putilich/iStock via Getty Images

Introduction

This article will discuss the trading patterns of five different SaaS companies and explain how investors can rely on diversification to increase their returns. However, we should start with discussing some definitions. I have an extremely broad definition of SaaS: essentially any company that allows for recurring revenues based on either cloud-based or downloadable tools and services. The key is the subscription: one the most popular ways in business today to earn revenues. I am not the only one with a broad definition, and the following description of the industry offers insight into the broad nature of the term.

Cloud computing is an umbrella term that covers various services such as – Software-as-a-Service (SAAS), Platform-as-a-Service (PAAS), Infrastructure-as-a Service (IaaS), and Hardware-as-a-Service (HaaS). In the absence of a standard taxonomy, other suggested service categories include Development, Database and Desktop as a Service (DaaS), Business as a Service (BaaS), Framework as a Service (FaaS), Organization as a Service (OaaS) etc. A cloud SaaS is a multi-tenant platform that uses common resources and a single instance of both – the object code of an application as well as the underlying database – to support multiple customers simultaneously. It is based on the Application Service Provider (ASP) model and heralds a new wave in application software distribution. Some of the key providers of this service are SalesForce.com, NetSuite, Oracle, IBM, Microsoft etc.

As such, I consider all the above taxonomies under a single umbrella, as it is easy to use narrower definitions for peer analysis. I instead want to look across the entire industry to find tradable patterns and diversify my SaaS exposure. Despite popular sentiment, there is more to SaaS than unprofitable, speculative, or high-risk investments. While many popular SaaS companies are resetting after the boost in valuation and performance during the pandemic, I hope to shed light on what other real opportunities there are (perhaps popularity is a defining bearish indicator).

For the sake of simplicity, I will focus on companies that have been public for at least three years in order to assess the change in valuation through the pandemic period. Recent IPOs and SPACs have had unfortunate trading patterns, but this does not take away from the opportunity of individual companies. As is always the case, the relation between qualitative and quantitative factors will create the share price, and for the most part there are simple explanations for the share price. But by looking at and understanding older, more mature companies, we can feel more comfortable assessing the new market entrants.

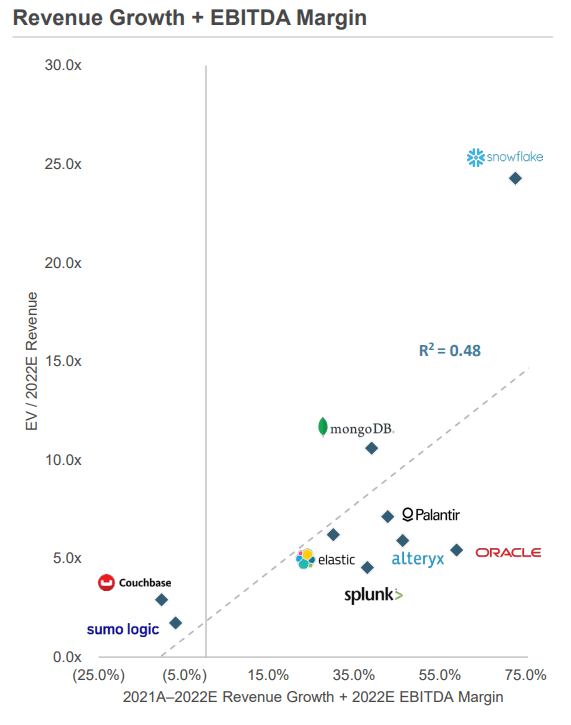

The five companies I will be discussing in this article are as follows, ranked by 1-year share price performance (as of 11/23/22):

-

Aspen Technology: +55.3%

-

Thomson Reuters: -4.58%

-

Oracle: -11.4%

-

Simulations Plus: -20.4%

-

Salesforce: -47.8%

I am sure the first takeaway for readers will be the fact that the most popular SaaS company, Salesforce is the underperformer. This highlights the fact that despite leading the industry in size, scale, innovation, and historical performance, the share price may not take these factors into consideration. Also, investors may notice that the four other names may not be traditionally known as SaaS companies. However, under my definition, the key of earning subscription revenues from cloud-based or downloadable applications is met for the majority of revenues of all companies.

I would also like to note that each of the five companies can be sorted into their own unique subset or sector within the SaaS industry as a whole. Therefore, there are other constituents or peers that trade similarly, or have similar performance patterns that I will make a note of. I hope you use the techniques I discuss in terms of qualitative and quantitative analysis for your own portfolio building journey.

What Happened to Salesforce?

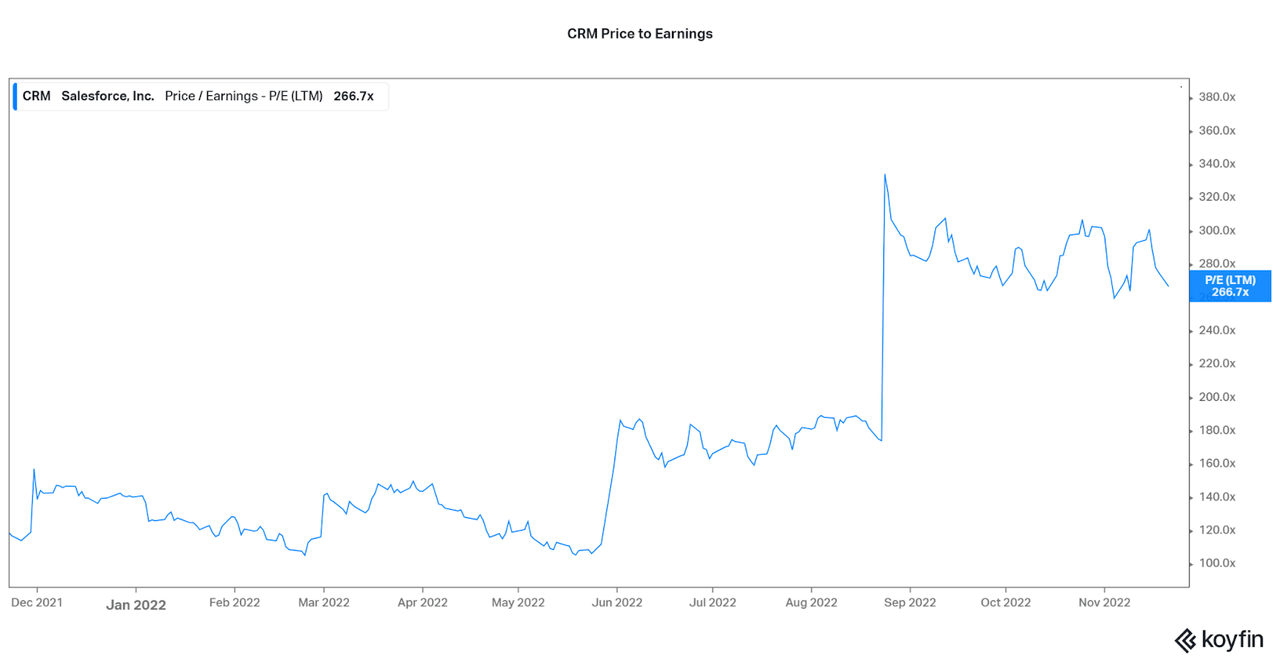

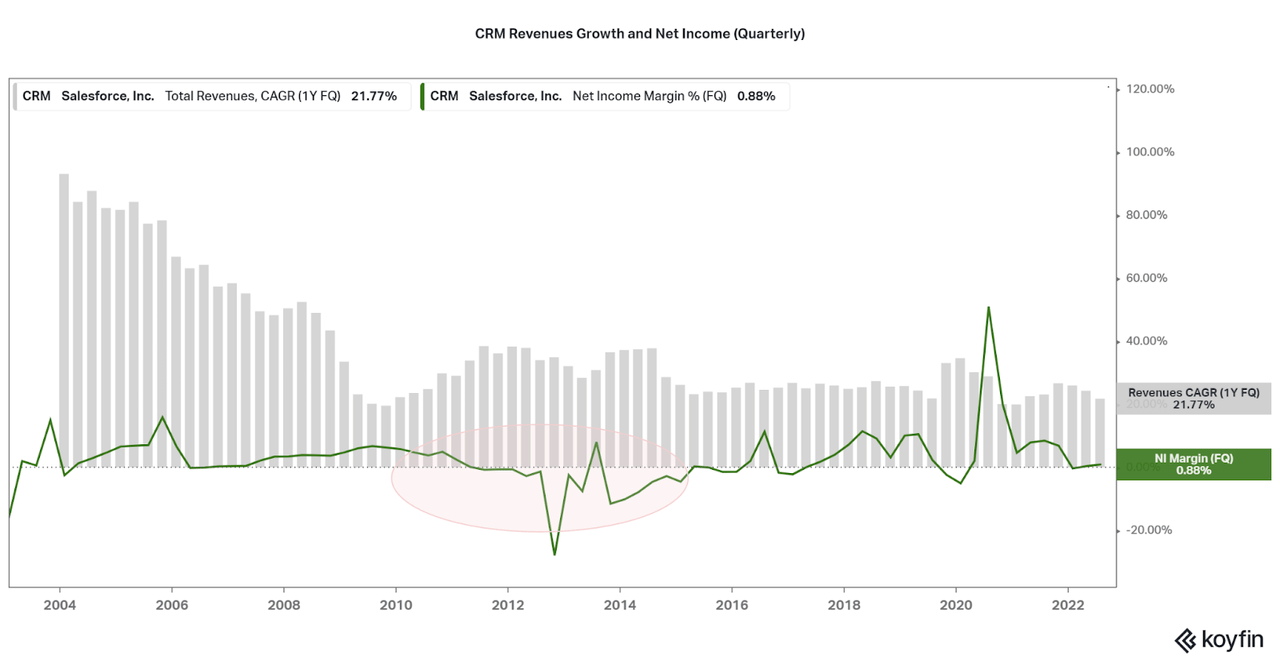

I suppose it is important to understand the unfortunate state of the star of the SaaS industry, Salesforce (CRM), before moving on to the more specialist names. As the leader in providing easy-to-use and access cloud services, CRM has been steadily compounding revenues over the past 20+ years. Why would this suggest the share price will fall 50% in one year? As is usual, valuation, sentiment, and historical performance all are factors to consider. Funnily enough, despite the 50% decline in share price, the Price to Earnings Ratio has tripled over the last year.

Koyfin

The major takeaway for investors is the breakdown of the tired adage of “growth will slow when the company gets large” or what have you, but profits will always be more important than revenue growth. For CRM, revenues have easily grown at an average rate of 25% per year for at least the past 10 years. At the same time, we can also see that high growth can also come with solid profitability for the most part.

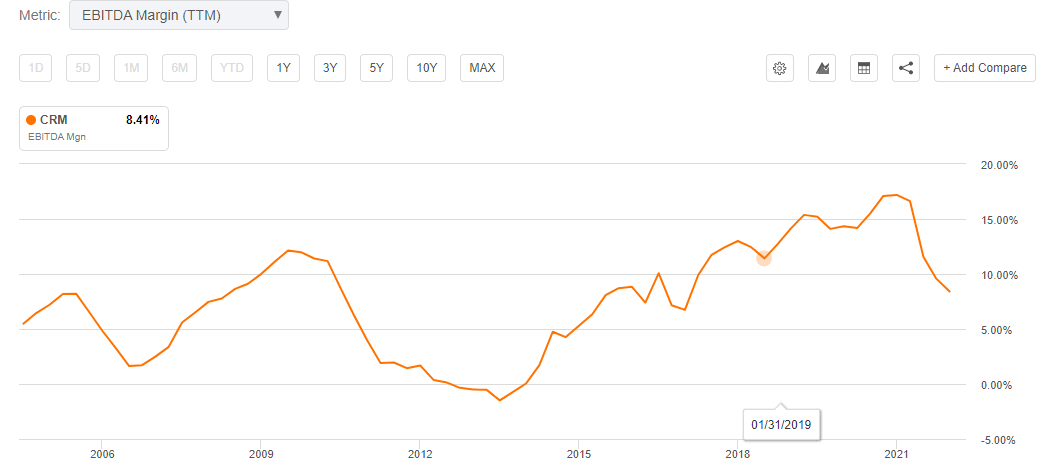

While earnings are not positive all the time, average EBITDA margins have remained above 5% for most of the company’s public history. Unfortunately, I see a pattern that highlights why CRM is now trading down 50% over the past year: profits disappear during bear markets. In particular, the EBITDA margins are already falling by 50%.

This pattern was not unique as EBITDA also fell negative during and after the GFC. In fact, there is a significant time delay for the company profitability, and this suggests that customer spending remained suppressed after the actual listed recession. However, profits eventually returned through the back half of the 2010s. When looking at the relation between profitability and revenue growth, we can see that the low profitability period coincided with rapid revenue growth as well, so we can also infer that the losses were due to investments in growth.

Seeking Alpha Koyfin

While it is clear that the sharp decline in profitability is the key reason for the market cap halving, it is less clear why. There are multiple factors to consider, but they seem to be internal. First, we have to consider that if revenues remain growing, then most of the losses can just be contributed into growth investments. It is clear that the long-term revenue trend is falling year after year, but perhaps this round of investments can create a new growth period like 2010-2015. Then, as the customer base is expanded, profits can be squeezed out during a strong economy and the cycle continues.

If revenue growth was more volatile, then I would suggest that the customer base is weak (a major reason for underperformance across the industry), but this is not the case for Salesforce (some may argue CRM-software is elective business spending though). While the pattern suggests that CRM will be operating fine 10, 20, or x years for now, the volatility along the way is scary for many.

One other factor that may influence the volatility of the asset is the exposure to consumers and retail investing, both of which increase the volatility beyond what the financials would indicate. We can see this reflected in the performance of Adobe (ADBE) who has traded down by 50% just like Salesforce, despite being a leader in SaaS solutions.

Therefore, it is important for investors to consider these issues and patterns, so I will now discuss a subset of the industry that is far less cyclical, but performing just as well as more popular fields.

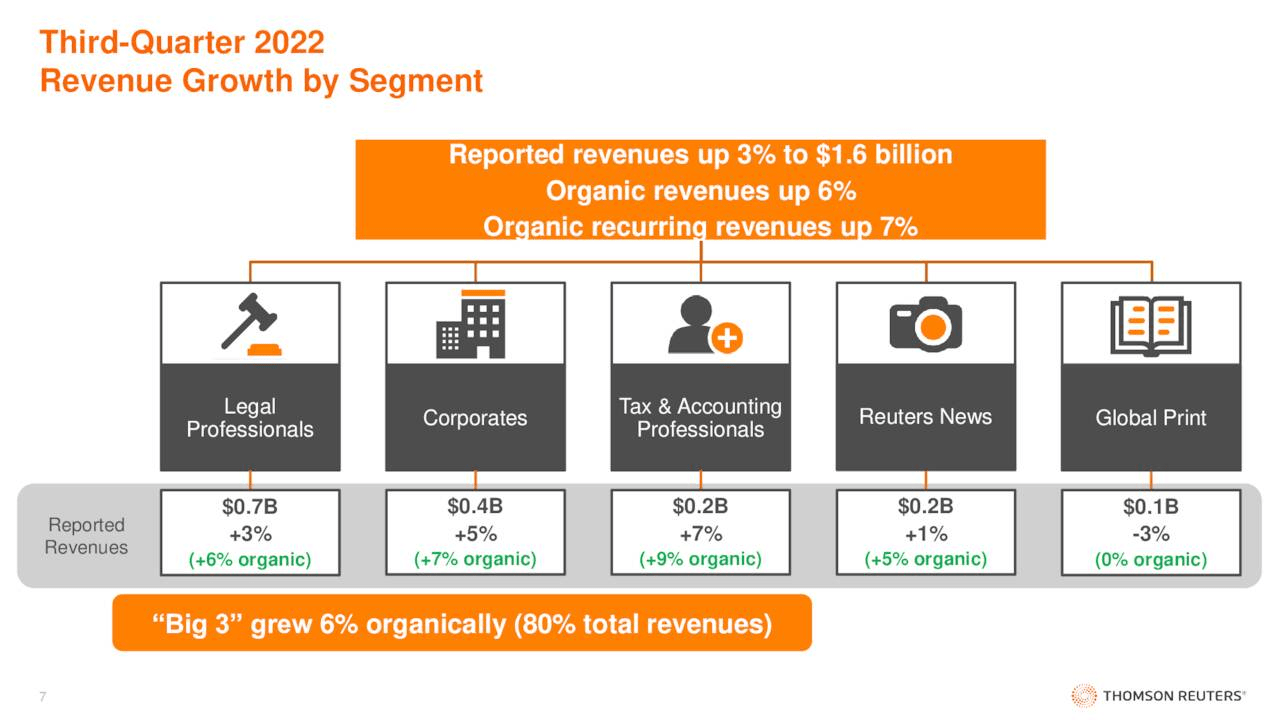

Thomson Reuters is the Leader in Critical Business Software

While customer relation management and other more loosely defined “discretionary” or “popular” subsets of SaaS have fallen by 50% or more (many hyped companies down 80-90%), a SaaS sector that provides critical business solutions has performed better than the broader market. The industry stalwart is Thomson Reuters (TRI), a $54 billion market cap provisioner of legal, corporate, and Tax & Accounting solutions. In fact, the more famous news and print segments only account for about 20% of total revenues. Also, 80% of total revenues are on a recurring basis as customers buy long-term software subscriptions on multiple different cloud or downloadable platforms.

Thomson Reuters

Due to the critical or essential nature of most solutions, the company is far less volatile and predictable than other high growth sectors of the market. This has allowed TRI to fall only 4.6% over the past year while SPY has fallen 14%. However, TRI is facing similar issues as Salesforce in regards to sliding profitability into 2022, slowing growth, and overvaluation. The reasons why CRM has sold off while TRI continues to outperform is the lack of significant public scrutiny, positive sentiment due to the more essential nature of the solutions, and higher profit retention even as other SaaS companies face losses. Regardless of a company’s performance, the share price remains in the hands of investors thanks to the inefficiencies of our market.

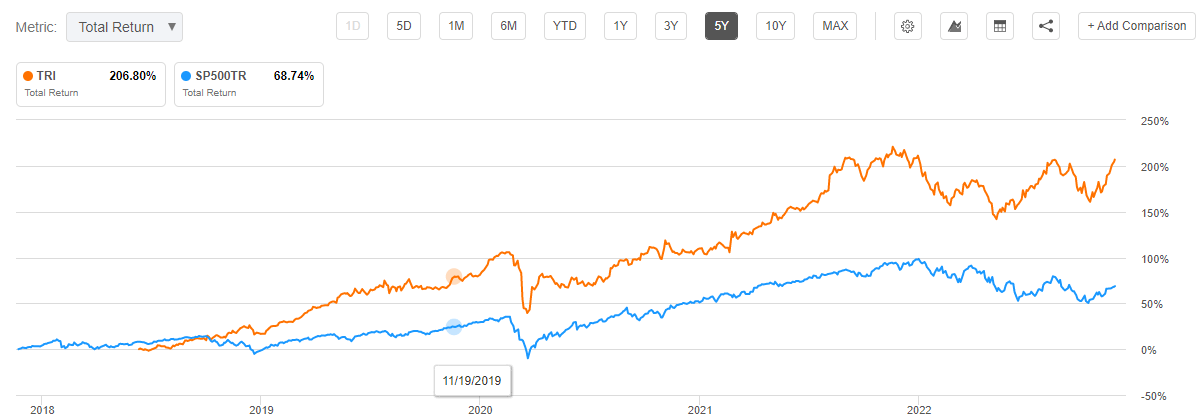

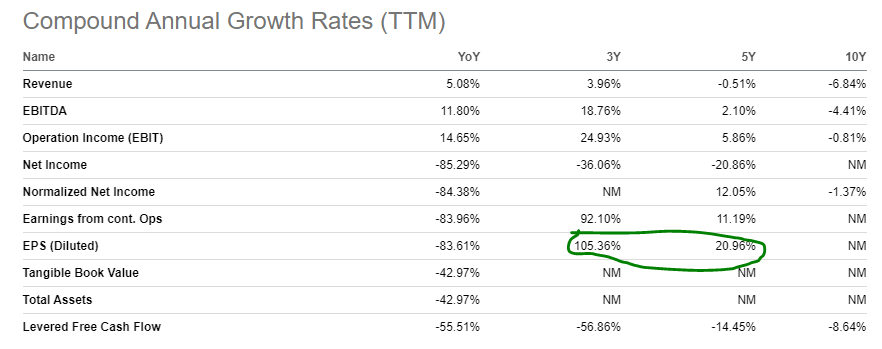

Moving to a broader scale, investors can expect TRI to offer a stable investment into the SaaS industry with partially reduced volatility but strong returns. In fact, over just the past five years TRI has outperformed the S&P 500 by almost triple, despite TRI only offering flat revenue growth. The key is that highly profitable, but slow growth SaaS companies such as TRI look boring on the surface, but the strong returns are thanks to the ability to grow earnings at a far higher rate than revenues.

As the company continues developing their cloud-based expertise and exposure to recurring revenues, EPS will continue growing leading to great returns. Combined with reduced volatility, most investors should avoid the high risk, low reward growth companies and instead enjoy investments in this subset of “critical business solutions” providers. Another peer I would recommend taking a look at would be RELX (RELX), and I discussed how the name may offer insight into the future performance of most major SaaS companies.

Seeking Alpha Seeking Alpha

The Sector Beating the Market

Despite popular belief, not all assets ex-energy are on the decline. Even an important sector of the SaaS industry is on a bull run thanks to macroeconomic difficulties. This industry revolves around the provision and development of supply chain management software, or other similar optimizations. The small, but extremely complex sector has multiple companies trading better than the broader market over the past year.

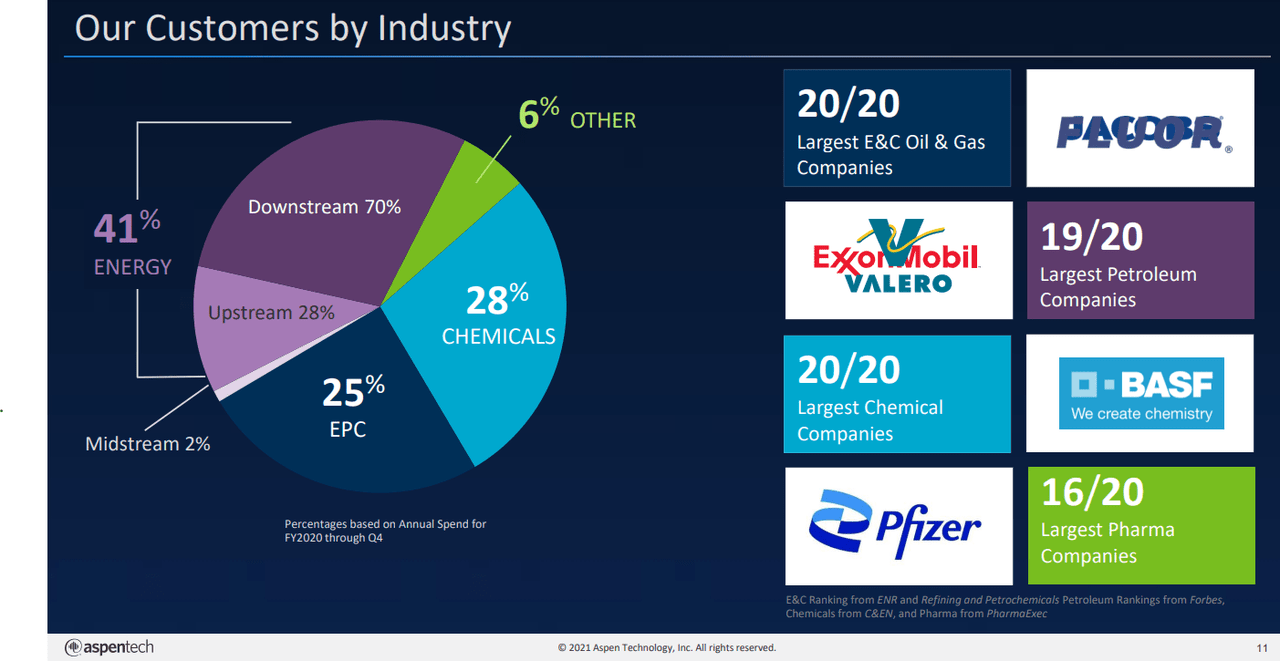

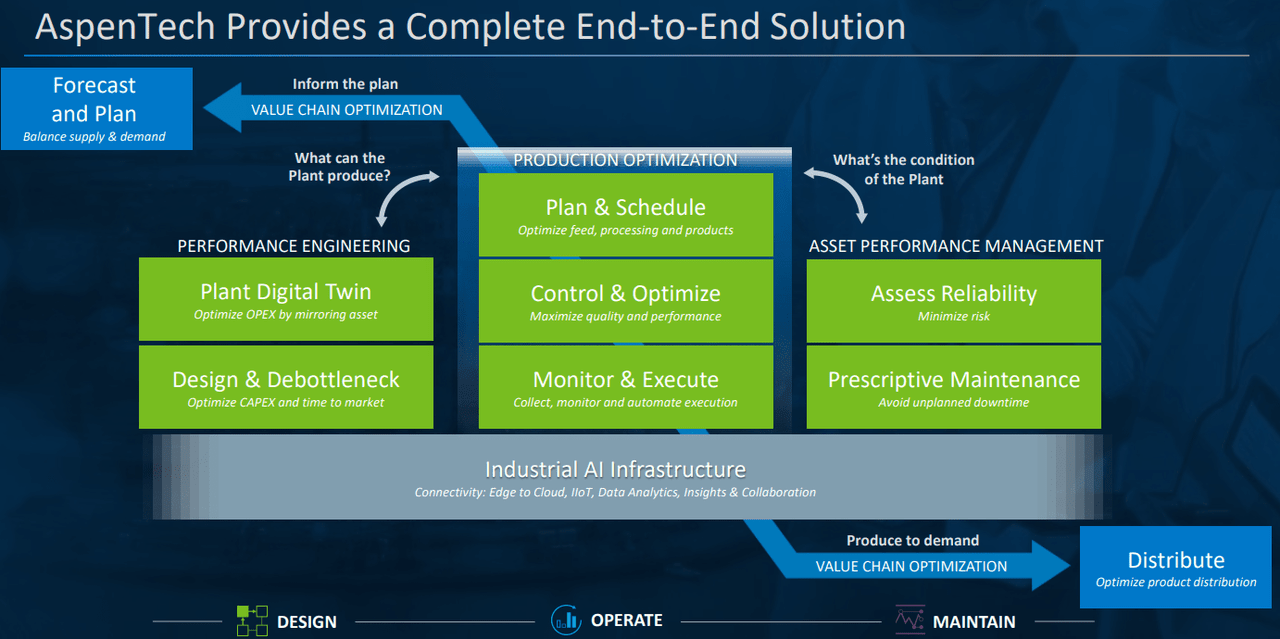

The best performer is Aspen Technologies (AZPN), who is up 56% YoY. Unfortunately, although supply chain management is just one of the leading aspect of their solutions, the major reason why the company is performing well is their exposure to oil & gas and pharmaceutical clients, the two industries that are performing well in 2022. Other peers performing better than the broader market are ASX-listed cargo and logistics specialist WiseTech (OTCPK:WTCHF) up 4% YoY, and retail-focused SPC Commerce (SPSC) down 8% YoY.

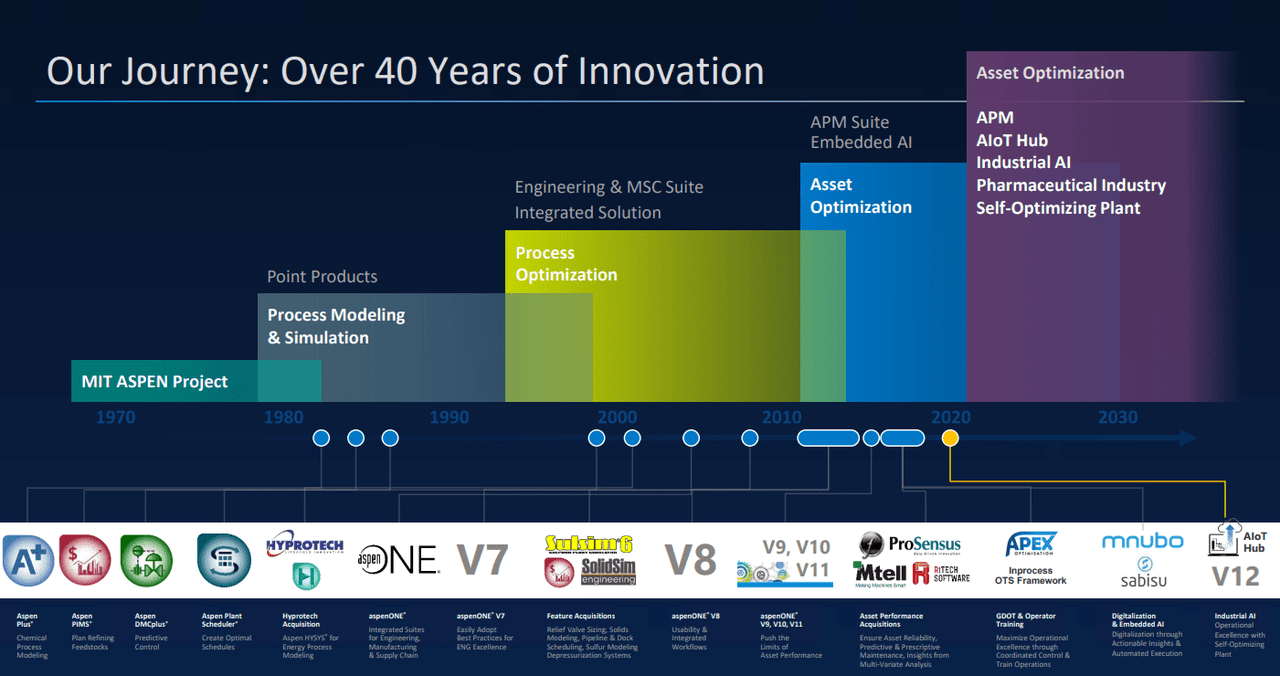

Aspen Technologies Aspen Technologies

The biggest need for businesses in 2022 is the tightening of the belts, optimization of their industrial processes, and efficient management of global supply chains. Although, these issues are essential at all times and this has proven lucrative for AspenTech. The questions investors must consider are what is the longevity of this current financial bull market and whether performance will eventually reset.

I believe that AspenTech quality historical and present qualities answers this question well. Yes, with gradual platform improvements, a software provider can continue growing for years and years, despite swift changes in the industry, sentiment, and economic conditions. Why? Because AZPN has been doing this for over 40 years.

Aspen Technologies

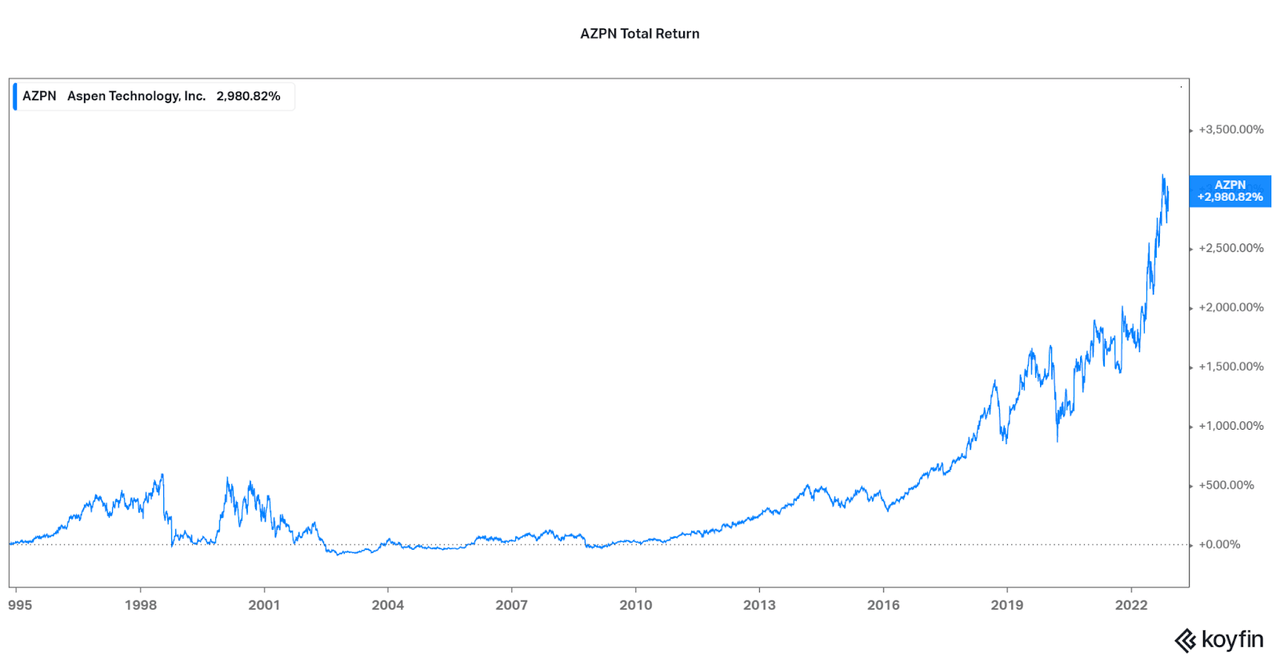

Unfortunately, this does not mean that the share price will be going up continually with performance. Innovation is expensive, customer demand may be cyclical, and uptake of new innovations may take a while. This has led AspenTech to have a volatile price over the past 30 years and I do not expect this to change moving forward. While economies of scale due to integrations and diversification will continue to reduce volatility moving forward, the next bear market in energy and industry will likely result in the share price falling swiftly. That’s okay though, try to take advantage of the cyclicality.

