Olemedia/E+ via Getty Images

Investment Thesis

Livent Corporation (NYSE:LTHM) continues to outperform the market, with a 16.34% stock rally YTD compared to the S&P 500 Index at -21.13%. Lithium Carbonate prices also remain elevated at 510.5K yuan/tonne ($70.9K) in September 2022, compared to 487K yuan ($68.4K) in August 2022 and 120K yuan ($16.8K) in September 2021. Analysts do not expect prices to fall to pre-pandemic levels of 77K yuan ($10.8K) as well, given the massive unmet demand from the EV and energy storage markets.

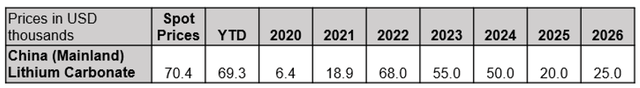

Analysts’ Projection On Lithium Prices

The market projected Lithium Carbonate prices to remain elevated over the next two years, at $55K in 2023 and $50K in 2024. While prices may fall from 2025 onwards due to incoming new supplies, investors must also note that these prices still represent a massive premium from 2019 and 2020 levels. Thereby, ensuring LTHM’s top and bottom line growth ahead.

Furthermore, lithium supply remains unbalanced, given the persistent deficit from -4.42 Mt in 2021, to -0.25 Mt in 2022, and -0.32 Mt by 2023. The immense global EV boom over the next few years will continue to fuel the demand for lithium, since the market is expected to grow from $287.3B in 2021 to $1.31T by 2028 at an impressive CAGR of 24.3%. The insatiable appetite for EV-related lithium batteries will also accelerate, given the projected growth in market share from 50% in 2022 to 80% by 2029.

Lithium is indeed in the midst of a commodity supercycle, in which the demand wave is so large that it takes a decade for supply to catch up. This is significantly worsened by the fact that it takes more than five years for new mines to be supply accretive while new EV/ battery factories are built within one or two years. Combined with the fact that the global EV waiting list is north of 3M units with an average of nine months waiting period, it is apparent that lithium will be in a constant deficit for the next few years.

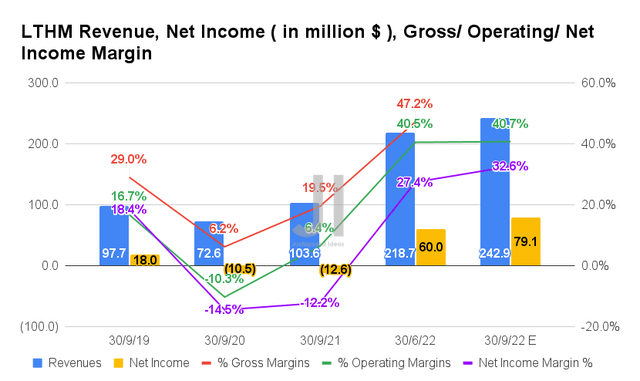

LTHM To Report Massive Growth In Profitability, Boosted By General Motors’ Deal

For its upcoming FQ3’22 earnings call, LTHM is expected to report revenues of $242.9M and operating margins of 40.7%, indicating an increase of 11.06% and 0.2 percentage points QoQ, respectively. Otherwise, a tremendous YoY growth of 234.45% and 34.3 percentage points, respectively. Thereby, pointing to the durability of lithium prices now, despite the Fed’s best efforts.

Naturally, LTHM will report improved profitability, with net incomes of $79.1M and net income margins of 32.6% for the next quarter, representing impressive QoQ growth of 31.83% and 5.2 percentage points, respectively. Otherwise, an eye-popping increase of 727.77% and 44.8 percentage points YoY, respectively.

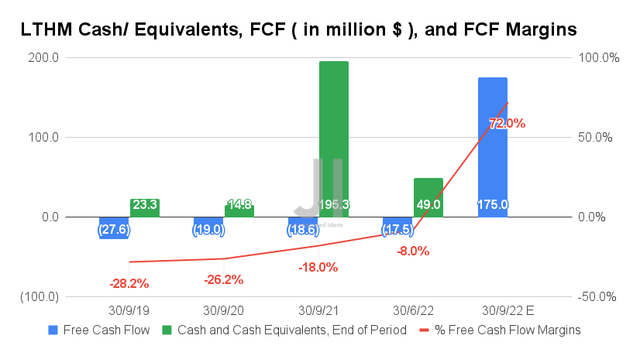

LTHM is also expected to report a stellar Free Cash Flow (FCF) generation of $175M and an FCF margin of 72% in FQ3’22. These are mostly attributed to the mega-sized $198M advance payment from General Motors (GM) from the long-term agreement in lithium supply between 2025 and 2030, assuming accretive by the upcoming quarter.

Otherwise, LTHM is expected to report cash from operations at approximately $55.97M and capital expenditure at approximately $78.97M, leading to an adj. FCF of -$23M then. Thereby, strengthening its balance sheet for the economic downturn ahead, as the company forges on with its aggressive expansion.

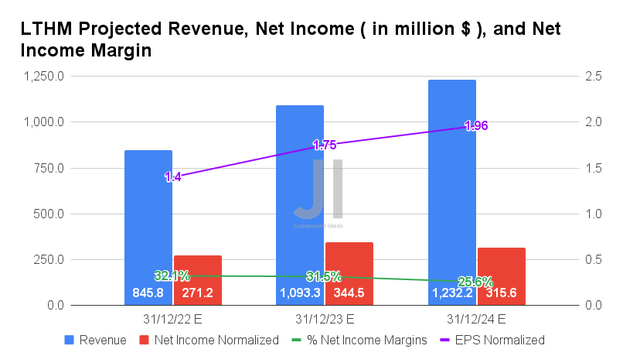

LTHM is expected to report an adj. revenue and adj. net income growth at a CAGR of 25.97% and 44.44%, respectively, between FY2019 and FY2024. It is evident that consensus estimates are optimistic that the elevated lithium prices will hold up over the next three years, given the notable upgrade in profitability by 12.31% since our analysis in July 2022.

The improvement in LTHM’s net income margins is also astounding, from net income margins of 12.9% in FY2019 to 0.1% in FY2021, and finally settling at a stellar 25.6% by FY2024. This will help to boost its EPS from $0.42 in FY2019 to $1.96 by FY2024, indicating an excellent CAGR of 36.08%.

Meanwhile, LTHM is expected to report revenues of $845.8M, net incomes of $271.2M, and EPS of $1.4 for FY2022, indicating an immense YoY growth of 201.18%, 452%, and 777.77%, respectively. It is even more impressive that the top and bottom line numbers have been upgraded multiple times, indicating Mr. Market’s growing confidence in the company’s forward execution, despite the worsening macroeconomics and the impending recession.

In the meantime, we encourage you to read our previous article on LTHM, which would help you better understand its position and market opportunities.

- Livent Stock: Riding On The Hyper Growth Wave

- Livent: License To Print Money – Speculative Bet For 2030

So, Is LTHM Stock A Buy, Sell, Or Hold?

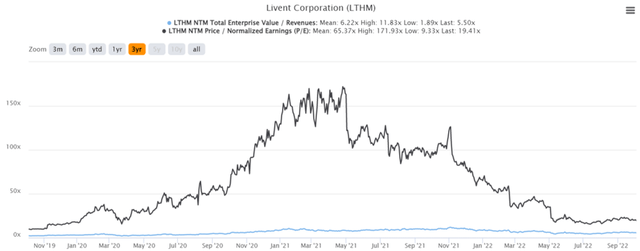

LTHM 3Y EV/Revenue and P/E Valuations

LTHM is currently trading at an EV/NTM Revenue of 5.50x and NTM P/E of 19.41x, lower than its 3Y mean of 6.22x and 65.37x, respectively. The stock is also trading at $29.69, down -18.38% from its 52-week high of $36.38, though at a premium of 53.43% from its 52-week low of $19.35. Nonetheless, consensus estimates remain bullish about its prospects, given their price target of $34.71 and a 16.91% upside from current prices.

However, LTHM is trading at a premium now, near its 50-day moving average and above its 100 and 200-day moving averages. Therefore, we prefer to rate the stock as a Hold for now, before encouraging anyone to add at current levels with a minimal margin of safety.

The September CPI to be released on 13 October will also provide the critical indicator in consumer spending, speculatively triggering further volatility in the short term. Assuming a moderated inflation rate, we may see an optimistic turnabout in market sentiment ahead, breaking the bearish cycle seen thus far. The Fed’s projected terminal rate of 4.6% by 2023 had 67.4% of analysts predicting an inline 75 basis point hike in November, with January 2023 moderating with a 50 basis point hike.

However, Mr. Market is still overly pessimistic, since the S&P 500 Index breached its previous June lows and hit maximum pain on 30 September with a -25.25% plunge YTD. Though the latter has recovered a little by now, there is still too much fear, uncertainty, and doubt in the stock market, speculatively indicating more downside from current levels. Patience for now.

Be the first to comment