Rafael_Wiedenmeier/iStock Unreleased via Getty Images

Intro to Lonza

Based in Switzerland, but with operations globally, Lonza Group (OTCPK:LZAGY) is a $40 billion contract development and manufacturing organization (CDMO). This makes the company the largest pure-play CDMO in the market beyond names such as Catalent (CTLT) and Avid Bioservices (CDMO). While most large pharmas – such as Pfizer (PFE), GSK (GSK), AstraZeneca (AZN), and even Samsung (OTC:SSNLF) – have plenty of in-house manufacturing, there may be a transition from in-house to contracting as therapies become more complicated in terms of production. Also, considerations such as risk management (suppose a biotech spends on in-house manufacturing prior to FDA approval but fails to get approved) and cheaper outsourcing all support the CDMO environment.

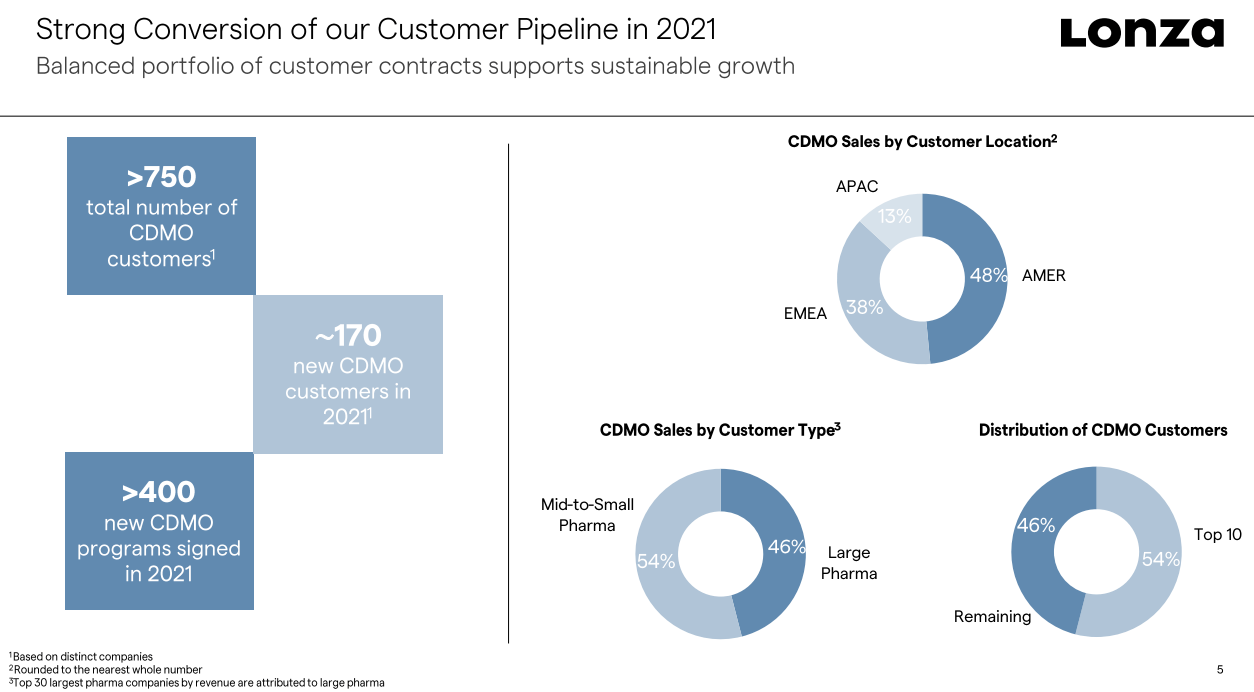

At the same time, drug developers are putting a lot of trust in a CDMO when contracted, and failures or mistakes will be a huge black swan event for the industry. As such, risk is reduced as a CDMO matures and expands their relationships. This makes Lonza potentially one of the least risky pure-plays, as highlighted by their ~750 customers across the world and almost 20 years of experience. This article will highlight why Lonza proves the CDMO business model is a great one for investors to favor.

