fizkes/iStock via Getty Images

LendingTree’s (NASDAQ:TREE) share price has dropped by more than 80% over the last twelve months, with most signs pointing to challenging times ahead. A recession and an increase in interest rates would significantly undermine LendingTree’s business model. Its market share could also be negatively affected by increasing competition among online lending platforms and marketplaces. Yet another headwind that might weigh on its shares in coming quarters and years is the declining revenues along with its inability to convert them into profits. Overall, LendingTree remains a risky investment despite a substantial price drop.

LendingTree’s Business Model is Vulnerable to Interest Rate Volatility

LendingTree is an online marketplace that connects customers with lenders. There are three business segments under the company’s umbrella, including consumer, home, and insurance. A variety of loan options are available within each segment, including personal loans, business loans, and auto loans. It does not offer loans itself. Basically, it acts as a mediator between borrowers and its network of 300+ lenders. LendingTree’s revenue comes solely from a small fee charged to lenders and borrowers when they reach an agreement on the loan terms. As a way to differentiate its platform from competitors and attract more customers, the company also offers various types of services such as free access to a credit score, budgeting, ways to improve credit score, and personalized savings recommendations.

In the past decade, the company has experienced rapid growth, with revenue leaping from less than $1 million in 2012 to $1.1 billion in 2019. However, in 2022, waning economic conditions and rising interest rates significantly dropped loans demand. Four interest rate increases have been made by the Fed so far in 2022, which means consumers are now paying an additional $225 in interest on $10,000 debt. Borrowers on marketplaces like LendingTree generally receive loans at higher rates than traditional banks due to lower documentation requirements and faster funding.

Borrowers can expect loans to become more expensive in the following quarters because the Fed is likely to raise interest rates multiple times to reach its targeted range of 4%. Given that, there is a risk that demand for loans would be severely impacted in the quarters ahead. LendingTree’s financial results and outlook also reflect this trend. The company’s second-quarter revenue of $261 million fell 3% year over year and 8% sequentially, with full-year revenue expected to fall 8 to 10%. In general, the market conditions look tough for online lending marketplaces like LendingTree due to Fed’s monetary tightening policies.

Increasing Competition, Depressing Margins, and Wanning Earnings Potential

LendingTree’s revenues and market share have been under pressure in recent years due to increasing competition from private and public fintech firms like SoFi (SOFI), Upstart (UPST), and LendingClub (LC). Therefore, Tree is having trouble maintaining the growth trends it experienced in the past decade. The company’s strategy of adding new loan categories like Medicare and changes in key management positions further illustrates the company’s struggles in a competitive market. To counter fierce competition, it plans to spend 32 to 35% of its overall revenue on advertising campaigns in 2022.

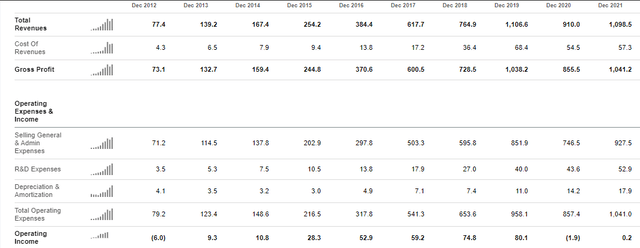

Income Statement (Seeking Alpha)

However, this strategy would further bolster its operating expenses which have already been increasing at a faster pace than the revenues. In 2021, the company posted revenue of $1.098 billion while its operating expenses came in at $1.04 billion. As the company plans to spend heavily on marketing campaigns in 2022, its operating expenses are likely to surpass its annual revenue forecast of $0.98 to $1.01 billion. This situation may probably last for the next couple of years, which isn’t a good indicator for its earnings potential and stock price performance.

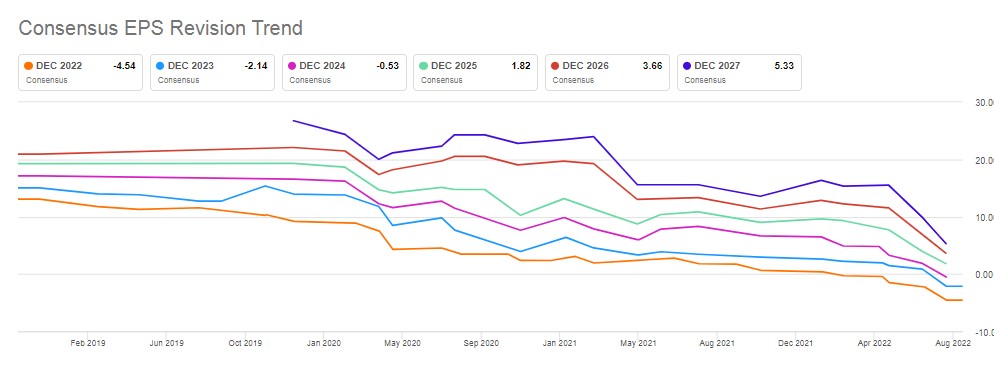

Earnings forecast (Seeking Alpha)

As shown in the chart above, Wall Street forecasts indicate that LendingTree will post one of its largest losses in 2022. A further concern is that the company may take years to get back to profitability. Moreover, its forward price-to-earnings ratio is forecasted to remain negative in the next two years, which doesn’t bode well for its share price performance. Newly launched companies with a negative PE ratio do not necessarily mean the stock is a bad investment. However, it is concerning when the PE of a company like LendingTree is expected to remain negative for a long period of time.

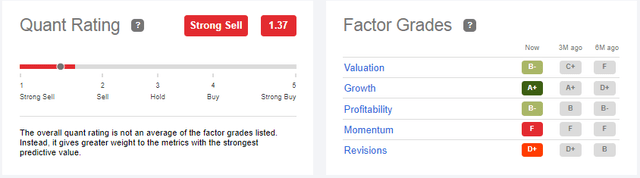

Quant Ratings

Quantitative techniques can assist investors in eliminating emotions and making data-driven decisions. According to Seeking Alpha’s quantitative grading system, LendingTree earned a subpar quant score of 1.35 out of 5. Quant analysis ranks it third worst among 40 stocks in its industry. A low momentum score indicates that LendingTree shares may continue declining and have limited upside potential. The company earned a D+ grade on the revision factor as Wall Street analysts have significantly slashed their revenue and earnings forecasts. While the quant rating gives an A+ grade to its growth factor, I believe this grade will also deteriorate in the coming months due to negative revenue and earnings growth projections.

In Conclusion

Due to multiple challenges, LendingTree’s shares may take a longer time to recover. The macroeconomic environment, high-interest rates, and increasing competition are among the factors that will hinder its future growth in the coming 12 to 18 months. The forecast for big losses in 2022 and in the following two years would also dampen investor sentiments. Thus, even after an 80% price collapse, LendingTree does not appear to be a good stock to buy.

Be the first to comment