tupungato/iStock Editorial via Getty Images

On paper, Lloyds Banking Group (NYSE:LYG) looks almost too good to be true. A P/E ratio of under 6, a dividend yield of 4.6%, and massive free cash flow generation sounds like a compelling combination. In practice, though, I am concerned that the business is about to enter a downturn, which explains its struggling share price.

Attractive Business with a Cloudy Horizon

There is a lot to like about the Lloyds business. It is the U.K.’s largest mortgage lender. It is strongly focused on one market, which, while it increases the risk associated with that exposure, also has the benefit of making the business easier to understand and manage. Compared to some peers listed on the London exchange, such as Barclays (BCS) or HSBC (HSBC), it should be less likely to trip up on some esoteric overseas development.

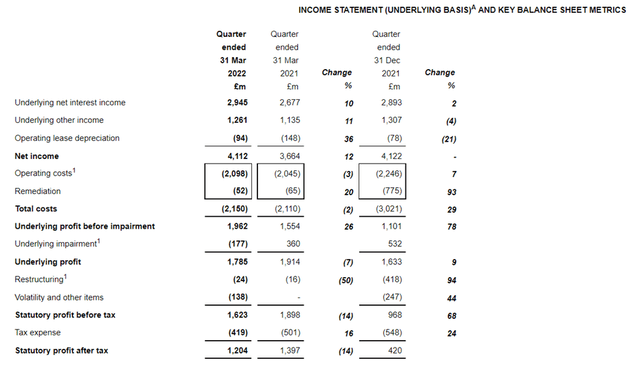

I think the basic attractiveness – but also some of the pending risks – were on display in the bank’s first quarter trading update. Profits were strong, although 14% down on the equivalent period last year.

The chief executive, in three brief paragraphs of introduction, spent almost a whole one saying:

the outlook for the UK economy remains uncertain, particularly with regards to the persistency and impact of higher inflation. We are proactively contacting customers where we feel they may need assistance and will continue to help with financial health checks and other means of support. We encourage customers, where affected, to get advice early and talk to us.

That is not reassuring to me, especially an appeal to customers at risk of default upfront in a set of quarterly results. Concretely, although the company said that, “[A]sset quality remains strong with new to arrears remaining very benign and below pre-pandemic levels,” it also took a £27m charge which partly reflected “additional provisions taken to capture the elevated inflation risk assumed in the updated base case and its potential impact on asset quality.”

In other words, the bank is now providing in its models (even if it has not yet shown up in practice) for the impact of an inflationary environment on asset quality and default rates. With the U.K. expected to head into recession in the second half (the Bank of England is warning both of recession and double digit inflation) I think there is a lot more of this to come. That bodes poorly for Lloyds. There is a storm coming, in my opinion, and the first quarter results provide the first glimpse of it on the horizon.

Dividend Hesitancy

I think there is good and bad news when it comes to the Lloyds dividend.

On the good side, the dividend currently yields 4.6%. Not only that, but the dividend is amply covered, as Lloyds is currently throwing off more free cash flow than it knows what to do with, which is why it has launched a share buyback of up to £2bn in value.

Last year, dividends cost Lloyds £877m while free cash flows were £1.7bn. That is a sizeable coverage, although I find it interesting that free cash flow only came in at £1.7bn while pre-tax profit was a much meatier £5.9bn: a reminder of the importance of looking beyond earnings to free cash flow.

The company has committed itself to a progressive dividend policy, something it reiterated in its most recent annual report. Nonetheless, I feel the board has been reluctant to pay dividends.

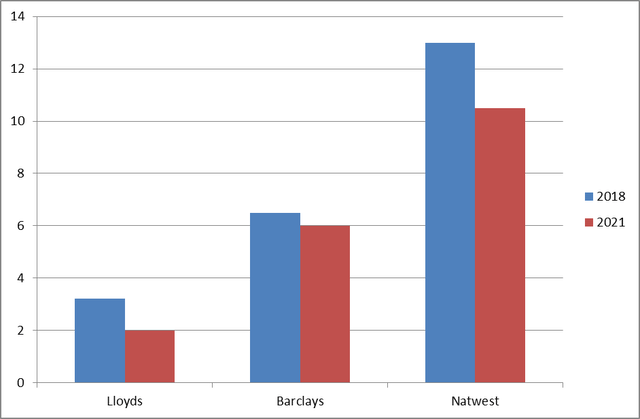

It is not alone in restarting dividends after a break enforced by the regulator at a lower level than they had been before the pandemic. But as this chart shows, that has been more pronounced at Lloyds than at its immediate U.K. competitors (I exclude HSBC due to the outsized role overseas markets play for it).

Chart: annual dividends of leading U.K. banks (P)

Chart compiled by author using data from Hargreaves Lansdown.

It is not as if the company lacks the resources. Recall the large share buyback program that is ongoing. Rather, I think the current board is downplaying the importance of dividends, which as a Lloyds shareholder infuriates me and is leading me to consider selling the shares.

Where this matters from a prospective angle is what happens when the economy next tanks. Lloyds says it is committed to a progressive and sustainable policy. But it has used the pandemic as an excuse effectively to cut the dividend. The last financial crisis, which was an existential experience for the company, led to it cutting the dividend between 2009 and 2015. While I think the bank is in better shape now than it was then, it is a concerning precedent for a bank that is already showing apparent hesitancy in raising dividends even to where they were four years ago.

Directors are Not Buying Heavily

Over the past year, a couple of directors have dipped into their own pockets to purchase Lloyds shares. In May, one spent £8,500 on them and in February, another one spent a chunkier £237,000 on them.

But what is more noticeable for me is the director selling. Stripping out award or tax-related sales, three directors have made multiple sales over the past year. Even at 43p and 44p, there has been selling in May and June. That does not suggest to me that the directors see the shares as undervalued and about to realize their true potential any time soon.

LYG’s Valuation Looks Cheap – But Is It?

The P/E ratio right now certainly makes the shares look cheap.

But that was true a year ago – and since then, they have lost 7% of their value. Meanwhile, the earnings outlook is worsening, meaning that the prospective P/E ratio looks less attractive.

I think the valuation for the company that looks so cheap is in fact not nearly as attractive as it seems, given the worsening economic environment in its core market. I note its dividend hesitancy and overall lack of director buying versus selling, and am starting to feel bearish on the name. I am considering selling my position on that basis.

Be the first to comment