Lonza

Financial Breakdown

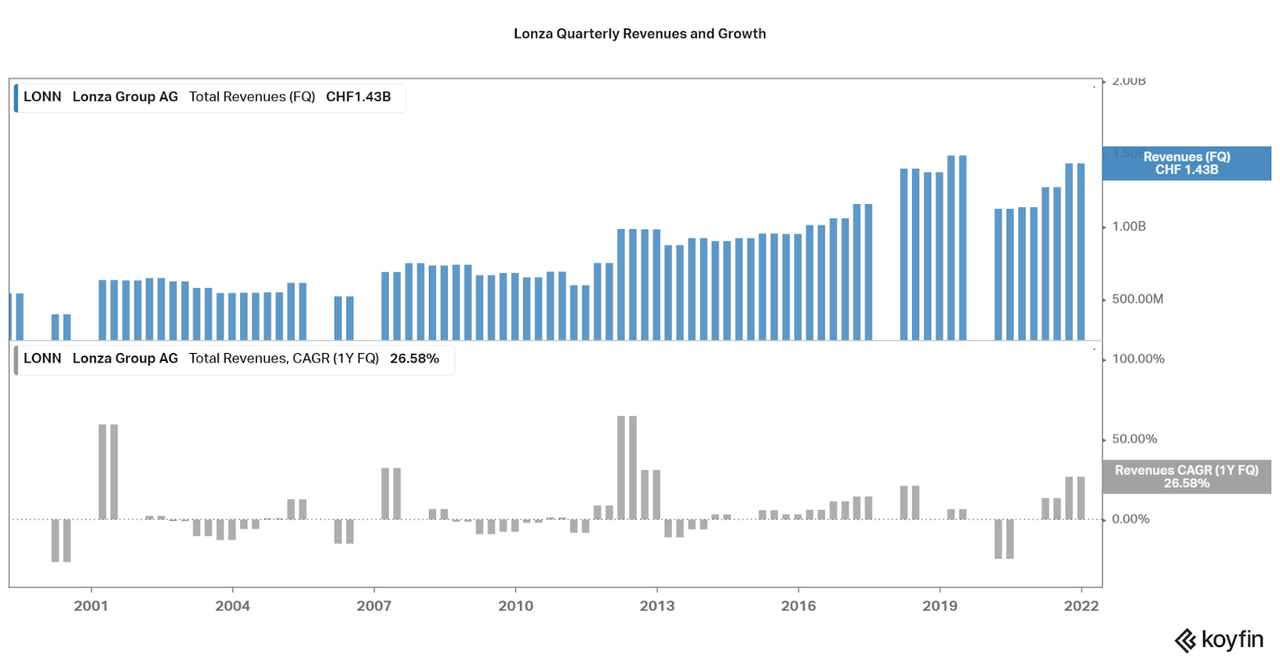

One of the primary reasons why Lonza – and other CDMOs in general – are more favorable as investments is thanks to revenue growth that is at a higher rate than pharmaceutical companies. While many pharmas have flat to ~5% revenue growth over the past 10 years, Lonza has a 7% annual rate. While slightly cyclical since the late 90s, the company has exhibited fairly steady, linear upward growth since the early 2000s. However, the pandemic took its toll on the entire industry, and revenues are just now returning to levels seen prior to the pandemic. I expect a return to form within a few quarters regardless of the economic situation, as the FDA backlog reduces in size and new therapies enter the market. Thankfully, Lonza has invested in expanding their own manufacturing capabilities and this will allow new contracts to be fulfilled moving forward.

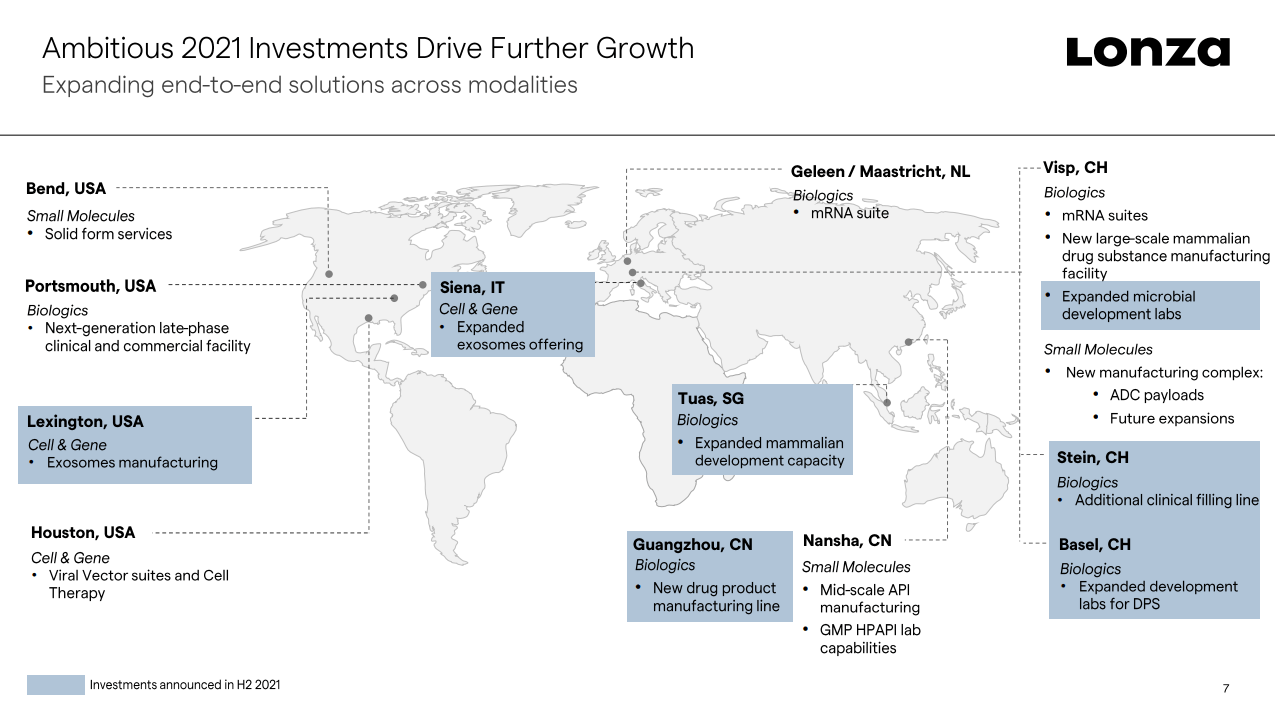

Koyfin Lonza

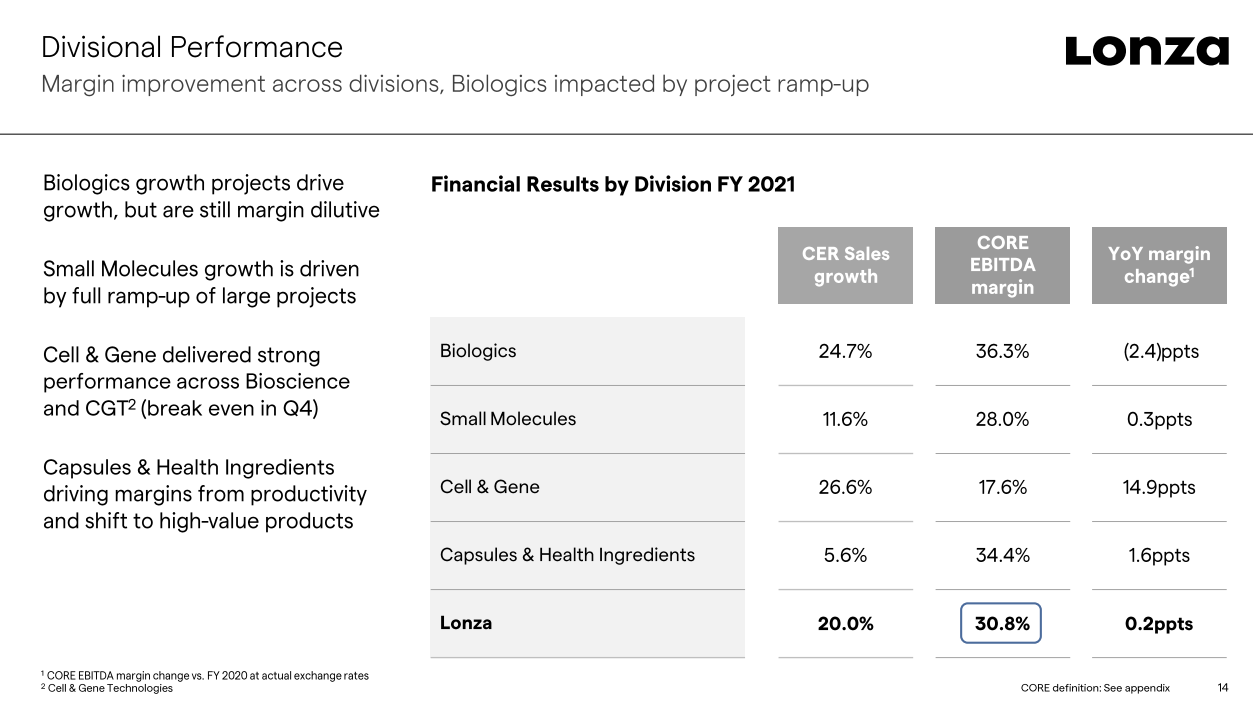

Recent revenue growth has been predominantly in the Biologics and Cell & Gene Therapy segments. However, this is where modern medicine and market growth are heading as small molecule and capsular/health manufacturing become more commoditized. Therefore, it is good to see 25%+ growth in the two most important segments. In fact, Lonza recently sold their Specialty Ingredients segment to reinvest in the future-focused growth segments. Also, look to the company to increase the complexity of their offerings through R&D in order to maintain profitability as competition arises. It will be important to be two steps ahead of peers to be able to earn the newest, highest value contracts from clients.

Lonza

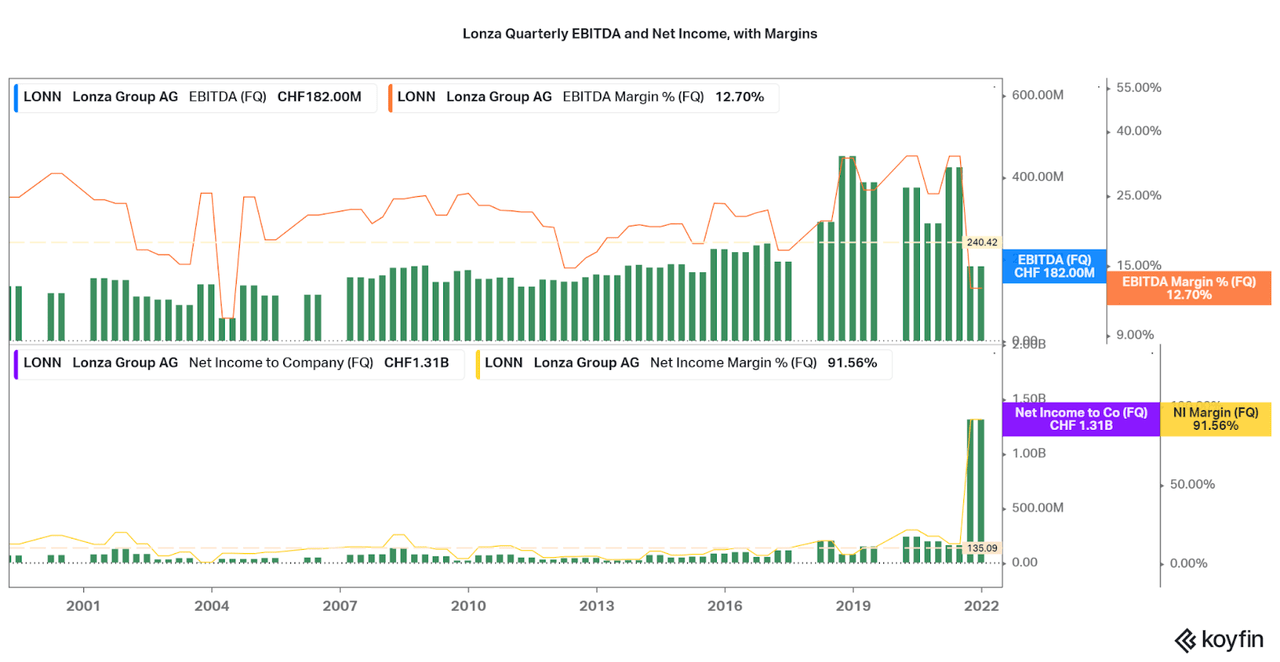

I will now move on to discussing the profitability of Lonza, one of the stronger traits of the company. Lonza has a long history of maintaining high-profit margins on their revenues. At the same time, net income was suppressed to drive investments into the company, but without accruing losses. The EBITDA margin has averaged around the 20% mark through the company’s history, but management is looking to increase their profitability moving forward. At the same time, a recent boost to net income from asset sales helps flush the balance sheet with cash that could have been earned if NI margin was at a normal level.

