Evgeny Gromov/iStock via Getty Images

Introduction

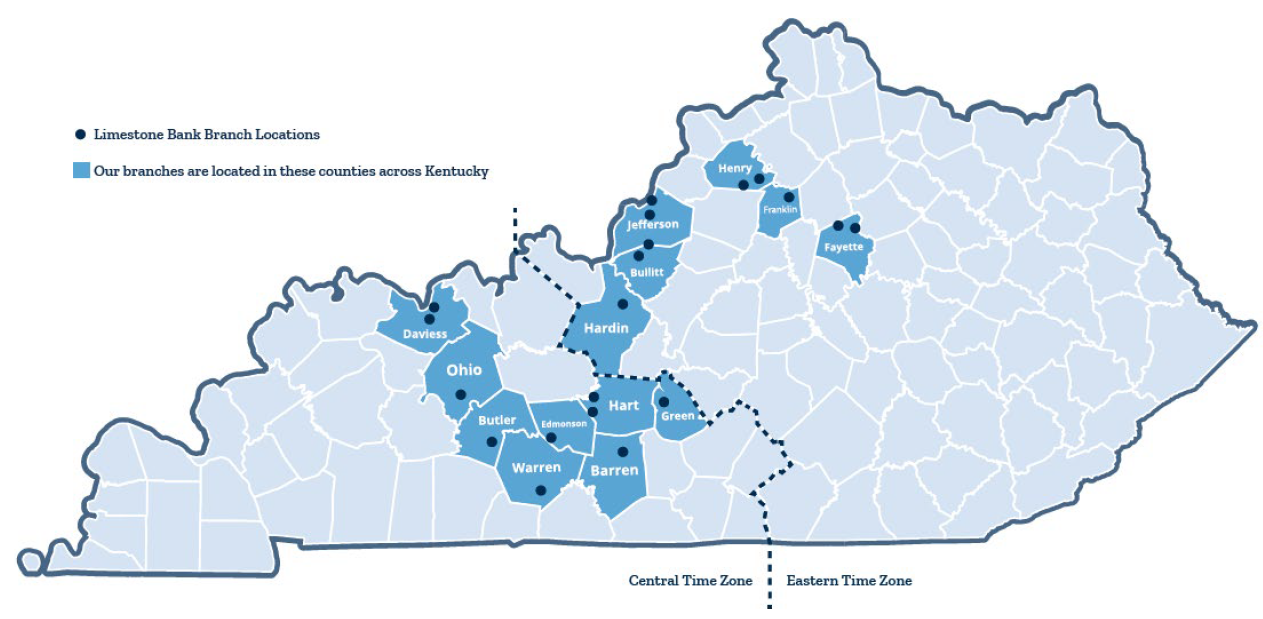

I’m always on the lookout for promising banks in the small-cap segment. Some of the smaller banks aren’t even a regional bank but could best be described as a ‘local’ bank and Limestone Bancorp (NASDAQ:LMST) fits that description. Limestone Bancorp is the holding company operating the Limestone Bank in Kentucky where it operates branches in fourteen counties, making it the thirteenth largest bank in the state.

Limestone Bancorp Investor Relations

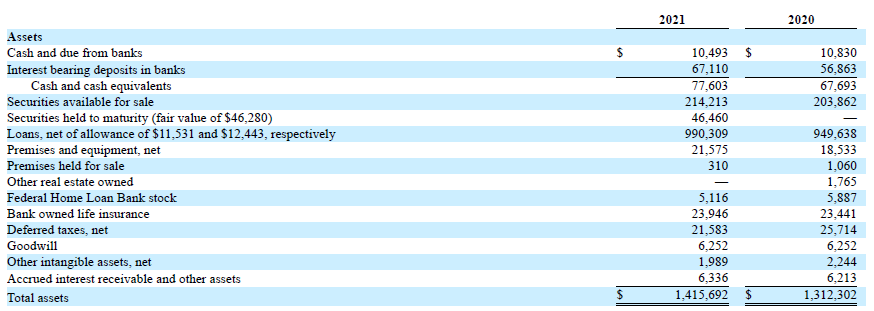

With a current market capitalization of just under $170M and total assets of $1.4B, I wanted to dig a bit deeper into Limestone’s performance.

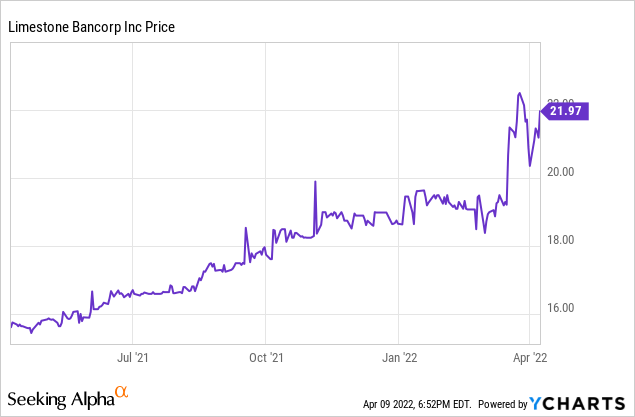

The share price has been on a nice upward trajectory, supported by good results

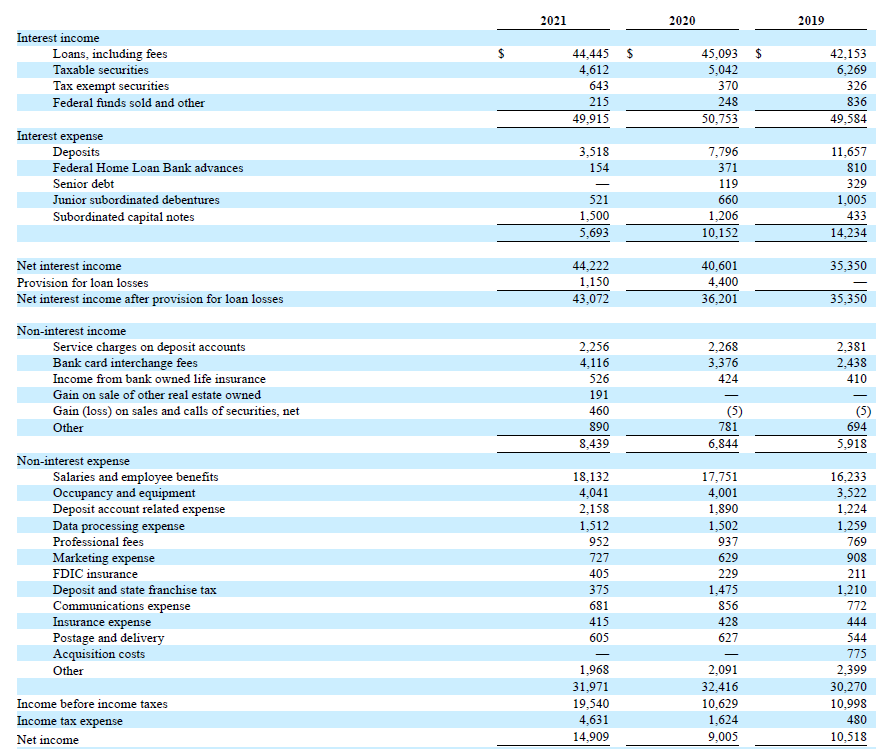

Although the bank’s balance sheet has been expanding, the reported interest income has barely increased. As you can see in the income statement, the interest income has been very stable in the past few years and the only reason why the net interest income has increased by in excess of 10% per year in the past few years is the dramatic reduction in interest expenses. In 2021, the bank’s net interest income was approximately $44.2M.

Limestone Bancorp Investor Relations

The bank also saw its net non-interest expenses decrease from $25.6M to $23.5M and that’s quite interesting as most banks see the opposite happen as their non-interest expenses increase. In Limestone’s case it looks like the bank card interchange fees are nicely contributing to the bigger picture while the bank has been able to keep its operating expenses under control.

The pre-tax and pre loan loss provision income was approximately $20.6M and as the bank recorded about $1.15M in loan loss provisions in 2021, the pre-tax income was $19.5M resulting in an after-tax income of $14.9M or $1.96 per share. That’s more than 50% higher than in FY 2020 but the loan loss provisions in 2020 were almost 4 times higher than in 2021 and that definitely had a negative impact on the result. But it also wouldn’t be fair to credit the lower loan loss provisions as only reason for the massive improvement as Limestone put in a good overall performance with a higher net interest income and a lower non-interest expense.

The bank retains the vast majority of its earnings on the balance sheet as its payout ratio is exceptionally low. Limestone Bancorp is paying a quarterly dividend of $0.05 resulting in an annualized dividend of $0.20 for a dividend yield of just 0.9%.

A closer look at the loan book and the non-performing assets

Whenever I look at a bank, I want to try to understand the balance sheet and the assets a bank invests in. As of the end of 2021, Limestone Bancorp’s balance sheet exceeded $1.4B, an increase of just over $100M compared to the end of 2020. About $77M was invested in cash and cash equivalents while an additional $260M was held in securities. So of the $1.415B balance sheet, about $337M or almost a quarter is held in liquid assets.

Limestone Bancorp Investor Relations

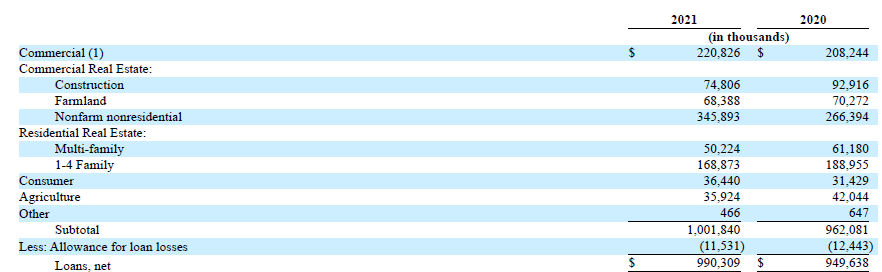

Looking at the $990M loan book, it appears Limestone has a rather sizeable amount of commercial loans on its balance sheet. Excluding the impact from PPP loans, the total amount of commercial loans increased from $188M to $219.6M (the $220.8M in commercial loans shown below includes approximately $1.2M in PPP loans) as of the end of 2021. The commercial real estate segment reaches a total of almost half a billion dollar while it looks like Limestone has reduced its exposure to residential real estate as the total value of that portion of the loan book has decreased from $250M in 2020 to less than $220M as of the end of 2021.

Limestone Bancorp Investor Relations

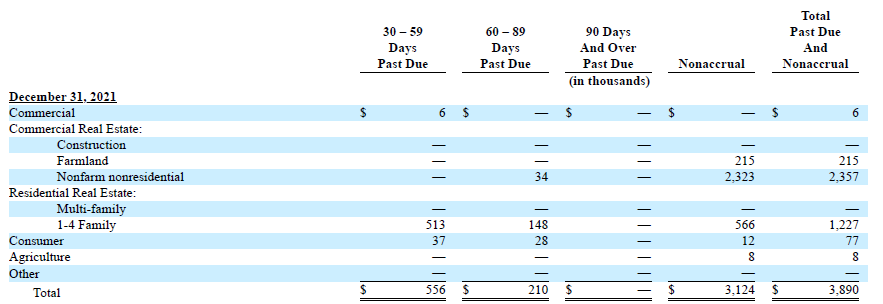

According to the image above, the total allowance for loan losses was just over $11.5M which is just around 1.1% of the loan book. That’s relatively moderate, and I’m happy to see this is more than sufficient the total of $3.9M in loans that are classified as past due or non-accrual. The $2.3M position in the nonfarm nonresidential real estate asset was related to one commercial real estate loan.

Limestone Bancorp Investor Relations

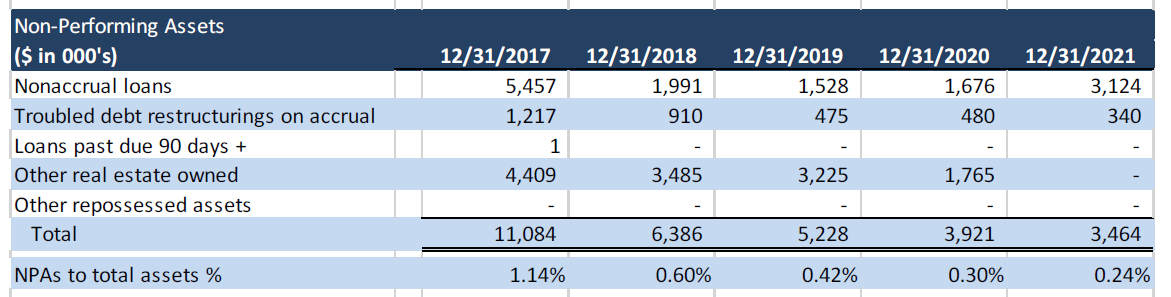

This obviously doesn’t mean Limestone Bancorp will ‘lose’ that amount as the loan is backed by a real estate asset as collateral and that helps to explain why the amount of loan loss provisions remained low in 2021. The level of non-performing assets compared to the total amount of assets has been on a downward trajectory in the past few years indicating the quality of Limestone’s loan book is improving. Unfortunately the bank has not disclosed average LTV ratios of the real estate assets. That’s a pity as it provides an additional level of information on the bank’s risk of losing money on loans.

Limestone Bancorp Investor Relations

Investment thesis

Limestone Bancorp has been a consistent performer and the bank continues to rapidly increase its book value. In the past four years, the tangible book value per share increased from just over $11 to in excess of $16/share. That means the bank is currently trading at a premium of just under 40% to its tangible book value but as Limestone is retaining a substantial portion of its earnings, the tangible book value should increase by in excess of $1.50 per share per year which means the TBV could reach $20/share by the end of 2023.

I currently have no position in Limestone Bancorp but it looks like this bank has its ducks in a row given the strong operating performance and the history of decreasing non-performing assets. I will keep an eye on Limestone and would be interested in initiating an initial small long position on weak days.

Be the first to comment