fotostorm

Investment Thesis

Lemonade (NYSE:LMND) is an AI-powered insurance company that’s looking to disrupt a multi-trillion-dollar industry with its simplified policies & customer-aligned business model. Using its AI chatbots, Jim and Maya, Lemonade is able to quickly approve both claims & pay-outs, resulting in a lot less hassle for customers & increased satisfaction.

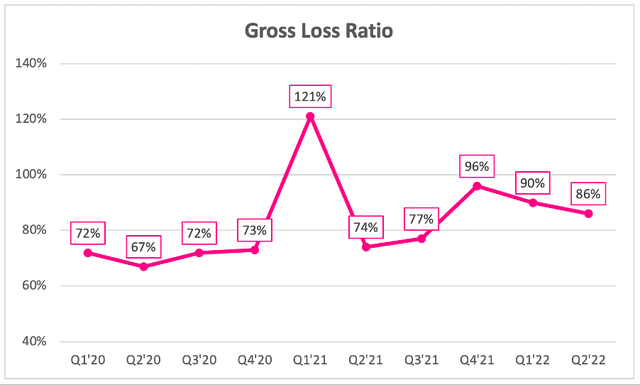

It won’t surprise anyone that disrupting an industry this large is no easy feat, with Lemonade coming up against incumbents who have been around for decades & the company also facing a number of technical challenges. It’s fair to say that Lemonade hasn’t won over many skeptics yet (just check the comments on this article, which I’m sure will confirm this) and that is fair – the loss ratios over the past 12 months are both unacceptable and unsustainable, but they are also understandable. In order to create better policies, Lemonade’s algorithms need more data, so the more policies they write, the better they become (in theory), and the lower the loss ratio goes.

Lemonade has been launching products left, right, and centre over the past year, with newer policies such as pet, life, and car insurance becoming a larger share of the in-force premiums. This has resulted in higher gross loss ratios, as Lemonade’s algorithms continue to learn more about how best to price policies for these new products. The question is, how long will investors put up with worsening loss ratios? It is quite frankly impossible to know whether or not the AI in the background is actually improving, so the gross loss ratio is a key metric for investors to look at in Lemonade’s Q2 results.

My personal investment thesis for Lemonade is this: there has to be a better way for insurance policies to be issued, and Lemonade is trying to achieve this by generating policies and processing claims in a matter of seconds. The business model has a bunch of strong economic moats that I highlighted in my previous article, so I have no doubt that Lemonade will succeed if it can get the technology right. The market is currently pricing Lemonade for failure, but if the company can execute on its plans, then it could make huge inroads into this multi-trillion-dollar industry.

Lemonade has just released its Q2’22 results, so let’s see whether or not the company has managed to ease investors’ concerns.

Earnings Overview

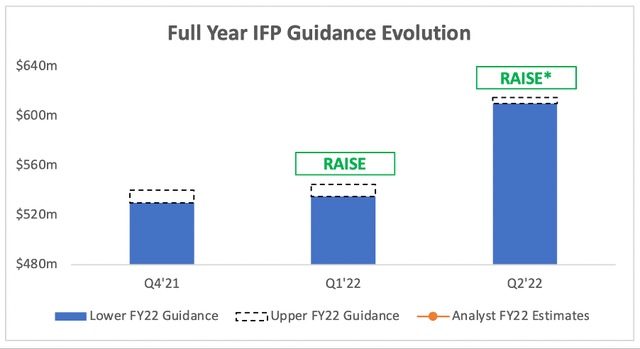

Before getting into these earnings, I should point out that the Metromile acquisition closed this quarter. As a result, investors will see substantial increases in the Q3’22 and full year outlooks, since Lemonade will now be including Metromile’s IFPs (in-force premiums), revenues, customers etc.

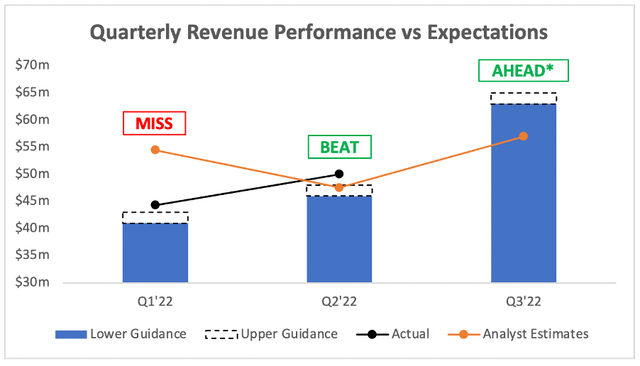

With that out of the way, time to look at the numbers. Lemonade’s Q2 revenue of $50.0m grew 77% YoY & beat analysts’ estimates of $47.6m, and also beat management’s guidance of $46.0-$48.0m.

Investing.com / Lemonade / Excel

Investors should be even happier with the Q3’22 guidance of $63.0-$65.0m, which came in way ahead of analysts’ estimates of $57.0m. Now this guidance includes revenue from Metromile; I would like to think analysts had included this in their estimates, but I can’t say that for sure – either way, it’s a guidance worth smiling about.

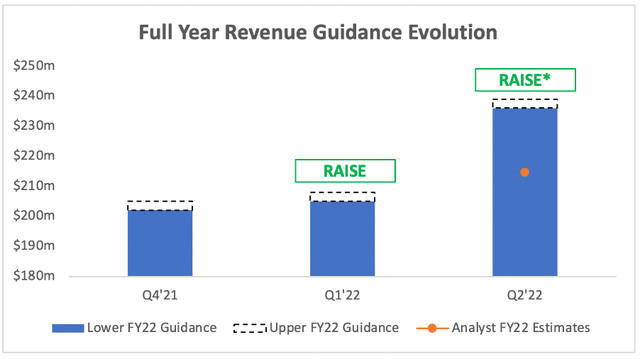

Speaking of this, Lemonade also took the opportunity to raise its full year revenue guidance substantially – again helped by the Metromile acquisition. Once again, I’m unsure if analysts took the Metromile acquisition into account with their expectations of $215m, but Lemonade’s new guidance of $236m-$239m smashed past these expectations.

Seeking Alpha / Lemonade / Excel

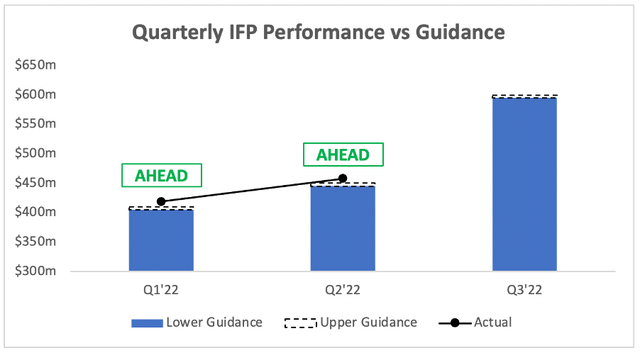

Another metric to watch is the IFPs (or in-force premiums) which refers to the annualised premiums for customers as at the end of Q2’22, and demonstrates how much money customers are spending with Lemonade on insurance policies.

Lemonade’s IFP increased 54% YoY to $457.6m, coming in above management’s guidance of $445-$450m; another positive note for this company.

Finally, guidance for the full year IFP was raised substantially following the Metromile acquisition, increasing from $535-$545m to $610-$615m.

I’ve learned to be disappointed by Lemonade’s quarterly earnings of late, so let’s just say the bar was set quite low in terms of my expectations – but boy did Lemonade clear that bar!

These results show a company that is unaffected by a recession, and the Metromile acquisition has boosted the numbers substantially. This is even more impressive when you consider the following details behind the Metromile acquisition, as stated in the Q2’22 Shareholder Letter:

Speaking of miles and driving, we’re thrilled to have closed our acquisition of Metromile 12 days ago. We spent approximately $145m-worth of stock on this acquisition, and in return we’ve received nearly 100,000 new customers, over $110m of additional IFP, over $155m in cash and cash equivalents, a second insurance entity with 49 state licenses, and precision data from about half a billion road trips. Downturns have their upsides.

I mean this acquisition was an absolute steal, and has truly bolstered the numbers & the outlook for Lemonade – all in all, a great quarter.

Delving Into Gross Loss Ratios

I mentioned that increasing gross loss ratio at the outset, and highlighted its importance to investors. I was praying that we would see a quarter where the gross loss ratio fell, and thankfully my prayers were answered. Lemonade’s Q2 gross loss ratio of 86% is nowhere near low enough for the company to become profitable, but that’s okay – it will take time to get there! The most important aspect of this gross loss ratio is the fact that it’s now trending back in the right direction.

Management gave some more color on these loss ratios, which was particularly helpful. They mentioned that this steady downward trend should continue across Lemonade’s pre-Metromile product lines in the coming quarters, but Metromile will probably increase the gross loss ratio by about 3-5% in the coming quarters – so, the trend might be a bit lumpy… great.

There is also the following extract in the Shareholder Letter, which gave me some more confidence – I will highlight key points:

What is remarkable, though, is that 73% of Lemonade’s premiums in Q2 were from customers who have been with us less than 24 months. For incumbents it’s the other way around: the overwhelming majority of their customer are comfortably beyond their second anniversary. A health check that fails to account for this, will yield an unduly grim prognosis.

It follows that, for companies like Lemonade, traditional loss ratios can send a distorted signal, an outdated one, or both. To be clear, that’s not an argument for dismissing loss ratios, but rather for understanding them more deeply. That’s where our machine learning comes in.

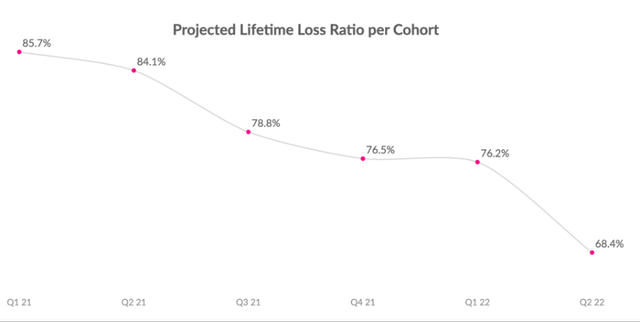

By using big data and machine learning to predict lifetime loss ratios, we timeshift ‘lifetime’ of future data into the present, allowing us to optimize our current business for the longtime. This is in stark contrast to traditional loss ratios. These also time-shift data to the present, but they do so from the past rather than from the future. That’s a material difference.

With that by way of context, below is LTV6’s prediction of the lifetime loss ratio of each cohort we onboarded in the past 18 months:

Lemonade Q2’22 Shareholder Letter

In short, the internal data that Lemonade sees implies that its business is going to be profitable down the road, even if the lagging indicators take a few years to fully reflect this.

Valuation

Given the huge industry and Lemonade’s potential within it, combined with heavy losses and complex financials, it is a difficult company to value.

I’ll take a very basic approach: Lemonade currently has a net cash position of $960m and a market capitalisation of $1,735m, therefore it is trading at less than 2x net cash.

Clearly if the business succeeds, it’s currently undervalued, and if the business does crash and burn and fail, then any price is too expensive. Frankly, I do not think precise valuations matter one bit for Lemonade right now; it is all about whether or not the business itself succeeds.

Investment Thesis: On Track

This quarter was just what the doctor ordered for Lemonade shareholders, as the company started to show some progress towards improving its AI-powered underwriting whilst continuing to grow customers and IFPs. It also highlighted that next quarter will be the peak for its financial losses, and the company is going to control spending in order to ensure it can continue to fund itself through to profitability – which management actually spoke about a lot in the Shareholder Letter, since nowadays more and more of Lemonade’s book consists of seasoned products and customers.

Lemonade Q2’22 Shareholder Letter

This is still very much an investment where you have to put your faith in management’s ability to execute, and I have not seen enough to put me off yet. Lemonade is undoubtedly a risky investment, but the potential payoff is huge & the company appears to be successfully working towards that goal.

Given all this, I’d say that my thesis remains on track & maintain my ‘Buy’ rating on Lemonade.

Be the first to comment