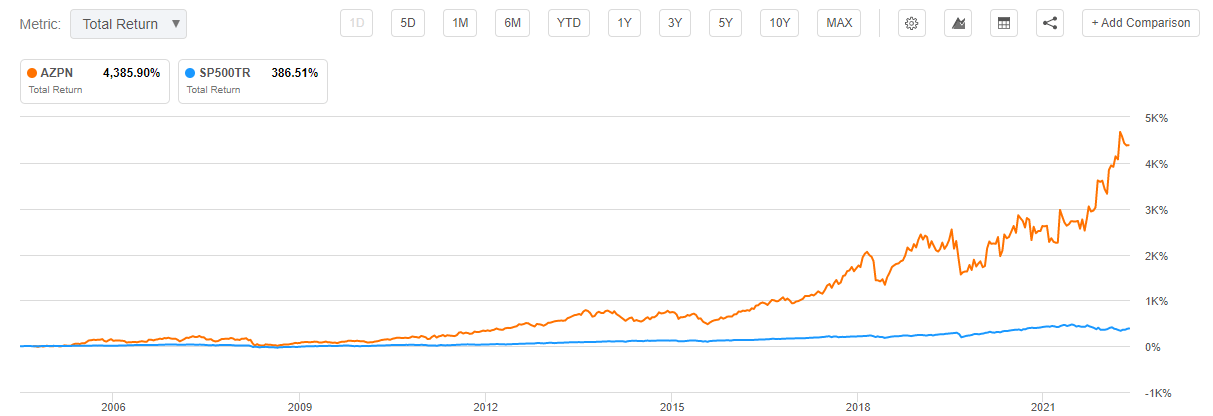

Investors must realize that many specialty SaaS companies will be cyclical and trade in line with the sectors or industries they service. Or, if you have a long enough time horizon, slowly adding on a recurring basis will negate most valuation and market risk even during times such as 2021 and the Dot-com bubble. While this expectation relies on an innovative, dominant company to meet growth expectations for decades, I am sure some of the more popular SaaS companies that have fallen over the past year are just temporary declines, and continuing to support those leading specialists will allow for strong long-term returns despite the volatility. As in Aspen’s performance, the S&P 500 can be left in the dust over a long-enough time frame.

Koyfin Seeking Alpha

Diversification vs Competition

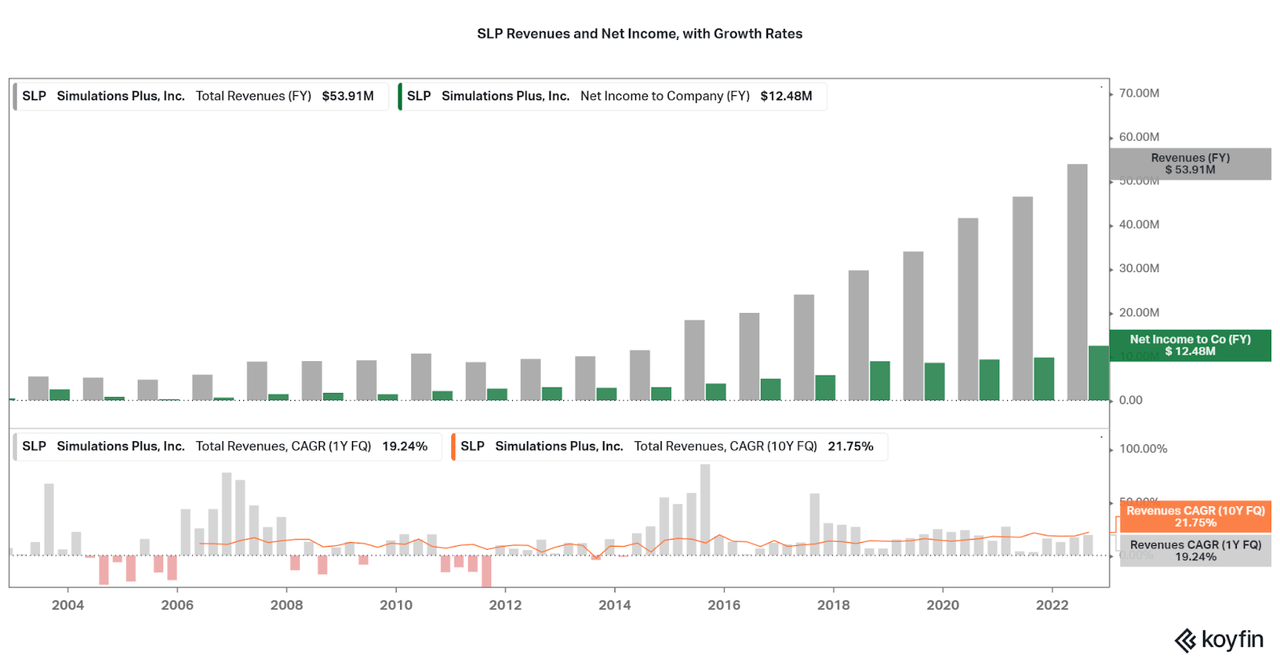

Another benefit of the SaaS industry is the ability to hold a diversified portfolio due to the wide range of use cases. As the first three companies I discussed show, SaaS is used in all businesses around the world and this provides unique ways to diversify your portfolio and increase returns. In fact, I believe it is possible to create a unique, market performing portfolio of just specialty SaaS companies. As an example, I would like to highlight an evolving SaaS sub-sector: drug discovery. One industry incumbent is Simulations Plus (SLP), a long-term player in pharmacokinetics and other chemistry-based modeling who continues to beat the market, but with some volatility along the way.

Seeking Alpha

While offering a complex SaaS mix, approximately 30% of total revenues are from services involving contract-based modeling and research for those without a large technical or capacity base. While growth was slow in the early days until the mid-2010s, revenues really took off the past five years with the rise in software adoption in healthcare. Now, revenues are growing at a 20% annual rate on average, and the rate is rising. For this reason, the share price is only down 20% over the past year as inertia is being maintained, despite having less than a $1 billion market cap.

A potential catalyst for investors to look for is the effect of earnings growth as the platform matures. While positive, net income is not growing at the same rate as revenues due to investments in the platform as the industry continues to have fast organic growth opportunities. In the future, as full market share is met, profits can be tightened again leading to significant opportunity for investors. This is similar to both Thomson Reuters and Aspen Technologies, and I believe that SLP has enough segment leadership to support this thesis.

Koyfin

This topic is also a great way to look at the major risk involving the SaaS industry: competition. I have covered this exact risk when discussing Alphabet’s AlphaFold, an innovative new protein visualization software. While SLP has been performing well lately, the entrant of SaaS giants, Google Cloud (GOOG), AWS (AMZN), and Microsoft (MSFT) into this lucrative and lifesaving industry will create immense competition. Will SLP’s experiences over the past 30 years be able to outcompete the size, scale, and capacity of these giants?

No one can predict the answer, and perhaps it is best not to leave it to chance. This issue is also not limited to the drug discovery software segment, and competition across the entire SaaS sphere has led to underperformance, bankruptcies, and more. For investors, this would mean taking advantage of cycles and bull markets, but being aware of the downside potential when performance weakens. Or, take advantage by investing in the companies that are large enough to limit competition through M&A and R&D.

Profits Matter

Notice something about all four companies on this list so far? All are profitable, and this is extremely important even when revenue growth seems to be held in higher regard for most companies. I will also note that earnings or revenue growth can still be rapid and market beating despite high profit margins, as is the case with SLP, ASPN, and TRI. I would now like to bring up the one company that epitomizes this fact: Oracle (ORCL).

Oracle has put their money where their mouth is and has kept up with competition over the past two or more decades thanks to high profit margins, willingness to change, and internal innovation. This includes moving their operations into a SaaS-like platform in order to meet the demand for cloud solutions. But, they did not stop there, and the company is now competitive across multiple SaaS segments including software development and MAD (Machine learning, Artificial intelligence, and Data infrastructure).

Seeking Alpha

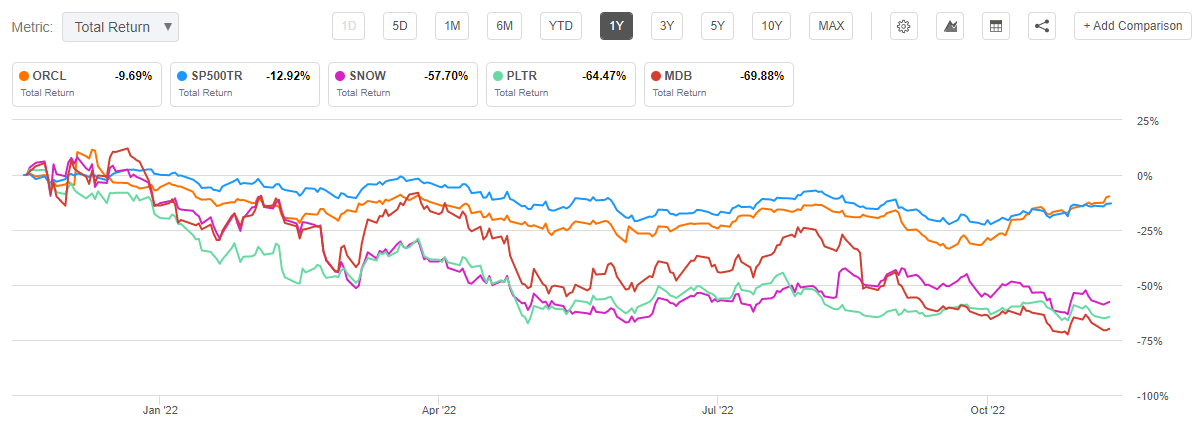

I have discussed Oracle’s advantage over other high publicity names such as Palantir, Snowflake, and MongoDB recently in an in-depth article, so I would head there for more insights. The gist is that one of the best ways to determine a SaaS company’s performance and opportunity is through the Rule of 40 and the relative valuation that results. The important things is to compare apples to apples, but can be reflected across all areas of the market. Despite revenue growth below peers, Oracle’s 30%+ EBITDA margins easily allow the company to beat the rule of 40. When combined with a far lower valuation than others who meet the rule of 40 through growth alone, Oracle is easily the best value in the industry, perhaps even across SaaS.

Houlihan Lokey Insights

Conclusion

Throughout this article, I have discussed various ways that the SaaS industry is complex, competitive, and volatile, but that there are ways to find consistent returns. This is just by comparing five companies that have divergent 1-year share price performance, but the wealth of knowledge reflected by these names is immense. I will summarize the general themes here:

-

Growth is not limited to the size or age of a SaaS firm, but innovation, diversification, and the cyclicality/opportunity of customer industries are the main driving forces.

-

The market is diverse enough that all types of investors can meet their goals: trading volatility, long-term recurring investments, low-risk value investing, income, and more. This also leads the performance of sub-sectors of SaaS to diverge from each other, and diversified holdings can be fruitful and non-correlated despite all being “tech”.

-

To find truly safe investments, either use the Rule of 40 plotted against valuation with sector peers, or rely on profitability and moat-like qualities for long-term success.

-

Then for those who are more nimble with their research and investing: simple patterns of cyclicality can be used to trim or add to positions without significant risk and plenty of historical data to base on.

Every investor has their own goals and risk tolerance. Thankfully, the SaaS industry is an acceptable place to gain most of your market exposure. If done correctly, performance can be in-line or beyond the general market, whether compared to QQQ or SPY. I would also not despair if your holdings are underperforming into 2022 as many SaaS constituents remain cyclical. Volatility is always present, but that also means there will be a chance for upside again and use the volatility for your benefit. Just make sure the asset you are investing in offers a reason to offer any upside at all.

Thanks for reading.

Be the first to comment