relif

Earnings of Live Oak Bancshares, Inc. (NASDAQ:LOB) will most probably dip this year due to higher provisioning and operating expenses. On the other hand, significant loan growth and slight margin expansion will lift the top line, which will, in turn, support earnings. Overall, I’m expecting Live Oak Bancshares to report earnings of $3.51 per share for 2022, down 5% year-over-year. Adjusting for the one-time gain on the sale of Finxact, I’m expecting the company to report earnings of $2.92 per share for the year. Compared to my last report on Live Oak Bancshares, I’ve barely changed my earnings estimate. The year-end target price suggests a small upside from the current market price. Therefore, I’m maintaining a hold rating on Live Oak Bancshares.

Continued Team Expansion is the Biggest Catalyst for Loan Growth

After increasing by 4% in the first quarter of 2022, the loan portfolio grew by only 2% in the second quarter. Loan growth significantly slowed down in the second quarter because of heightened prepayments, as mentioned in the earnings presentation. The surge in the federal funds rate by 225 basis points so far this year will play a pivotal role in keeping credit demand in check for the remainder of the year. Small businesses will likely curtail their capital expenditure plans due to the high borrowing cost.

On the other hand, the continued team expansion will likely support loan growth through the end of 2023. Live Oak Bancshares added 13 new lenders in the first half of 2022, which was somewhat better than last year, according to the details given in the presentation. In 2021, Live Oak Bancshares added 23 new lenders. (Side note: please don’t confuse lenders with total employees. Live Oak Bancshares hired 164 new employees last year, as mentioned in the 4Q2021 conference call.)

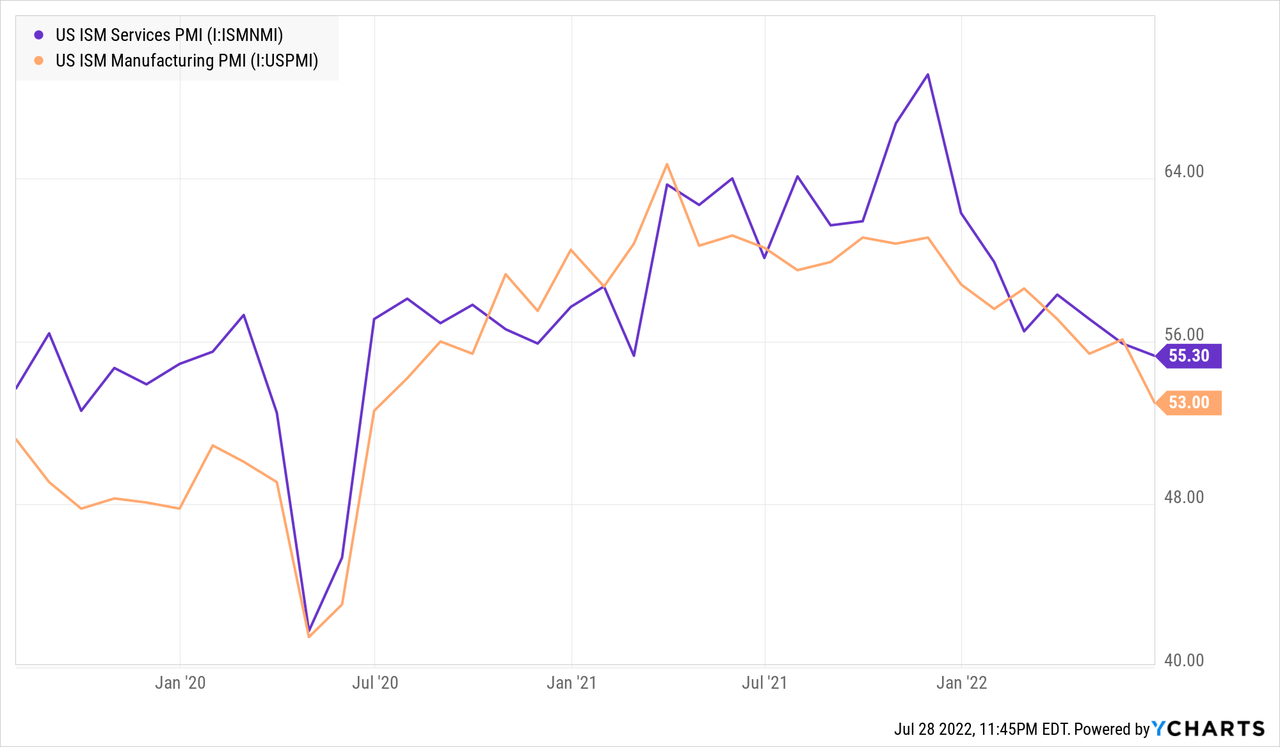

As small businesses, SBA 7(a) Program loans make up a majority of total loans, the PMI index is a good gauge of future credit demand. Despite the contraction in GDP for a second consecutive quarter, the PMI is still in expansionary territory (above 50).

The above chart doesn’t show it, but the provisional reading for July was also above 50, at 52.3.

During the second quarter of 2022, Live Oak Bancshares sold Finxact at a gain of $120.5 million, which boosted the cash balance. The management hopes to use the proceeds to support continued growth. As mentioned in the second quarter’s conference call, the management believes it can continue to grow loans at a mid-teens annualized pace. Considering these factors, I’m expecting the loan book to grow by 6.1% in the second half of 2022, leading to full-year loan growth of 12.6%. In my last report on Live Oak Bancshares, I estimated loan growth of 17% for 2022. I have reduced my loan growth estimate because of the second quarter’s performance as well as the headwinds from high interest rates.

I’m expecting loan growth to improve next year, moving closer to the historical average. Meanwhile, deposits will likely grow in line with loans through the end of 2023. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | |||||||

| Net Loans | 1,320 | 1,811 | 2,599 | 5,093 | 5,458 | 6,147 | 7,191 |

| Growth of Net Loans | 48.4% | 37.2% | 43.5% | 95.9% | 7.2% | 12.6% | 17.0% |

| Other Earning Assets | 777 | 1,075 | 1,611 | 1,932 | 2,044 | 2,317 | 2,710 |

| Deposits | 2,260 | 3,150 | 4,229 | 5,713 | 7,112 | 8,652 | 10,122 |

| Borrowings and Sub-Debt | 27 | 1 | 3 | 1,542 | 318 | 83 | 76 |

| Common equity | 437 | 494 | 532 | 568 | 715 | 815 | 912 |

| Tang. Book Value Per Share ($) | 11.5 | 11.9 | 13.0 | 13.6 | 15.9 | 18.2 | 20.4 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Margin to Slightly Expand Before Stabilizing Next Year

Slightly more assets than liabilities are scheduled to re-price in 2022. As mentioned in the first quarter’s 10-Q filing, the asset-liability gap stood at 4.6% of total assets at the end of March 2022. Therefore, the surge in interest rates will have a small positive impact on the net interest margin. Another Fed Funds rate hike is likely after the 75 basis points hike this week, but I believe the bulk of the monetary tightening is now behind us. I’m expecting rates to also start declining from next year.

Overall, I’m expecting the net interest margin to increase by 13 basis points in 2022 before stabilizing in 2023. In my last report on Live Oak Bancshares, I estimated the margin to increase by 6 basis points in 2022. I’ve increased my margin estimate due to the greater-than-expected hike in interest rates so far this year.

Higher-Than-Normal Provisioning Likely for the Remainder of the Year

After remaining subdued in the first half of 2022, provisioning will likely remain above normal in the second half of the year because of high interest rates. However, I’m not too concerned because of government guarantees. Thanks to the loan portfolio’s concentration in small business loans, around 44% of the portfolio is government guaranteed.

Overall, I’m expecting Live Oak Bancshares to report a net provision expense of 0.70% of total loans in 2022. In comparison, the provision expense averaged 0.65% of total loans in the last five years.

Expecting Earnings to Dip by 5%

Earnings will likely decline this year relative to last year because of higher provisioning expenses. Further, operating expenses will be higher due to the recent hires as well as other efforts to boost the balance sheet. On the other hand, strong loan growth and some margin expansion will support the bottom line. Overall, I’m expecting Live Oak Bancshares to report earnings of $3.51 per share for 2022, down 5% year-over-year. Excluding the one-time gain on the sale of Finxact, I’m expecting Live Oak Bancshares to report earnings of $2.92 per share for 2022. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | ||

| Income Statement | ||||||||

| Net interest income | 78 | 108 | 140 | 195 | 297 | 330 | 386 | |

| Provision for loan losses | 10 | 13 | 20 | 41 | 15 | 43 | 41 | |

| Non-interest income | 173 | 104 | 68 | 86 | 160 | 213 | 105 | |

| Non-interest expense | 143 | 153 | 165 | 193 | 231 | 302 | 321 | |

| Net income – Common Sh. | 100 | 51 | 18 | 60 | 167 | 157 | 103 | |

| EPS – Diluted ($) | 2.65 | 1.24 | 0.44 | 1.43 | 3.71 | 3.51 | 2.29 | |

| Normalized EPS – Diluted ($) | 1.78 | 0.73 | 0.36 | 0.71 | 2.91 | 2.92 | 2.29 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates, Seeking Alpha (In USD million unless otherwise specified) |

||||||||

In my last report on Live Oak Bancshares, I estimated earnings of $2.83 per share for 2022. Excluding the one-time gain on the sale of Finxact, my earnings estimate has not changed much. I’ve tweaked all income statement line items but have not made any big changes.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates. The new Omicron subvariant also bears monitoring.

Small Upside Justifies a Hold Rating

Live Oak Bancshares is offering a dividend yield of only 0.32% at the current quarterly dividend rate of $0.03 per share. The earnings and dividend estimates suggest a payout ratio of just 3.4% for 2022, which is below the five-year average of 10.5%. Live Oak Bancshares has maintained its dividend per share at $0.03 per share since the mid of 2017. A slightly lower-than-average payout ratio is not reason enough for the company to break with its tradition now, in my opinion.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Live Oak Bancshares. The stock has traded at a trimmed average P/TB ratio of 1.79x in the past, as shown below. I have removed the outlier in 2021 from the average.

| FY17 | FY18 | FY19 | FY20 | FY21 | T. Average | |

| T. Book Value per Share ($) | 11.5 | 11.9 | 13.0 | 13.6 | 15.9 | |

| Average Market Price ($) | 23.2 | 26.3 | 17.1 | 22.2 | 64.5 | |

| Historical P/TB | 2.01x | 2.21x | 1.32x | 1.63x | 4.06x | 1.79x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the trimmed average P/TB multiple with the forecast tangible book value per share of $18.2 gives a target price of $32.6 for the end of 2022. This price target implies a 12.5% downside from the July 28 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.59x | 1.69x | 1.79x | 1.89x | 1.99x |

| TBVPS – Dec 2022 ($) | 18.2 | 18.2 | 18.2 | 18.2 | 18.2 |

| Target Price ($) | 29.0 | 30.8 | 32.6 | 34.4 | 36.2 |

| Market Price ($) | 37.3 | 37.3 | 37.3 | 37.3 | 37.3 |

| Upside/(Downside) | (22.3)% | (17.4)% | (12.5)% | (7.6)% | (2.8)% |

| Source: Author’s Estimates |

The stock has traded at a trimmed average P/E ratio of around 13.9x in the past, as shown below. I have removed the outliers in 2018 and 2019 from the average.

| FY17 | FY18 | FY19 | FY20 | FY21 | T. Average | |

| Earnings per Share ($) | 2.65 | 1.24 | 0.44 | 1.43 | 3.71 | |

| Average Market Price ($) | 23.2 | 26.3 | 17.1 | 22.2 | 64.5 | |

| Historical P/E | 8.7x | 21.2x | 38.8x | 15.6x | 17.4x | 13.9x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the trimmed average P/E multiple with the forecast earnings per share of $3.51 gives a target price of $48.9 for the end of 2022. This price target implies a 31.2% upside from the July 28 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.9x | 12.9x | 13.9x | 14.9x | 15.9x |

| EPS – 2022 ($) | 3.51 | 3.51 | 3.51 | 3.51 | 3.51 |

| Target Price ($) | 41.9 | 45.4 | 48.9 | 52.4 | 55.9 |

| Market Price ($) | 37.3 | 37.3 | 37.3 | 37.3 | 37.3 |

| Upside/(Downside) | 12.3% | 21.7% | 31.2% | 40.6% | 50.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $40.7, which implies a 9.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 9.6%. As this expected return is not high enough for me, I’m maintaining a hold rating on Live Oak Bancshares.

Be the first to comment