Wirestock/iStock Editorial via Getty Images

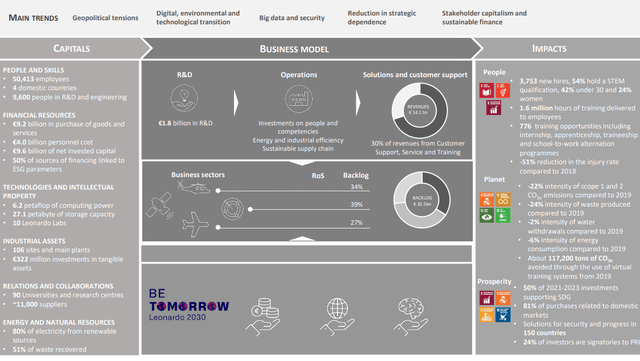

Leonardo S.p.a. (OTCPK:FINMF) is an industrial and technological company based in Rome, Italy, and formerly known as Leonardo – Finmeccanica S.p.a. The firm offers a wide range of products in the segments of helicopters, defense electronics and security systems, aeronautics and space, in both defense and civil markets.

Leonardo Business Model (Annual Presentation 2021)

The company is a very interesting pick, especially in this period. In particular, it is well positioned in the geopolitical context, and the valuation is very cheap compared to the last 10 years. In the following sections I explain in detail the reasons behind the reliability and good results of the company, and why, despite the risks, it can prove to be a good value opportunity. Finally, I calculate the company’s fair value using a scenario-based discounted cash flow model, resulting in a potential 65% upside. For these reasons, I give the company a Strong Buy rating.

Business Key Takeaways

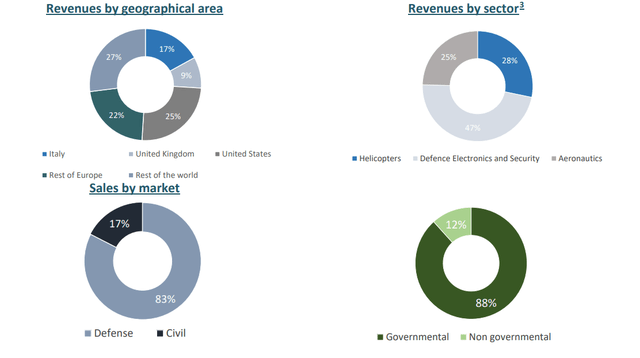

Leonardo’s revenue is well diversified geographically, which makes the company very reliable and stable in the changing geopolitical environment. Furthermore, following the outbreak of war in Ukraine, most of the NATO countries have announced an increase in military spending in the coming years: this makes Leonardo an excellently positioned company capable of meeting the technological and military demands of both Europe and the United States segments, which alone represent respectively 48% and 25% of total revenue. Just think of the contract signed in July 2022 with Poland, which provides for the supply of 32 AW149 helicopters, for a total of €1.43 billion.

Leonardo Revenue (Annual Presentation 2021)

I would also like to point out Leonardo’s positioning in the Defense Electronics and Security segment, which represents 47% of total revenue. The segment is certainly one of the catalysts for future growth of the company, also thanks to the resources that Leonardo is investing in the sector. Newton’s launch at CANSEC 2022 is proof of this. Newton is a software solution capable of simulating the latest generation threats and, at the same time, the countermeasures available to the armed forces. The software can be used to accelerate and improve the development of new electronic warfare technologies, techniques and tactics.

In my opinion, these two macrotrends (increase in military and electronic defense spending) are the basis of the company’s solidity and the keys for its long-term performance.

Q3Y22 Quarterly Results Show Strong Results

Despite the difficulties regarding supply chain issues and energy rising costs, the group beat analysts’ expectations in Q3 confirming the positive year. These results in Q3 are mainly thanks to the absence of restructuring charges, a tax rate as low as 15%, and the capital gain on the Ges/Aac sale.

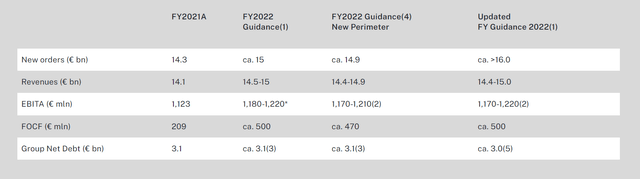

Furthermore, the company shows strong guidance for the end of 2022. The key points are:

- the reduction of Leonardo’s net debt, from €3.1 billion to €3.0 billion

- the increase in new order intake from €15 billion to €16 billion

- the upward revision of FOCF from €470 million to €500 million

(Data from Leonardo 2022 Guidance)

Synthesizing, the company recorded solid results in the first nine months of the year, in terms of profitability, new orders, and cash performance.

Guidance (Leonardo Guidance 2022)

Why Is Leonardo So Undervalued?

So far Leonardo looks like a reliable company, poised to grow, with a central role in the current evolving scenario, but there are some priced-in hidden risks that make it very undervalued.

The macro scenario and the inflationary and recessionary context for 2023 remain the main factors to monitor that could have a negative impact on the group’s performance. Moreover, the management has not provided any indications on expected margins for 2023, and despite the strong results in Q3, Leonardo stock collapsed at Piazza Affari by 6.39% to €7.67 after the earnings release, because of fears of shrinking margins.

