everythingpossible

This Article was researched and written by January Mbuvi.

Investment Thesis

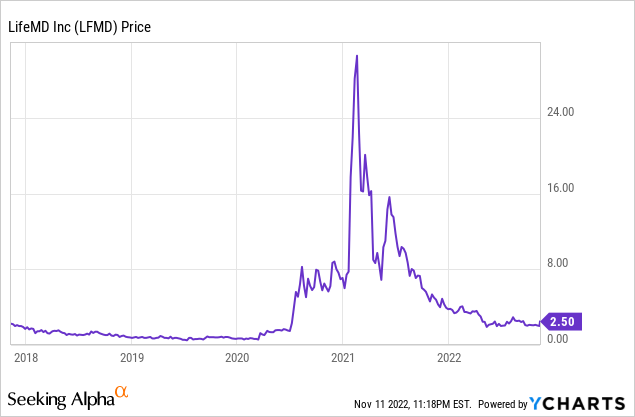

LifeMD, Inc. (NASDAQ:LFMD) is a US direct-to-patient telehealth company that links consumers to healthcare specialists for concierge care, men’s sexual health, dermatology, and other conditions. Founded as Conversion Labs, Inc., the company rebranded as LifeMD, Inc. in February 2021. It went public in October 2020 at $7.85 per share. After then, the price per share skyrocketed to a record $30.5 just four months later. To a large extent, I attribute this development to the growing number of new customers attracted by the company’s rebranding efforts.

Since hitting the record-high price, the company has been on a downward trajectory losing more than 93% of its highest price in February 2021.

The precipitous drop in share prices can be traced back to low profitability and weak cash flows. In light of this concerning pattern, firm leadership is making strides to put the organization on the path to profitability. The company is making great strides, as evidenced by the 90% year-over-year increase in adjusted EBITDA it reported on the Q3 2022 press call.

With the company’s dedication to becoming profitable, I am confident that this goal will be achieved by 2023 at the latest. While I believe in this company’s long-term potential, I rate it as a hold until its profitability improves.

A better and broader range of services

The virtual primary care business of LFMD continues to expand and scale significantly. The firm offers a wide range of services, some of which are listed below.

- RexMD, a men’s telehealth brand that provides virtual medical treatment from licensed providers for a variety of men’s health needs;

- LifeMD Primary Care, a personalized subscription-based virtual primary care service; and Shapiro MD

- A telehealth platform brand offering access to virtual medical treatment, prescription medications, patented-doctor formulated OTC products

- FDA-approved medical device for male and female hair loss.

- PDFSimpli; a cloud-based service for making, editing, converting, signing, and sharing PDF files.

One way to become profitable is by improving its service line and platform. In its Q3 2022 transcript call, it reported that its platform supports urgent and generalized primary care offerings and can facilitate treatment for hundreds of different conditions. Its programs are set up so patients can keep seeing the same doctor, which improves both the results and the patient’s experience.

During the third quarter of 2022, LFMD reported substantial progress in diversifying its telehealth business with additional telehealth service offerings. Its virtual private cloud [VPC] keeps growing at a breakneck pace. This high increase was possible through implementing a plethora of new products on its primary care platforms, such as Symptom Checker.

Beyond its direct-to-consumer telehealth business, it’s building out its business-to-business operation, partnering with pharmaceutical companies using its best-in-class telehealth technology platform and affiliated physician group. They just added four branded prescription medications through their third pharma alliance. They’ve created a strong pipeline of possible transactions, of which they expect many to finalize in 2023. This move will help diversify its revenue mix with high-margin B2B income and provide cross-selling opportunities on its VPC platform.

Accelerating profits

The management of LFMD is eager to restore profitability to the organization. The company is doing much more than just the abovementioned initiatives to speed up profitability. First, the company is growing its customer base while retaining and maintaining existing customers. In its MRQ, LFM reported, per Justin Schreiber:

We eclipsed our previous guidance of ending the third quarter with 2,000 subscribers by nearly 20% and continue to remain ahead of our previous expectations with growing momentum for this business.

Currently, the company’s VPC has around 4000 subscribers. Additionally, in recent weeks they have begun to boost their daily new patient acquisitions from about 30 to 60 to 90 without increasing their marketing expenditure budgets.

Secondly, the company is expanding output and decreasing expenses, except in areas where the latter is impossible. For instance, they have recently developed their clientele with no additional investment in advertising. In addition, they improved their marketing efficiency, cutting their blended CAC by 18% year-over-year and by 8% quarter-over-quarter.

Finally, this section concludes with a discussion of how the telehealth industry is diversifying its service offerings. The most recent improvement is the introduction of LEAP and the VPC’s topical pain treatment service. Since their introduction in the second quarter, when they contributed about 1% of total revenue and subscribers, these two products have grown to provide nearly 12% of new patient acquisition volume and just under five percent of total revenue. Further, the company eliminated investment in select product lines which did not meet the profitability threshold and redirected them to profitable sections.

Obstacle on the Path to Profitability

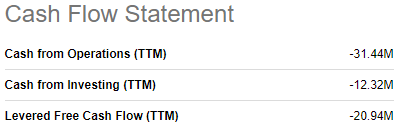

The firm is exerting every effort possible to become successful, but it is not a stroll in the park. It is faced with some challenges; among them is its weak balance sheet. In terms of financial leverage, the company is weakly levered. It has a debt of $1.58M which is 0.03X its market cap of $62.21M. This weak leverage implies that the company relies heavily on cashflows to fund its CAPEX, adversely affecting its cash flow. This argument can be affirmed by the company’s negative cashflows of -31.44M in operating cashflows, -12.32M in cashflow from investing, and -20.94 in levered FCF.

