xamtiw/iStock via Getty Images

Investment Thesis: While Lindt & Sprungli may come under broader market pressure as a result of current macroeconomic conditions, I am cautiously optimistic that a strong cash position and growing sales will continue to mean longer-term upside.

In a previous article, I made the argument that while Lindt & Sprungli (OTCPK:LDSVF) might see further upside in the longer-term, supply shortages and price concerns could hinder growth in the more immediate term.

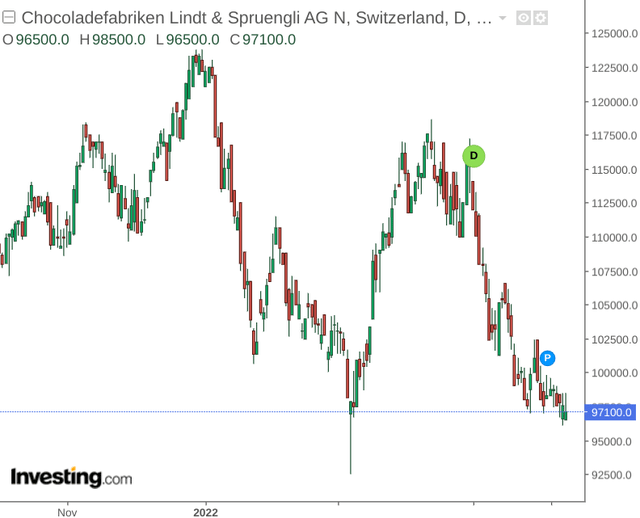

So far this year, the stock has seen downside overall:

The purpose of this article is to assess the degree to which Lindt & Sprungli is equipped to handle ongoing macroeconomic pressures for the remainder of this year, and whether the stock has potential for a rebound to prior highs seen in 2021.

Performance

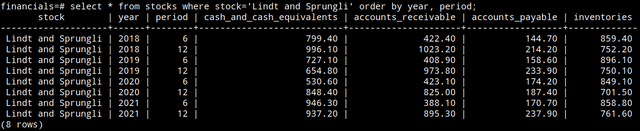

To get a better overview of Lindt & Sprungli’s financial situation, I decided to gather data from 2018 to 2021 inclusive regarding the company’s cash position from historical financial statements, particularly in relation to that accounts receivable, accounts payable and inventories.

Specifically, I decided to collate this information into a SQL table for further analysis:

Figures sourced from historical financial statements for Lindt & Sprungli. SQL table created by author.

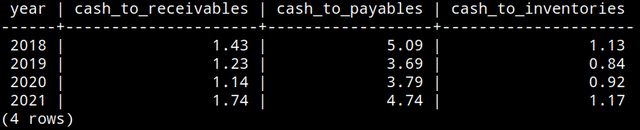

Averaging by year, the ratios for cash to receivables, cash to payables and cash to inventories were calculated.

Financial ratios calculated by author using SQL.

We can see that on the basis of these three ratios, the company’s cash position is higher on the whole than that of previous years.

The company is holding more cash relative to receivables – meaning that Lindt & Sprungli is better able to withstand potential delays in payment from debtors. Similarly, the cash to payables ratio has risen, indicating the company holds more cash relative to the amount it owes debtors, while cash to inventories is also up – indicating that the company is not holding on to excessive inventory relative to its cash levels.

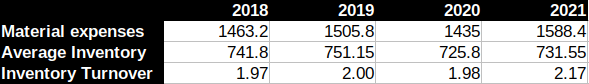

Of course, having too much idle cash can also be counterproductive, as it indicates that a company might be missing out on investment opportunities. However, when looking at Lindt & Sprungli’s inventory turnover (calculated as material expenses over the average inventory of the current and previous year), we can see that the inventory turnover ratio has been rising – indicating that the company is selling its stock at an increasing rate, which is encouraging.

Figures sourced from historical annual reports of Lindt & Sprungli. Inventory turnover ratio calculated by author.

From this standpoint, I take the view that Lindt & Sprungli is showing a strong financial position from the point of view of bolstering cash reserves while concurrently increasing its turnover.

Looking Forward

In terms of upcoming half-year results, evidence of continued growth in cash flow as well as growth in inventory turnover will be encouraging, as this will indicate that the company is bolstering its sales despite an inflationary environment – while also ensuring sufficient cash on hand to deal with current liabilities.

One potential challenge the company could face in North America is the potential underperformance of Russell Stover that was seen in 2021 continuing into this year. Russell Stover is one of the leading chocolate manufacturers in the United States, and Lindt & Sprungli acquired this company in 2014 to expand its reach in the North American market.

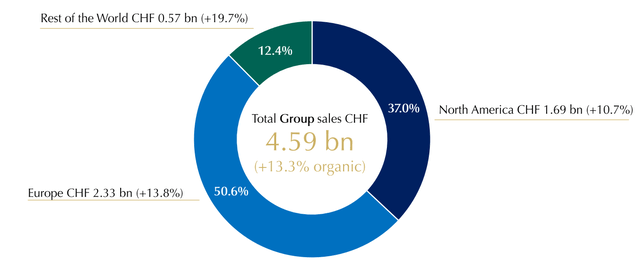

We can see that on the whole, sales in North America account for nearly 40% of total sales:

Lindt & Sprungli: 2021 Annual Result Presentation

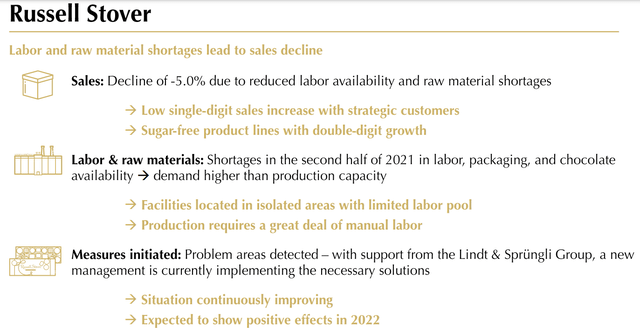

As elaborated on by Lindt & Sprungli previously, reduced availability of labor and raw materials were a significant reason behind the sales decline for Russell Stover.

Lindt & Sprungli: 2021 Annual Result Presentation

Should these issues persist due to global inflation concerns and the ongoing situation in Ukraine, then we might see some underperformance across the North American market as a whole.

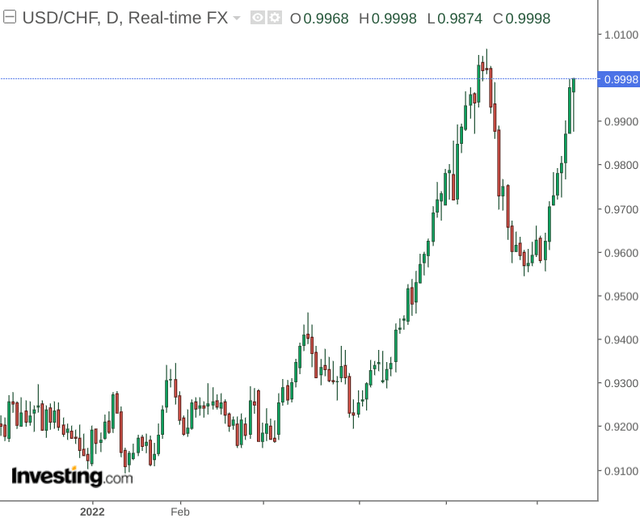

Additionally, the Swiss franc has strengthened significantly against the U.S. dollar in 2022, and this might also compel Lindt & Sprungli to raise prices in the U.S. market, putting aside other inflationary pressures.

While H1 2022 results will set the tone for performance across the rest of this year, I take the view that Lindt & Sprungli should be able to continue bolstering sales as international travel picks up after COVID and the company continues to cater to the luxury end of the market.

Conclusion

To conclude, Lindt & Sprungli has shown strong financials and while the stock itself may come under broader market pressure as a result of current macroeconomic conditions, I am cautiously optimistic that the company is in a good position for long-term upside from here.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment