bfk92/E+ via Getty Images

Leonardo (OTCPK:FINMY) is a holding I picked up dirt-cheap back when defense was unloved and no one could ever imagine that Europe would see another war. I liked the company’s F-35 Eurofighter exposure, and the NH90 program, and I thought it would deliver solid growth and 3-4% YoC as I bought it on the cheap.

Now, here we are years later, and my holding is up more than 135%.

Oh, how things can change, right? But this is what I try to do.

I try to find unloved, quality companies that the market hates, and I buy them. Diversified, quality-oriented investments. Usually, this turns out similar to this – even if it sometimes takes years.

Let’s look at what Leonardo is, and what it can do for you.

Leonardo – An Overview

This company, originally known as Finmeccanica, is an Italian multinational defense, security, and aerospace business with headquarters in Rome, Italy. The company has 180 global sites and is the eighth-largest defense contractor in the world.

Company ownership is appealing – 30% belongs to the Italian government, and it is by far the largest shareholder. The company’s roots go back to 1948, to after the second world war. Unfortunately, Leonardo doesn’t share the high credit ratings of its international peers and comes in just below IG-rating at BB+ from S&P Global, though Fitch does consider it BBB-, which is borderline IG.

The company has an annual yield of around 2-3%. Given the ownership backdrop, I would argue that investing in Leonardo is a good proxy to investing in Italy or Italian defense/aerospace.

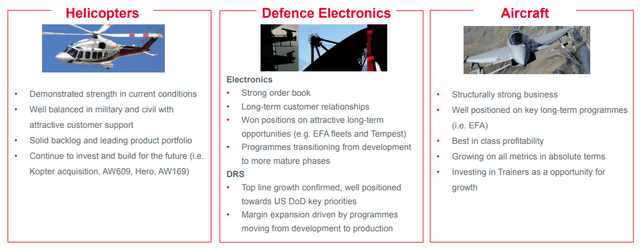

On a high level, Leonardo has four different divisions with 50,000 employees.

Of these, the divisions of Helicopters, Electronics & Defense as well as Aeronautics make up for most of the revenues from this business. Space is the fourth segment, though it’s relatively small at this time.

Leonardo Segments (Leonardo IR)

The company has no noticeable emerging market currency exposure, and its sales are appealingly diversified with 47.6% in Europe, 28% in North America with the rest in the rest of the world.

What Leonardo does, is the research, development, and production of Civil/Military Helicopters, Aircraft, UAS, Avionics Systems, Naval Systems, Security Systems, Missiles, Land & Naval armaments, underwater torpedoes, and training/service, as well as servicing and manufacturing of space-related components.

The company has an impressive order backlog of well over €35B, with annual orders of over €13B, and a resulting EBITDA of €1.5-€2B.

The company’s overall sales mix is quite appealing, with overall appealing high-level trends that are set to see an incredible tailwind on the back of the recent geopolitical development.

In Helicopters and Aircraft, the company is likely to continue to see very strong military and civil order flows, adding to its already-substantial backlog, while Leonardo remains a key player in International programs, such as the EFA, Tempest, JCF, and Euromale. The company has near-best-in-class profitability for its aerospace segment, and the company’s electronics business is working well, with a large backlog, good positioning, and good ramp-up of new programs even before the war.

The company was set to restructure its business fundamentally before the onset of COVID-19, with a good FOCF ramp-up in 2022-2023. However, due to the pandemic, there was a massive impact in aerospace as we all know – and Leonardo suffered.

That’s what enabled me to pick up shares at less than 5 euros.

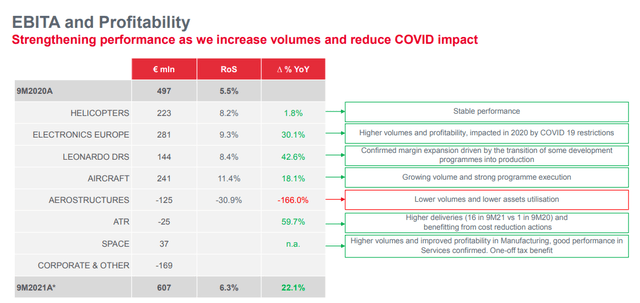

2021 is expected to be the trough year for Leonardo, with every subsequent year expected to be significantly better. Profitability is already looking up significantly in 2021.

Leonardo Profitability (Leonardo IR)

The company has cash, credit, and revolving facilities giving available liquidity of €3.6B at the end of 2021.

The company is more than just a helicopter business. The company’s electronics division has reached more than 50% of sales and has become the main growth driver of the entire business, with Europe at around 60% of this segment. The Electronics Europe sub-segment is supported by the need within NATO countries to comply with their investment’s guidelines, as well as freeing themselves from the legacy US dependency European forces have long been forced to act under.

