alexei_tm

Happy “gobble” time!

Though maybe that’s not the best term to use right now considering everything going on.

This isn’t to say we can’t still have a good time. And we can definitely still be thankful. However, it is safe to say that this Thanksgiving here in America might not look quite like it did last year.

Last year, family and friends were coming together – some for the first time since the shutdowns began in March 2020! – with full spreads of turkey, stuffing (or dressing), potatoes, cranberry sauce, green bean casserole, and whatever else typically marks your Thanksgiving meal.

Inflation was on most normal people’s radars by then, mind you, but I don’t think many of us realized it would get as bad as it has.

This year, we’re definitely the wiser though. And poorer.

On Tuesday, November 22, Yahoo Finance published, “Thanksgiving 2022: Americans plan to spend less on food, alcohol amid inflation, layoffs.” It begins like this:

“Nervous shoppers are saying they’ll buy less or switch to cheaper brands this holiday season, as inflation remains high and more Americans worry about whether they’ll be able to hold onto their jobs.

“Among consumers, 70% say they intend to purchase less meat, seafood, or canned goods, [go with] a cheaper brand, or both, as the nation prepares for Thanksgiving and the winter holidays, according to an Ipsos survey in mid-November.”

That’s just life as we know it in 2022.

Inflation Rising – Painfully So

In case you didn’t get the message that inflation is an issue, the Yahoo article continues with:

“Roughly 7 in 10 Americans say they will buy a smaller amount or look for a cheaper choice when shopping for desserts and treats… 68% intend to make the same changes when picking up frozen foods, 65% will try to save money when purchasing fresh produce, and 64% will make a switch or buy less when filling their carts with pre-prepared foods.

“American adults are even cutting back on booze, with half of those polled saying they plan to shrink the amount of alcohol they’ll purchase or pick up a less expensive alternative.”

I’m not sure how much that “booze” is up in price year-over-year, but the article does list several other categories:

“Last month, the price of butter and margarine was up 34% as compared to last year, the biggest annual hike ever recorded, according to the Bureau of Labor Statistics. Other record breakers include flour and prepaid flour mixes which cost 24% more, and frozen vegetables, turkey and other poultry, which are all up 17%.”

That’s thanks to the pandemic, or at least the pandemic played a very big, very prominent role in fueling it all. Between supply shortages, hiring scarcities and, of course, government spending.

The results have been brutal to consumers, changing our behavior at almost every turn.

According to QSRweb.com, 59% of Americans are eating out less often these days, though they are going to fast-food joints a lot. They’re shopping more at Walmart (WMT) and less at Target (TGT). And they’re not buying big-ticket electronic items nearly as much.

The last round of quarterly results showed as much. However…

There is one area people just aren’t giving up on, it seems.

The Best Things in Life Are Free

This Thanksgiving is going to be a busy one for travel, expert sources say. Last year saw a definite uptick in holiday traffic, both at airports and on the road, and this year will see even more.

Due to work-from-home capabilities, many people are able to spread their flying schedules over different days. But they’re still flying nonetheless. As ABC News reports:

“The busiest travel days during Thanksgiving week are usually Tuesday, Wednesday, and the Sunday after the holiday. This year, the Federal Aviation Administration expects Tuesday to be the busiest travel day with roughly 48,000 scheduled flights.”

And:

“It looks like the rush started early this year, as the Transportation Security Administration screened nearly 2.33 million travelers on Sunday. It’s the first year that the number of people catching planes surpassed the 2.32 million screened the Sunday before Thanksgiving in 2019, before the Covid-19 pandemic began.”

It also cites AAA as predicting that “54.6 million people will travel at least 50 miles from home in the U.S. this week.” That’s a “1.5% bump over Thanksgiving last year and only 2% less than in 2019.”

ABC goes on to quote James Daly of Mission Viejo, California. He and his family of four flew off to Ireland on Monday to spend the (admittedly American) holiday with his parents.

“The economy is a little concerning,” he said, “but that’s life.” It’s still worth it “to be part of that joy and part of those relationships.’”

And that’s the key. Perhaps we have to spend less on extras. Perhaps we have to eat less. But we get to be with family – a privilege so many of us were denied two years ago.

That’s what I meant when I started out with saying we can “still have a good time” in the face of inflation. “And we can definitely still be thankful” just as long as we know where to focus.

The same goes for the stock market to a lesser degree when compared with family. But still, if you’re concerned about properly preparing for that family, the following real estate investment trusts (“REITs”) can definitely help.

