Volha Levitskaya

Littelfuse (NASDAQ:LFUS) remains one of our favorite companies, one which is not widely followed despite having generated impressive shareholder returns.

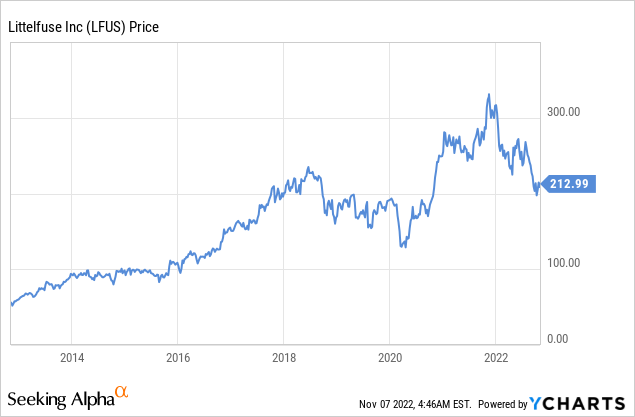

The company once more delivered strong results exceeding expectations. For Q3, Littelfuse achieved revenue growth of 22%, and organic growth of 8%, despite foreign exchange rate headwinds and a weakening economy. Despite its resilience and continued growth, the share price has come down in sympathy with the market, and is down about a third from its peak reached in late 2021.

The company reported demand in general remains strong, but it is softer for consumer-oriented end-markets like appliances. Littelfuse has been able to compensate some of the demand weakness with new design wins, especially with applications geared towards sustainability and battery power. Some examples of design wins during the quarter include applications in power tools and electric bicycles.

Q3 2022 Results

Revenue was $659 million, up 22% over last year and up 8% organically. The Carling and C&K Switches acquisitions added 18% and foreign-exchange reduced revenue by 4%. GAAP operating margins were 18.5%, while adjusted operating margins were 21%. Third quarter GAAP diluted earnings per share were $3.02, and adjusted diluted EPS was $4.28, up 8% over last year.

A Quality Business

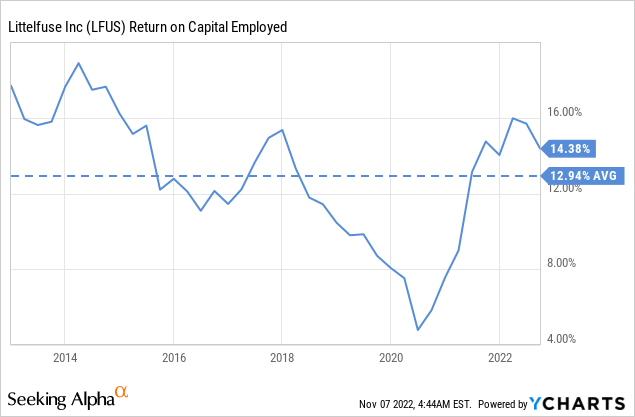

As a reminder of why we like Littelfuse so much, this is a business that is not only growing revenue and earnings in the double digits, but it also grows profitably. The ten =0year average return on capital employed is ~13%. This is particularly important given that Littelfuse retains most of its earnings.

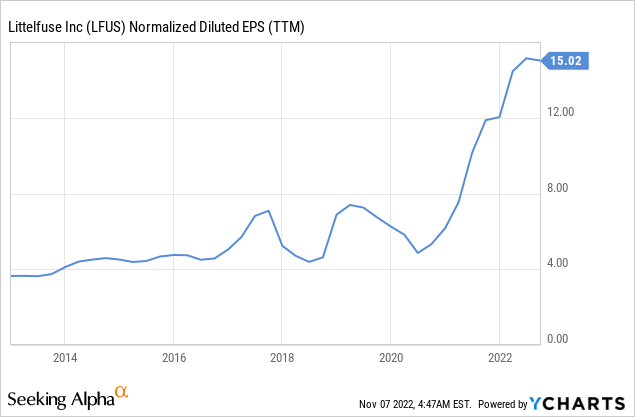

This is a well-run business that has nearly quadrupled its earnings per share during the last decade, despite operating in cyclical industries.

Innovation

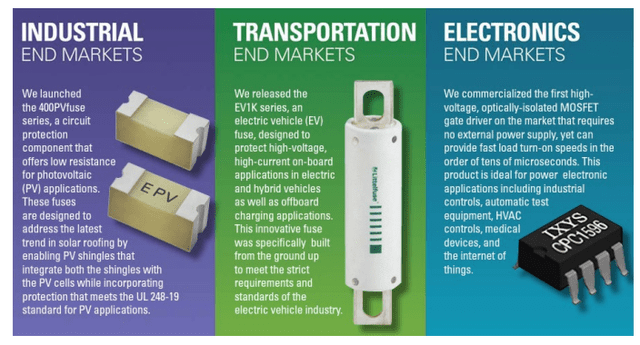

Importantly, Littelfuse continues to innovate and launch new products and technologies, many of which enable sustainability. Some examples are shown below, these include a circuit protection component for photovoltaic applications, an electric vehicle fuse, and an optically-isolated MOSFET gate driver.

Littelfuse Investor Presentation

Balance Sheet

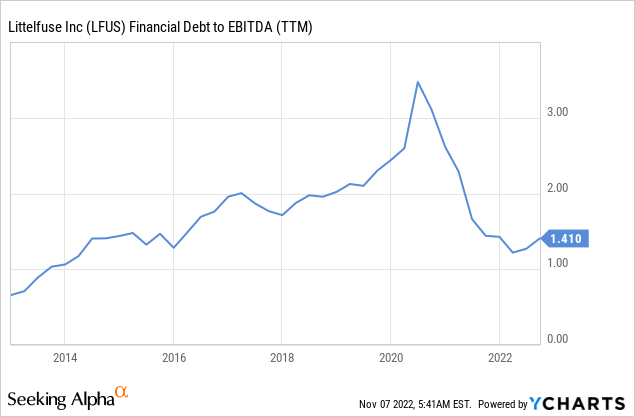

Littelfuse ended the quarter with $474 million of cash and short-term investments. The net debt to EBITDA leverage remains at the low end of their target range, which should allow the company to make new acquisitions should the weakening economy bring attractive M&A opportunities.

Outlook

For the fourth quarter the company expects sales in the range of $603 million to $623 million, up 11% versus last year and up 4% organic. This assumes about 15% growth from acquisitions and a 4% headwind from foreign exchange. Littelfuse is projecting fourth quarter adjusted EPS to be in the range of $3.14 to $3.34.

Fourth quarter guidance implies full-year sales of ~$2.5 billion and adjusted earnings per share of ~$16.77, both records for the company. This would represent 21% sales growth over the previous year, and 27% adjusted earnings growth.

Valuation

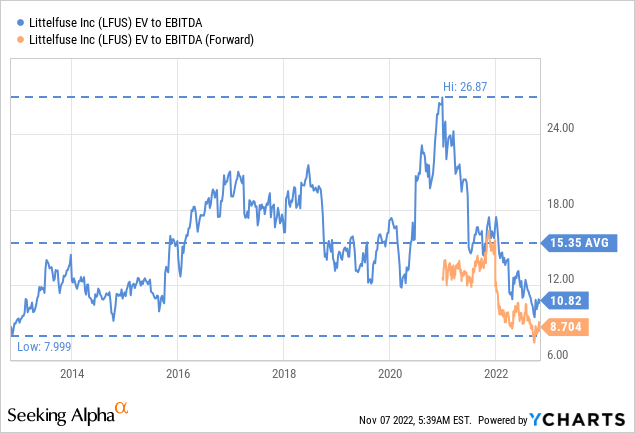

The market is currently giving very little credit to Littelfuse’s outstanding results. Shares are trading near the bottom of its EV/EBITDA range for the last ten years. We believe ~10x for such a high quality company is an attractive price, and therefore consider shares to be somewhat undervalued.

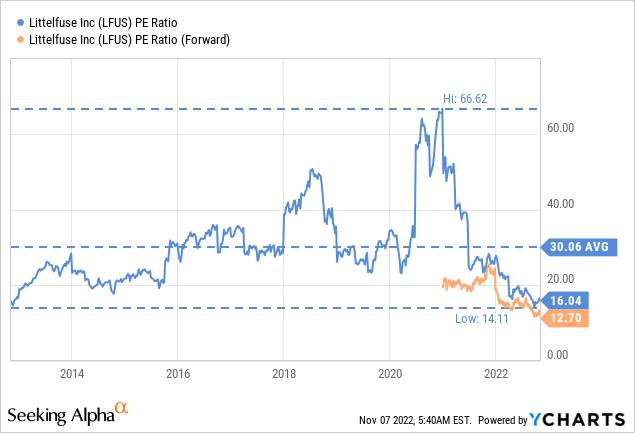

The trailing twelve months price-earnings ratio is almost half of the ten-year average, and the forward P/E is even lower at ~12.7x.

Risks

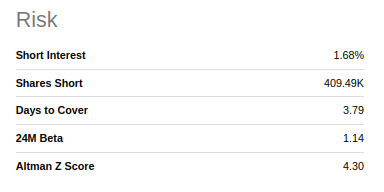

We believe the biggest risk with Littelfuse is that it operates in very cyclical industries, and investors appear very worried that earnings and revenues are about to crater. This is likely the reason for the valuation to have come down as much as it has, despite the company delivering excellent results so far. While it is entirely possible that we are about to enter a severe recession, there is also the possibility of a soft landing or a very mild recession. In any case, we believe the company is strong enough and has the balance sheet to survive a deep recession. This strength is reflected in the very high Altman Z-score of 4.3x, which is comfortably above the 3.0 threshold for strong companies.

Seeking Alpha

Conclusion

Littelfuse shares have lost about a third of their value since they peaked in late 2021, despite the company continuing to deliver solid growth and positive results, which now include the most recent Q3 quarter. We continue to view the company as a very high quality business, despite the cyclicality of the industries in which it operates. As a result, we consider current prices an opportunity to purchase shares at a low valuation. There are risks to consider, including the possibility of a recession around the corner, but we are reassured by the strength of the business, new design wins, and its solid balance sheet.

Be the first to comment