alexsl/iStock via Getty Images

A Quick Take On AudioEye

AudioEye (NASDAQ:AEYE) recently reported its Q2 2022 financial results on August 9, 2022, beating consensus revenue and EPS estimates.

The company operates a SaaS platform for website accessibility monitoring and related compliance requirements.

Given the firm’s tepid topline revenue growth, continuing operating losses and free cash burn, I’m on Hold for AEYE until operating breakeven and a faster growth trajectory.

AudioEye Overview

Tucson, Arizona-based AudioEye was founded in 2005 to provide accessibility monitoring and related compliance information for agencies, websites on the open web and on specific platforms.

The firm is headed by Chief Executive Officer David Moradi, who was previously CEO of Anthion Management, a technology venture fund and prior to that was a portfolio manager at Pequot Capital Management.

The company’s primary offerings include:

-

Website accessibility checker

-

Color contrast checker

-

Accessibility training

The firm acquires customers through its in-house sales and business development efforts as well as through channel partners.

AudioEye’s Market & Competition

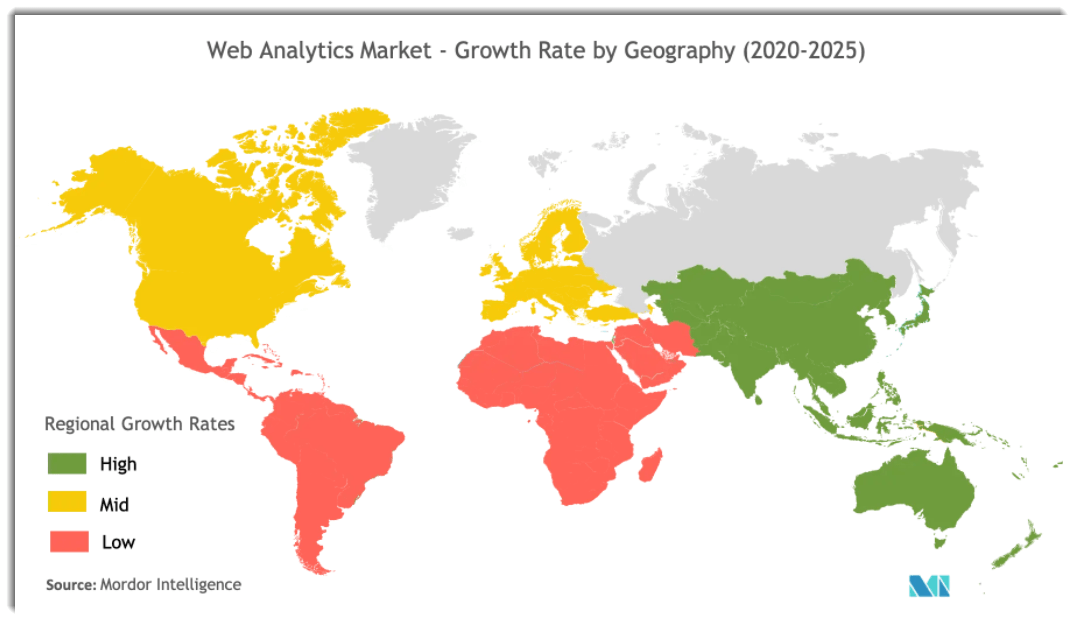

According to a 2021 market research report by Mordor Intelligence, the global market for web analytics was an estimated $3 billion in 2020 and is forecast to exceed $7 billion by 2026.

This represents a forecast very strong CAGR of 15.2% from 2021 to 2026.

The main drivers for this expected growth are a continued rise in the automation of online marketing and growth in online shopping by consumers and businesses.

Also, the COVID-19 pandemic will likely provide a significant boost to web analytics providers as businesses demand more information about their online properties to cater to more customers performing buying activities online.

