Fahroni

Welcome to the November 2022 edition of the lithium miner news. The past month saw lithium prices hit new record highs again and further reports of lithium prices expected to stay stronger for longer supported by deficits. We did also see a minor lithium price pullback based on a Chinese ‘rumor’ (see market news below). We also saw some stellar Q3 earnings results from the majors with Albemarle up 7x and SQM YTD up 10.5x (see company news for details).

Lithium price news

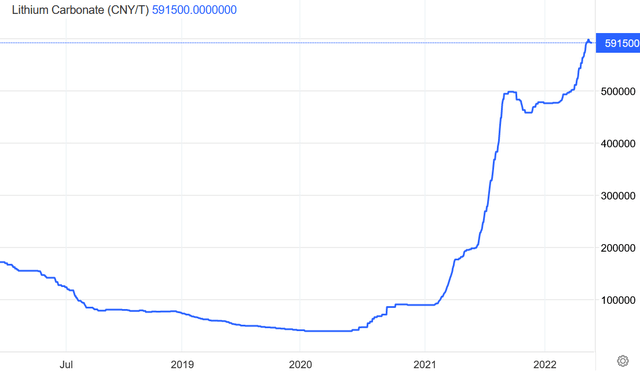

Asian Metal reported during the past 30 days, the 99.5% China lithium carbonate spot price was up 1.6% and the China lithium hydroxide price was up 1.56%. The Lithium Iron Phosphate (Li 3.9% min) price was minus 0.08%. The Spodumene (6% min) price was up 0.98% over the past 30 days.

Benchmark Mineral Intelligence reported China lithium prices of (battery grade carbonate – RMB 568,500 ($80,150), hydroxide RMB 564,000 ($79,525), and Benchmark stated (paywalled): “Contacts reported to Benchmark that rumours were circulating the market regarding cell manufacturers limiting their production in November, weighing on lithium demand sentiment, however these speculations are yet to be confirmed, with some players confirming publicly that operations were running as normal……overall demand in 2023 is expected to continue to rise, meaning any softening is likely to be transitory.”

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 39,058 (~USD 5,470/mt), as of November 22, 2022.

In mid-November Pilbara Minerals reported the results of their latest 5,000t spodumene BMX auction stating: “….the highest bid of US$7,805/dmt (SC5.5, FOB Port Hedland basis) which on a pro rata basis for lithia content and inclusive of freight costs equates to a price of ~US$8,575/dmt (SC6.0, CIF China basis).”

China Lithium carbonate spot price 5 year chart – CNY 591,500 (~USD 82,838)

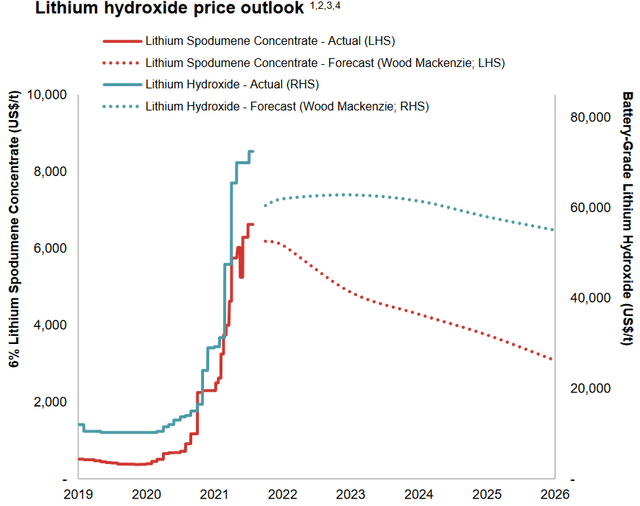

Wood Mackenzie’s lithium price forecast – July 2022 (Source)

Mineral Resources presentation courtesy Wood Mackenzie

Lithium demand versus supply outlook

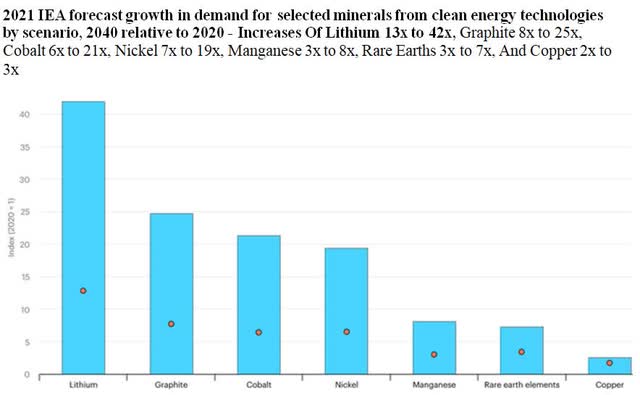

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

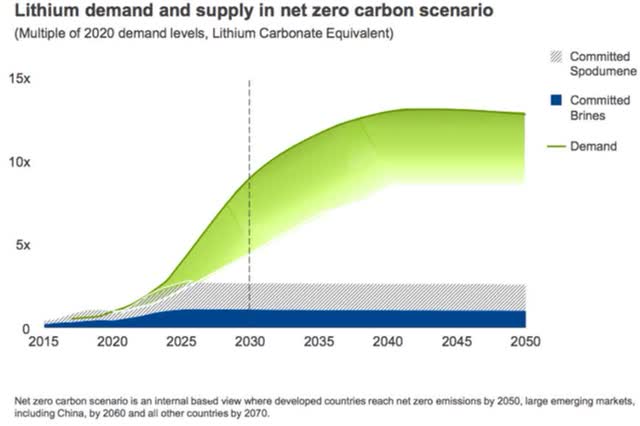

Rio Tinto forecasts lithium emerging supply gap (October 2021) – 60 new mines the size of Jadar will be needed

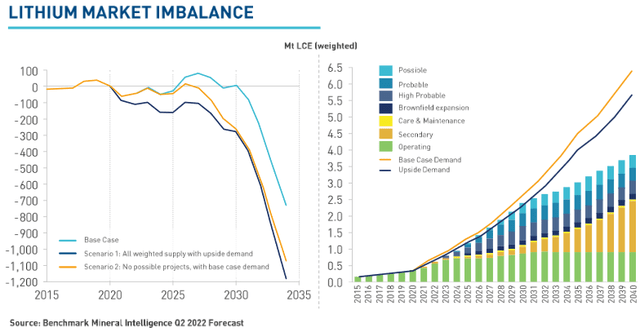

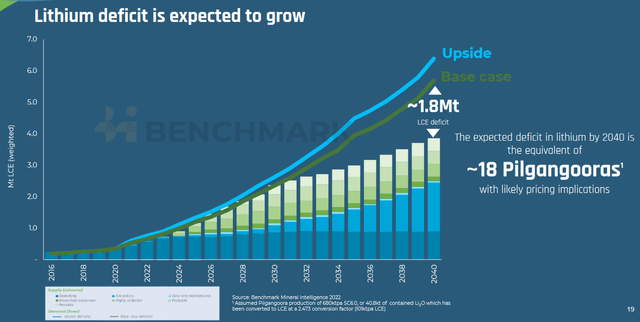

Lithium demand v supply forecast by Benchmark Mineral Intelligence (mid 2022 forecast)

BMI (Q2, 2022 forecast) – Lithium demand to exceed supply mostly this decade

Winsome Resources courtesy BMI

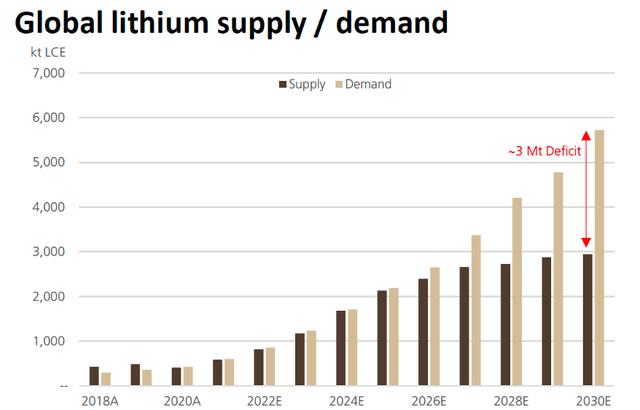

2022 – UBS lithium demand v supply forecast to 2030

BMI demand growth 2022-2035 (in mtpa) for critical metals, also number of new mines required by 2035

Benchmark Mineral Intelligence (LinkedIn) UBS

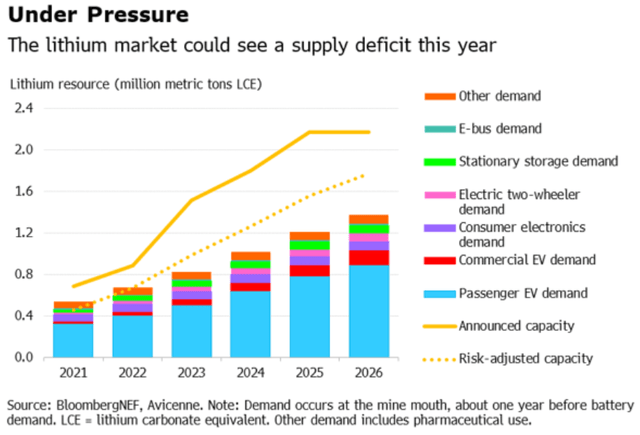

BloombergNEF lithium demand v supply forecast (as of mid 2022)

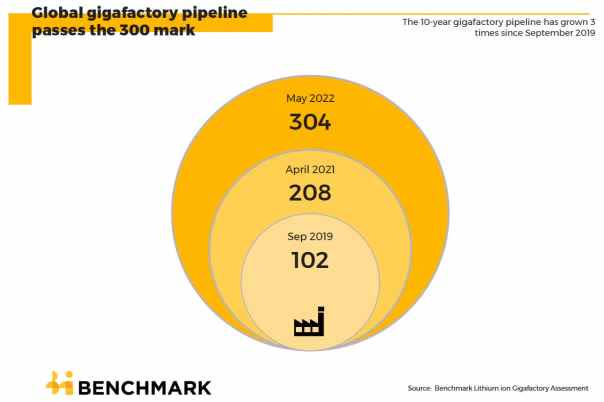

BMI – Global lithium-ion battery gigafactory pipeline – now at 304 and 6,387.6 GWh as of May 2022

BMI

Lithium market and battery news

On October 25 Reuters reported:

Volkswagen: we have never had supply chain shortages like today……”We never used to talk to mining operators – now we know their business model”……

On October 25 Fastmarkets reported:

Deglobalization of lithium-ion supply chain key for transition to new generation energy for Western economies. “Get used to deglobalization,” Wood McKenzie’s vice-chairman metals & mining, Julian Kettle, said at the LME Metals Seminar on Monday October 24, “[because that] is how we will deliver the energy transition – rather than globalization.”….. Delegates heard how Western economies have been increasingly moving to deglobalize the lithium-ion battery supply chain to reduce their over-reliance on certain countries – namely China. And they were told that supplies of lithium, alongside other key battery materials such as cobalt and nickel, have been tight in recent years and struggling to keep up with the surge in demand as the world pushes for electrification……In the meantime, tight global supplies have seen lithium prices reached record highs.

On October 25 Caixin Global reported:

CATL aims to mass produce sodium-ion batteries in 2023……it has been setting up a supply chain for the batteries and has entered negotiations with some carmakers about their use. The context: The technological limitations of sodium-ion batteries have mostly seen their use confined to things like e-bikes and energy storage, according to analysts at brokerage Pacific Securities Co. Ltd…….CATL’s first-generation sodium battery generates 160 watt-hours electricity per kilogram, compared to over 200 watt-hours for a mainstream lithium battery.

On October 25 Mining Technology reported:

Imerys to develop new lithium exploitation project in France. The project, which would cost about €1bn for construction, is expected to produce 34,000 tonnes of lithium hydroxide annually. French minerals company Imerys is set to develop a new lithium exploitation project, named the Emili Project, at its Beauvoir site in Allier, France…..French minerals company Imerys is set to develop a new lithium exploitation project, named the Emili Project, at its Beauvoir site in Allier, France……Based on initial assessments, the project is expected to produce 34,000tpa of lithium hydroxide for at least 25 years.

On October 28 DigiTimesAsia reported:

Oversupply of LFP battery cathode materials may loom on rapid capacity expansion in China…..The supply of cathode materials is about to exceed the demand, but this does not necessarily mean that the shortage of lithium mineral refining has been resolved, industry sources said, stressing that the refining crunch will not ease until 2025 and many new makers of cathode materials may lack upstream lithium materials to support their production as a result.

On October 28 Stockhead reported:

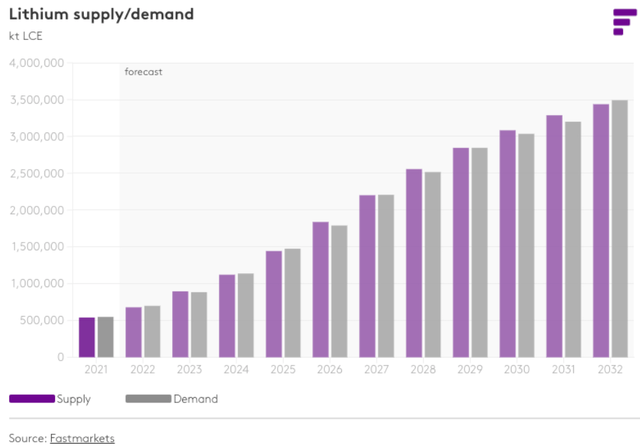

Eye on Lithium: It’ll be tight, but global battery metals supply WILL be able to meet surging EV demand, Fastmarkets. Although demand for EVs is expected to grow significantly through to 2032, Fastmarkets says BRM supply will be able to support that demand. “It is going to be tight and supply-demand balances will go slightly negative in the second half of decade but overall, the combination of investment, expanded production, new projects, evolving technology, and an emerging recycling market is forecast to support EVs and other battery demand through 2032,” the agency says.

Fastmarkets lithium demand v supply forecast (as of 2022) (Source)

Stockhead courtesy Fastmarkets

On October 31, Reuters reported:

Panasonic to start building Kansas battery plant next month…..and aims to begin mass production by March 2025, targeting North America’s fast-growing market for electric vehicles. The conglomerate’s energy unit said in July it had picked Kansas as the site for a new plant to supply batteries primarily to Tesla Inc……..

On November 1, Reuters reported:

EV battery production faces supply chain, geopolitical headwinds – report…….original equipment manufacturers’ battery-electric and hybrid vehicle sales aspirations will face strong headwinds as they scramble for raw materials, with annual market demand for lithium-ion batteries pegged at about 3.4 Terawatt hours (TWh) by 2030…….”Elements such as lithium, nickel, and cobalt do not just magically appear and transform into EV batteries and other components,”……The intermediate steps between excavation of elements and final assembly are a particular choke point, he added……

On November 1, The Business Times reported:

South Korea launches government-backed battery alliance to source key metals……The country, home to major battery makers LG Energy Solution, Samsung SDI, and SK Innovation’s SK On, is seeking to bolster supply chain stability and metals to become a major player in the field, which is dominated by China…….

On November 5, Global X ETFs posted on Seeking Alpha:

Lithium market update: Elevated prices are creating favorable dynamics for miners……Supply is unlikely to grow in lockstep with demand through the first half of the decade, likely generating deficits that could support elevated lithium pricing.

On November 8, The European Union announced:

COP27: European Union concludes a strategic partnership with Kazakhstan on raw materials, batteries and renewable hydrogen…….The EU and Kazakhstan have committed to develop a Roadmap for 2023-2024, with concrete joint actions agreed within six months of the signature of the Partnership……The Commission has already adopted two strategic partnerships on raw materials with Canada (June 2021) and Ukraine (July 2021).

On November 8, Bloomberg reported:

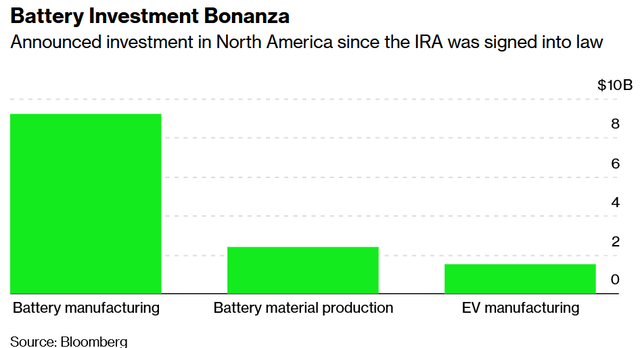

Democrats supercharged EV investment while they had the chance…… More than $13 billion of investment in battery raw material production and battery and EV manufacturing has been announced in the less than three months since Biden signed the IRA into law on Aug. 16. Volkswagen and Mercedes-Benz almost immediately sealed agreements to secure mining and refining resources from America’s neighbor to the north. Honda and Toyota earmarked almost $7 billion worth of EV battery plant investments within two days of one another. An Australian development company started up the first US cobalt mine in three decades. BMW said it would spend $1.7 billion expanding its South Carolina SUV factory, and that its battery supplier would build a new plant nearby.

Democrats supercharged EV investment. Battery manufacturing being the main winner so far (Source: Bloomberg)

On November 10, S&P Global reported:

FEATURE: Raw material supply a challenge to meet battery demand. Lithium could present greatest challenge…..As the Western world looks looking to increase battery making capacity, one challenge facing the industry is raw material supply and whether there will be enough to meet demand by 2030…Battery maker Northvolt does not believe there will be enough raw material supply and refineries to supply the planned gigafactory capacities planned by 2030…The Cobalt Institute believes there will be enough cobalt to meet demand by 2030, although it will require investment, continued diversification and recycling, its president Adam McCarthy said…….”

On November 10, Korea JoongAng Daily reported:

Posco Chemical finishes largest cathode plant in world. Posco Chemical finished construction of the world’s largest cathode plant in Gwangyang, South Jeolla, to become a major player in the fast-growing electric vehicle (EV) battery industry. The 165,203-square-meter plant has 90,000 tons of annual capacity, which is enough to make batteries for 1 million EVs. That is the world’s largest facility in terms of cathode production, Posco Chemical said. Made of lithium, nickel, cobalt and manganese, cathode materials account for 40 percent of the production cost of an EV battery.

On November 11, Simon Moores from BMI tweeted a quote from Goldman Sachs:

“Now, adjusting our global lithium demand assumptions for this stronger restocking environment…the lithium market is expected to be in an 84kt deficit in 2022 (vs 8kt surplus previously) and a small surplus in 2023 (vs 76kt surplus previously)” Goldman. Sachs

On November 11, Bloomberg BNN reported:

Ford, GM in talks with Posco on investing in battery metal hubs. Ford Motor Co., General Motors Co., and Stellantis NV are in talks with South Korea’s Posco Chemical Co. about potentially investing in plants producing electric-vehicle battery materials in North America, according to people familiar with the matter. The factories would make cathode-active or anode materials……

On November 13, CBS News reported:

U.S. military weighs funding mining projects in Canada amid rivalry with China. Canadian companies told they qualify under Defense Production Act……The United States military has been quietly soliciting applications for Canadian mining projects that want American public funding through a major national security initiative.

On November 15, Seeking Alpha reported:

Lithium stocks slammed on talk of Chinese cutbacks, negative analyst notes…..following a selloff in Asian lithium producing peers on rumors of production cutbacks at a major Chinese producer of cathodes…… Goldman Sachs reaffirmed its bearish views on lithium this week, forecasting supply will begin to outpace demand from 2023 onwards.

Note: On November 14 Fintel reported: “Goldman Sachs Group Inc reports 48.11% increase in ownership of LAC / Lithium Americas Corp.”

On November 16, Teslarati reported:

Tesla to negotiate battery-grade lithium refinery in TX behind closed doors. Tesla’s negotiations for a battery-grade lithium refinery in Texas are going to be handled behind closed doors. Tesla will be discussing the details of its planned $365 million lithium refinery with Nueces County commissioners. On Wednesday, November 16, Nueces County commissioners unanimously voted to move negotiations with Tesla to executive session.

On November 16, Benchmark Mineral Intelligence reported:

How can the world meet Elon Musk’s 300 TWh battery capacity target? The world will need to increase battery production thirty-fold from today’s levels……Production of lithium ion batteries will need to increase from 0.6 TWh a year to 20 TWh by 2050…….That would require a twenty-fold increase in lithium supply to 12 million tonnes of lithium LCE and a similar increase in nickel sulphate to 8 million tonnes. Cobalt supply would have to increase by five times to 1 million tonnes of cobalt sulphate, and manganese by over twenty-fold to 2.5 million tonnes of manganese sulphate, according to Moores.

Note: Bold emphasis by the author.

On November 17, The West Australian reported:

Expert predicts meteoric price rise for lithium. Internationally recognised lithium expert Joe Lowry expects the price of battery quality lithium carbonate to continue its upward trajectory into 2027 before hitting highs of US$97,000 per tonne as the supply and demand curve starts to invert…….Whilst the US$97,000 tag is the peak price predicted by Lowry, the Global Lithium LLC founder has identified a base value of just below $US80,000 and a potential 2027 low of around $US70,000……Lowry predicts the current global lithium supply deficit to continue for some years and whilst there has been significant growth in potential supply with numerous projects being unlocked all over the world, demand is still growing faster.

On November 17, Stockhead reported:

Monsters of Rock: Chris Ellison goes HAM on lithium bears at MinRes AGM…… Speaking at the lithium and iron ore miner’s AGM in Perth today, two days after analyst notes from Credit Suisse and JPMorgan on a drop in carbonate futures in China sent investors in lithium running, Ellison bullishly said there is “way more demand than supply”…

On November 17, Market Index reported:

Lithium market to remain in deficit despite supply efforts and price volatility: Macquarie. Macquarie expects the lithium market to remain in deficit through to 2030…..

On November 18, Reuters reported: “U.S. Republicans aim to shorten EV mine permitting after House win.”

On November 20, Joe Lowry tweeted: “Finally a “Morgan” that gets the #lithium market situation. @jpmorgan seems to be listening to the @globallithium podcast.”

Joe Lowry twitter

On November 21, BNN Bloomberg reported:

Canada’s battery supply credibility jumps as multi-billion announcements keep coming…… Research firm BloombergNEF pushed Canada’s position in its annual global ranking of battery-producing countries ahead of everyone else but China…….Canada has announced more than $15 billion in investments over the past 10 months in areas ranging from critical mineral mining and processing to battery component manufacturing, electric vehicle production and the country’s first gigafactory.

On November 21 The Tennessean reported:

South Korean firm to spend $3.2B in TN, create 1,000 jobs in what governor calls historic investment……Tennessee and LG Chem announced plans to develop a cathode materials plant for electric vehicle batteries, which Lee said will bring around 1,000 jobs to the area with a $3.2 billion investment…….LG Chem CEO Hak Cheol Shin said construction on the plant is set to begin in the first quarter of 2023, with mass production scheduled to start in late 2025. Shin said the factory is projected to produce 120,000 tons of cathode battery materials annually once fully operational, which is enough to power batteries in 1.2 million electric vehicles.

Note: Piedmont Lithium recently announced their plans to build a lithium hydroxide facility in Tennessee with production to start in 2025.

Lithium miner news

Albemarle (NYSE:ALB)

On November 2, Albemarle announced: “Albemarle reports net sales increase of 152% for third quarter 2022.” Highlights include:

- “Net sales of $2.1 billion, an increase of 152%.

- Net income of $897.2 million, or $7.61 per diluted share; Adjusted diluted EPS of $7.50, an increase of 614%.

- Adjusted EBITDA of $1.2 billion, an increase of 447%.

- Completed the acquisition of the Qinzhou lithium conversion plant in Guangxi China for $200 million on Oct. 25, 2022.

- Kemerton II lithium conversion plant achieved mechanical completion and transitioned to commissioning phase.

- Awarded U.S. Department of Energy grant for US-based lithium concentrator facility to support domestic EV supply chain.

- Concluded strategic review of the Catalysts business; to be retained as wholly owned subsidiary branded as Ketjen.

- Realigning core Lithium and Bromine businesses into Energy Storage and Specialties segments expected to be effective Jan. 1, 2023.

- Tightened full-year 2022 guidance including net sales of $7.1 – $7.4 billion (>2x 2021) and adjusted EBITDA of $3.3 – $3.5 billion (3.7x 2021).”

On November 2 Seeking Alpha reported:

Albemarle Non-GAAP EPS of $7.50 beats by $0.51…..Revenue of $2.09B (+151.6% Y/Y) misses by $120M. The company tightened FY2022 guidance:…..Adjusted EPS of $19.75 – $21.75 from previous outlook of $19.25 – $22.25…..We had an outstanding quarter driven by strong demand for lithium-ion batteries,” said Albemarle CEO Kent Masters……With our acquisition of the Qinzhou lithium conversion plant in China and mechanical completion of our Kemerton II expansion in Australia, we are on track to more than double our lithium conversion capacity compared to last year.

On November 3 Bloomberg reported:

Albemarle profit hits record high as EV boom powers lithium demand. Earnings were more than seven times the same year-ago period. World’s top miner sees ‘ongoing strength in lithium pricing’.

On November 9, Albemarle announced: “Albemarle Corporation invests up to $540 million in Arkansas facility expansion…..”

Sociedad Quimica y Minera de Chile S.A. (NYSE:SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV)

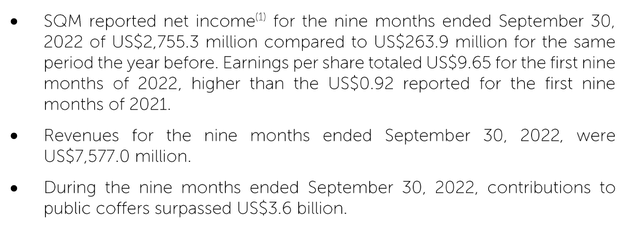

On November 16, SQM announced: “SQM reports earnings for the third Quarter of 2022.” Highlights include:

Sociedad Quimica y Minera S.A.

On November 9 The Korea Post reported:

SK On signs lithium hydroxide supply deal with SQM of Chile. To secure high quality lithium hydroxide for five years starting in 2023……In addition to the supply deal, SK On and SQM agreed to discuss a mid-to long-term partnership to enhance their cooperative relationship, including additional lithium supply, potential investment in production plants, and waste battery recycling.

Upcoming catalysts:

Q4, 2023 – Mt Holland spodumene production to begin (SQM/Wesfarmers JV).

Q4, 2024 – 50ktpa Lithium hydroxide [LiOH] refinery (SQM/Wesfarmers JV).

Investors can read SQM’s latest presentation here or the latest Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTCPK:GNENF) (OTCPK:GNENY)

No lithium news for the month.

Investors can read the latest Trend Investing article on Ganfeng Lithium here.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466], Tianqi Lithium Energy Australia (TLEA) is a JV with Tianqi Lithium (51%) and IGO Limited (49%). TLEA owns the Kwinana lithium hydroxide facility in WA

No significant news for the month.

You can watch a good Tainqi lithium CEO video interview here, where he discusses lithium market demand and supply issues.

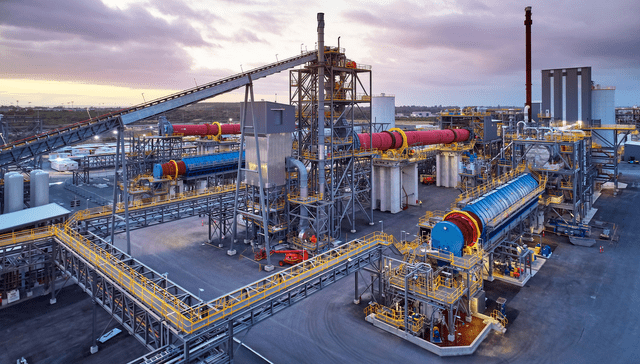

Kwinana lithium refinery JV (51% Tianqi: 49% IGO) in Western Australia

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On October 25, Pilbara Minerals announced: “September 2022 quarterly activities report. Increased production and sales generate a significant $783.7M contribution towards a cash balance of $1.375 billion, as works commence on the P680 Project.” Highlights include:

Production and sales

- “Production – 147,105 dry metric tonnes (dmt) of spodumene concentrate (16% increase from the June Quarter 2022: 127,236 dmt).

- Shipments – 138,249 dmt of spodumene concentrate (June Quarter 2022: 132,424 dmt).

- Ngungaju Plant achieves nameplate capacity of 180-200,000 dmtpa.

- Sale of 45,041 dmt of “middlings” product (SC1.2 concentrate), which was produced during commissioning of the Ngungaju Plant.

- Shipping milestone – one millionth tonne of spodumene concentrate.

- Average realised sales price of US$4,266/dmt SC5.3 basis (CIF China) achieved for spodumene concentrate shipped. This equates to a reference price of US$4,813/dmt on an SC6.01 basis (CIF China) when adjusted pro-rata for lithia content (June 2022 Quarter: US$4,267/dmt SC6.0 basis (CIF China)…..”

Project development

- “P680 Project commenced, with bulk earthworks underway and long-lead item contracts awarded.

- Construction of the 43,000tpa LHM primary lithium hydroxide chemical processing facility in South Korea in joint venture with POSCO was progressed, with certain key contracts awarded and preliminary site activities underway.”

Corporate

- “A substantial $783.7M increase in the Quarter-end cash balance to $1.375B (June Quarter: $591.7M).

- Cash balance inclusive of irrevocable letters of credit ($132.2M) for shipments completed up to 30 September 2022 increased to $1.508B (June Quarter: $874.2M inclusive of $282.4M of irrevocable bank letters of credit).”

On November 11, Pilbara Minerals announced:

$250m Australian Government financing to support expansion at Pilgangoora……Funding earmarked to support construction of P680 Project expansion at the Pilgangoora Operation…….The Facility is subject to final negotiation of Facility terms…..

On November 16, Pilbara Minerals announced:

Results of BMX auction. Equivalent price of ~ US$8,575/DMT (SC6.0, CIF China)……A cargo of 5,000dmt at a target grade of ~5.5% lithia was presented for sale on the digital platform, with delivery expected from mid December 2022…..

On November 16, Market Index reported:

Pilbara Minerals to hit dividend status in FY23: What does the payout look like?…..The company is targeting a payout ratio between 20-30% of free cash flow. Based on Macquarie’s FY23 earnings estimates, the dividend could sit between 19.7 cents to 30 cents per share.

Upcoming catalysts:

Late 2023 – Plan to commission production of POSCO/Pilbara Minerals (18%, option to increase to 30%) JV LiOH facility in Korea.

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (60% ALB: 40% MIN) restarted in mid 2022. (Note the non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV). The 50ktpa Kemerton Lithium Hydroxide refinery (60% ALB: 40% MIN) is due for first sales in H2, 2022.

On October 26, Mineral Resources announced: “Quarterly exploration and mining activities report July to September 2022 (Q1 fy23).” Highlights include:

- “Mt Marion and Wodgina remain on track to achieve FY23 production guidance (490 – 540 kdmt attributable2).

- The average spodumene concentrate 6% (SC6) equivalent FOB reference price to be applied to Wodgina and Mt Marion shipments of spodumene to be converted to higher value products is US$4,187/dmt for shipments from 1 July 2022 to 31 December 2022…….

- Mt Marion shipped 56k dmt (51% share) of spodumene concentrate over the quarter. The average realised spodumene concentrate price at Mt Marion was US$2,364/dmt which includes grade adjustments and product discounts.

- The Wodgina ramp up continued with first spodumene concentrate produced from Train 2 in July. Wodgina shipped 26k dmt (40% share) of SC6 over the quarter. Wodgina spodumene concentrate earnings will be recognised once converted to lithium hydroxide and sold.

- A total of 4,703 tonnes (attributable) of lithium hydroxide was converted during the quarter. MinRes’ 51% offtake share of Mt Marion spodumene concentrate for the quarter was converted into 3,772 tonnes of lithium hydroxide in China and sold under the tolling agreement with Jiangxi Ganfeng Lithium Co. Ltd (Ganfeng), at an average realised lithium hydroxide price of US$79,288/t (inclusive of China VAT). A total of 931 tonnes of lithium hydroxide was converted by Albemarle from Wodgina spodumene (MinRes 40% share) during the quarter which is expected to be sold in Q2 FY23.

- MinRes continued4 to evaluate various strategic options to maximise value creation for shareholders, including in relation to its lithium business…..”

On November 18 Market Index reported:

A lithium spin-off is off the cards: Mineral Resources. The prospect of a lithium demerger was shot down by MinRes Managing Director Chris Ellison on Wednesday. Ellison wants to keep all four business divisions together.

Investors can read the latest Trend Investing article on Mineral Resources here.

Livent Corp. (LTHM)[GR:8LV]

On November 1, Livent Corp. announced:

Livent releases third quarter 2022 results. Revenue was $231.6 million, up 6% and 124% from the second quarter of 2022 and the prior year, respectively. Reported GAAP net income was $77.6 million, 29% higher than the previous quarter, and 37 cents per diluted share. Adjusted EBITDA was $110.8 million, 17% above the previous quarter and over seven times higher than the prior year, and adjusted earnings per diluted share were 41 cents…..”Lithium demand has remained robust despite some near-term supply chain disruptions and global macro concerns,” said Paul Graves, president and chief executive officer of Livent. “Published lithium prices moved higher in the third quarter amid continued favorable market conditions. Livent achieved higher realized prices and delivered increased volumes to customers.”

On November 4, Reuters reported:

Livent looks to Canada for lithium growth opportunities – CEO. Lithium producer Livent Corp is eyeing acquisitions in Canada and other countries as it looks to boost its production and processing of the metal used to make electric vehicle batteries, its chief executive told Reuters…….”We see Canada as a core part of our expansion capacity,” Paul Graves, Livent’s CEO, said in a Thursday interview. “We have to get bigger. We can’t just sit still.”

On November 14, Livent Corp. announced:

Livent completes North Carolina expansion of largest lithium hydroxide production site in the United States…..The expansion in Bessemer City will boost the site’s lithium hydroxide manufacturing capacity by 50%, helping meet the growing demand for EV battery materials produced in the United States…..

You can read the Trend Investing Livent article here when Livent was trading at US$7.26.

Allkem [ASX:AKE] [TSX:AKE] (OTCPK:OROCF)(formerly Orocobre)

On November 14, Allkem announced: “Sustainability report 2022.”

On November 15, Allkem announced:

First lithium hydroxide successfully produced at Naraha. Allkem Limited (ASX|TSX: AKE, “Allkem” or the “Company”) and Toyota Tsusho Corporation (“TTC”) are pleased to advise that the Naraha Lithium Hydroxide plant in Japan has produced its first lithium hydroxide chemical product. Allkem has a 75% economic interest in Naraha through a joint venture with Toyota Tsusho Corporation who manage the Narahan operation.

Upcoming catalysts include:

- Late 2022 – Naraha to begin commercial production.

- H1, 2022 – Olaroz Stage 2 expansion commissioning followed by a 2 year ramp to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- Late 2023 – Sal De Vida Stage 1 production targeted to begin and ramp to 15ktpa. SDV Stage 2&3 combined will begin about 2025 and ramp to an additional 30ktpa. Total combined when completed will be 45ktpa.

- Mid 2024 – James Bay production targeted to start.

You can read the latest investor presentation here. You can read the latest Trend Investing Allkem article here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

On November 2, AMG Advanced Metallurgical Group NV announced: “Lithium performance drives AMG to all-time record earnings and increased full year guidance.” Highlights include:

Lithium

- “The project to expand the spodumene production in AMG Brazil is under construction. The objective is to be at full capacity in the second half of 2023.

- The AMG Lithium refinery in Bitterfeld, Germany, Europe’s first lithium hydroxide refinery, is under construction, and commissioning for the first 20,000-ton module of the battery-grade lithium hydroxide upgrader will commence in the fourth quarter of 2023.