Seeking Alpha

In the short term, the firm’s low financial leverage will damage it, especially when it wants to turn profitable. However, investors should be patient with the management since they will gain from the low leverage in the event of a recession.

The company is still extremely under-liquid with a cash balance of $11.72M, or 0.19X its market cap. Compared to the company’s total operating expenses during the trailing twelve months of $143.6M, the current balance is 12.25X lower, indicating that financing needs are severely stressed. The company’s short-term financial health is highly precarious, as seen by the current ratio of 0.72, which suggests that its current liabilities exceed its existing assets.

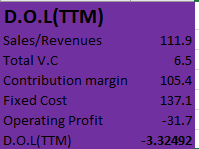

Lastly is the company’s worrying DOL. On computing it, the company has a DOL of -3.3, indicating that it is not generating enough revenues to cover costs.

Author’s Computation

As discussed earlier, this phenomenon may change as the company increases its revenue by gaining more customers while cutting costs where possible. Given this information, I expect the company to make losses in the short run as these obstacles will be a significant setback to profitability; however, in the middle and long run, I expect the company to turn profitable as the attempts to accelerate profitability will trump these setbacks.

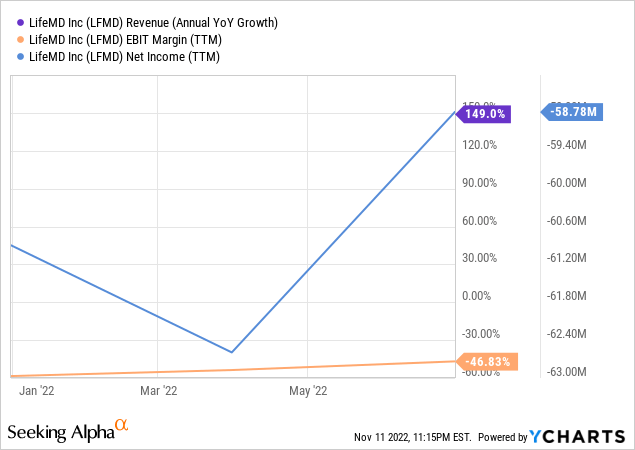

Poor Profitability

The company is registering poor profit margins despite a revenue growth of 73.67% and a 3-year CAGR revenue growth of 123.07%. It has an EBIT margin of -46.72% and a net income of -$58.78M [-52.55%.]

I attribute these poor results to the company’s high operating expenses, not forgetting the low leverage, which necessitates us of cashflows to finance CAPEX. In addition, the company has a return on total assets of -154.82% compared to the industry median of 4.60%, indicating how inefficient the company is in generating income from its investments compared to its peers.

Q3 2022 Highlights

For LifeMD, the third quarter of 2022 represents a significant turning point in realizing its route to profitability and long-term sustainable, profitable growth. To support my claim, I shall describe some of the quarter’s most notable events.

- LFMD brought its adjusted EBITDA loss down to $889,000. As a result, this number exceeded LFMD’s expectations and represented a 90% increase over the previous year. They are still on track to have a profitable adjusted EBITDA for the fourth quarter.

- At the same time, WorkSimpli’s third-quarter sales increased by 57% year over year, and the company’s EBITDA of almost $1 million was up significantly from the previous quarter. While the top line is expected to expand by double digits, the business believes WorkSimpli can generate $20-$25 million in EBITDA by 2023.

- With an increase of 26% year-over-year, third-quarter revenue hit a record $31.4 million. In the third quarter, recurring subscriptions generated 93% of total revenues.

- Third-quarter gross margins hit 85%, an increase of 500 basis points year over year. Compared to the same period a year earlier, gross profit for the quarter was up 35%, coming in at $26.7 million.

- Operating expenses for the third quarter reached $33.5 million, up $1.1 million from a year ago, excluding non-cash stock-based compensation, depreciation, and amortization charges of $4.5 million. Operating expenses as a percentage of revenue declined 1,900 basis points from the prior year. Equally noteworthy, they lowered their marketing expense as a percentage of revenue to 55% from 81% a year ago and improved leverage by 1,700 basis points compared to the prior quarter.

- As of September 30, 2022, the company had $5.8 million in cash, and its cash burn rate was cut to roughly $500,000 per month. In fact, by year’s end, they want to stop the cash outflow on a consolidated basis completely. This attempt exemplifies management’s dedication to reducing costs, increasing profits, and eliminating the bleeding of cash.

All of the aforementioned successes align with the firm’s initiatives to turn it profitable. In my opinion, they are proof that the company is headed in the right direction and will soon become profitable.

Conclusion

The low profitability of LFMD has contributed to its share price plummeting since the beginning of last year. The management is doing everything within its reach to turn the company profitable by implementing measures to accelerate profitability realization. The measures range from cutting costs to increasing the customer base.

Investors should wait a bit longer to cash in on the company’s promising prospects for profitability because the company’s weak balance sheet will hold the efforts hostage in the short term. As seen in the highlights from Q3 2022, I believe the company is on the ideal road and will be profitable no later than 2023. Until then, I give the company a hold rating.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment