Michael Fitzsimmons/iStock Editorial via Getty Images

The Intro

As tensions build around Taiwan and Ukraine, we think it’s important to ask yourself, “What’s the worst-case scenario?” If China were to invade Taiwan, how would the world respond? Sanctions were placed on Russia, sending energy prices soaring and creating the conditions for a “long, cold winter” in Europe. If the same sanctions were placed on China, the consequences could be far worse; we wouldn’t rule out a global depression. China is the world’s largest nation in terms of trade. Companies like Apple (AAPL), Starbucks (SBUX), and Nike (NKE) are heavily exposed to China. Much of what we use on a day-to-day basis is manufactured in the country.

Nancy Pelosi visited Taiwan, in the face of a Chinese military claiming it will “not sit idly by.” Meanwhile, hardheaded politicians are ruling over the world’s largest countries, armed with nuclear capabilities. While it seems like the last priority, we’re in the investment business. If one thinks of what type of business would do well in a world showered with war and economic hardship, one might think of the aerospace defense companies Lockheed Martin (NYSE:LMT) and Raytheon Technologies (NYSE:RTX). In the decade ahead, we project returns of 7% per annum.

The Economic Shield

Lockheed Martin

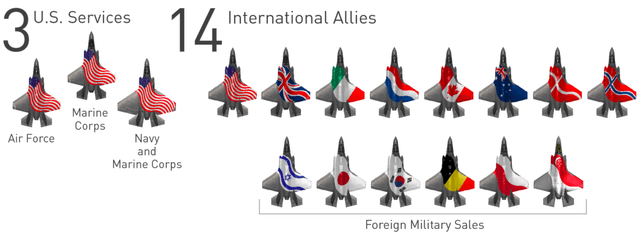

Lockheed makes its money through contracts, not only with the U.S. military, but with allied countries around the world:

Global F-35 Partners (Lockheed Martin)

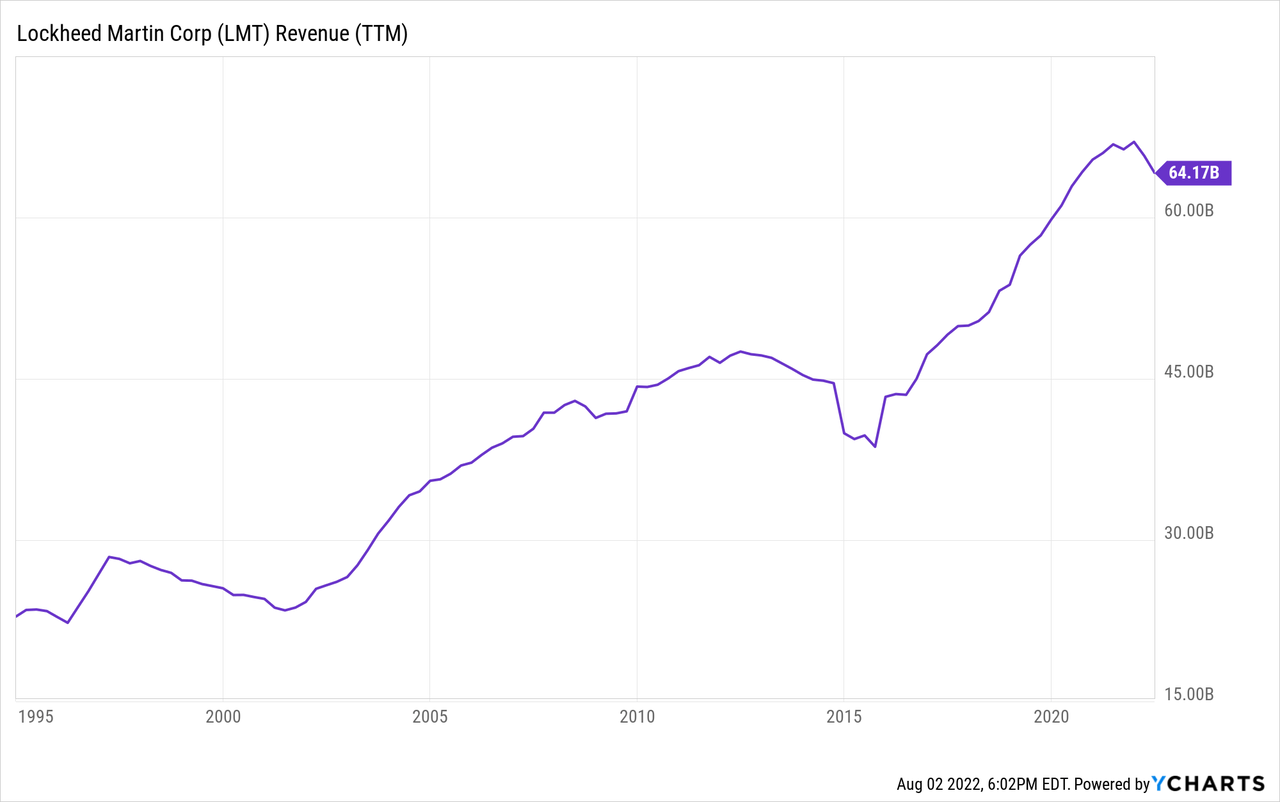

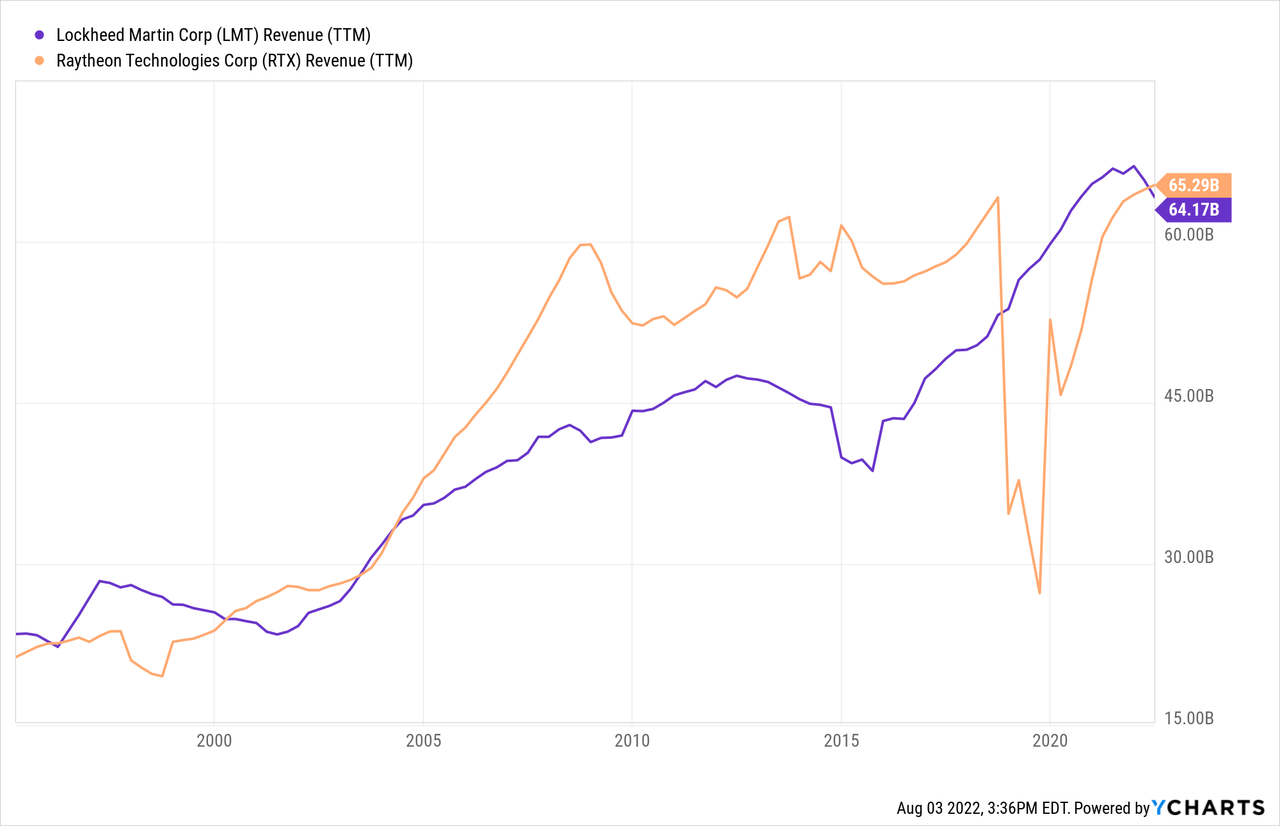

This business relies not on the strength of the consumer, but on the strength of the government. So long as governments are not burdened financially, Lockheed’s business is economically insensitive. The company grew revenue right through the global financial crisis of 2008:

Lockheed Martin makes most of its money selling military equipment such as fighter jets and missile defense systems, but is also in partnerships with NASA through its space division. Here’s a breakdown of the company’s segments:

| Segment | Description | Percentage of Sales |

| Aeronautics | Advanced Military Aircraft | 40% |

| MFC | Missiles and Fire Control | 17% |

| RMS | Rotary and Mission Systems | 25% |

| Space | Satellites, Transportation, and Military Systems | 18% |

Source: Image created by author with data from Lockheed’s annual report.

Raytheon Technologies

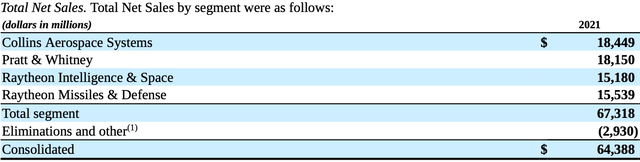

Raytheon is similarly resistant to economic weakness, although it is partially exposed to commercial aircraft and, therefore, the travel industry. Raytheon’s “Collins Aerospace” and “Pratt & Whitney” segments are exposed to both military and commercial planes. Raytheon sells technology to Boeing and Airbus, and is one of the world’s largest suppliers of aircraft engines. On the other hand, customers in the “Intelligence & Space” and “Missiles & Defense” segments are largely government agencies. Here’s a breakdown of the company’s segments:

Raytheon Revenue By Segment (Annual Report)

Conflict And Defense Spending

All things considered, the world’s been a pretty peaceful place since the end of World War II. Such a conflict-free century seems like an anomaly when compared to world history.

Defense contracts have become fairly stable, with slow and steady revenue growth the expectation. But, if conflict becomes widespread, there could be a worldwide shortage in military aircraft and missile defense, driving up revenues and margins for Raytheon and Lockheed.

The invasion of Ukraine was a wake-up call for the world. Following the invasion, NATO and greater Europe decided to increase defense spending by $50-75 billion. Countries like Canada and Japan are also planning to spend more. It’s possible this is just the beginning. These countries are realizing they can’t solely rely on the United States to protect from invasion. All of this could boost international sales for Lockheed Martin and Raytheon Technologies.