- AMG Lithium’s battery-grade hydroxide refinery has signed a binding supply agreement with EcoPro, a leading South Korean cathode paste producer, for an initial three-year term to deliver a minimum of 5,000 tons per annum of battery-grade lithium hydroxide to EcoPro’s cathode materials production plant in Debrecen, Hungary.

- AMG has negotiated a strategic tolling contract for our spodumene production as well as third-party spodumene to supply technical-grade hydroxide to Bitterfeld.

- AMG has consolidated its lithium value chain under one legal entity and is currently aligning its lithium management and governance structures to further increase the long-term value of its lithium activities. Accordingly, we are preparing a re-segmentation of AMG to be approved by the Supervisory Board in December and become effective on January 1, 2023.”

Financial Highlights

- “Revenue increased by 36% to $425 million in the third quarter of 2022 from $312 million in the third quarter of 2021.

- EBITDA was a record $103 million in the third quarter of 2022, up 210% versus the third quarter 2021 EBITDA of $33 million.

- Annualized return on capital employed was 29.5% for the first nine months of 2022, more than double the 10.4% for the same period in 2021.

- Cash flow from operations was $75 million for the third quarter 2022, driven by the high profitability of AMG Lithium in Brazil.

- Net income attributable to shareholders for the third quarter of 2022 was $68 million, yielding $2.09 diluted earnings per share, compared to $0.02 diluted loss per share in the third quarter of 2021.

- AMG’s liquidity as of September 30, 2022 was $489 million, with $306 million of unrestricted cash and $183 million of revolving credit availability.”

On November 21, AMG Advanced Metallurgical Group NV announced:

AMG update on energy transformation: LIVA Batteries. AMG Advanced Metallurgical Group N.V. (“AMG”, EURONEXT AMSTERDAM: “AMG”) announces that its subsidiary, AMG LIVA, has put its first battery Hybrid Energy Storage System (“HESS”) into fully automatic operation mode in Hauzenberg, Germany. The HESS battery system is an ecosystem combining Lithium-Ion and Vanadium Redox Flow batteries with artificial intelligence routines and self-learning algorithms to maximize efficiency, safety and lifetime of the batteries, integrating the HESS with the facility’s power system, renewable energy sources, and the electrical grid.

Upcoming catalysts:

- Q4, 2022 – Lithium-vanadium battery (“LIVA”) for the energy storage market to be ready.

- End Q4, 2022 – New vanadium spent catalyst recycling facility in Zanesville, Ohio to be commissioned.

- H2, 2023 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing total production capacity to 130ktpa.

- Q4, 2023 – Lithium hydroxide facility in Bitterfeld-Wolfen Germany to be commissioned. First module to be 20,000tpa LiOH.

- 2023 –> Saudi Arabia vanadium Projects JV with Shell & Aramco.

- 2025-2028 – German LiOH facility expansion with Modules 2-5 (100,00tpa LiOH.

You can view the latest company presentation here or the recent Trend Investing article here.

Lithium Americas [TSX:LAC] (LAC)

On October 27, Lithium Americas announced: “Lithium Americas reports third quarter 2022 results.” Highlights include:

Argentina

Caucharí-Olaroz

- “Construction continues to progress towards production with key areas of the processing plant commenced commissioning in late Q3 2022.

- With construction nearing completion, focus remains on prioritizing production volume over product quality during ramp-up. As previously announced in July 2022, construction on a portion of the purification process designed to achieve battery-quality was deferred to the first half of 2023. The Company expects to provide an update and guidance on production ramp-up schedule around the end of 2022.

- Due primarily to the low official Argentine exchange rate and high local inflation, capital cost estimates at the official exchange rate have been revised to $852 million (on a 100% basis), up 15% from $741 million previously; however, at the substantially more favorable market-based exchange rate available and the streamlined production plan, the Company expects that there will be no material change to its total funding requirements for Stage 1. As of September 30, 2022, 85% of the budget has been spent with a substantial portion deferred until 2023, to complete the purification process. As of September 30, 2022, the Company had $63 million (49% share) in capital costs remaining at the official Argentine exchange rate, requiring funding of an estimated $31 million based on the latest market-based exchange rate.

- Development planning for Stage 2 expansion of at least 20,000 tonnes per annum of lithium carbonate equivalent continues to progress to align with completion of Stage 1. In Q2 2022, the seven local communities in the vicinity of the project approved the proposed expansion.”

Pastos Grandes

- The Company continues to advance the Pastos Grandes $30 million development plan, with completion of the plan and a resulting construction decision expected for the second half of 2023. Following the recent exploration results from the adjacent property owned by Arena Minerals Inc. (TSXV: AN) and additional modelling of the basin, the Company is updating its exploration plan.

United States

Thacker Pass

- “The Lithium Technical Development Center (“LiTDC”) in Reno continues to operate based on the Thacker Pass flowsheet processing raw ore to final battery-quality lithium carbonate. As of September 2022, over 100 tonnes of lithium ore were collected at Thacker Pass to feed the LiTDC to produce product samples for potential customers and partners. Results of ongoing test work to de-risk each step of the flowsheet continues to be in line with expectations.

- In Q2 2022, cultural work on approximately 13,000 acres was completed as required under the National Environmental Policy Act and conducted by an independent consultant, with the oversight and assistance of the Fort McDermitt Paiute and Shoshone Tribe (“Tribe”). No areas of archeological significance were identified at Thacker Pass.

- In October 2022, the Company signed a Community Benefits Agreement with the Tribe, to establish a framework for continued collaboration and define long-term benefits for the Tribe.

- On August 11, 2022, briefings were submitted for the appeal of the issuance of the Record of Decision (“ROD”) for Thacker Pass. The US District Court, District of Nevada has scheduled an oral hearing for January 5, 2023.

- Lithium Americas is moving ahead with pre-construction activities, including the selection of an engineering, procurement and construction management firm to execute the development and construction plan for Thacker Pass.

- The Company is also evaluating potential investment, partnership and supply agreements to support the development of a North American supply chain. In addition, Lithium Americas continues to progress the U.S. Department of Energy Advanced Technology Vehicles Manufacturing loan program application.

- The timing for completion of a feasibility study is now scheduled for Q1 2023, in order to reflect ongoing feedback from strategic partnership and financing process, results of LiTDC operations and to align with the anticipated timing of the ROD appeal ruling.”

Corporate

- “As at September 30, 2022, the Company had $392 million in cash, cash equivalents and short-term bank deposits, with an additional $75 million in available credit.

- On July 18, 2022, the Company made an equity investment in Ascend Elements, Inc. (“Ascend Elements”), a US-based lithium-ion battery recycling and engineered material company, by way of a subscription for Series C-1 preferred shares for $5 million.

- On September 20, 2022, the Company entered a Strategic Collaboration Agreement with Green Technology Metals Ltd. (ASX:GT1) (“GT1″), in which it owns a 5% stake, to advance a common goal of developing an integrated lithium chemical supply chain in North America….”

On November 3, Lithium Americas announced: “Lithium Americas announces intention to separate into two leading lithium companies.” Highlights include:

The Separation will establish two separate companies that include:

- “An Argentina focused lithium company (“Lithium International”) owning Lithium Americas’ current interest in its Argentine lithium assets, including the near-production Caucharí-Olaroz lithium brine project in Jujuy, Argentina (“Caucharí-Olaroz”); and

- A North America focused lithium company (“Lithium Americas (NewCo)”) owning the Thacker Pass lithium project in Humboldt County, Nevada (“Thacker Pass”) and the Company’s North American investments.”

Upcoming catalysts:

- Q1, 2023 – Record of Decision (“ROD”) for Thacker Pass. The US District Court, District of Nevada has an oral hearing for January 5, 2023.

- Q1 2023 – Thacker Pass FS.

- H2 2022 – Cauchari-Olaroz lithium production to commence and ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2024 – Possible lithium clay producer from Thacker Pass Nevada (full ramp by 2027).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy. Argosy is now producing at a small scale and ramping to 2,000tpa lithium carbonate starting June 2022.

On November 1, Argosy Minerals announced: “Rincon 2,000tpa Li2CO3 operational update.” Highlights include:

- “98% of 2,000tpa operational development works complete – with plant commissioning 86% complete.

- Current commissioning and production test-works producing primary lithium product toward battery quality lithium carbonate production.

- Continuous lithium carbonate production operations scheduled during next quarter.”

Upcoming catalysts:

- Late 2022 – Rincon Lithium Project commissioning.

Investors can view the company’s latest investor presentation here, and the latest Trend Investing Argosy Minerals article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTCPK:CXOXF)

Core 100% own the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China’s Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a “high potential for additional resources from 500km2 covering 100s of pegmatites.” Fully funded and starting mining with a planned Q4 2022 production start.

On October 27, Core Lithium Ltd. announced:

Offtake update. Australian lithium miner, Core Lithium (Core or Company) (ASX: CXO), provides the following update on a definitive product purchase agreement with Tesla under the binding term sheet (announced 29 August 2022). The date for concluding the term sheet passed on 26 October 2022 without the agreement being completed…..The sale of 15,000 tonnes of direct shipping ore (DSO) shows strong international demand for Finniss lithium……Demand for spodumene DSO material was strong, evidenced by the price achieved. The DSO is expected to be shipped before the end of the year, in advance of spodumene concentrate production in H1 2023. Agreements in place with Ganfeng, and Yahua bring total concentrate sales under offtake contracts to about 80% of the Finniss Lithium Project production over the first four years of operations.

On October 31, Core Lithium Ltd. announced: “Quarterly activities report for the three months ended 30 September 2022.” Highlights include:

- “Progressed construction activities at the Finniss Lithium Project.

- Uncovered ore in the Grants pit.

- Upgraded the Finniss Mineral Resource Estimation (MRE) by 28% and Finniss Lithium Project Ore Reserve by 43% to extend the Life of Mine to 12 years.

- Received final assays for BP33 diamond drilling, which confirmed strong potential for further MRE growth.

- Successfully completed a fully underwritten $100m capital raise in October.

- Continued offtake negotiations with globally significant parties.

- Welcomed new CEO Gareth Manderson.”

On November 11, Core Lithium Ltd. announced: “Business update.” Highlights include:

- “Transport of DSO from the Finniss Lithium mine to the Darwin Port has commenced.

- Loading of the first ship is scheduled to commence in the coming weeks.”

Investors can read a company presentation here, or the Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- H1 2023 – Lithium spodumene concentrate production at Finniss targeted to begin.

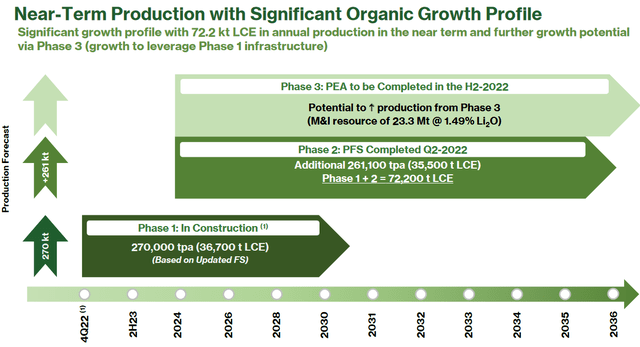

Sigma Lithium Resources [TSXV:SGML] (SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On November 18, Sigma Lithium Resources announced: “Sigma lithium announces significant progress on construction, completing 94% of concrete and 76% of steel for greentech plant, commissioning to be initiating December 2022.” Highlights include:

- “Sigma Lithium construction activities advanced significantly on multiple fronts during the third quarter of 2022…….

- Sigma Lithium remains on track to initiate commissioning of the crushing plant by year end, planning to commence commercial production in April 2023: Expected to generate significant free cash flows in the second quarter of 2023, as one of the lowest cost producers of battery grade lithium concentrate. Further benefits from extremely robust current lithium pricing environment throughout 2023……

- Mining activities are ongoing, with the opening of the Phase 1 mine: Completed ‘pre-stripping’ of the mine. Ongoing preparation for operational readiness and initiation of spodumene ore mining this month.

- The Company has practically completed all civil construction of the Greentech Plant. Finalized over 99% of concrete works for the crushing module and 94% for the dense media separation (“DMS”) module of the Greentech Plant. Finalized 98% of steel rebars for the Greentech Plant….

- The Company also made significant progress on the electrical sub-station, achieving 50% completion.

- The construction of the piping system to bring the water from the Rio Jequitinhonha is also significantly advanced as follows: 97% of pipe distribution completed. 75% of welding completed. 58% of pipe excavation completed.”…..

Corporate

- “Sigma Lithium ended the third quarter with C$85 million in cash & cash equivalents as of September 30, 2022. The current cash position as of November 18, 2022 is C$58 million.

- As result of the extremely robust current lithium pricing environment Sigma Lithium decided to preserve maximum commercial flexibility for the commercialization of its Battery Grade Sustainable Lithium. Therefore, obligations under the heads of agreements entered into with Mitsui in March 2019 (the “Mitsui HOA”) were terminated, and the Company decided to repay C$4.0 million drawn under the Mitsui HOA.”

Catalysts include:

- Late 2022 – Commissioning at the Grota do Cirilo Project.

- April 2023 – Commercial production targeted to begin at the Grota do Cirilo Project in Brazil and ramp to 531,000tpa spodumene (Stage 1 and 2 combined).

Investors can read the latest company presentation here or the Trend Investing article here back when Sigma was trading at C$5.00.

Sigma Lithium has very large production plans (source)

Sigma Lithium company presentation

Lithium miner ETFs

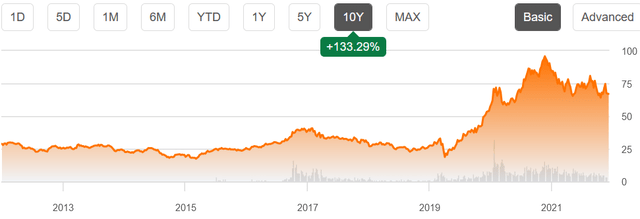

The LIT fund was slightly down in November. The current PE is 23.12.

Our model forecast is for lithium demand to increase 5.3x between end 2020 and end 2025 to ~1.8m tpa, and 13x this decade to reach ~4.5 m tpa by end 2029 (assumes electric car market share of 32% by end 2025 and 70% by end 2029).

Note: A Nov. 2020 UBS forecast is for “lithium demand to lift 11-fold from ~400kt in 2021 through to 2030.”

Global X Lithium & Battery Tech ETF (LIT) 10 year price chart

- The Amplify Lithium & Battery Technology ETF (BATT) is currently on a PE of 11.02. It is a well diversified fund. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles. BATT seeks investment results that correspond generally to the EQM Lithium & Battery Technology Index (BATTIDX).

Conclusion

November saw a stellar month for lithium producers hitting earnings out of the ballpark, boosted by strong lithium prices.

The strange thing about November was that most lithium miners stock prices did not rise, even SQM fell ~10% the day after announcing record earnings (up 10.5x YTD YoY). Something will have to give as lithium producers forward PE ratios continue to fall into the single digits (Eg: ALB 9.9, SQM 7.0, PLS 6.9). Given analysts use very conservative pricing for their forecasts then one must question why are the lithium producers trading at 2-3x less than the market average (19.4), given we are in the lithium decade with 11-13x demand growth forecast. Looks like a massive disconnect that at some point must close. Or put another way the lithium producers could all double in price and still look reasonably well valued, if lithium prices remain stronger for longer.

Goldman Sachs have already admitted they got their bearish call wrong in 2022, perhaps Morgan Stanley will be next after their 2021 forecast went horribly wrong (“Morgan Stanley expects the price to normalise in the second half of 2022 at $US13,000 a tonne”). Perhaps our Trend Investing forecasts (paywalled) and the real lithium experts are wrong and a global recession or EV sales collapse will have changed everything in 2023. Let’s look back in a year and reflect.

Highlights for the month were:

- Volkswagen says: “We never used to talk to mining operators – now we know their business model.”

- Deglobalization of lithium-ion supply chain key for transition to new generation energy for Western economies.

- CATL aims to mass produce sodium-ion batteries in 2023.

- Fastmarkets: It’ll be tight, but global battery metals supply WILL be able to meet surging EV demand.

- Panasonic to start building Kansas battery plant next month, primarily for Tesla.

- European Union concludes a strategic partnership with Kazakhstan on raw materials.

- Democrats supercharged USA EV investment with US$13b of investments announced so far, led by battery manufacturing.

- S&P Global: Raw material supply a challenge to meet battery demand. Lithium could present greatest challenge.

- Goldman Sachs changes its lithium forecasts – “84kt deficit in 2022 (vs 8kt surplus previously) and a small surplus in 2023 (vs 76kt surplus previously)”.

- Posco Chemical finishes largest cathode plant in world. Ford, GM in talks with Posco on investing in battery metal hubs.

- U.S. military weighs funding mining projects in Canada amid rivalry with China.

- Lithium expert Joe Lowry expects the price of battery quality lithium carbonate to continue its upward trajectory into 2027 before hitting highs of US$97,000/t…..has identified a base value of just below $US80,000 and a potential 2027 low of around $US70,000.

- MinRes CEO Chris Ellison says there is “way more demand than supply”.

- Macquarie expects the lithium market to remain in deficit through to 2030.

- U.S. Republicans aim to shorten EV mine permitting after House win.

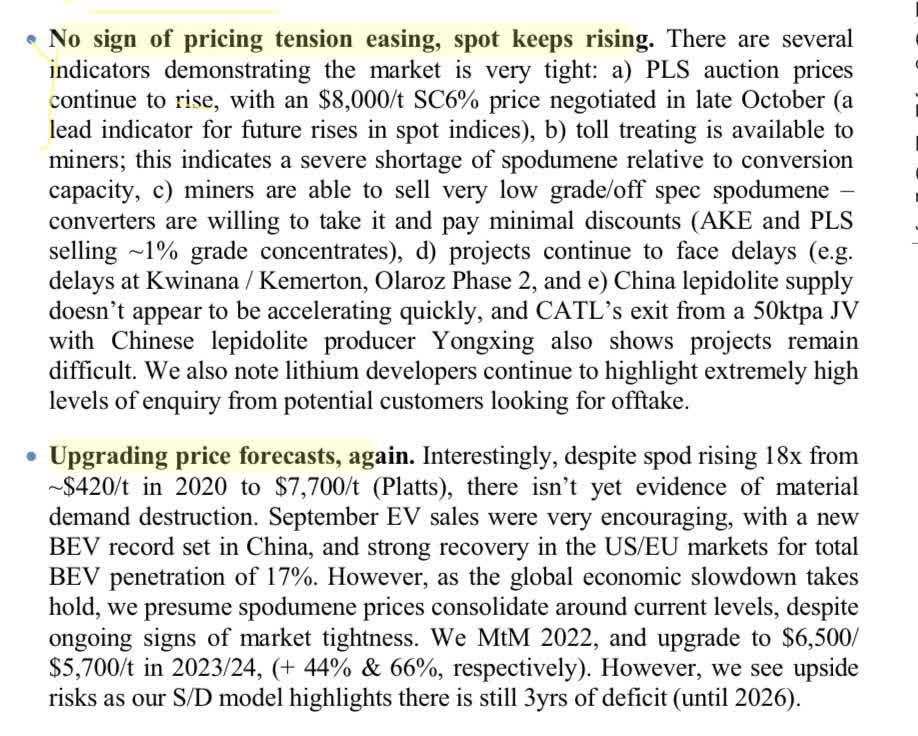

- JPMorgan upgrades lithium spodumene prices to $6,500/$5,700/t in 2023/24 (+44% & 66%, respectively), 3 years of deficit (until 2026).

- Canada’s battery supply credibility jumps as multi-billion announcements keep coming.

- LG Chem (now LGES) to spend $3.2B in Tennessee to develop a cathode materials plant for EV batteries.

- SK On signs 5 year lithium hydroxide supply deal with SQM, starting 2023.

- Albemarle CEO: “We had an outstanding quarter driven by strong demand for lithium-ion batteries.” Earnings were more than seven times the same year-ago period.

- SQM EPS for the first 9 months of 2022 was US$9.65, up 10.5x from US$0.92 the corresponding period in 2021. SK On signs lithium hydroxide supply deal with SQM.

- Pilbara Minerals achieves another record BMX spodumene price (Eq. price of ~US$8,575/DMT (SC6.0, CIF China)). Begins works on the P680 Project. Receives A$250m Australian Government financing to support expansion at Pilgangoora.

- MinRes – Mt Marion and Wodgina remain on track to achieve FY23 production guidance.

- Livent looks to Canada for lithium growth opportunities. Completes North Carolina expansion of largest LiOH production site in the United States.

- Allkem achieves first lithium hydroxide production at Naraha.

- AMG’s net income attributable to shareholders for Q3 2022 was $68m. AMG Brazil expansion is under construction, to be at full capacity in H2, 2023. AMG Lithium refinery in Germany is under construction, set to begin Q4, 2023.

- Lithium Americas announces intention to separate into two leading lithium companies.

- Argosy Minerals 98% of 2,000tpa operational development works complete with plant commissioning 86% complete.

- Core Lithium term sheet with Tesla expires with no agreement. Transport of DSO from the Finniss Lithium mine to the Darwin Port has commenced. Progressed construction activities at the Finniss Lithium Project.

- Sigma Lithium Grota do Cirilo Project commissioning in December 2022, commercial production in April 2023.

As usual all comments are welcome.

Be the first to comment