LaylaBird

Investment Thesis

Levi Strauss & Co. (NYSE:LEVI) is an American apparel company headquartered in San Francisco, California. The company is famous for its Levi’s brand of denim clothing. In this thesis, I will primarily analyze the Q2 2022 results of the firm and its future growth prospects. I will also be analyzing the impact of the worsening macro-economic conditions on the company’s growth. After analyzing the performance of LEVI in the recent quarter and considering all the growth and risk factors, I assign a buy rating for the company.

Company Overview

LEVI is a multinational clothing brand with operations in more than 110 countries worldwide. LEVI designs and sells apparel, footwear and accessories through wholesale and DTC channels. The company currently owns and operates four brands; Levi’s, Signature by Levi Strauss & Co, Denizen, and Dockers. The company owns around 500 retail stores, and the company’s products are available in 50,000 retail stores worldwide.

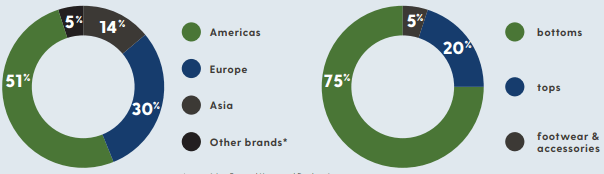

Investor Presentation

LEVI has a strong brand image and is one of the oldest clothing brands in the United States. Of the four brands, most of the revenue is earned by Levi’s brand, 87% of the total revenue. The company earns 49% of its total revenue from sales in the United States, followed by Europe at 30% and Asia at 14%. The company is well known for its denim jeans and earns 75% of its total revenue from bottom wear, followed by tops at 20% and footwear and accessories at 5%. The wholesale channel constitutes 64% of the total sales by the company, followed by DTC at 36%. The company has expressed its vision to take DTC channel contribution to 50% by the end of FY23.

Q2 2022 Results

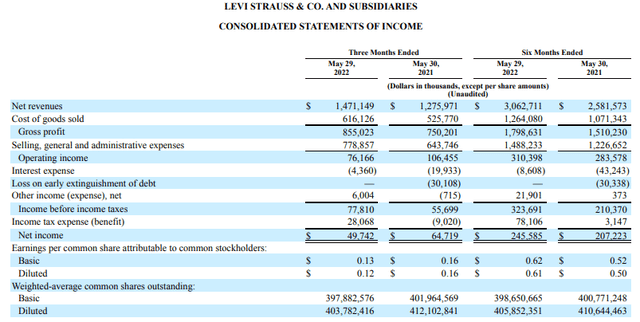

LEVI reported Q2 2022 results on 7th July 2022. It beat the market estimates, both in terms of revenue and EPS. The company beat the EPS estimates by 25% and revenue estimates by 2.7%. The company posted a strong quarterly result, but I doubt this growth rate to continue in the coming quarters; given the rising inflation and growing speculation of recession, I believe the company can have a tough time ahead.

The company reported net revenue of $1.47 billion, a 15% increase from Q2 2021 net revenue of $1.27 billion. The main revenue driver was secular growth across all business segments, with outperformance from the digital sales growth of 20%. The gross margins showed no improvement from the last quarter and were flat at 58.1, the same as Q2 2021. The net income was reported at $49.7 million, as compared to $64.7 million in Q1 2021, an effective decline of 23%.

The primary reason for this decline was $60 million in charges related to the Russia-Ukraine war that the company had to bear. These charges mostly incorporated full impairment of store assets and goodwill in Russia. I believe that the Russia-Ukraine war has caused far more damage to LEVI in the form of supply chain disruption and a higher cost of inventory. The company reported diluted EPS of $0.12, compared to $0.16 EPS in the year-ago period. The additional cost of $60 million related to the Russia-Ukraine crisis was the main factor in this decline.

Overall, the company reported strong Q2 2022 results, but the company’s growth prospects failed to impress me. There are a lot of roadblocks ahead in the form of inflation, continued supply chain issues and possible recession, which could seriously affect consumer spending and also impact the firm’s profit margins with increased costs across segments. The company is also trading at a rich valuation, which makes it even harder to take any new position in the stock currently.

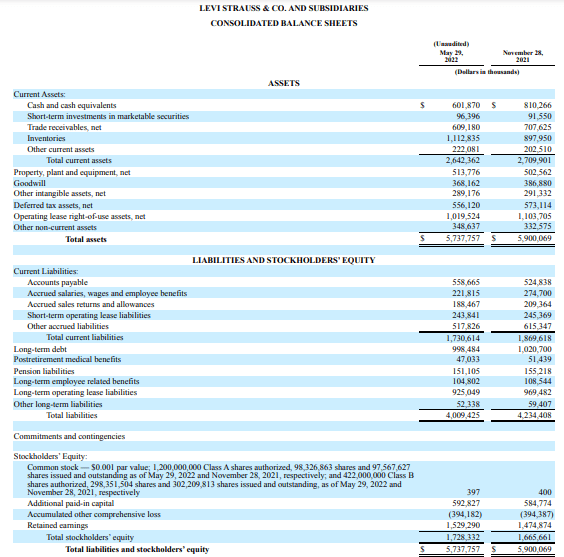

SEC:10Q LEVI

LEVI has cash and cash equivalents of $601.8 million and long-term debt of $998.4 million. The company has total liquidity of $1.5 billion. The company’s leverage ratio improved to 1.1, compared to the leverage ratio of 2 in Q2 2021. I believe that the balance sheet reflects that the company needs to maintain more substantial cash reserves to tackle inflation and to reduce the long-term debt to limit the interest payments, given the steep hike in the interest rates in the past few months.

The company returned around $80 million to investors in Q2 2022 in the form of dividends and share repurchase. The company paid the shareholders $40 million in dividends, a $0.10 per share dividend. Currently, the dividend yield stands at 2.84%. The company also repurchased shares worth $40 million in Q2 2022. LEVI has also announced a share repurchase of $750 million in June 2022 with no expiration date.

Harmit Singh, Chief Financial Officer of Levi Strauss & Co, stated,

We delivered another solid quarter, growing reported net revenues 15% and adjusted EBIT 27%, while returning $80 million in capital to shareholders. Although the operating environment remains dynamic, the diversity of our business is providing the resilience and flexibility needed to drive solid financial results in fiscal year 2022, while progressing us on our path to achieve net revenues of $9 to $10 billion and adjusted EBIT margin of 15% by fiscal year 2027.

The company has maintained its previous outlook for FY22, with net revenue growth estimates of 11%-13% and adjusted EPS estimates of $1.50-$1.56. As per my analysis, these growth estimates don’t provide confidence in the stock growth from current price levels. There are better investment opportunities with a better growth story and lower valuation in the market.

Risk Factors

Global Economic Condition: The rising inflation and interest rates are affecting all businesses. The U.S. economy is expected to face a slowdown in the coming period as inflation is decreasing the demand for the products. The inflation rate of the U.S. has reached its highest level since September 1975 due to this year’s sharp price increase, which is predicted to have increased further in June 2022 and reached 8.7%. The Consumer Price Index (CPI) published by the US Bureau of Labor Statistics (BLS), shows that the yearly inflation rate for clothing is 6.8%. All garment prices have now risen to an all-time high, which has caused a sharp decline in demand. I believe that with the current supply chain disruption due to the Russia-Ukraine war, inflation will keep increasing, affecting the consumer’s discretionary income and demand for clothes.

Dependency on Key Wholesale Customers: The company depends on key customers for a large chunk of its revenue. In FY19, FY20 and FY21, the company generated 26%, 29% and 32% of the revenue from ten wholesale customers. The company doesn’t have any long-term contracts with all of them, which can secure its relationship with all of them. If any significant customer decreases its purchase order or defaults on payment of the order, it can be a substantial loss for the company. This high dependency of the company on critical customers can be a big risk factor for the company in the current economic situation.

Valuation

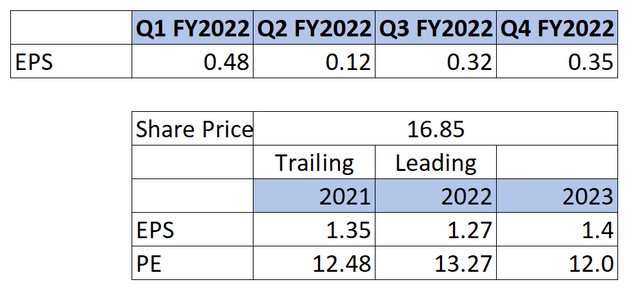

LEVI is currently trading at a share price of $16.85 with a market capitalization of $6.7 billion. The company is trading at a leading P/E multiple of 13.27x, indicating that it is fairly valued at current price levels. I have tried considering the business’s seasonality while estimating the full-year EPS. I think FY22 and FY23 both will be affected by the rising inflation and interest rate. That’s why I am following the conservative approach while estimating the company’s future outlook. I estimate that full-year diluted EPS for FY22 will be $1.27, which gives the leading P/E multiple of 13.27x. I believe the company is currently trading within its traditional P/E range, and it will trade at a P/E multiple of 15x, which gives a price target of $19.05 with a 13.05% upside.

Conclusion

Last week, the company reported strong Q2 FY2022 results, but I believe the company’s future growth path for FY22 and FY23 is not going to be a smooth ride because of the rising inflation and interest rate. After considering the current economic scenario, I think the company is trading at a fair value, and I would not recommend taking any new positions in LEVI stock. The company has a strong brand image and the investors who are already invested in the company can hold the stock for the long term with a dividend yield of 2.85%. After taking into consideration all these factors, I assign a hold rating for LEVI.

Be the first to comment