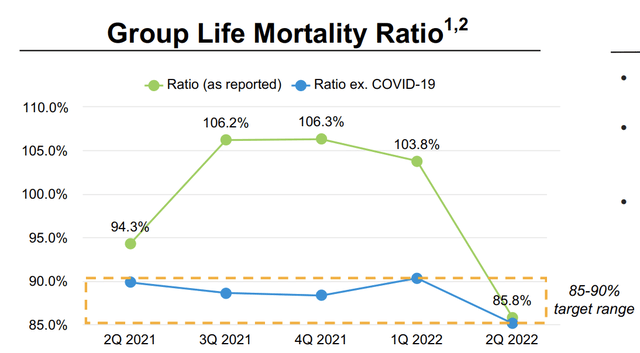

In the US, which accounts for about half of the business, earnings fell 13%, though underwriting results improved, led by the group benefits group as the headwind of COVID fades away, allowing earnings to rise 61% to $400 million. As you can see below, the excess mortality associated with the COVID-19 pandemic caused the company to have a loss ratio over 100%. 100% represents breakeven, so over the past three quarters, MET was losing $5 for every $100 in policies. This quarter it returned back to the targeted 85-90% loss ratio. Barring another round of pandemic deaths, what has been a $250-$300 million hit to earnings is now largely behind MetLife.

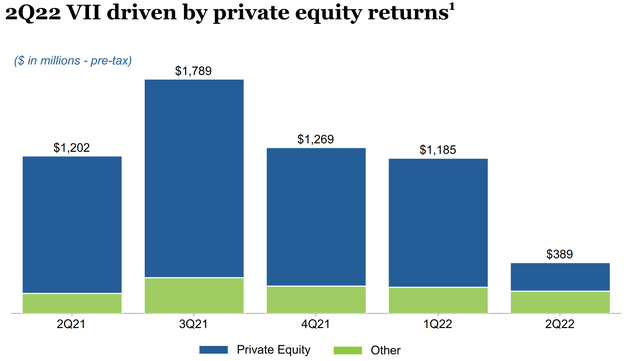

These gains were offset by declines in the retirement business as this is where riskier investments, like private equity, are held in larger size. We will examine the investment portfolio in greater depth below, but in general, private equity returns tend to be correlated with the stock market, so the decline in PE income is not surprising. This higher-risk investment is one area where insurers do carry some cyclical risk.

Outside of the US, Asia profits fell 26% with a 4% currency hit. European earnings had a 16% headwind from currency. In general, investment headwinds were similar overseas as domestically. Currency will continue to be a significant headwind for the company as the US Dollar remains quite high vs the yen, euro, pound, and most other currencies. This could be a $250-350 million headwind to reported results over the next year if the dollar remains at current levels.

The big headwind MetLife faces is that adjusted net investment income fell by $600 million to $4.5 billion. Excluding private equity, it was up about $200 million. As you can see below, PE returns fell dramatically. I expect to see continued weakness in PE returns in Q3 and likely Q4 given the stock market volatility. While private equity investments do not change value every day like publicly-listed stocks, their valuation tends to be correlated, sometimes with a lag. So just as strong 2021 stock market returns came with strong PE returns, the reverse is likely to be true over the balance of the year.

While private equity can drive much of the quarterly volatility in investment income, like most insurers, MetLife primarily invests in bonds. Here is where the details matter. The company’s book value came at $41.73 in Q2, down from 40% from last year, a shocking decline. This is because last year, the firm had an $18.6 billion unrealized gain on assets; now it has a $9.5 billion unrealized loss. That is nearly a $30 billion swing.

Of the $448 billion carrying value in its investment portfolio, $368 billion is allocated to bonds and mortgages. As interest rates have risen dramatically over the past year, bond prices have fallen, causing this drop in book value and unrealized gains. These unrealized gains flow through into accumulated other comprehensive income (AOCI). If we exclude AOCI, book value was $55.54, down 1% from a year ago.

For an insurance company, it makes sense to look at results ex AOCI. Insurers primarily run their investment operations using a “book value” approach, essentially carrying bonds as their purchase price until maturity. The company seeks to match the duration of its investment portfolio with that of its insurance contracts. When the company sells you a life insurance policy, if based on the actuary tables you are expected to live 30 years, it prices the policy based on what 30-year interest rates are. It then buys a portfolio of 30-year bonds with the premiums you pay. In this way, it has hedged the interest rate exposure to the business.