There might be a lot to worry about right now when it comes to our finances. But I for one am grateful that some stocks are in a great place to stand the test of time anyway.

Even a time like 2022 into 2023.

Thankful Pick #1: Prologis, Inc. (PLD)

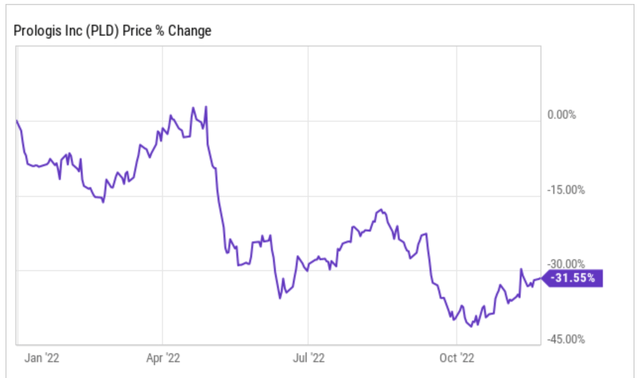

Prologis is the premiere warehouse REIT, but in 2022 the stock has been under pressure, down 31% on the year.

What gives you might ask?

For starters, the market as a whole has been stuck in a bear market with the S&P 500 (SPY) down 17% and the broader REIT sector (VNQ) down 25%.

In addition, rising interest rates have certainly impacted the REIT as has the company’s decision to acquire Duke Realty at a time when valuations seemed inflated.

Duke Realty was another sizable warehouse REIT with over 500 properties and over 140 million square feet of leasable warehouse space. Investors were not upset with the acquisition as much as they were with the timing of it. Prologis paid $23 billion to acquire Duke Realty, which they closed on just last month.

The announcement of the acquisition came just days after Amazon (AMZN) announced that they had “too much warehouse space” and would need to slim that down. These two events back-to-back sent shares of Prologis sliding.

However, when you look at it, the company has still been operating quite well and the Amazon announcement was taken out of context. Amazon is looking to improve its warehouse locations with high tech facilities like that which Prologis offers and rid themselves of older buildings.

In the company’s most recent earnings release, management stated that they have received “zero terminations or non-renewals” from the likes of AMZN, which goes hand in hand with the thesis I just laid out.

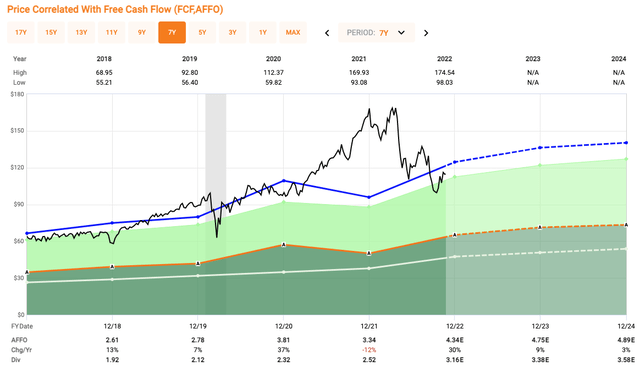

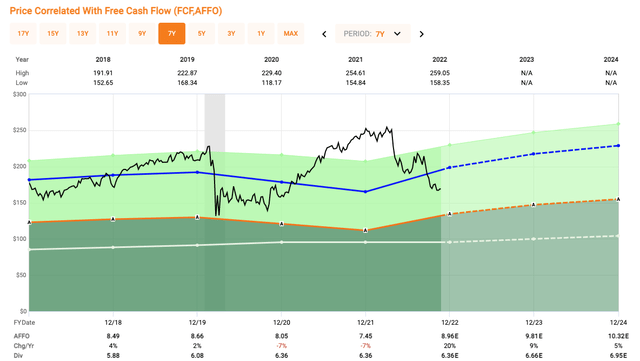

All of this provides shareholders a great opportunity on this blue-chip REIT right now. Shares of AVB are currently trading at a forward P/AFFO of 24x. Over the past five years, PLD shares have traded with an average AFFO multiple of 28.7x.

Analysts are looking for 9% AFFO growth in 2023.

Shares of AVB pay an annual dividend of $3.16 per share, which equates to a dividend yield of 2.8%. The dividend is well covered by a low 62% payout ratio and an A rated balance sheet.

At iReit on Alpha, we currently rate shares of PLD as a STRONG BUY.

Thankful Pick #2: AvalonBay Communities, Inc. (AVB)

AvalonBay Communities is a REIT that develops, acquires, owns, and operates multifamily apartment communities across the U.S. The company focuses on major markets with growing employment and higher wages. Some of these metropolitan markets include:

- New England

- Pacific Northwest

- New York

- California

The company currently holds a direct or indirect interest in 293 apartment communities which amount to 88,405 apartment homes within 12 states.

Apartments are a great place to invest cash, even if you expect a slowing economy in the near future. Great REITs with strong property offerings, like AVB, have pricing power and flexibility, which allows them to adapt with the ever-changing economic conditions.

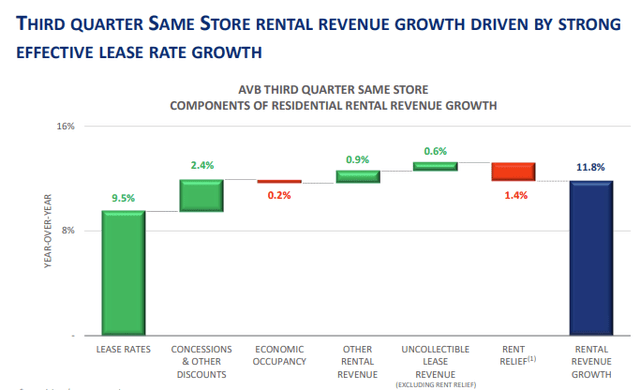

During the company’s most recent quarter, AVB saw same-store rental revenue growth climb 11.8% year over year, which was attributable primarily to higher rental rates, which accounted for 9.5% of rental growth.

Even in a period in which we hear about a slowing real estate market, AvalonBay understands the shortage of housing and the opportunity in front of them.

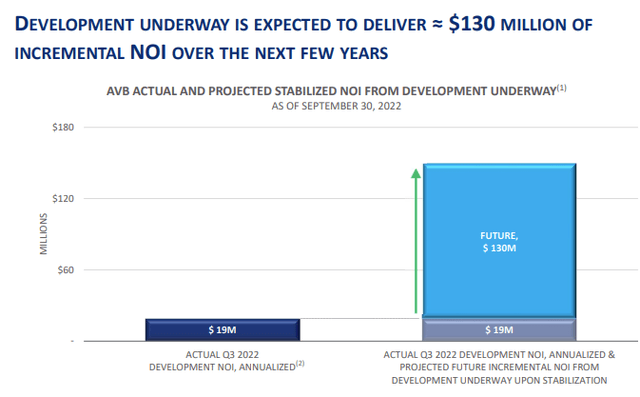

The REIT currently has development underway of new apartment communities, which are expected to deliver $130 million in additional NOI over the next few years.

AVB also is backed by a strong A-rated balance sheet, which can give investors even more confidence in times of a slowing economy. AVB has a net debt to EBITDAre of 4.6x, which is firmly below their target range of 5.0x-6.0x.

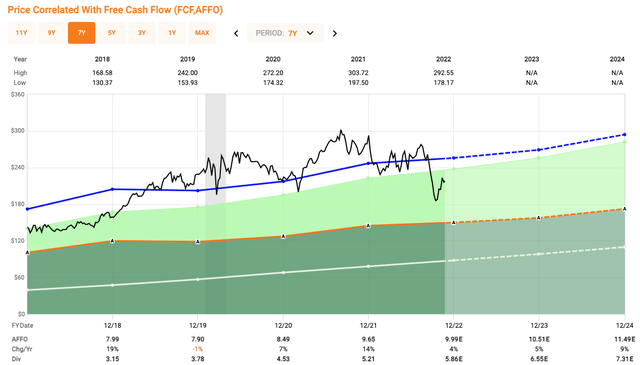

AVB is a high-quality blue-chip REIT and it looks undervalued at current levels. Shares of AVB currently trade at a P/AFFO of 19x, which is well below their 5-year average of 22x.

Year-to-date, shares of AVB are down nearly 30%, presenting a great opportunity to buy this apartment REIT leader.

In addition, you receive a 3.8% dividend yield that is well covered with an FFO payout ratio of 65%.

At iREIT on Alpha, we rate shares of AVB a STRONG BUY.

Thankful Pick #3: American Tower Corporation (AMT)

American Tower Corporation is the leading cell tower REIT in the industry in a time when the demand for strong cell service and data range is climbing higher.

AMT currently has a portfolio of ~223,000 communication sites and that is expected to climb with the continued rollout of 5G. The new 5th Generation network is much faster than 4G, but the issue is the lack of range in which the data can be carried.

4G is expected to have a range of roughly 10 miles, but when it comes to 5G wavelengths, they only have a range of roughly 1,000 feet, less than 2% of the range of 4G. What this means is there is a greater need for more cell towers to support 5G, which is a tailwind for a company like AMT.

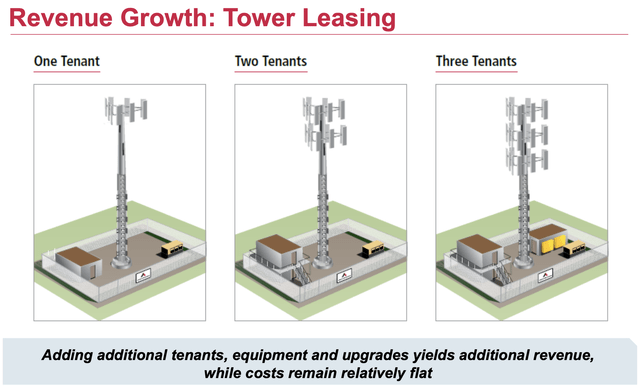

Currently, a cell tower can hold between one or three different tenants, as seen in the slide below. The single tenant towers have very low margins, but when AMT is able to add multiple tenants the margins explode, just due to the fact much of the costs are in building the tower itself.

AMT Q3 Investor Presentation

The rollout of 5G and the need for more towers continue to be a growth driver for the company, but so does the rising number of mobile devices.

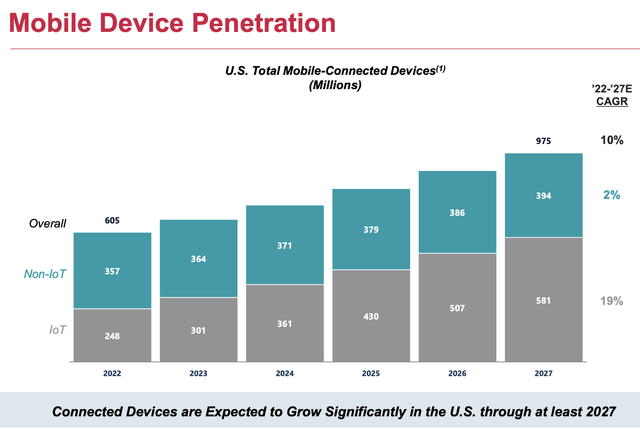

By 2027, AMT expects there to be 975 million connected devices in the U.S. alone, and with more devices means a need for more cell towers.

AMT Q3 Investor Presentation

AMT is a unique REIT in the fact that they are a dividend growth REIT. REITs tend to pay higher yields, but dividend growth is usually not a huge percentage.

With AMT you get a dividend yield of 2.7% with a 5-year dividend growth rate of 18%. The dividend is also well covered with a payout ratio of only 64%.

Looking at valuation, shares of AMT have largely traded at a premium when compared to the overall REIT market. Over the past five years, shareholders have paid an average of 25.5x AFFO for shares of AMT.

Today, shares of AMT trade at an adjusted funds from operations (“AFFO”) multiple of 21.9x, well below their five year average, and look quite intriguing at these levels.

At iREIT on Alpha, we currently rate shares of AMT a BUY.

Get a Slice of REIT Pie

Of course, as you know, I always save the best for last, and just like Mom’s pumpkin pie, I want to now tell you about my highest conviction pick.

I must admit, we’ve been crushing it lately at iREIT on Alpha, and I’m pleased to report that our subscriber base has grown significantly over the last 30 days.

It’s picks like I’m going to provide you now that gets me excited, because I can highlight the effort that our team puts into a selection using fundamental analysis. In a recent article I explained,

“A major reason Hannon Armstrong’s (HASI) credit losses have been almost non-existent is because it knows how to structure deals that all but ensure it gets paid. This fact is not obvious in its earnings reports nor in the analysis done by other authors that I’ve read.”

One of the things we look for very closely within the dividend sector is predictability. Recognizing that income is the key driver for total returns, we insist on companies that provide reliable sources of income – and HASI meets that standard very easily.

“99% of Hannon Armstrong’s investments were performing in line with or exceeded expectations as of the end of Q3. That’s up there with the best mREITs. Since the initial public offering in 2012, credit losses have been less than 20 basis points on a cumulative basis.”

Said another way, we have no interest in owning shares in EPR Properties (EPR) given the exposure to theaters and unsustainable operators.

We also look for strong balance sheets and once again, HASI checks that box:

“Hannon Armstrong ended Q3 with a 1.7x debt-to-equity ratio. That’s conservative, and equally important, well under management’s previous guidance of 2.5x. This shows management is serious about keeping leverage low.