Koyfin

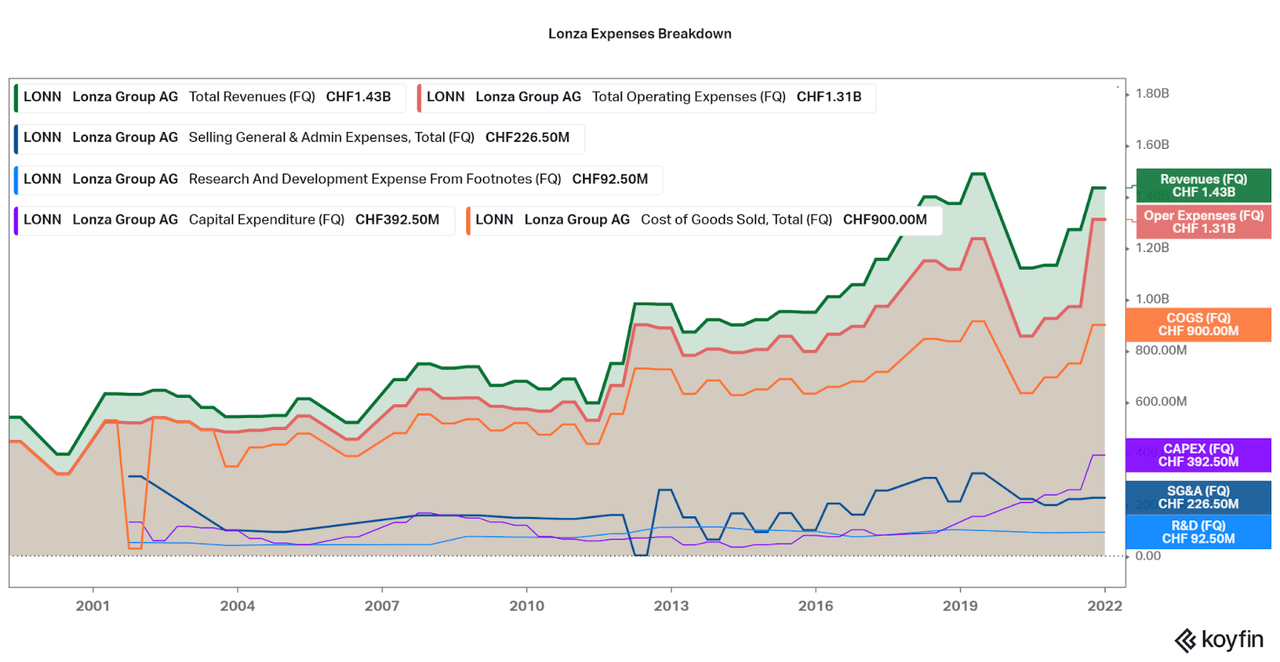

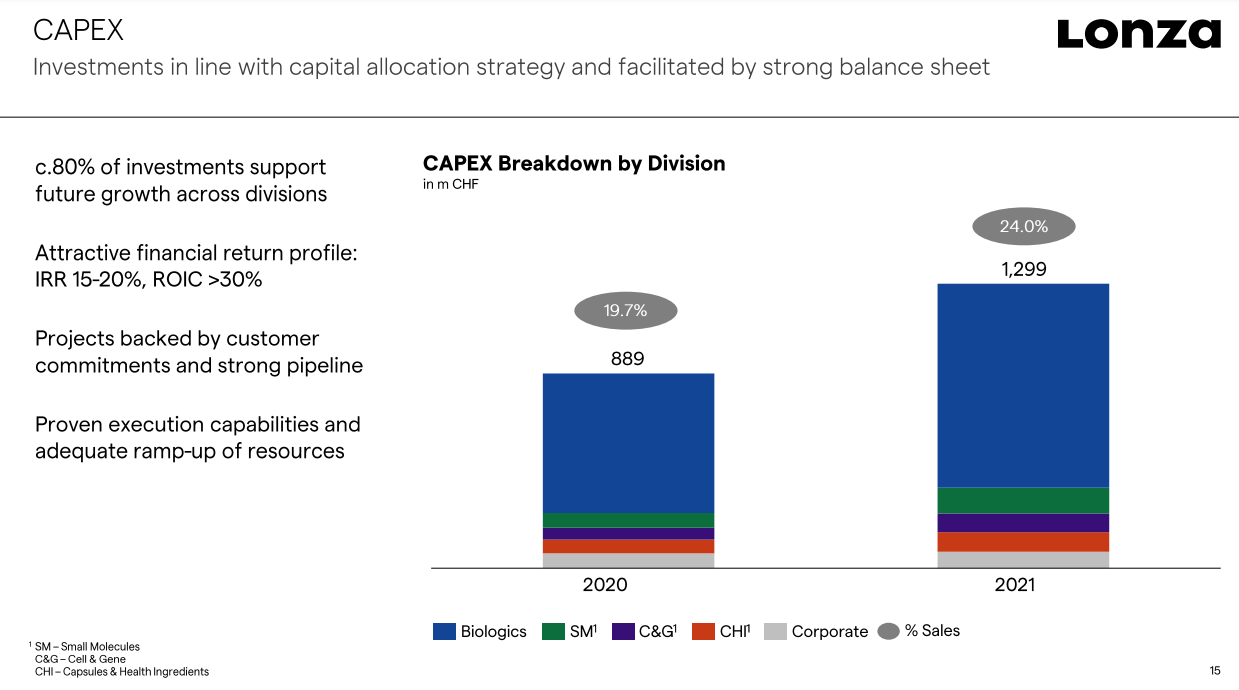

To easily see where money is flowing for Lonza, I separated out expenses by type. Most importantly, we can see the green shaded areas as operating profits, and this chart highlights the consistently positive profitability. At the same time, we can see that profits are mostly being driven by the costs of revenues, or goods sold, whether due to ingredient costs or the licensing of therapy intellectual property. The low spend on SG&A as a proportion of revenues is always a great sign towards a strong business model. No unnecessary expenses from marketing, sales, or administrative costs are detracting from both revenue growth and profitability. At the same time, we can see the company putting in millions of dollars (or Swiss francs) into CAPEX and R&D spending to support the future revenue potential. This is because the majority of CAPEX spending is going directly into the high-growth biologics segment.

