MicroStockHub/iStock via Getty Images

Dear Friends & Clients:

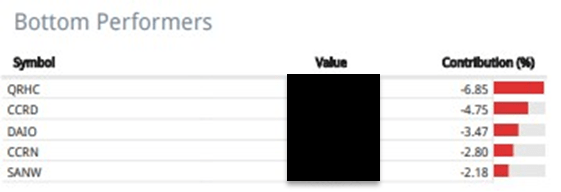

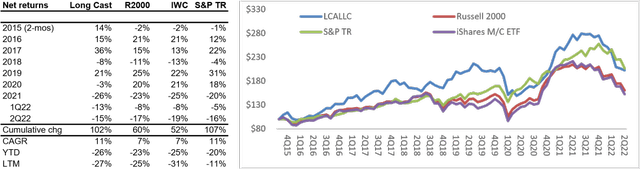

For the 2Q22 quarter (ended June 30, 2022), cumulative net returns declined 15%, bringing our YTD returns to a 26% decline. Since inception in November 2015 through quarter end 2Q22, LCA returned a cumulative 102% net of fees, or 11% CAGR. As a backdrop to returns, over the same period we are roughly in line with the S&P and exceed two representative indices for passive small company investing, the iShares MicroCap ETF and Russell 2000 index.

Because our portfolio is concentrated on just a handful of typically small “off the beaten path” businesses, we should expect variance from returns and greater volatility (higher highs and lower lows) than the indices. Past performance is no guarantee of future results.

The decline in the portfolio was led by our largest holdings. I stress that YTD is an arbitrary and short reference point compared to our expected long-term holding periods and I also understand that to some “long term” can be stressful. Where there is growing evidence and confidence that our companies are operating along a wide and long opportunity pathway that is not reflected in valuation, I am adding. If there is no such evidence, I’m subtracting. In general, I want to always increase the quality of the portfolio and jettison the companies that don’t show evidence of management success.

In that vein, for the first time in many years, CTEK is no longer part of our portfolio. The company was long a source of opportunity, then frustration and now is a tax loss and an expensive lesson in portfolio management. Across the portfolio since inception, it is the largest drain on returns, with a negative contribution of 7% (but for some accounts it was materially higher).

The company announced in May that it is selling itself to privately held Clearwater Compliance for $18M, which is about 50% less than what Auxilio paid for then privately held CynergisTek (CTEK). There was a lot wrong with this investment and for the price we paid, I would like to wring every available lesson out of it. I wrote a letter to the Board, discussing their mistakes and mine. In that letter, I shared my honest reflection on what I did wrong:

I’m keen to hear the Board’s perspective as well. Also no longer in the portfolio, subsequent to the close of the quarter, RBCN announced its sale to OTCPK:JANL through a $20 tender offer for 45% of the company. The remaining 55% will receive a one-time $11 dividend and thereupon the stock will be delisted. To RBCN shareholders, this comes to a blended price of $15.05. It wasn’t the deal we were looking for but it’s better than a loss.

PORTFOLIO UPDATE: REVIEW OF TOP HOLDINGS

All our largest long-time holdings were the most significant headwinds in the quarter, partially offset by growth in two newer additions to the portfolio, RELL and SOTK. I wrote about SOTK in our 4Q21 letter and recently published a comprehensive writeup on RELL on my blog.

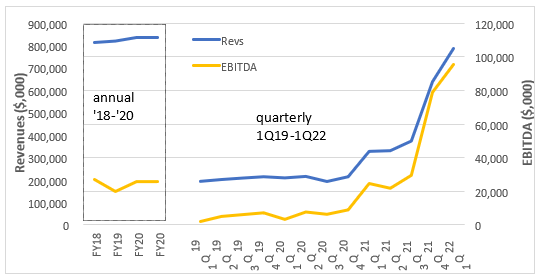

Here is a graph of CCRN’s revenues and EBITDA over the last four years.