North America is forecast to continue to provide the highest demand of any region worldwide, although the Asia Pacific is expected to grow demand at the fastest rate through 2025 as the chart shows below:

Global Web Analytics Market (Mordor Intelligence)

Within AudioEye’s specific market, the global market for website accessibility software was an estimated $386 million in 2021 and is forecast to reach $796 million by 2028, according to a research report by Market Research Guru.

This represents a forecast CAGR of 10.9% from 2022 to 2028.

Key companies in this space include:

-

Google

-

Siteimprove

-

DYNO Mapper

-

Deque

-

Crownpeak

-

Level Access

-

DubBot

-

Monsido

-

Silktide

AudioEye’s Recent Financial Performance

-

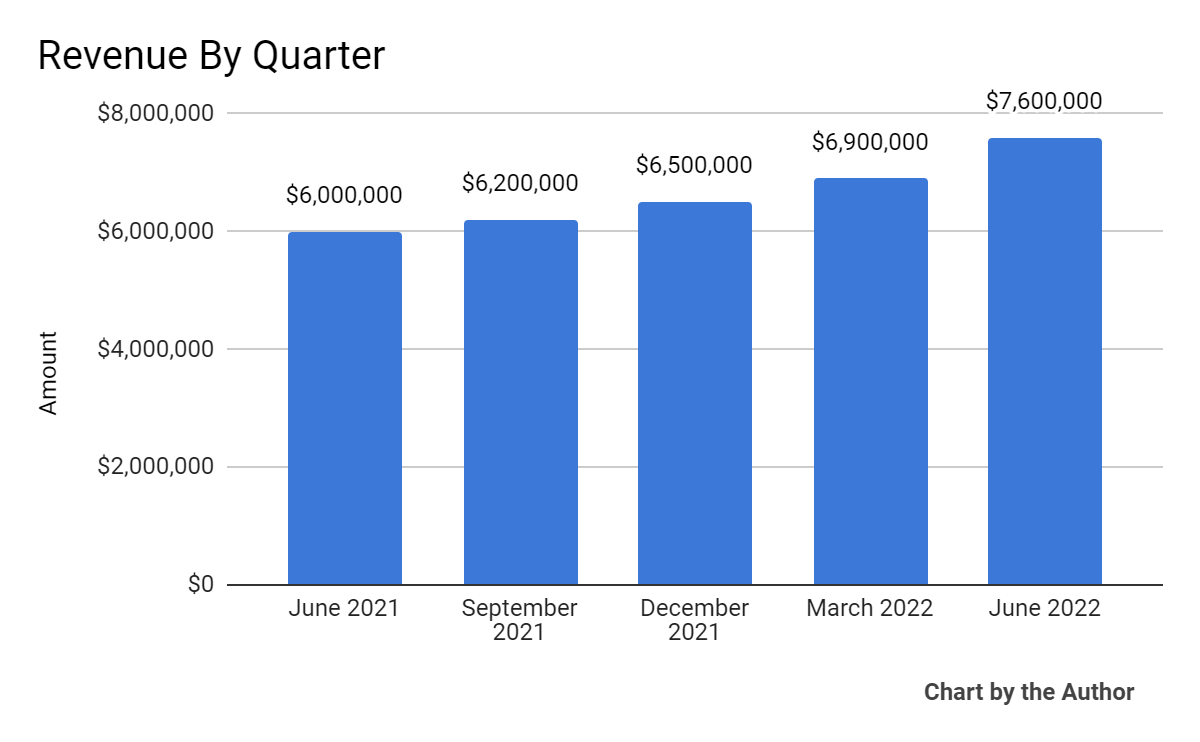

Total revenue by quarter has risen moderately in the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

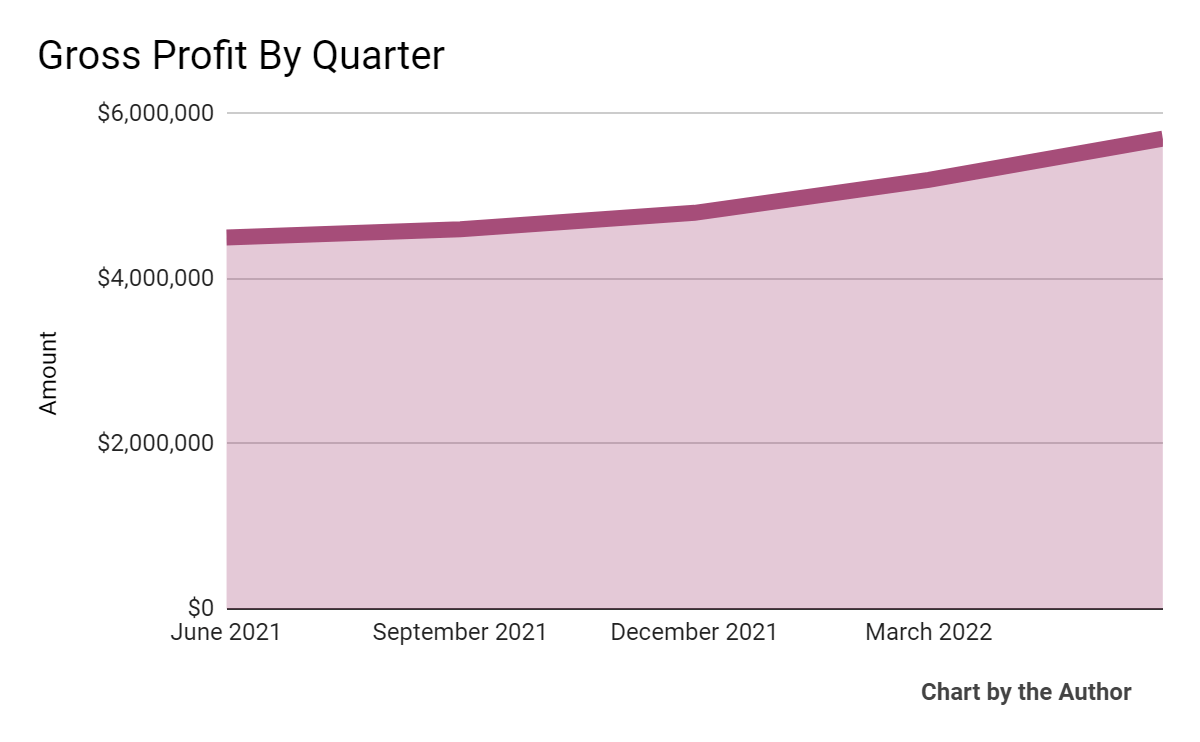

Gross profit by quarter has followed approximately the same trajectory as that of topline revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

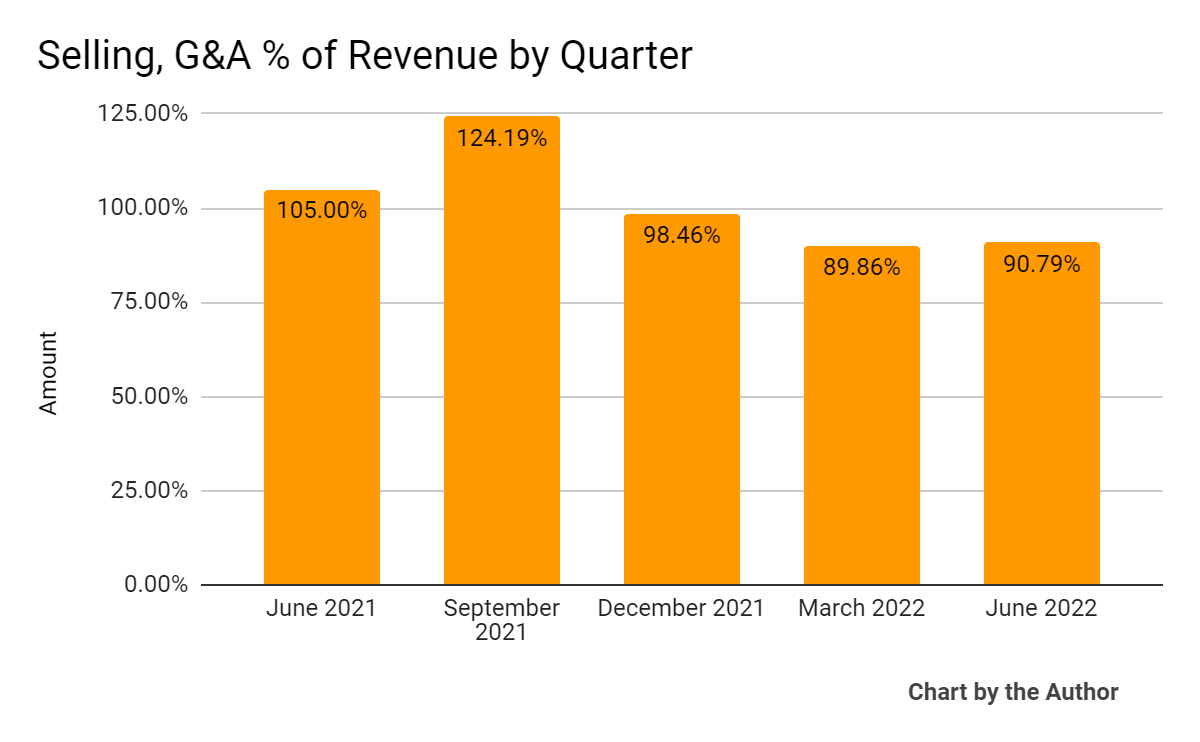

Selling, G&A expenses as a percentage of total revenue by quarter have remained fairly elevated in recent reporting periods:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

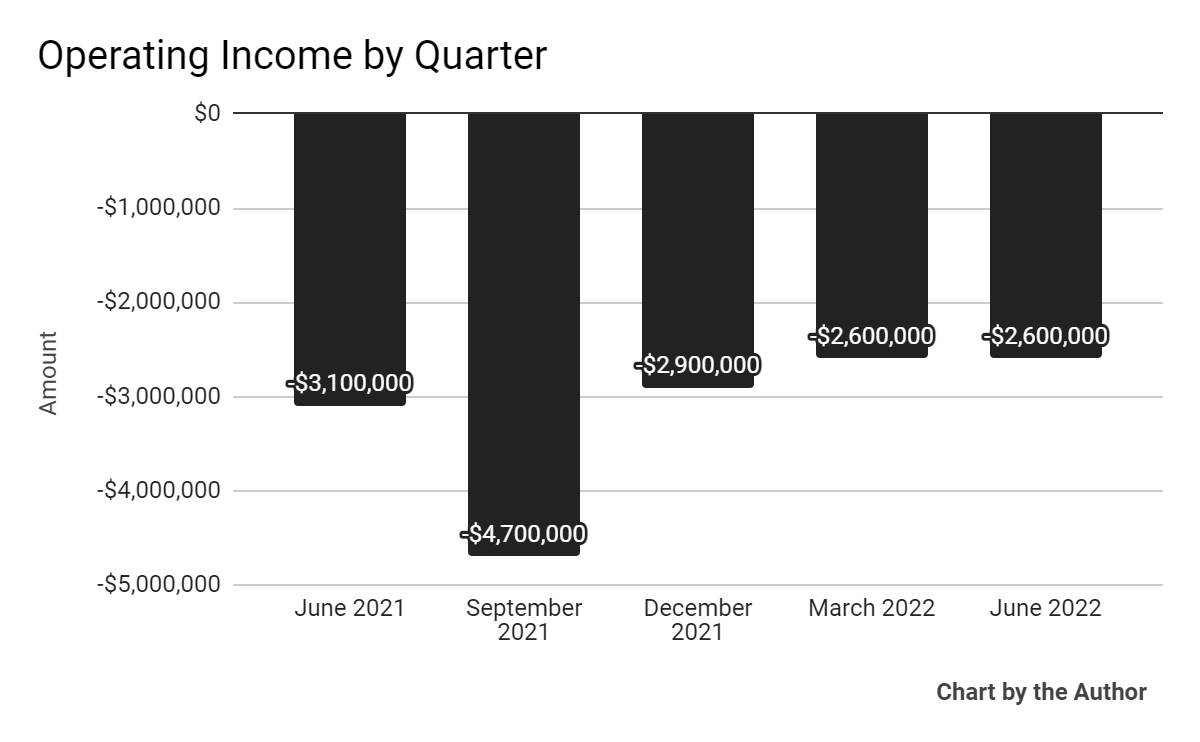

Operating losses by quarter have continued:

5 Quarter Operating Income (Seeking Alpha)

-

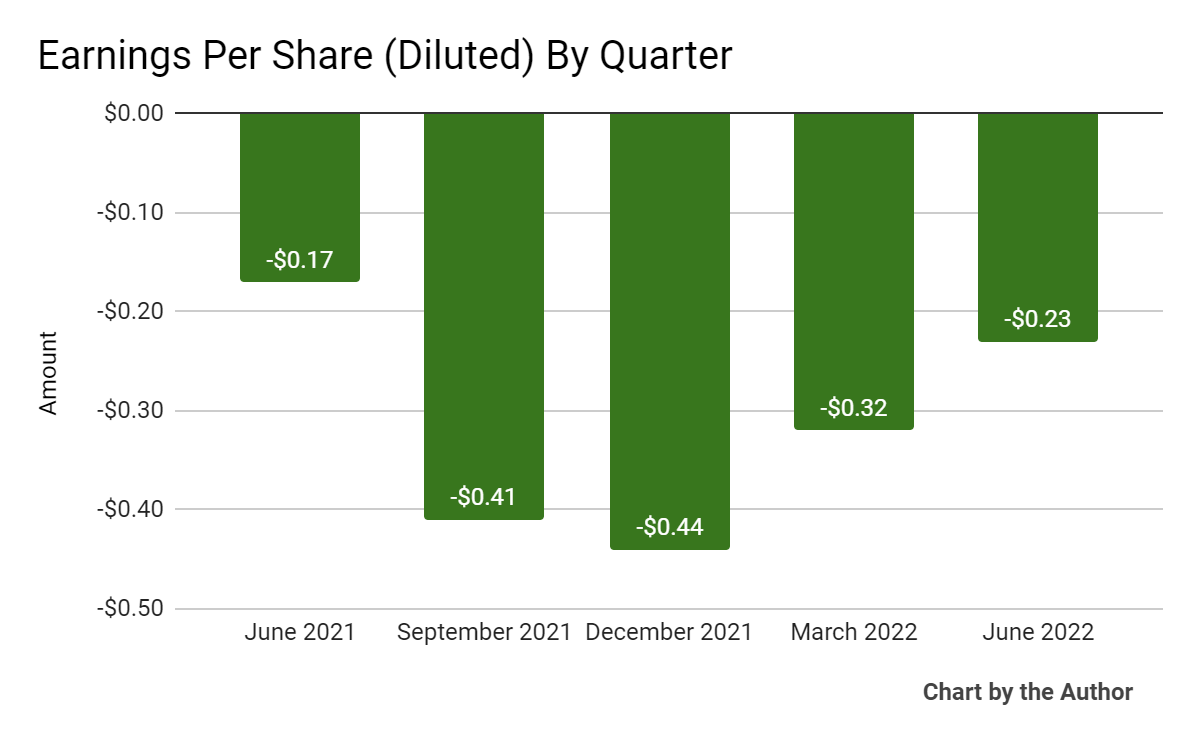

Earnings per share (Diluted) have also remained negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

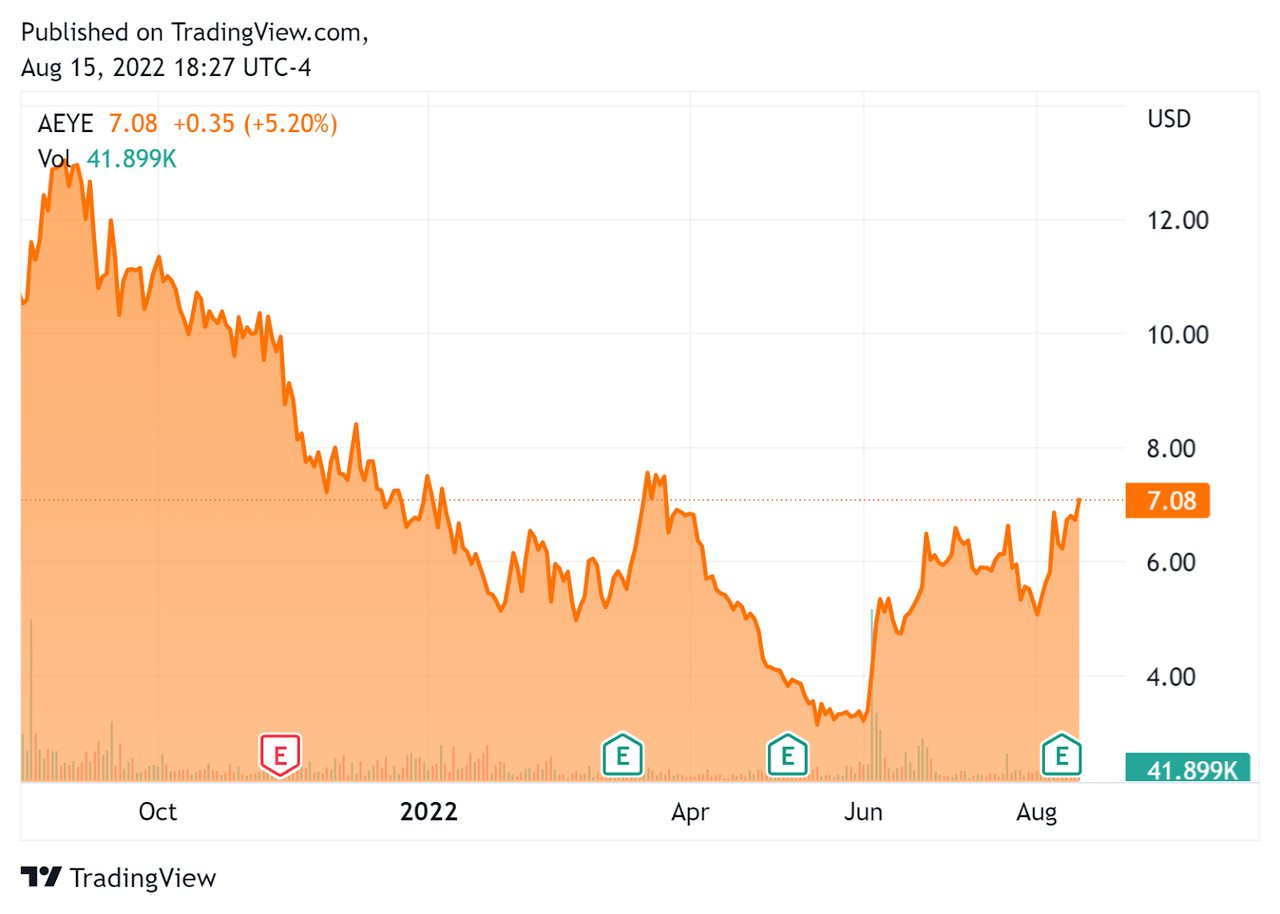

In the past 12 months, AEYE’s stock price has fallen 34% vs. the U.S. S&P 500 index’ drop of around 4.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For AudioEye

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$69,360,000 |

|

Market Capitalization |

$77,040,000 |

|

Enterprise Value / Sales |

2.55 |

|

Revenue Growth Rate |

16.5% |

|

Operating Cash Flow |

-$8,690,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.40 |

|

Net Income Margin |

-58.8% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

AEYE’s most recent GAAP Rule of 40 calculation was negative (34%) as of Q2 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

16% |

|

GAAP EBITDA % |

-50% |

|

Total |

-34% |

(Source – Seeking Alpha)

Commentary On AudioEye

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its revenue growth due to expansion in its partnership and marketplace channel and from its acquisition of the Bureau of Internet Accessibility [BOIA].

The company also recently announced two partnerships, with Celerant as an omnichannel retail POS solutions company and Vendasta, a platform for local sellers of digital solutions to SMB clients.

As to its financial results, total revenue rose by 26% year-over-year and was at the high end of the previous guidance range.

However, GAAP operating losses remained steady at negative ($2.6 million) as operating expenses increased 10% due to increased headcount and expenses associated with integrating its acquisition of BOAI.

For the balance sheet, the firm finished Q2 with $9.3 million in cash and used $2.7 million in free cash during the quarter, in line with management’s expectations.

In early June, the company announced a $3 million stock buyback program, purchasing $410,000 worth of shares by the end of the quarter, so the Board of Directors apparently believes the stock is undervalued or doesn’t need the related cash for near-term requirements.

Looking ahead, management guided Q3 revenue at 25% year-over-year growth and non-GAAP operating loss to ‘near breakeven by the fourth quarter.’

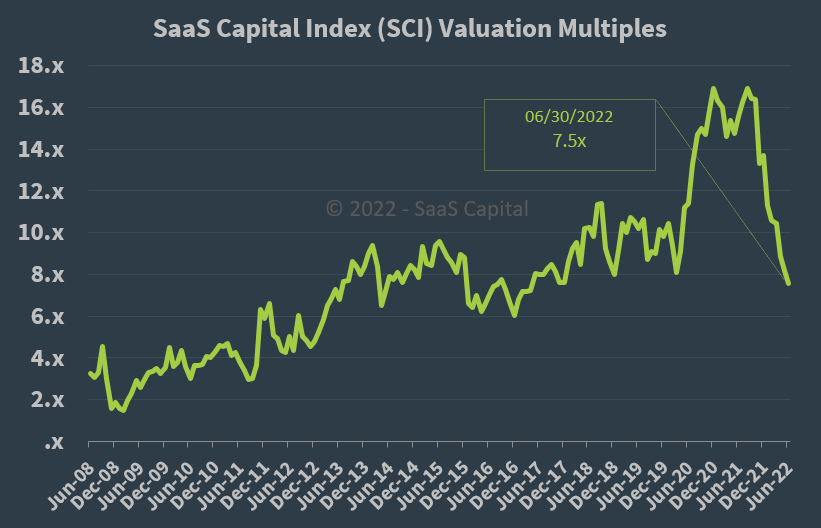

Regarding valuation, the market is valuing AEYE at an EV/Sales multiple of around 2.6x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, AEYE is currently valued by the market at a discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

Notably, the New York Empire State factory gauge in August plunged 42 points to a negative 31.3, the second largest drop in history. Economists were expecting a reading of a positive 5.0.

A potential upside catalyst could be reduction in interest rate rises in the event of a material economic slowdown, increasing the valuation multiple for money-losing companies like AEYE.

Given the firm’s tepid topline revenue growth, continuing operating losses and free cash burn, I’m on Hold for AEYE until operating breakeven and a faster growth trajectory.

Be the first to comment