phototechno

Investment thesis

Logitech International S.A. (NASDAQ:LOGI) has been in a long-term downtrend since August 2021, significantly underperforming the broader technology market, with just sporadic periods of relative strength. The stock marked a new low on September 26, 2022, on its ex-dividend day, but has immediately reverted and is building up some significant relative strength when compared to its industry. Although the volatility and the selling pressure on the markets are still high, the stock could attempt to form a short-term reversal, based on the last leg of its corrective Elliott sequence. As I underscored in my last article on LOGI, fundamentally the company looks significantly undervalued and offers very attractive opportunities in most of its business segments. As now technically I see an opportunity for a rebound, I maintain my buy rating which I now confirm also in a short-term perspective. Despite this, the risks are still significantly high, and investors should consider strictly managing their risk exposure. The recent price action suggests a higher likelihood for a first price target seen at $50.60 and if the overhead resistance can be overcome, a second target at $60.40. A failure of these assumptions could lead the stock to test the recent low and even fall further on its next support levels.

A quick look at the big picture

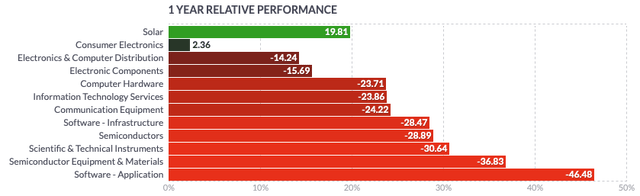

While the technology sector in the US could show some sporadic relative strength after touching a low in June 2022, the sector has again turned to be a loser in the last 3 months, led by companies active in the electronics and computer distribution industry, semiconductor manufacturers, and computer hardware manufacturers, while companies in the solar industry, and consumer electronics manufacturers could perform better also in a yearly perspective.

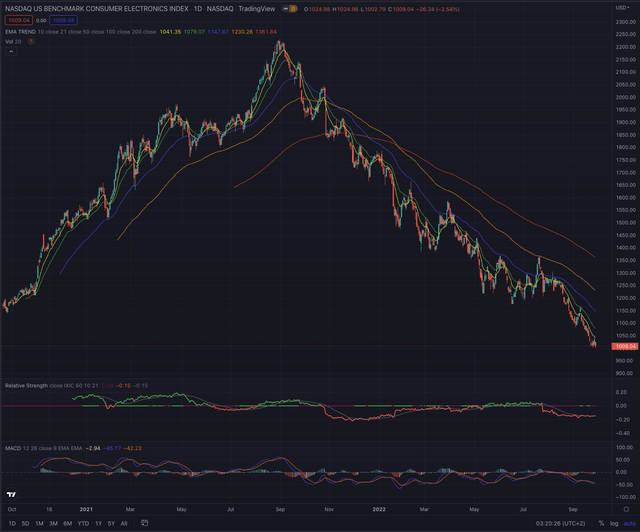

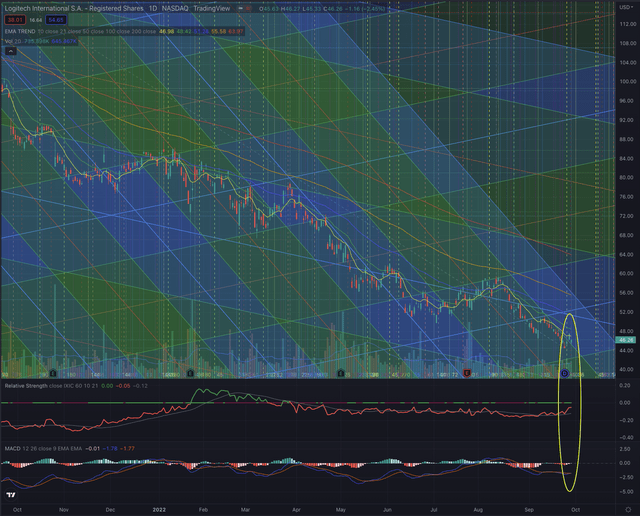

The NASDAQ US Benchmark Consumer Electronics Index (NQUSB40203010) topped End of August 2021 and has since severely corrected, losing 55% until September 27, 2022, showing significant relative weakness when compared to its main reference index. The benchmark looks quite extended after its negative momentum increased significantly during the last two months.

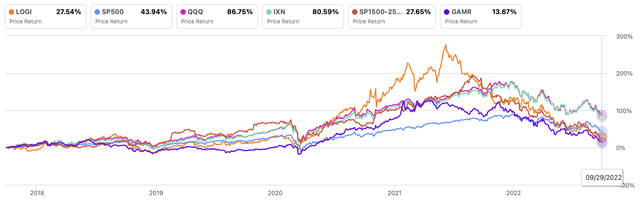

Looking back even further, Logitech showed some relative strength compared to major market indexes (SP500) and (QQQ) and the broader tech market iShares Global Tech ETF (NYSEARCA:IXN), especially during 2018 and the recent pandemic, but performed globally worse over the past 5 years, resulting in only 27.54% performance. Despite this, LOGI’s performance is in line with the S&P 1500 Composite Consumer Electronics Index (SP1500-25201010) and significantly better than the Wedbush ETFMG Video Game Tech ETF (NYSEARCA:GAMR).

Author, using SeekingAlpha.com

Where are we now?

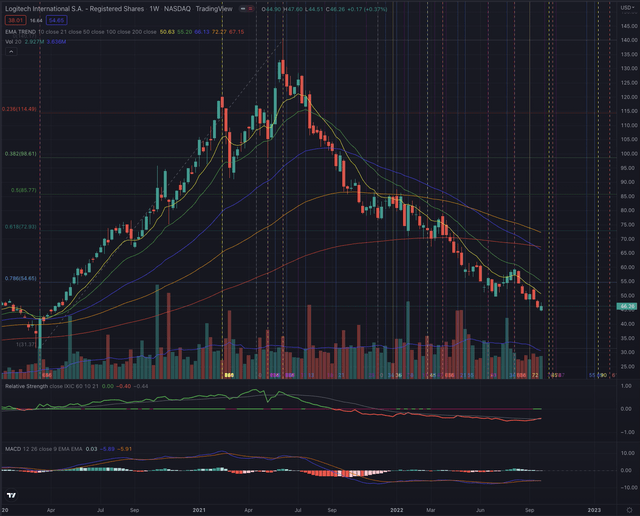

Since my last article ‘Logitech: Down 66% With A Huge Upside Potential’ published on September 8, where I wrote about the company’s massive fundamental undervaluation but also warned about an unfavorable technical setup and continuous selling pressure with possible more weakness in the short-term, the stock rebounded almost 10% and finally formed a new low on September 26, reaching its pre-pandemic price levels, as shown in its weekly chart. Interestingly, despite the selling pressure still being meaningful, it seems that it is dropping, as the volume in the recent weeks has been below its average.

The recent bottom at $44.51 on September 26, has been set on the ex-dividend day and triggered a positive reaction, which already began the same day during the session at the SIX, where the stock is listed under the Blue Chips index SMI under the symbol LOGN, as the stock recovered more than the drop caused by the dividend payment, but was then dragged slightly down after the opening of the US markets.

While the stock is still in a long-term downtrend, some relative strength is now seemingly building up, as the stock looks significantly extended and its negative momentum seems slightly to flatten. Despite that, the sector and the most relevant industry for Logitech are both still in a strong downtrend and it will need substantial volume and conviction to build resilience and consistent relative strength.

What is coming next

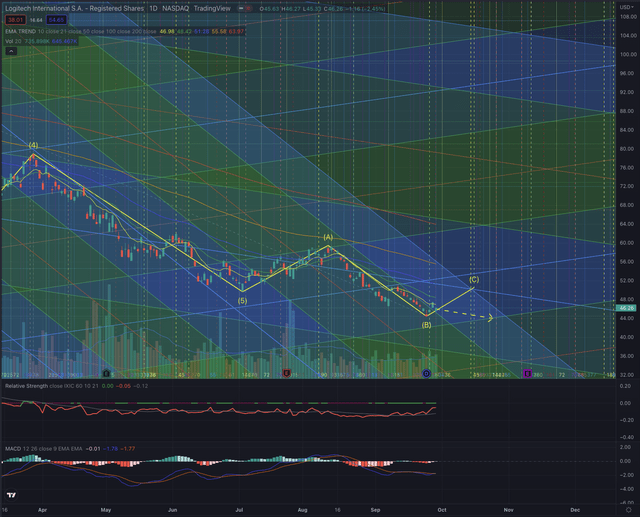

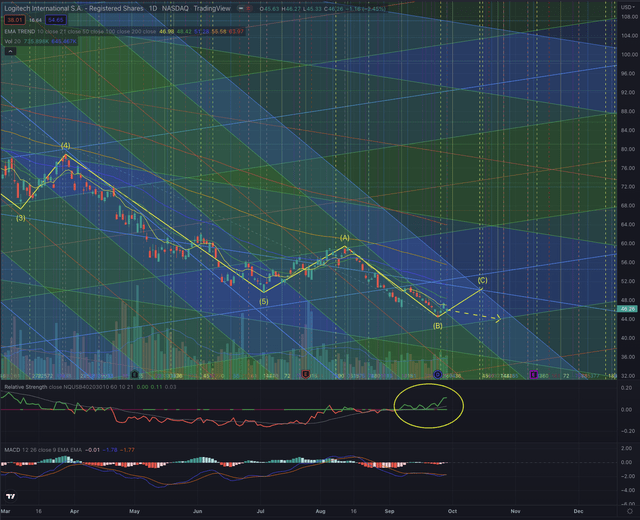

I expect the stock to continue to reduce its negative momentum and build up some relative strength. While it’s still too early to call for a bottom and the process would likely take some time, the stock could now form a short-term rebound, as it seems to form the last leg of a corrective sequence, after having completed a long impulse sequence since its ATH on July 9, 2021.

When comparing the stock to the NASDAQ US Benchmark Consumer Electronics Index (NQUSB40203010), it becomes even more noticeable how the stock is building up relative strength despite the ongoing drop in the market.

My projection, based on Fibonacci’s theory, suggests that the last leg of the corrective sequence could likely lead the stock to approximately $50.60, while a lasting positive momentum could bring the stock even further, with likely targets seen at respectively $54.40 and $58.10 until the most optimistic target in the near term seen at $60.40. If those scenarios instead fail, and the stock pulls back, even more, I see the stock likely testing the recent low at $44.50 for some time, before possibly forming new lows.

The closest resistance levels are now set by the stock’s EMA21 and EMA50, two trailing resistances that have repeatedly pushed back the stock at every breakout attempt. The stock also has further significant overhead resistance to overcome once it has reverted to growth, but I will consider those levels once they become relevant, as for now, the stock has still to form a sound base from which it could form a new uptrend. On the downside, the stocks’ most important support levels are seen at the recent low at $44.50 and further around $43.60 and $41.90.

Investors should observe the price action and how the stock behaves at the next support levels, and how an eventual attempt to overcome its resistances is confirmed or rejected, by particularly observing the trading volume in both directions. As the last few sessions showed a substantial spike in buy-side volume, this should eventually be confirmed by a slowdown in the actual negative trend and could lead to an attempt to form a bottom, but it’s too early to make any statement in this sense.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

As I wrote in my former articles on Logitech, I consider the company to be significantly undervalued when considering its fundamentals. The company has a very unique profile in the industry and is financially in a strong position, while its management has excellent proven skills and capabilities to push the company’s boundaries in terms of innovation and growth. Logitech is a leader in its business segments, and despite some being in a cyclical downturn, its strong positioning on secular growth drivers will most likely bring the company back to higher growth rates. LOGI will most likely also profit from the recent news in the gaming industry, where the Saudi wealth fund’s Savvy Games Group announced investments of $37.8B, and the company just launched its first cloud gaming handheld Logitech G Cloud, which is a first step that opens up great opportunities in a very promising category. Based on technical aspects, the stock is still in its long-term downtrend in stage 4 but has recently given signs of a possible short-term rebound and since this article focuses on purely technical aspects, I confirm my buy rating also in a more short-term view, but would definitely keep my stop-loss tight and set them close to the recent lows, as the downside risks are still significant and the general market is still in an unfavorable situation, facing major headwinds and high volatility.

Be the first to comment