The Valuation

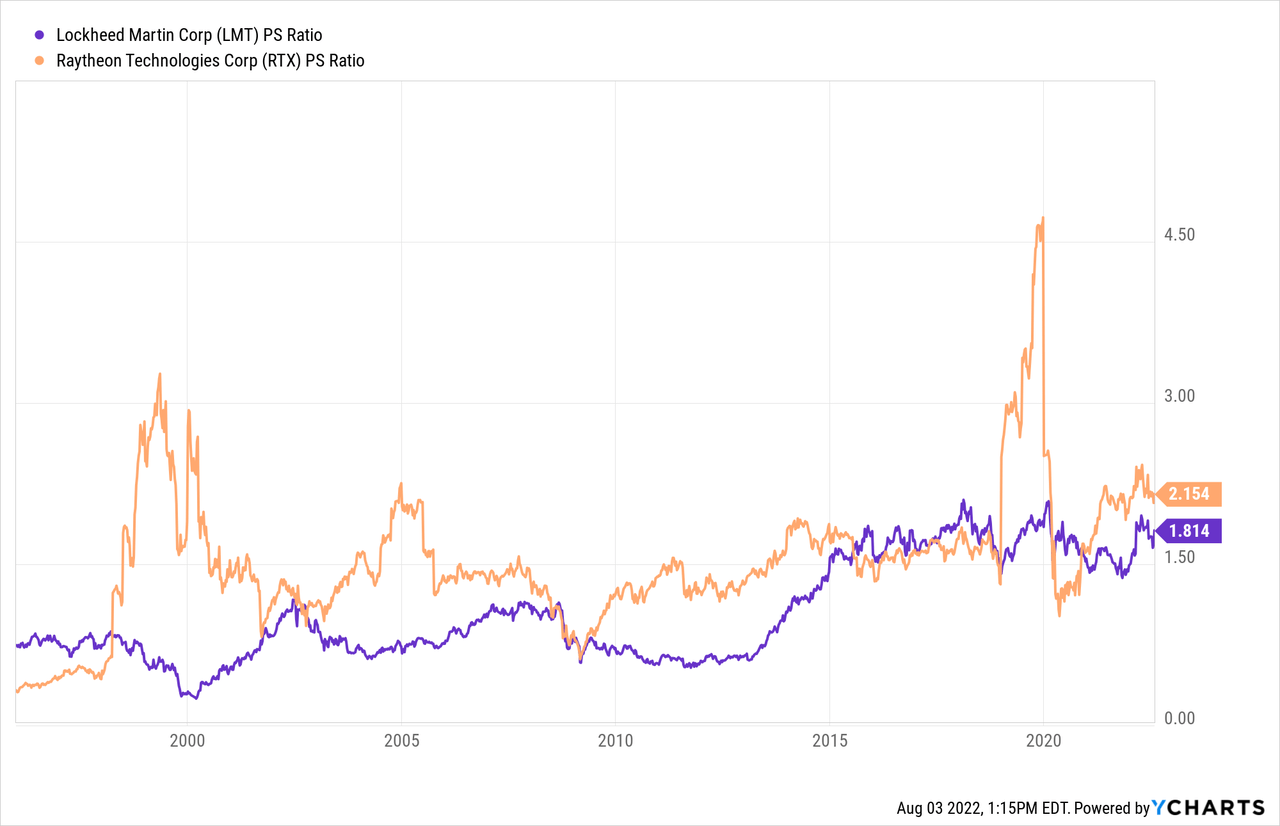

Lockheed’s become more expensive over time on a price to sales ratio, while Raytheon is hovering around its historical average:

