Ekaterina79/iStock Editorial via Getty Images

Investment Thesis: Lindt & Sprungli’s (OTCPK:LDSVF) position in the luxury end of the chocolate market should allow the company to bolster sales growth in spite of inflationary pressures.

In a previous article back in June, I made the argument that Lindt & Sprungli could see longer-term upside as a result of a strong cash position and growing sales – despite the risk of inflation and supply shortages hindering growth in the short to medium-term.

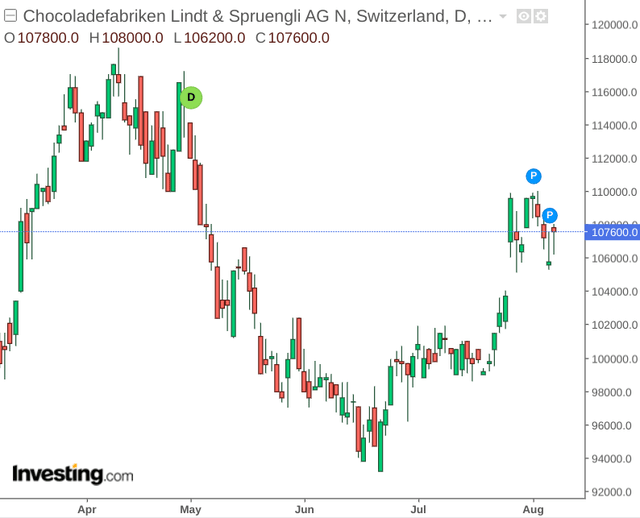

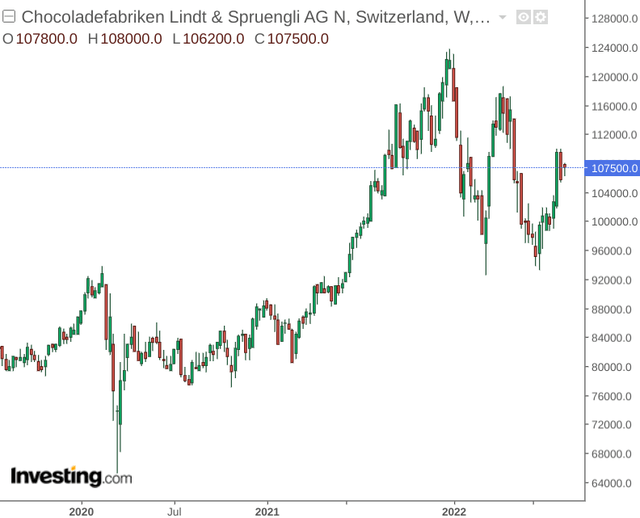

Over the summer months, we have seen the stock rebound:

The purpose of this article is to assess whether the stock could see a further rebound in growth over the rest of this year, taking the company’s recent half-year results into account. Please note that the above stock price, as well as all figures cited from the company’s financial reports are denoted in Swiss Francs.

Performance

To gauge Lindt & Sprungli’s cash position, I decided to calculate the quick ratio (cash plus accounts receivable plus marketable securities all over total current liabilities) for December 2021 and June 2022. We can see that the quick ratio has fallen during this time – indicating that the company has less cash left over to meet its short-term liabilities.

| Dec 2021 | Jun 2022 | |

| Cash and cash equivalents | 937.2 | 794 |

| Accounts receivable | 895.3 | 383.7 |

| Marketable securities and current financial assets | 250.3 | 0.3 |

| Total current liabilities | 1485.7 | 1262.9 |

| Quick ratio | 1.40 | 0.93 |

Source: Figures sourced from Lindt & Sprungli Half-Year Report 2022. Quick ratio calculated by author.

With that being said, the company’s income statement shows an increase in sales and diluted earnings per share from the half period last year – up by 10% and 37% respectively – in spite of an 8% increase in total expenses over the same period.

| Jan-Jun 2021 | Jan-Jun 2022 | |

| Sales | 1799.2 | 1991.7 |

| Total expenses | -1675.7 | -1817.7 |

| Net income | 101.6 | 138.4 |

| Diluted earnings per share | 419.2 | 577.1 |

Source: Figures sourced from Lindt & Sprungli Half-Year Report 2022.

From this standpoint, investors are more likely to overlook a declining cash position in the short-term – for as long as sales and earnings growth continues to remain vibrant.

In addition, growth in expenses is likely to have been at least partly driven by inflation and rises in the cost of raw materials – but the company has managed to bolster net income overall. Additionally, with the company catering to the luxury end of the market – I anticipate that sales growth should still remain vibrant even if Lindt & Sprungli is forced to pass on costs to customers in the form of price increases.

Looking Forward

The business model of Lindt & Sprungli is highly seasonal – and the rebound in travel during the summer months as well as occasions such as Easter and Mother’s Day have been cited as key growth drivers for the company this year.

In this regard, while we are likely to see a sales rebound once again over the Christmas season – we could see sales growth moderate somewhat over the autumn months.

Going forward – the unveiling of a 1 billion share buyback program by the company could increase interest in the stock over the short to medium-term, as such a move could be expected to bolster the stock price. Moreover, such a move sends a signal to investors that Lindt & Sprungli is in a good position to be able to use excess cash to finance such a buyback – and this is another reason why I think investors would be willing to overlook the drop in cash flow that we saw from December of last year.

As regards the global chocolate market more generally, a CAGR of 4.5% is expected through to 2027 – with demand for fine flavor cocoa seeing significant growth in Europe and North America. With Lindt & Sprungli reportedly using a substantial portion of fine flavor cocoa bean varieties across its product lines, we could see growth across this segment perform better compared to the broader chocolate market as a whole.

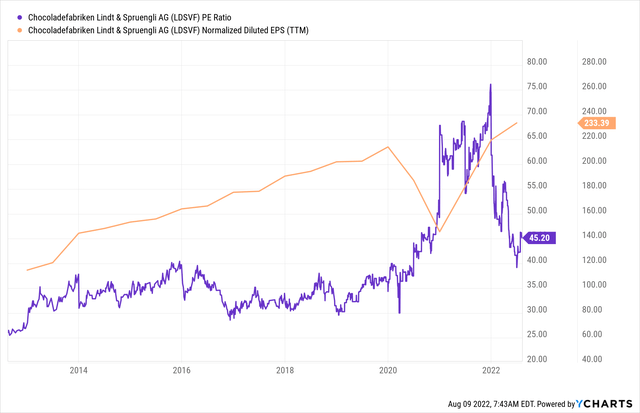

From a valuation standpoint, the stock seems to be trading at good value from an earnings standpoint. We can see that the P/E ratio is trading at substantially lower levels than that seen in 2021 – while earnings per share (on a normalized diluted basis) is at a 10-year high:

In this regard, despite the fact that price is still significantly higher than that seen before 2021, Lindt & Sprungli still appears to be trading at significant value.

Conclusion

To conclude, Lindt & Sprungli has seen growth and remained resilient during a challenging macroeconomic environment.

While macroeconomic headwinds cannot be ruled out with respect to supply chain issues – I take the view that the company is in a good position to continue bolstering growth in sales and earnings from here.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment