relif/iStock via Getty Images

Earnings of Live Oak Bancshares, Inc. (NASDAQ: NASDAQ:LOB) will likely decline this year mostly because of the normalization of provision expenses and non-interest income. On the other hand, margin expansion will likely support the bottom line. Further, a conducive economic environment and team expansion will likely drive loan growth, which will in turn support earnings. Overall, I’m expecting Live Oak Bancshares to report earnings of $2.83 per share in 2022, down 24% year-over-year. Despite the dip, earnings will likely remain much higher than the pre-pandemic level. Following the recent stock price correction, the year-end target price suggests a small downside from the current market price. Therefore, I’m upgrading Live Oak Bancshares to a hold rating from my previous rating of sell.

Team Expansion, Economic Strength to Drive Loans

Live Oak Bancshares’ loan growth was lower than average last year partly because of Paycheck Protection Program (“PPP”) loan forgiveness. The PPP portfolio still makes up a sizable chunk of total loans. Therefore, the remaining forgiveness will likely have a material impact on the total loan portfolio size this year. PPP loans outstanding made up 4.7% of total loans at the end of December 2021, according to details given in the earnings release.

Apart from the PPP forgiveness, the portfolio performed quite well during the quarter. As mentioned in the earnings presentation, Live Oak Bancshares achieved more than $1 billion in loan production in the last three quarters of 2021.

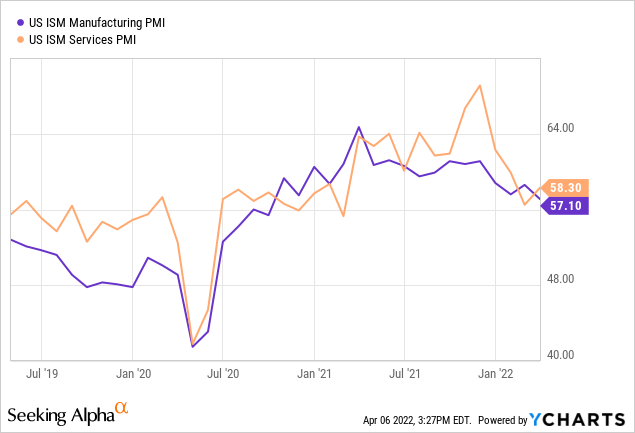

This strong momentum is likely to continue through 2022 partly due to economic factors. Live Oak Bancshares focuses on small businesses; therefore, the purchasing managers’ index (“PMI”) is a good gauge of future credit demand. As seen in the chart below, PMI has been in the expansionary territory (above 50) in the last few quarters.

Further, team expansion will contribute to loan growth. Live Oak Bancshares hired 164 new people last year, as mentioned in the conference call. To put this number in perspective, 164 make up 20% of the total number of employees at the end of 2021. The management is targeting similar hiring for this year. Most of the team expansion will take place on the revenue side, with some on the technology side.

Considering these factors, I’m expecting the loan portfolio to increase by around 17% in 2022. Meanwhile, I’m expecting deposit growth to slightly outpace loan growth. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 1,320 | 1,811 | 2,599 | 5,093 | 5,458 | 6,385 |

| Growth of Net Loans | 48.4% | 37.2% | 43.5% | 95.9% | 7.2% | 17.0% |

| Other Earning Assets | 777 | 1,075 | 1,611 | 1,932 | 2,044 | 2,391 |

| Deposits | 2,260 | 3,150 | 4,229 | 5,713 | 7,112 | 8,320 |

| Borrowings and Sub-Debt | 27 | 1 | 3 | 1,542 | 318 | 294 |

| Common equity | 437 | 494 | 532 | 568 | 715 | 837 |

| Tang. Book Value Per Share ($) | 11.5 | 11.9 | 13.0 | 13.6 | 15.9 | 18.6 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Both Loans and Deposits are Quite Rate-Sensitive

The early forgiveness of PPP loans last year resulted in the accelerated booking of PPP fees. Due to the large PPP balance, this accelerated fee had a significant positive impact on the margin last year. The decline in the accelerated booking of PPP fees this year will therefore hurt the margin.

On the other hand, the anticipated increase in interest rates will boost the margin. The Federal Reserve projects a 175 basis points increase in the federal funds rate in 2022. Live Oak Bancshares’ loan portfolio is quite sensitive to interest rate changes as just under 50% of the portfolio is based on variable rates, according to details given in the conference call.

Unfortunately, the liability side is also quite sensitive to rate changes. Transaction deposits made up 51% of total deposits at the end of December 2021. These transaction deposits will re-price soon after every rate hike. Therefore, the overall margin is only moderately sensitive to interest rates. The management’s interest-rate sensitivity analysis given in the 10-K filing shows that a 200-basis points increase in interest rates can boost the net interest income by only 2.5% over twelve months.

Considering these factors, I’m expecting the margin to increase by six basis points in 2022. In my last report on Live Oak Bancshares, I estimated the margin to decline by two basis points this year. I have revised upwards my margin expectation because of the economic data released since my last report on Live Oak Bancshares. Further, the Federal Reserve has revised upwards its projection for the Federal Funds rate since the issuance of my last report on Live Oak Bancshares.

Provision Expense Normalization on the Cards

A large part of Live Oak Bancshares’ loan portfolio is guaranteed by SBA or USDA. Therefore, the portfolio’s credit risk is quite low. Unguaranteed non-performing loans made up just 0.33% of total loans at the end of December 2021, as mentioned in the 10-K filing. In comparison, allowances made up 1.30% of total loans at the end of last year. As allowances easily cover the portfolio’s existing credit risk, I’m not expecting provisioning pressure from the existing portfolio.

However, the anticipated loan additions mentioned above will most probably require provisioning for expected loan losses. Overall, I’m expecting the provision expense to return to a normal level this year. I’m expecting the net provision expense to make up around 0.64% of total loans in 2022, which is close to the average provision-expense-to-total-loan ratio of 0.65% for the last five years.

Earnings Likely to Dip by 24%

Provision normalization will likely drag earnings this year relative to last year. Further, the one-time gain of $44 million booked in the second quarter of 2021 will not recur this year. On the other hand, strong loan growth and margin expansion will likely support the bottom line. Overall, I’m expecting earnings to decline by 24% year-over-year to $2.83 per share. Despite the dip, earnings will likely remain much higher than the pre-pandemic level. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 78 | 108 | 140 | 195 | 297 | 344 | |

| Provision for loan losses | 10 | 13 | 20 | 41 | 15 | 41 | |

| Non-interest income | 173 | 104 | 68 | 86 | 160 | 109 | |

| Non-interest expense | 143 | 153 | 165 | 193 | 231 | 251 | |

| Net income – Common Sh. | 100 | 51 | 18 | 60 | 167 | 127 | |

| EPS – Diluted ($) | 2.65 | 1.24 | 0.44 | 1.43 | 3.71 | 2.83 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

In my last report on Live Oak Bancshares, I estimated earnings of $2.76 per share for 2022. I have revised upwards my earnings estimate mostly because I have increased my estimate for the net interest margin.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Upgrading to a Hold Rating

Live Oak Bancshares is offering a dividend yield of 0.23% at the current quarterly dividend rate of $0.03 per share. The earnings and dividend estimates suggest a payout ratio of only 4.2% for 2022. Live Oak Bancshares has maintained its dividend per share at $0.03 since the mid of 2017. As there is no indication from the company that it will break this longstanding tradition soon, I’m not expecting any change in the dividend level this year.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Live Oak Bancshares. The stock has traded at an average P/TB ratio of 2.25 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| T. Book Value per Share ($) | 11.5 | 11.9 | 13.0 | 13.6 | 15.9 | |

| Average Market Price ($) | 23.2 | 26.3 | 17.1 | 22.2 | 64.5 | |

| Historical P/TB | 2.01x | 2.21x | 1.32x | 1.63x | 4.06x | 2.25x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.6 gives a target price of $41.7 for the end of 2022. This price target implies an 18.5% downside from the April 5 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.05x | 2.15x | 2.25x | 2.35x | 2.45x |

| TBVPS – Dec 2022 ($) | 18.6 | 18.6 | 18.6 | 18.6 | 18.6 |

| Target Price ($) | 38.0 | 39.9 | 41.7 | 43.6 | 45.4 |

| Market Price ($) | 51.2 | 51.2 | 51.2 | 51.2 | 51.2 |

| Upside/(Downside) | (25.8)% | (22.2)% | (18.5)% | (14.9)% | (11.3)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 20.4x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 2.65 | 1.24 | 0.44 | 1.43 | 3.71 | |

| Average Market Price ($) | 23.2 | 26.3 | 17.1 | 22.2 | 64.5 | |

| Historical P/E | 8.7x | 21.2x | 38.8x | 15.6x | 17.4x | 20.4x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.83 gives a target price of $57.5 for the end of 2022. This price target implies a 12.3% upside from the April 5 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 18.4x | 19.4x | 20.4x | 21.4x | 22.4x |

| EPS – 2021 ($) | 2.83 | 2.83 | 2.83 | 2.83 | 2.83 |

| Target Price ($) | 51.9 | 54.7 | 57.5 | 60.3 | 63.2 |

| Market Price ($) | 51.2 | 51.2 | 51.2 | 51.2 | 51.2 |

| Upside/(Downside) | 1.2% | 6.7% | 12.3% | 17.8% | 23.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $49.6, which implies a 3.1% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 2.9%.

I adopted a sell rating in my last report on Live Oak Bancshares. The stock price has corrected substantially since my last report, which has reduced the price downside. As a result, I am now upgrading Live Oak Bancshares to a hold rating.

Be the first to comment