So while the value of its holdings fell by $28 billion, the theoretical present value of its insurance policies also lose value as rates rise. This benefit to MET isn’t reported in financials. Moving the value of the assets but not the liabilities creates a misleading picture of its financial health (last year’s book value overstated MET’s worth, now it understates it). By simply excluding AOCI, and valuing the bonds at their amortized purchase price, this issue is essentially moot.

I stress this because interest rates have continued to rise. As a consequence, MET is likely to report further book value declines in Q3 results and a greater unrealized loss on its investment holdings. It is important to look past that and see what results are ex-AOCI. Here, results were stable with book value down slightly and an adjusted return on equity of 14.3%. One point of caution is that while the company “seeks” to hedge the duration risk, it is impossible to know if this was done perfectly immediately, and when interest rates have swung as dramatically as they have, the market is likely to price in some additional risk premium in case there was a duration mismatch, which will materialize itself over time in worse life & retirement profits.

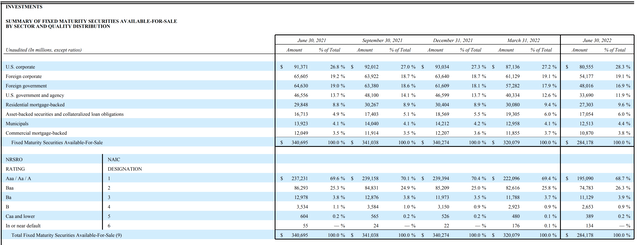

Rather than movements in interest rates impacting bond prices, I would be more worried about credit losses. If MetLife lends money to a corporation that defaults, that is a permanent loss that will be realized at some point. Fortunately, the company has a very conservative portfolio. Just 5% of its fixed maturity portfolio is rated below investment grade (Ba, B, or Caa). This portfolio should be able to weather a downturn with limited losses.

During the quarter, the yield on its bond portfolio rose 0.14% to 3.66% as MET has been able to invest new premiums and maturities into higher-yielding securities. As the company continues to do this, this will create some tailwind for its investment earnings potential. However, given its retirement business, its bond portfolio has a longer duration. Based on its swing in unrealized gains, MetLife’s portfolio has exhibited a 7-9 year duration. That is nearly double AIG’s portfolio. That longer duration means fewer bonds mature every year, which means it will take longer for higher interest rates to boost income for MET than some other insurers.

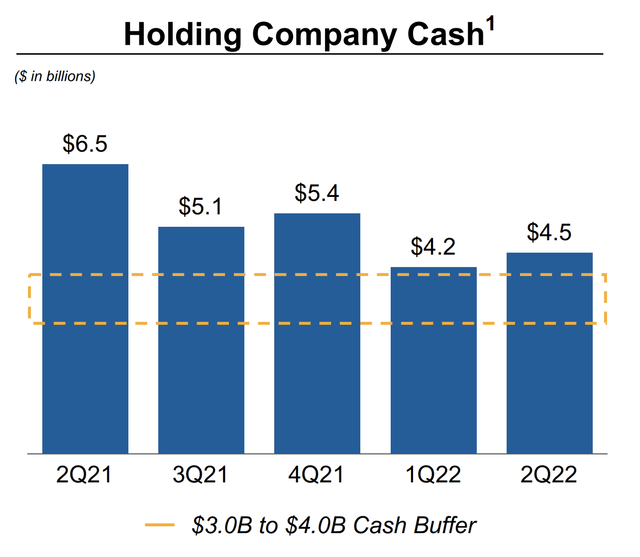

I would also note that MET has been returning significant cash to shareholders, including a $1.1 billion buyback in Q2. As a result, its share count has fallen by about 7.2% from a year ago. The company has spent down much of its excess cash holdings with these buybacks, so while MET will be able to use ongoing earnings to repurchase stock, the pace may be slower over the next year than the last year.

With some currency headwinds and private equity results likely to remain changed, partially offset by rising interest income, I would look for MET to have about $7.5-$8.00 in earnings power, giving the stock about an 8.5x P/E. The stock also trades at 1.14x book value. In addition to its 3.2% dividend yield, MET should be able to return $3.5-$4 billion to shareholders via buybacks. With underwriting improving after COVID and a conservative investment portfolio, I believe MET merits some premium to book value, but shares will be unlikely trade much higher until interest rates stabilize for several quarters and we see how investment and underwriting results are after the very volatile gain/loss swings settle down.

While MetLife may hold in better than the market the current bear market worsens given its defensive characteristics, its upside is limited. If shares trade down to book value, I would be a buyer, but at these levels, MetLife is a hold, and I see better options elsewhere.

Be the first to comment