Note how the company’s quarterly EBITDA now compares to its pre-COVID annual EBITDA. Note as well that revenues this year will exceed $2B, vs ~$850M prior to COVID. Nurse staffing was an obvious COVID beneficiary and I anticipate some “mean reversion” is in order. But I have three variant perspectives on what “mean reversion” looks like. The first is the impact of Kevin Clark’s returning January 2019, after 20-ish years in other successful CEO roles.

The company Clark rejoined in ‘19 was for decades mediocre. In his first 14 months, Clark upgraded technology rationalized more than 20 brands and closed offices. Clark’s efforts may always be “pshawed” as merely “COVID tailwind,” but he did more for the company in the two years ’19-’20 than the last two CEO’s did in the prior 20. Now he’s Chairman and the current CEO is an outsider from Aya, the largest privately held nurse staffing company in the US. I’ve seen countless “expert transcripts” touting the conventional window that this is still an awful company, but 0% are exposed to this new tenure.

Second variant perspective is making a working capital adjustment: For the 10 years before COVID (’09’19) the company averaged a steady $2.40 / share in w/c. At 1Q22 it had $11 / share working capital, driven by $675M in AR that’s materially expected to convert to cash in 2H and will be used to pay down long term debt. The delayed cash conversion overstates the enterprise value. I conservatively assume a $350M swing towards net cash from the AR conversion.

The third variant perception is around mean regression EBITDA margin. Pre-COVID CCRN was doing $840M sales and 3% EBITDA margins. Clark, pre-COVID, guided to a l/t 8% EBITDA margin target (same as AMN’s from 10-years ago) via brand rationalization, office consolidations, tech investments, acquisition and scale, all of which he’s done.

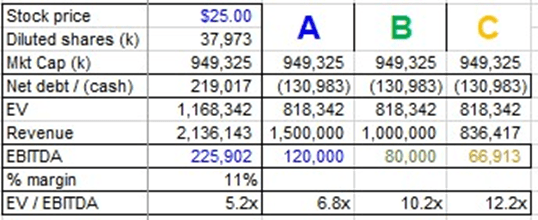

With these adjustments we can take a clear-eyed view. Labor rates will come down. Bill/pay spreads will narrow. EBITDA margins will decline from 12%. Hospitals will increase permanent pay and reduce their use of contingent labor. This is not a secular $225M EBITDA company. But sharpen the pencil and consider three scenarios based on three different declining revenue estimates ($1.5B, $1B and pre-COVID $840M). Adjusting for net cash and assuming 8% EBITDA margins, at $25 this looks cheap every which way.

Now consider the importance of long-term staffing relationships in healthcare, the company’s strategic bet on at-home care and other avenues of growth. I think this remains a high probability five-year double.

Corecard (CCRD)

Lots of people ask what Corecard does and I have two answers. First, I tell them they do the same thing as First Data’s “Global Financial Solutions” segment ($1.5B revs / 45% EBITDA margins). As per First Data’s last 10Kbefore the sale to Fiserv (FISV), one can observe six references to “VisionPlus,” the software that powered the GFS segment. CCRD developed that software, sold it to FDC, kept a piece of it and re-wrote it in C++ making it more flexible, customizable and adjustable, investing in it for +10 years before generating a “big time license sale” to Goldman Sachs (GS)’ as the Apple (AAPL) Card’s system of record.

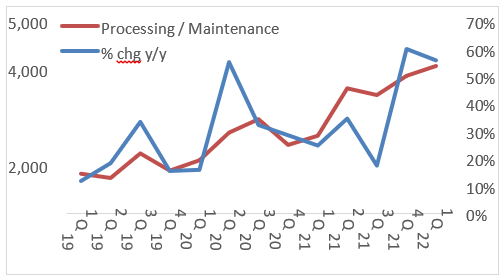

Goldman recently acquired a separate license for the new GM Card. Due to license fees and professional services to customize the software, GS currently represents +80% of sales. These are capital not recurring sales to GS, which essentially owns the software through the license and pays a fee when the number of active monthly accounts reaches materially new thresholds.

Management is investing the proceeds from these license sales to expand “recurring revenue” processing capabilities. This side of the business has averaged 30% y/y growth for the last three years, and it’s this “rest of business” that matters long term. Margins on the processing side – normally +40% – are compressed on higher labor costs and investments in talent to grow in EMEA and APAC. What could this look like if those investments scale and sales growth continues? I assume this can get to $100M in sales in the next three years and I think that would support a +$500M market value.

Getting back to the other answer to what they do, my second answer is “pretty much the same thing as Marqeta (MQ), but operated for profitability and cash flow.” That’s a material difference to an investor. IMHO this stock belongs in every small-cap investors’ portfolio.

QRHC borrowed heavily to purchase Rome RWS, Inc., and with results from the acquired company not yet fully on the income statement, the debt ratios expanded and equity valuations declined. Management – and really the Board – is undertaking a high skill maneuver of integrating its largest acquisition to date, carrying an unprecedented level of debt all concurrent with the long planned retirement of the long tenured CFO. It’s a little more exciting than necessary but the valuation is undemanding and the opportunity set quite large.

Since I’ve long written about what this company could look like if it leaned more deeply into utilizing technology within its two-sided marketplace, I’ll be closely following the XPO Logistics (XPO) spinoff of the truck brokerage business, expected in 4Q22. Truck and waste brokerage share some similar dynamics and as I’ve long noted, the technologist at XPO worked at Oakleaf concurrent with QRHC CEO Ray Hatch. Technology was a big enabling factor at Oakleaf and in XPO’s +10x growth. I think it would have a similar function for QRHC were management to wisely invest time and resources in its development.

The chip maker Micron (MU) reported disappointing earnings guidance on weakness in PC’s and handheld devices, but robust auto market chip sales. NXP (NXPI) reported 36% jump in automotive product sales. These data points could be a meaningful indicator for the company’s near-term results. Long term, every company that supplies the automotive market sees growth in chips per car and that would justify growth in more chip programming. Automobile inventory are low so I expect a healthy rebuild cycle even if the chip shortage resolves into a recession.

Portfolio additions / subtractions. We’ve acquired a sizable position in RELL. I wrote extensively about that here. We’ve recently acquired some exposure to AIM.TO. It is a holding company that recently sold its largest asset and has received cash of $5.97 per share meanwhile the stock trades for $4.50. Why the discount? Two reasons. First, simply due to timing, the balance sheet won’t reflect the cash until the end of 3Q21. Second, the company has a long history of poor capital allocation.

However, one can observe recent changes at the Board and management level buried in a 1Q22 earnings announcement that may lead extinguish this behavior going forward.

IN CONCLUSION: BRIEF THOUGHTS ON THE ECONOMY

I largely view the decline in market prices as a cautious buying opportunity in a market that was previously overvalued on unhealthily low rates, now spooked by rising interest rates, war and “general uncertainty”. I view the spookiness function partially the result of a cohort of post-2000 investors who don’t know from a non-FED-put intermediated business cycle and who might think 5% rates are too high. This cohort also only knows the US at war.

There is a “2nd derivative” concept to the market that encompasses the rate of change of information, how it relates to expectations and whether it is better or worse than the last piece of information. In a world where people adapt and “get used to things,” I ask myself, where does the next piece of bad news come from when we already anticipate countries starving from lack of wheat, where we already expect energy prices to remain elevated and where there is an expected likelihood that the fourth largest economy in the world will freeze this winter?

I’ve no crystal ball and this limits my insight into the future of the economy. Even my view of the present is suspect to biases since local observations are unlikely representative of elsewhere. Obviously, geopolitics could always get worse and more complicated (China vs Taiwan for example) but I think the time to be an interested investor is when the market is worried and scared, as it already is today.

My intention remains to position our portfolio for long term capital appreciation by acquiring shares in overlooked companies at valuations that do not reflect their growth, profitability and cash flow opportunities, with the expectation that we will own them for long periods, at least three-to-five year, possibly more. As painful is the current market downturn has been, we are presented with valuations not seen in many years, both for companies in our portfolio and in the overall market. I see a great deal of opportunity ahead for investors and welcome the outreach from our growing number of clients and followers.

As always, I appreciate your entrusting me with your capital and the responsibility of being its steward. I look forward to continuing this conversation into the future.

Sincerely

Avram

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment