Oselote

It feels like ages since we heard from Nvidia (NASDAQ:NVDA) about its disappointing guidance for FQ3. In fact, every other semiconductor has already reported earnings and guidance for the current quarter since then. So it leaves Nvidia as the lone “high-growth” semiconductor to either put the cherry on top of disappointment with poor FQ4 guidance or find outperformance in areas outside client and retail, bucking the trend of peers. Of course, the one segment this can happen with is Data Center, which I’ll be watching closely when Nvidia reports on Wednesday.

It’s no secret, nor surprise semiconductors are seeing tremendous weakness in the client aspect of their businesses. AMD (AMD), Intel (INTC), Micron (MU), and Qualcomm (QCOM), among others, have all reported weak quarters in this particular market segment and continue to see the weakness prevail in the current quarter. Therefore, Wednesday is not about Nvidia’s Gaming segment, where the brunt of its retail weakness is found, but about what can buoy it until this segment recovers.

Outperformance in a segment outside consumers is key to becoming the best player in a weak time.

I single out Nvidia because of the trends across tech where layoffs are being switched out for investments in AI (artificial intelligence). I told my readers in June to expect this shift before it began. It was then solidified in Meta Platforms (META) Q3 earnings press release, where it called out AI investments directly to help its business while laying off 11,000 employees shortly thereafter.

For 2023, we expect capital expenditures to be in the range of $34-39 billion, driven by our investments in data centers, servers, and network infrastructure. An increase in AI capacity is driving substantially all of our capital expenditure growth in 2023.

– Meta’s Q3 Earnings Release

I plan to dive deeper into this in another article, but the relevance here is to keep an eye on Nvidia to see how much it benefits from companies like Meta investing in AI more heavily and how it’s a tailwind in a recession and not a headwind.

The contrast between retail and cloud is quite astonishing when you think about it. The economy is being hit with high inflation and a pullback in retail spending, yet cloud providers are boosting CapEx to add more capacity. We saw this when the pandemic first started; expansion to accommodate massively increasing end use of the cloud.

But now, the cloud needs to provide businesses with a more efficient workforce – cut headcount but continue to provide the same or better services. The answer is AI. This is precisely what Meta outlined in its earnings and why Nvidia is in a prime position to capitalize.

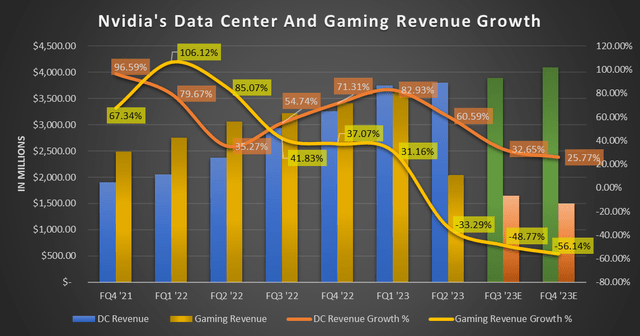

With its Gaming segment now massively underperforming, its Data Center division is both the highest-grossing revenue center by far and the fastest growing. However, the Auto segment is challenging the latter.

Chart and estimates mine, data from Nvidia Revenue Trend PDF

The company expects sequential gains for FQ3 in the Data Center. The question is, to what extent?

I have modeled a modest 2.5% sequential gain in the data center for FQ3 and 5.1% sequential growth in FQ4. This may be a bit ambitious, but there are a few orders the company expects to realize in FQ3 that weren’t in FQ2, so there’s opportunity for outperformance there. Additionally, there’s the backdrop of an already weak Chinese cloud market, but also the hoarding of A100 and H100 units to get ahead of the export ban from the US.

The magnitude of these give and takes can sway the Data Center segment from minimal sequential growth to more pronounced growth capable of offsetting more of the Gaming segment weakness. If there’s Data Center outperformance, it’ll carry overall revenue and create a better outlook on the top line.

That being said, analysts are questioning Nvidia’s Data Center outlook, likely for FQ4, as the company has already guided for sequential growth for FQ3. They’re contemplating what I mentioned between China demand, China high-performance chip hoarding, and North American cloud weakness. At the end of the day, I expect Nvidia to outperform in Data Center as it navigates the current climate as North America remains strong, especially as 2023 ramps up.

In terms of details, I’ll be listening to the earnings call for color around North America’s cloud providers and the relative strength there. While sequential gains in this region were offset by China, they doubled year-over-year, according to the CEO on last quarter’s earnings call. But, judging from Meta’s 2023 plans, Nvidia should see strength continue in the near and medium term as investments ramp up at the Facebook parent – and other cloud providers, for that matter. Additionally, any color on the extent of the retail correction would be meaningful, as the expectation for channel inventory is for it to be almost resolved by year-end.

While the stock has pulled itself off the bottom in recent weeks, it may not make a straight-line back to $200, especially if things don’t align with current expectations. But, given the low expectations for retail and the increasing hesitancy from analysts on data center, it may not take much to push the stock higher going into the end of the year if there’s any upside in Data Center revenue.

There are a lot of small details waiting to be shared in Wednesday’s call, and I look forward to comparing them to the market’s expectations.

Be the first to comment