Design Cells

Investment Summary

Since we last reviewed the investment debate for LeMaitre Vascular, Inc. (NASDAQ:LMAT), we’ve noticed several developments unfold. First, the company missed Q3 consensus revenue estimates by ~$1mm, whilst its TTM EPS narrowed in to $0.97 from $1.34 the same time last year. Moreover, it has successfully closed its manufacturing facility in France, and hopes to fulfil 5 new MDR CE Mark submissions by year’s end. It also increased its staff base to 558 by the end of Q3 FY22. Given these data points, we’re back at our analytics today to discuss findings from our most recent analysis on LMAT. Despite the notable headwinds, we remain bullish on the long-term outlook of the company, citing balance sheet strengths and valuation as key upside drivers to our thesis. Net-net, we reaffirm LMAT as a buy, but narrow our next price objective down to $56.00.

To understand our LMAT play in full, we encourage you to read our previous publications on the company :

LMAT Q3 results: organic growth compressed by FX headwinds

Speaking of the numbers, we noted the company’s outside US (“OUS”) footprint resulted in heavy FX headwinds resultant from the USD’s strength in 2022. To illustrate, Q3 sales growth came in at 200bps higher, on a reported basis, but were up ~700bps organically.

However, it should be noted the company also recognized a ~485bps FX headwind due to USD strength, totalling $1.9mm in “lost revenues” for the quarter.

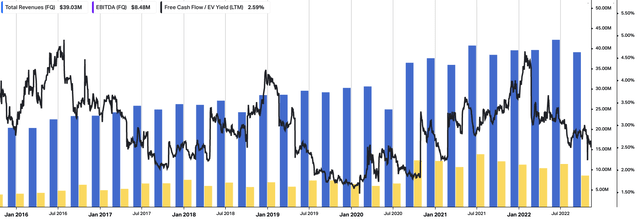

It foresees these trends continuing into Q4, hence assumes another $6.4mm in FX headwind for the full-year results. Alas, gross margin came in lower YoY at 64.2% from the same. It pulled this down to operating income of $6.15mm and EPS of $0.25, down 32% and 16.7% YoY respectively. A look back at LMAT’s operating results from FY16–date is seen in Exhibit 1.

Exhibit 1. Sequential revenue growth with respectable FCF yield with no debt on the balance sheet.

Data: HBI, Refinitiv Eikon Koyfin

Turning to the operational highlights for LMAT’s quarter, are takeouts include the following:

- We noted that biological turnover still makes up >50% of total revenue, the segment growing 700bps YoY. It made new regulatory submissions in Germany for its Allografts segment, along with the carotid indication for its XenoSure arm. It also began first XenoSure shipments to Korea, expecting first revenues booked in Q4.

- It’s also worth noting that LMAT continued to prioritize hiring over putting its balance sheet to use via acquisitions last period. It increased its total staff base 27% YoY to 558 and focused its efforts on direct hiring and expanding its sales force. On that note, it increased the rep headcount 28% to 118, whilst direct labour headcount lifted to 213, up 54%. This resulted in a c.20% increase in OpEx to $18.92mm.

- Taking the Q3 revenue result as an anchor, each sales rep hypothetically generated $330,508 in revenue per rep for the quarter. For the full year, it expects a 125 rep headcount number. It also forecasts Q4 turnover of ~$42 at the upper end [discussed later], thus, each sales force member must look to generate $336,000 in revenue per rep in order to meet this guidance. There’s numerous risks in increasing headcount, as the company knows, and as we’ve seen countless times before [think employee turnover, rep quality, etc.]. Nevertheless, as rep headcount grows, each respective territory gets smaller, a potential tailwind for FY23 in our estimation. Consequently we’ll be benchmarking LMAT against these figures looking ahead.

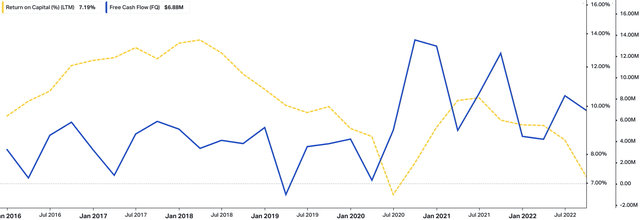

- We’d also point out that, as the cost of capital rises, LMAT’s use of its balance sheet to make investments is a standout. Aside from the investment into its sales force above, the company generated 7.2% in trailing return on capital last quarter, whilst it realized a free cash inflow of c.$8mm [Exhibit 2]. It has no debt on the balance sheet and thus can utilize leverage for acquisition purposes to drive its return on capital number higher. We believe this is an upside factor in the investment debate, notwithstanding the company’s $0.13 per share quarterly dividend that has grown for the past 11 years.