I wouldn’t be surprised to see an investment grade rating from all three major rating agencies in the next 12 months. That’s a real tailwind and practically unheard of in the mREIT subsector.”

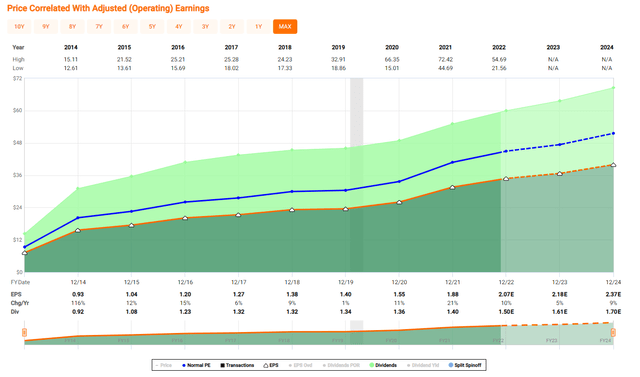

The chart below provides a great illustration of HASI’s model of repeatability:

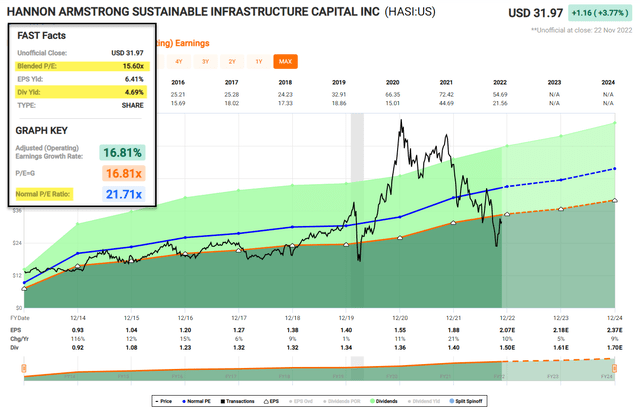

Of course, the reason I added this “pumpkin pie pick” is because of HASI’s very attractive valuation. As you can see below, shares are trading at a wide margin of safety – based on all traditional valuation metrics:

In a recent article we discussed the short attack and shares have since climbed but are still trading well below normal valuation ranges (even discounting Covid-19, the normal P/E is around 18x).

I recently interviewed the management team and I hold them in high regard, as capable and experienced leaders. While we certainly appreciate the short sellers viewpoint, we have maintained our “strong buy” rating, recognizing the durability of the time-tested business model.

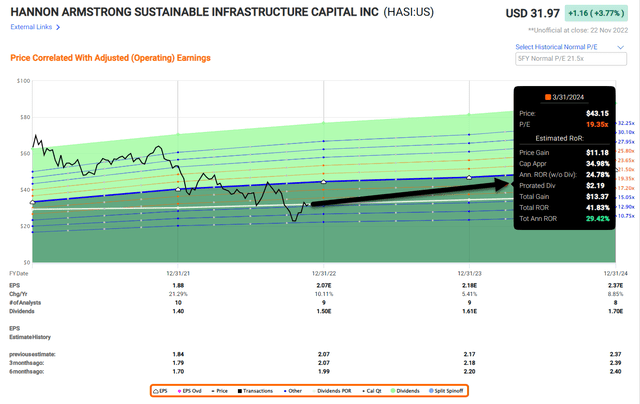

It’s in markets like we’re in now that you want dependable income that’s increased in “thick or thin”. I am continuing to add to my HASI position as it has become a larger holding in my retirement account. As viewed below, we’re targeting returns of 25% annually.

In Closing…

I want to thank all of my followers on Seeking Alpha and for all of the comments shared over the years (12+). It’s hard to believe that I have squeezed out over 3,500 articles since I began writing in 2010.

As you know, my focus is not quantity however, it’s quality.

I want every reader to feel as though they have benefitted from my writing and analysis. You can agree or disagree, but at the end of the day, I encourage all readers to be insightful, as Howard Marks explains (emphasis added):

“In my view, that’s the definition of successful investing: doing better than the market and other investors. To accomplish that, you need either good luck or superior insight. Counting on luck isn’t much of a plan, so you’d better concentrate on insight.

In basketball, they say, ‘You can’t coach height,’ meaning all the coaching in the world won’t make a player taller. It’s almost as hard to teach insight. As with any other art form, some people just understand investing better than others. They have — or manage to acquire — that necessary ‘trace of wisdom’ that Ben Graham so eloquently calls for.”

I wish everyone a safe, happy, healthy, and prosperous Thanksgiving.

All the best!

Be the first to comment