Koyfin Lonza

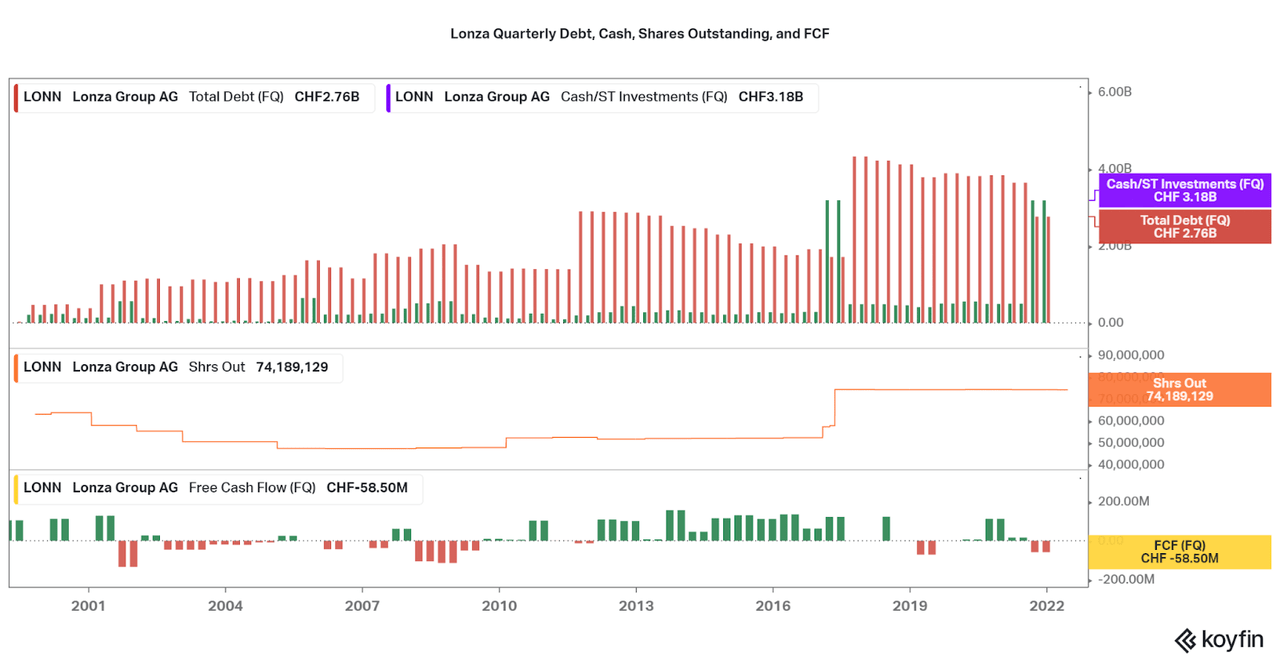

While profits are high, and net income losses are non-existent, some risk factors show up on the balance sheet. First, the significant levels of debt on the balance sheet. At ~$2.7 billion USD, or 5% of market cap, there is little wriggle room in terms of leverage. However, S&P ranks the company as BBB+, investable and stable, and the debt has an average interest rate of less than 2%. Additionally, shareholders have seen some dilution over the years, although not since an acquisition in late 2016. Therefore, while initially risky-looking at first glance, Lonza is just another well-capitalized European company that occasionally performs leveraged acquisitions. While it will be a factor moving forward, if shares are issued in the future, the underlying earnings growth will far outpace dilution in my eyes. Just look at the current diluted EPS 10-year annual growth rate of 29%.

Koyfin

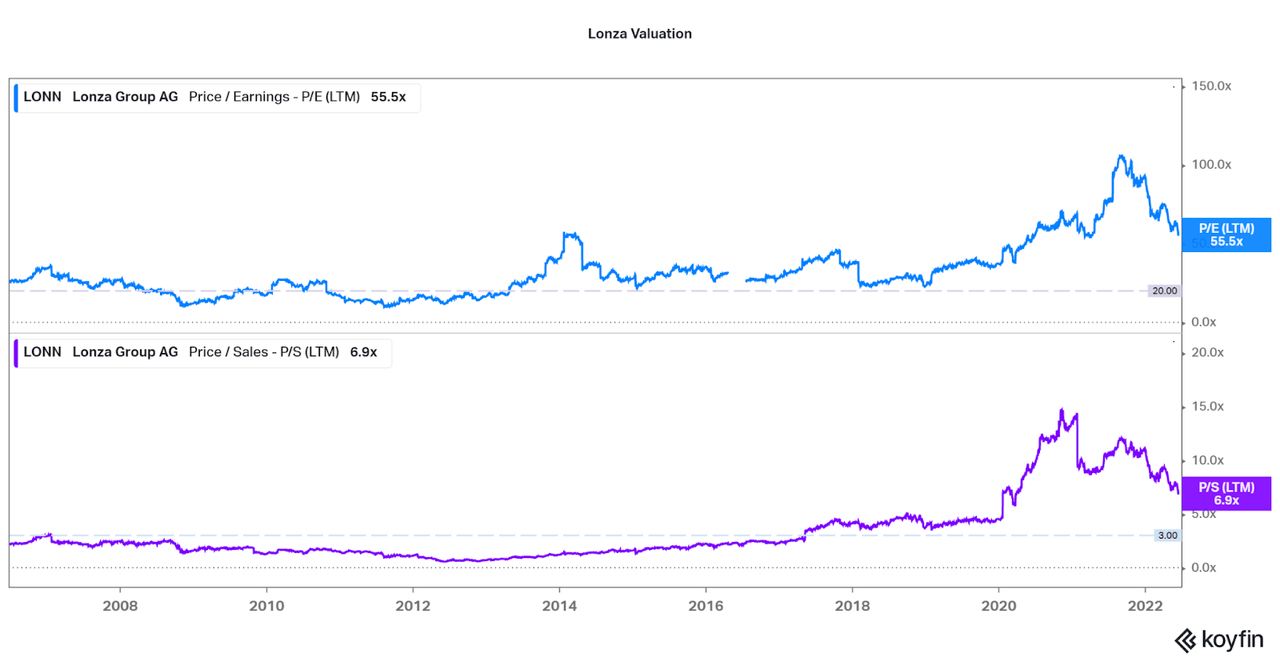

While Lonza offers strong financial performance and a positive outlook on the underlying industry, the valuation has a relatively justified and full premium at the moment. With the share price having fallen by a third so far this year, the current P/E stands at 55.5x (LTM) and the P/S stands at 6.9x (LTM). Two factors will influence the movement from this position over the next few months. First, continued revenue growth recovery in the post-pandemic period and, as production upgrades come online. This lowers the current valuation towards the historical averages that hover around 20x and 3.0x, respectively, without downside risk to shareholders. However, the main issue is that the more than 50% overvaluation from the approximate trend lines shown below is not a good look for current investors.