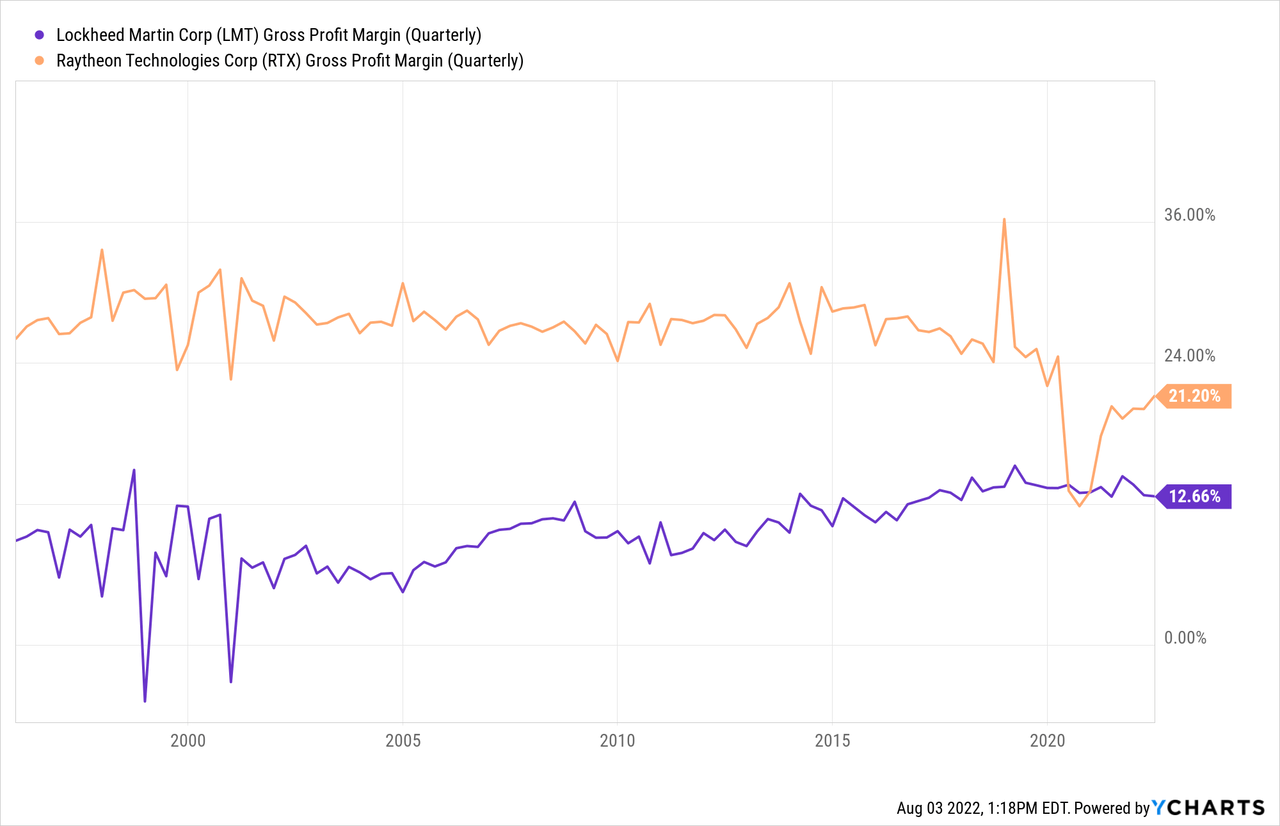

At the same time, Lockheed’s gross margins have expanded, while Raytheon’s have dipped below historic levels as the pandemic hit its commercial business:

Overall, we think LMT and RTX are fairly expensive. These stocks trade in an exuberant U.S. market, and were much better buys back in 2010. Earnings will have to grow at a faster pace to justify the current valuations.

Lockheed Martin sports industry leading returns on capital and thus has a higher price to book ratio but a lower forward PE than its peers:

| Lockheed Martin (LMT) | General Dynamics (GD) | Raytheon Technologies (RTX) | |

| Price to Sales | 1.8 | 1.6 | 2.1 |

| Price to Book | 9.7 | 3.6 | 2.0 |

|

Forward PE |

15.7 | 18.7 | 19.8 |

| Dividend Yield | 2.7% | 2.2% | 2.4% |

Long-term Returns

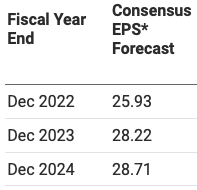

Expert consensus thinks these companies will grow at enormous rates into 2024:

Lockheed Earnings Forecast (Nasdaq) Raytheon Earnings Forecast (Nasdaq)

We think growth will slow following this uptick. Buybacks should also slow as there isn’t enough cash to maintain the current pace. Looking at the industry, U.S. defense spending is projected to grow at just 3% per annum through to 2032. It’s possible that international spending in this category grows faster, but the United States will need to maintain its alliances for Lockheed Martin and Raytheon to benefit. These businesses have grown revenue at 5.5% per annum since 1995:

Our 2032 price targets for Lockheed Martin and Raytheon Technologies are $655 per share and $142 per share respectively, implying returns of 7% per annum with dividends reinvested.

- We’ve projected Lockheed Martin and Raytheon to grow current EPS by 9% and 11.5% per annum respectively, resulting in 2032 EPS of $40.95 and $8.88. This growth is possible on the back of expanded profit margins. We’ve assigned a terminal multiple of 16x.

Conclusion

Using Lockheed Martin and Raytheon Technologies to hedge against world war isn’t a terrible strategy, but it should yield fairly mediocre returns. The best time to buy a hedge is when nobody wants it. In hindsight, 2020 was a great time to hedge against higher oil prices. As famed investor Carl Icahn once said:

“You’ve got to buy them when nobody wants them, really. I mean that’s the real secret. It sounds very simple, but it’s very hard to do. When everybody hates it, you buy it. And when everybody wants it, you sell it to them.”

We think geopolitical fears have reduced long-term returns for Lockheed Martin and Raytheon Technologies. That said, they’re still a decent hedge against major conflict. We have a “hold” rating on the shares.

Be the first to comment