Aeronautics is 20% of sales, with aircraft programs at around 75% of this segment. Leonardo acts as a manufacturer for military programs, including the Typhoon and their respective trainers, M-346 and M-345. Like any aviation business, Leonardo benefits from a strong service and maintenance program, which is locked to any other manufacturer or business, giving Leonardo some stability here. There has been a resurgence of interest in the Eurofighter Typhoon.

In space, Leonardo, under IFRS 11 doesn’t recognize any revenues here. Its operations in Space are through 2 JVs with Thales (OTCPK:THLLY) and its Telespazio alliance, which is owned 66.7% by Leonardo and Thales Alenia Space, with a reverse ownership relationship. A lack in satellite production drove this segment down in 2016, but the market here is slowly recovering.

On a high level, Leonardo is an Italian play on several appealing technologies with a restructuring program that’s been delayed for some time by COVID-19. It has some excellent upsides due to a completed turnaround for some of its legacy segments and is likely to deliver growth through strong military exposure as well as strong civil program exposure.

There’s a growing market for Leonardo’s government customers, and with the onset of the war, there’s likely to be a massive influx of orders, with governments acting as very safe and creditworthy customers. Leonardo could also, technically, list its DRS segment in the US. Doing so, with a segment EV of around €3B, would infuse the company with further cash, and free up company resources for a focus on its core operations.

Leonardo also bought a recent significant minority stake in the German company Hensoldt AG (OTC:HAGHY), at a price of ~€600M. Hensoldt specializes in radars and electronics for the defense industry, and this recent investment given the ongoing conflict has been a part of driving valuation up for Leonardo.

Overall, Leonardo is a very able Italian defense company with its fingers in programs across Europe as well as the world. It’s well-capitalized, well-run, and has seen its strategy succeed.

The recent conflict only adds to the appeal of this business, now reflected in a massively-improved share price valuation.

Leonardo’s Risks

Leonardo’s risks were mainly related to the overall government reluctance to spend more on defense budgets. The past month has seen a complete 180 on this perspective, and because of this, the most fundamental risk for Leonardo is no longer valid.

Still, there are things to talk about in the risk segment. These include a lasting Aerospace impact as well as continued issues in Satellite as well as helicopter recovery after 2017. The company also has somewhat higher leverage than some of its low-leverage peers, which is an integral part of the low credit rating that Leonardo operates under.

There is also, shall we say, a governance problem.

CEO Alessandro Profumo was sentenced last year in the first instance to six years imprisonment for false accounting in his previous role as chairman of Banca Monte dei Paschi di Siena

(Source: Reuters)

There was an activist shareholder, Bluebell Partners, with a 25 share ownership, who launched a proposition for liability action against the CEO, seeking damages for the conviction. However, this proposal was slapped down – hard. Investors accounting for 99.3% of the share capital represented at Leonardo’s annual shareholder meeting on Wednesday voted against Bluebell Partners’ proposal, Leonardo said in a statement.

Reuters had reported earlier, citing sources, that shareholders voted against the proposal and that the economy ministry, which controls the defense group with a 30% stake, also voted against the proposal, reserving the right to assess future developments in the ongoing legal proceedings involving Profumo.

So, there are some murky waters regarding the CEO, at the very least.

However, beyond this, the recent set of conflicts has served to dispel some of the more fundamental risks of Leonardo, instead making the company a major beneficiary of the current trends where we can now clearly expect order growth and massive expansion.

So I would argue that aside from some weakness due to the recovery in pandemic-afflicted sectors as well as some governance-related issues, there’s nothing specifically negative to focus on here.

Leonardo’s Valuation

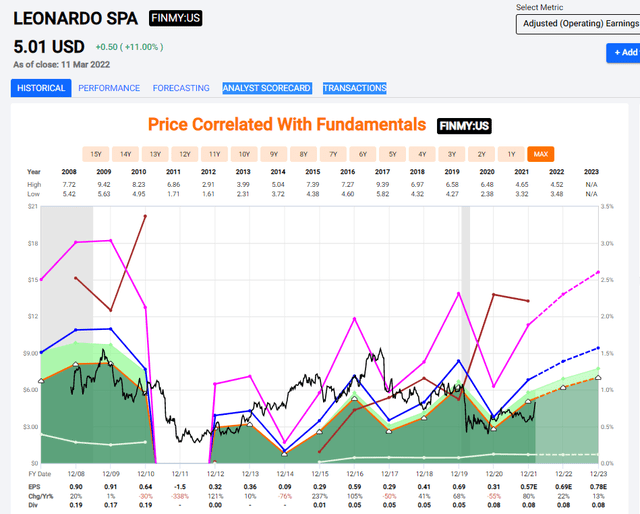

Now, unfortunately, Leonardo is no longer cheap. My original thesis for Leonardo, which is around 0.4% of my core portfolio, was basically told hold it and wait for that recovery and growth from legacy and some military. I foresaw 15-20% annually eventually, once they got issues under control.

Instead, the company has delivered a less than 2-year annualized RoR of 135%+, including dividends and FX.

I’ve been working on adjusting my calculations and thesis for Leonardo for the past 2 weeks. This is the result of that.

For DCF, I use a 3-5% sales growth number, a relatively wide range due to the uncertainty of just how much growth might be happening as a result of this, with more than 65-75% of sales related to defense part of the business. The WACC is in line with other EU defense businesses, but slightly higher due to the lower credit rating, at 9.4%. I’m assuming a lockstep 3-5% increase in CapEx and working capital as sales increase, with no significant improvement in overall margins beyond a 12% EBITDA margin (up from a trough of 10-11%). Based on these assumptions, we get an EV/share range of €9.3-€11 DCF range, which is more or less in line with the current share price, at the low end. It’s also around €1.5 higher than my pre-war target.

Remember, I don’t want to invest in a company that’s appealing just because of the war. Leonardo is more appealing because of it. It was an attractive business before this.

Public comps are easy. You’re looking at Airbus (OTCPK:EADSY), Thales, Rheinmetall (OTCPK:RNMBY), BAE Systems (OTCPK:BAESY), and others. These traded at average P/Es of between 10-20X, with an average of 17X, but Leonardo suffers from pandemic-depressed EPS numbers, impacting its P/E ratio. The company’s P/E needs to be normalized because of this, which distorts the public comp perspective somewhat. The company is cheaper on a P/Book level, EV/EBITDA level, and even a normalized P/E level – these things are part of what drew me to Leonardo in the first place.

Evaluating NAV is somewhat more tricky. The company has multiple stakes, including 25.9% of Avio, some 25% of MBDA, and the aforementioned Hensoldt AG stake. The publicly-listed companies are easy – other stakes are measured on an EV/EBIT multiple, ranging from between 11X to 14X on the high end. I apply low multiples to reflect the ongoing headwinds in both civil and military helicopters, with somewhat higher multiples for the company’s Electronics segment. All in all, we reach a total of €13B gross on the high end, about €12.6B on the low end, coming to around €7.5B net at 572M shares, or a NAV/share of €13.11.

S&P Global gives us some assistance here as well. Analysts consider Leonardo valued at about €6.65 on the low end and €13 on the high end.

The low end of €6.65 reflects a pre-war, fully impacted COVID-19 Leonardo with 2-4 years until profitability. I know the forecast because this is where I was back when COVID-19 began, and I bought the company for under €5.

€13 reflects a fully recovered, and military-tailwind Leonardo with plenty of new orders and recoveries in legacy.

As usual, the “truth” for me is somewhere in between these two. S&P Global considers an average target of €9.24 to be accurate, with 10 out of 15 analysts having a “BUY” or “Outperform” rating on the stock.

However, I want to clearly tell you that these forecasts or targets have not yet been adjusted for the military conflict we’re seeing. They reflect the average that has been relevant for over a year and haven’t yet been adjusted above 2021 levels to reflect what I see as a clear upside.

Equity analysts have bumped their targets to over €10.5, with potential upgrades on the horizon.

I see continued risks in some of the legacy segments – war won’t make this simply disappear. But I believe any price target below €10/share during this time is unfairly discounting the company’s long-term fundamentals.

That is why I am a “BUY” here, despite some of the bounce we’ve been seeing.

Leonardo is hard to evaluate – no doubt about that. But it’s my view that averaging things out like this and considering the company for the long term could mean investment success on your part while being cushioned by a decent yield and safe ownership.

Thesis

This is one of my success stories in investing in European defense companies. I’m easily up triple-digits on this investment in less than 2 years, and I’ve bought more during that time. I’m also not anywhere near selling here, given the recent trends we’ve been seeing.

Investing in Leonardo can be done using the native ticker on the Italian stock exchange, known as LDO. There’s also a fairly liquid 0.5X ADR known as FINMY.

F.A.S.T graphs Leonardo (F.A.S.T graphs)

I prefer the native here, but given the ADR liquidity, this can be bought instead. There’s a significant long-term upside if the trends hold and this turn in defense policy is a consistent one. Because I believe that it is, at least for the foreseeable future.

Be the first to comment