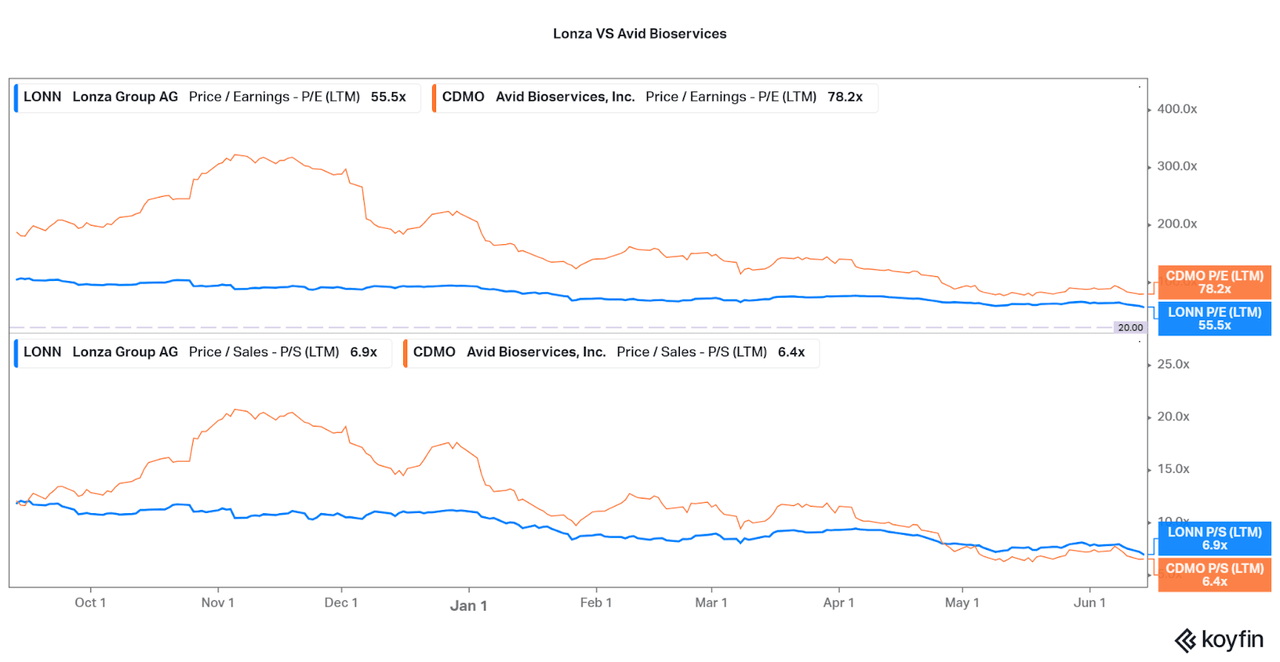

This is why I remain hesitant to add shares at this level but would consider beginning to recur – invest if you are holding or a long-term investor. It is also important to consider that the current valuation is impacted by the asset sales that brought significant profits, and may not fully represent the underlying performance and value. Therefore, I personally continue to load up on smaller competitor Avid Bioservices, which offers far higher growth via their expansive increases to production capacity – while at a lower P/S ratio. As a young investor with patience, I find the risk of investing in the smaller name to be the better investment for myself. For those who want a less risky approach, I will support your investment in Lonza, but recommend either waiting to see if the price continues to fall, or stagger your investments.

Koyfin Koyfin

Conclusion

While I believe that Lonza is a great company with plenty of future potential and investment safety, I will be neutral on the shares for the moment. Lonza may even be comparable to having a Taiwan Semi (TSM) – like moat at the current rate of performance. I certainly will be closely watching the ticker and will update my thoughts if the thesis improves over the next few quarters. Catalent is also certainly worthy of consideration, but the name had more COVID revenue boosts than peers and is guiding for far less forward revenue growth than either Lonza or Avid. Therefore, I will be revisiting that name in a few quarters to compare against Lonza. All three are certainly worth further due diligence. I hope I piqued your interest.

Thanks for reading. Feel free to share your thoughts in the comments.

Be the first to comment