Exhibit 2. FCF vs. return on capital coupling, FY16–date

Data: HBI, Refinitiv Eikon, Koyfin

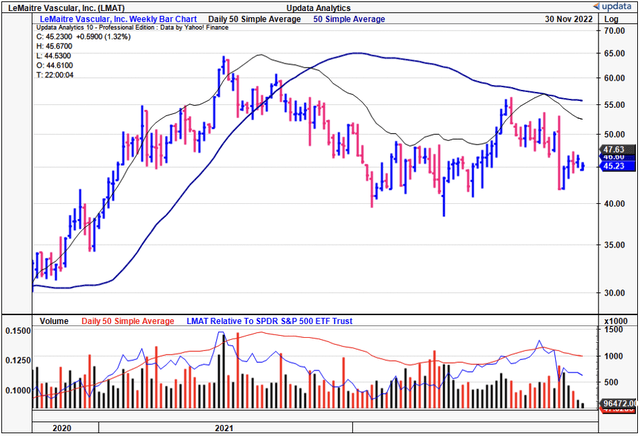

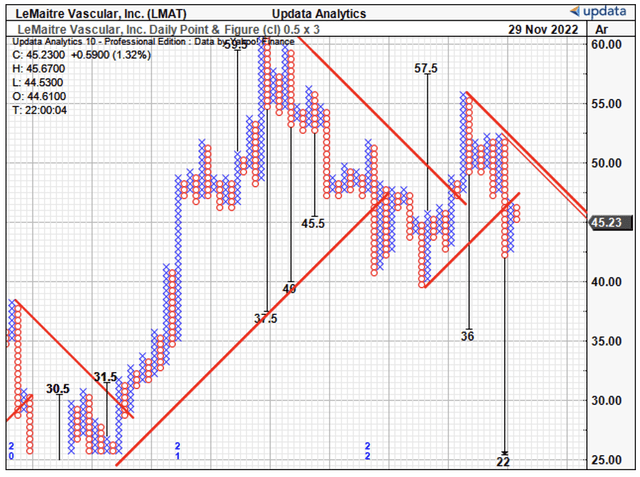

Technicals point to potential short-term weakening

Turning to our technical studies and we see LMAT’s SEM trading in more or less a sideways consolidation for the past 55 weeks [Exhibit 3].

Despite several positive breakout points in weekly volume, this hasn’t transposed over to corresponding price action. The last 8-week rally has been reversed and the stock now trades in-line with its November 2021 range. Moreover, the 50DMA was rejected heavily at the 250DMA 9 weeks ago and has pushed south ever since.

Exhibit 3. LMAT 18-month price evolution [weekly bars, log scale]. Has been backing and filling in wide range the past 12 months

As such, we’re noticing downside price targets as low as $22 in our point and figure studies, which is a note of caution to investors. Moreover, the stock has slipped below the latest support line, as seen below. Alas, may be some short term downside to be realized just yet.

Exhibit 4. Downside targets as low as $22

Guidance numbers help explain recent chart downside

We’d also highlight that LMAT hopes to submit MDR CE Mark applications for 5 additional products by the end of the year. This would tack onto the 7 submissions it made in 2021. Despite this, management narrowed both Q4 and FY22 full year guidance on the earnings call.

It now expects Q4 revenue in a range of $39.8–$42.2mm from a previous $41.2–$42.2mm. Meanwhile, it projects FY22 revenue of ~$160–$163mm, calling for 900bps of YoY organic growth at the midpoint. It hopes to bring this down to EPS of $0.91–$0.97, a revision down from previous estimates of $0.99–$1.05.

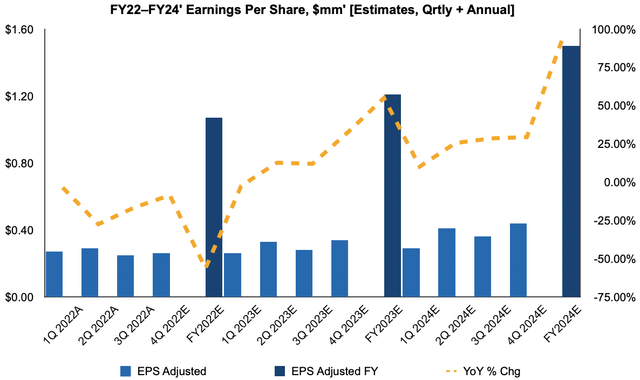

We firmly believe investors have priced this downside in swiftly, and with the stock price up nearly 6% in the past month, are of the additional opinion that it has been dealt with accordingly. We are ahead of management’s posture on bottom line growth and estimate $1.07 in EPS for FY22, projecting this number stretching up to c.$1.25 and c.$1.53 in FY23’ and FY24’ respectively. You can see our full stream of EPS estimates with YoY growth assumptions below.

Exhibit 5. LMAT FY22–24’ EPS growth assumptions [internal estimates; Qrtly, annual]

Valuation and conclusion

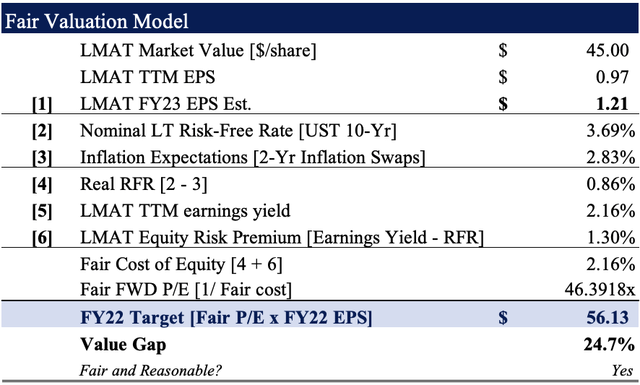

Consensus values the stock at 42-48x forward earnings, from adjusted—GAAP estimates respectively.

We are comfortable with this range. Our calculations value LMAT at a fair forward P/E of 46.4x, thus, we opine LMAT can unlock additional risk capital looking ahead.

At this multiples, rolling our FY23 EPS estimates forward derives a price objective of $56.13, slightly behind our previous estimates. Nevertheless, this confirms our bullish thesis.

Exhibit 6. FY22 EPS Est. x 46.4 = $56.13

Net-net, we continue to rate LMAT a buy on valuation and the company’s ability to unlock risk capital looking ahead. The main downside risk to our thesis is if the company comes in with a large surprise to the downside come next reporting period.

Be the first to comment