On the other hand, despite the lack of any quantitative indications, the management is confident in the ability to offset the inflation even though 70% of the backlog has fixed prices, while energy is covered until 2023.

In my opinion, the company will continue on the virtuous path shown in Q3 results despite the headwinds, as we see a gradual slowdown in inflation and an improvement in the global supply chain. Therefore, I believe that the risks are currently “overpriced-in” and they do not show the true value of the company.

Other Risks And Credit Analysis

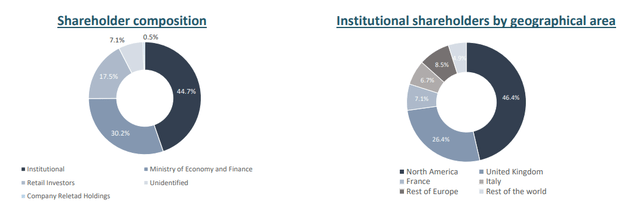

We must not forget the high participation of the Italian Government as a shareholder of the company. As can be seen from the image, the Ministry of Economy and Finance holds 30.2% of the company, therefore with its pros and many cons.

Shareholder Composition (Annual Presentation 2021)

Moving on, the quick ratio and the current ratio, 1.18 and 0.96 respectively, are both sufficient as the ratio debt/equity of 78%. The credit rating is Ba1 positive outlook according to Moody’s, BB+ positive outlook according to S&P, and BBB- stable outlook according to Fitch.

However, I consider these as marginal risks. In fact, the financial situation does not worry too much, as well as the high participation of the Italian Government in the company.

Valuation

I evaluated the company using a discounted cash flow model built on different scenarios based on macro environment, possible catalysis, and risks I explained in the section before. In this specific case, I used the three main financial statements and I estimated the future free cash flows for the next 10 years.

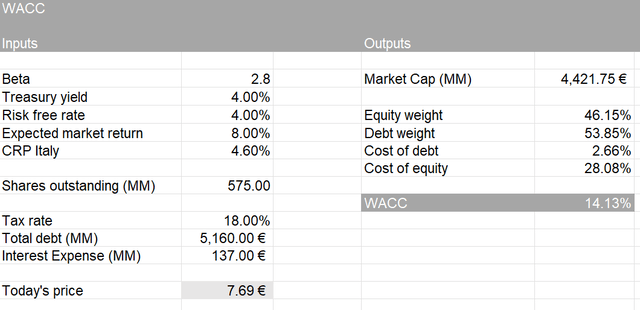

In order to build the model I made some assumptions: I estimated a risk-free rate of 4.00% (Italian Government Bond 10 year Yield) and a country risk premium of 6.4%, and I used those to model the WACC (weighted average cost of capital), which resulted equal to 14.13%.

WACC Calculation (Personal DCF Model, Excel)

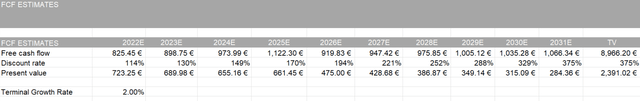

Furthermore, I assumed a terminal growth rate of 2.0% (in this case I have considered the estimates for the average future expenditure of the countries that have partnerships with Leonardo)

FCF Final Table (Personal DCF Model, Excel)

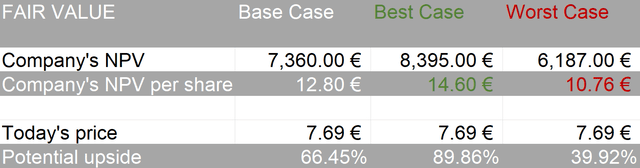

In the base case scenario, in which the management is able to partially offset the inflationary pressures and maintain average EBITA margins, the company’s NPV (Net Present Value) I calculated is €7.36 billion. Therefore, Leonardo’s NPV per share is €12.80, meaning that according to the valuation there is a potential upside in the stock price of 66.45%.

In the pessimistic scenario, I considered a contraction in margins in 2023 and 2024 and lower-than-expected revenue growth in the following years. The estimated fair value is €10.76, which means a potential upside of nearly 40% from the actual stock price.

I also considered an optimistic case where the fair value is €14.60. However, I find this very unlikely, as I have assumed no impact on the company’s margins in 2023 and a further increase in military spending over the next 10 years.

NPV Final Table (Personal DCF Model, Excel)

It should be noted that all the results and calculations on the DCF Model are made in euros. Furthermore, the FCF results in the “FCF Final Table” image are from the base case scenario.

Conclusion

Leonardo is a reliable company, with strong fundamentals and different future growth catalysts. Despite the numerous successes of 2022, the company is currently deeply undervalued due to the risks regarding 2023 margins and, probably, due to the overall risk-off sentiment in the markets.

The target price that I estimated with the discounted cash flow model is €12.80, indeed I consider the base case scenario to be the most probable, given the experience of the management and the gradual improvement of the global supply chain with a consequent slowdown in the prices of raw materials.

However, the key concept of the analysis is clear: Leonardo is highly undervalued, and it has a large margin of safety.

Be the first to comment