Andy Andrews/DigitalVision via Getty Images

When I covered Lexicon (NASDAQ:LXRX) in May, Sotagliflozin had one NDA pending resubmission in heart failure in certain patients with type 2 diabetes or T2DM, and another with a CRL in Type 1 diabetes with “ongoing regulatory engagement.” The CRL in T1DM seems to have resulted from incidences of diabetic ketoacidosis or DKA that was observed in trials. The T2DM program does not have this problem. The T2DM NDA is supported by data from two phase 3 trials — SOLOIST-WHF in patients with type 2 diabetes who had recently been hospitalized for worsening heart failure; and SCORED in patients with type 2 diabetes, chronic kidney disease and risks for cardiovascular disease.

Sotagliflozin is its lead asset targeting the SGLT1/2 glucose transporters. It is the first dual SGLT1/SGLT2 inhibitor targeting diabetes. There are two SGLT2-only blockers that are blockbuster drugs. These are Jardiance and Farxiga. Both drugs made nearly $1bn each in quarterly revenue, or around $4bn a year. As of my May article, after withdrawing their NDA due to “technical reasons,” the company was planning a resubmission early in the second quarter of 2022 – this was completed in May itself.

Despite its long list of setbacks, sotagliflozin has continued producing excellent data, in both preserved and reduced ejection fraction patients, something that neither Jardiance nor Farxiga has been able to manage. While they have each showed strong data in HFrEF, they have shown no improvement in HFpEF patients.

At the American College of Cardiology or ACC meeting this year, Lexicon Chief Medical Officer Craig Granowitz, M.D., Ph.D. noted a major difference between sota and other SGLT2 inhibitors:

What was seen in this study, which hasn’t been seen with SGLT2 inhibitors, is a benefit in reducing heart attack and stroke, whether or not that patient has had a prior heart attack or stroke or has another diagnosis related to cardiovascular disease

Despite all that, and an approval in the EU, sota has continued to remain outside the US market for years.

That may change by May 2023, by which time the FDA is expected to make a decision on sota. The T1DM decision got a split adcom vote of 8-8 mainly due to DKA, which is not a problem anymore with the T2DM application. Results, albeit from trials truncated due to funding crunch during the pandemic, have been stellar. No doubt the stock has seen very strong price movements in the last few months. The company does not expect an adcom this time.

The target market for sotagliflozin is significant. As the company noted in its latest earnings call:

The overall heart failure market is already a very large multibillion-dollar market and is anticipated to further grow at nearly 20% per year for the most of this decade driven primarily by the SGLT inhibitor class and newly adopted guidelines for heart failure in the U.S. We believe that our unique mechanism of action, clinical data in a growing market offers an opportunity for sotagliflozin to achieve blockbuster potential.

About these guidelines, the company further notes:

The guidelines recently adopted by 3 major cardiology societies in the United States, the American Heart Association, the American College of Cardiology and the Heart Failure Society of America, adopt SGLT2 inhibitors as standard of care for heart failure with reduced ejection fraction, with a recommendation at the highest level of confidence and provide a similar recommendation notably with a higher level of confidence than for any other class of therapy for heart failure with mildly reduced ejection fraction and heart failure with preserved ejection fraction which collectively represents 60% of all heart failure patients. Importantly, the guidelines highlight the need to optimize medical therapies during heart failure hospitalizations and specifically cite the SOLOIST-WHF study.

It is sadly ironic that while US heart failure guidelines reference the SOLOIST-WHF study, the FDA has still failed to approve sotagliflozin, which has singlehandedly improved the prospects of SGLT inhibitors.

Financials

LXRX has a market cap of $467mn and a cash reserve of $62mn as of June 30. This amount does not include the $82.2 million in approximate net proceeds received from the company’s July 27, 2022 public offering and concurrent private placement of its common stock. This also does not include the $150M loan facility with Oxford Finance.

Research and development expenses for the second quarter of 2022 stood at $13.4 million, while Selling, General and Administrative (SG&A) expenses were $10.7 million. Pre-commercialisation costs will also increase their expenses; however, with some $150mn in the bank and a similar amount of loan facility, the company looks adequately financed for the next 4 crucial quarters.

Bottomline

LXRX is a below-the-radar stock which has been beaten down by bad luck and FDA rejections. In just the last few months, right after I bought into the stock, it went up more than 100%, and has now settled at 50% above my buy price. LXRX has a major regulatory event in May 2023, and its price performance gives me confidence that the market is looking at it very positively. Recently, Piper Sandler came out with very positive sentiments for LXRX. My article does not even touch on its pipeline, which has produced some strong phase 2 data in diabetic neuropathy this year. Bottomline, LXRX looks like a buy, although at a price point lower than what it is today. For those already in, as is my usual style, I would take profits at 30% increases, and then buy the dips.

About the TPT service

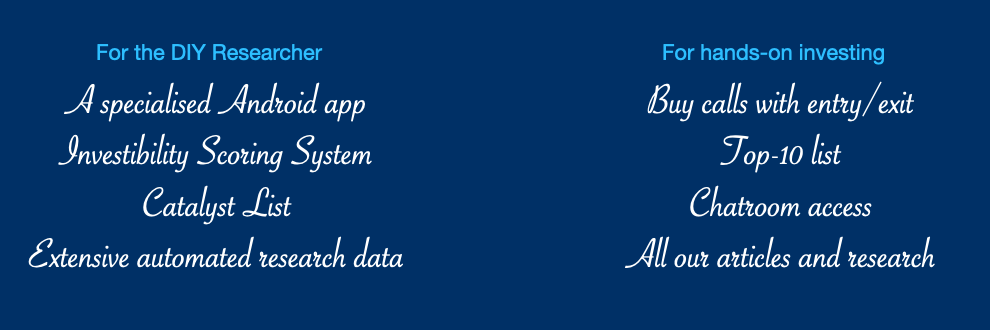

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment