NicoElNino

Leidos (NYSE:NYSE:LDOS) is a technology powerhouse that provides mission-critical security and IT services to large organizations. The company is poised to benefit from the growth across at least three secular trends. The first is the Aerospace and Defense industry which is forecasted to grow at a solid 8.5% Compounded Annual Growth Rate [CAGR] to over one trillion by 2026. This growth is expected to be driven by increased geopolitical uncertainty from the Russia-Ukraine War and the rise of China as a major superpower.

The second secular trend is the growth in the cybersecurity market which is expected to expand by over 13.33% CAGR and reach nearly $300 million by 2027. This trend is driven by the rise of hybrid working and the increasing number of cybersecurity attacks globally.

The third trend is the growth in IT spending which is forecasted to grow at a 7.1% CAGR and reach over $1.5 trillion by 2027.

Leidos focuses on winning large government and civil contracts across these three growing and essential trends. The company’s large backlog of orders offers significant predictability to revenue and the business even pays a cheeky 1.5% dividend. In this post, I’m going to break down the business’s business model, second-quarter earnings and valuation, let’s dive in.

Secure Business Model

Leidos is a legacy IT and Cybersecurity company that was founded back in 1969. The company was previously known as Science Applications International, which summed up its business model quite well. Leidos provides science, technical and cybersecurity solutions to five main industries; aviation, defense, civil, energy and health. Leidos offers a capital light business model across 7 main capabilities which include;

- Cyber Operations

- Digital Modernization

- Integrated Systems

- Mission Operations

- Mission Software Systems

- Enabling Technologies

- Technology Certificates

The Cyber Operations division includes a variety of sub-services. One example is penetration testing, in which an “ethical hacker” will try to break into a company’s system in order to identify vulnerabilities. Another service is its “Zero Trust” framework which sets up a “least privileged access” solution, so teams are only given access to the applications they need.

Cybersecurity Leidos Services (Investor Presentation)

Leidos also helps with the setting up and optimizing of a Security Operations Center [SOC]. This is a centralized business unit inside an enterprise that focuses on improving the business’s cybersecurity “posture” while also detecting and preventing attacks.

Leidos has over 41,000 employees with ~2,900 of these being cybersecurity professionals which are trained to help improve network security.

The company’s other business units focus on IT system design for “Digital Modernization” of businesses to the cloud. In addition, to developing “mission critical” systems and software.

Growing Financials

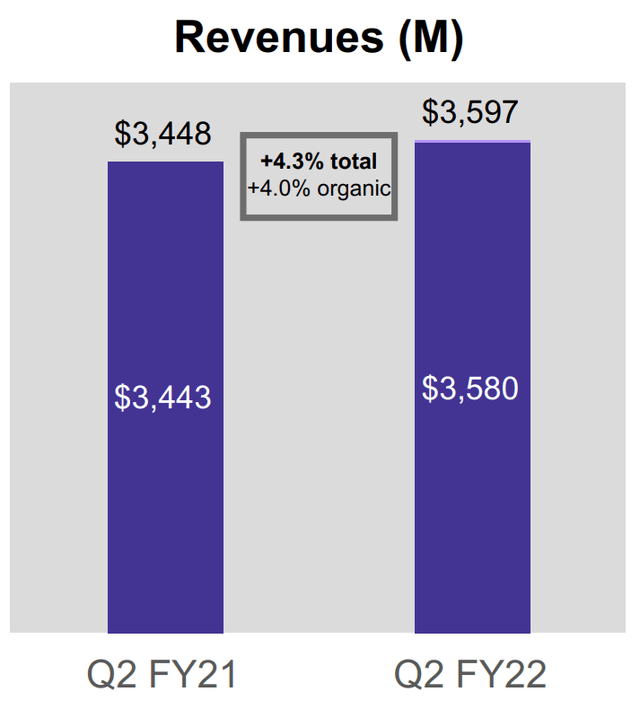

Leidos generated strong financial results for the second quarter of 2022. Revenue was $3.6 billion which beat analyst expectations by $80.78 million. This also represented a steady 4.3% growth year over year.

Revenue (Investor Presentation)

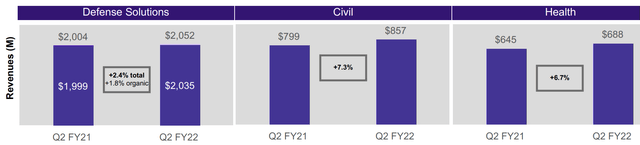

By reporting business unit, Defense makes up the largest portion of total revenue (~69%) which increased by 2.4% year over year. Civil revenue was the fast-growing segment and popped by 7.3% year over year to $857 million. The Health segment also generated strong growth as revenue popped by 6.7% year over year to $688 million.

Revenue by Business unit (Q2 Presentation)

Leidos offers incredibly consistent and predictable revenue thanks to its large government contracts. For example, the company has a strong Backlog of $34.7 billion in potential revenue, which is up 4% year over year. This Backlog is driven by a series of large contracts. For example, the business has recently scored a $358 million contract with the U.S. Navy to design an unmanned undersea vehicle. Other tailwinds include a potential win of the Social Security Administration IT task orders which are worth ~$800 million. In addition to an $11.5 billion Defense Enclave Services (DES) contract by the Defense Information Systems Agency.

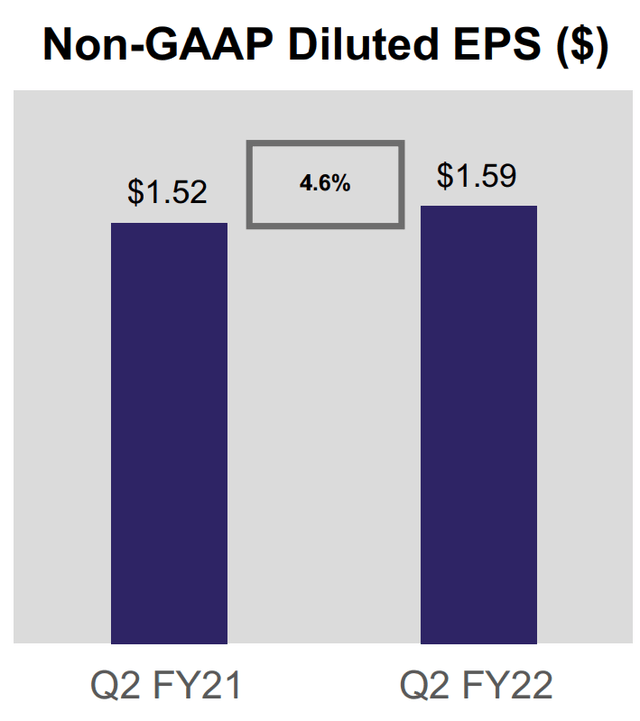

Leidos is also a business that offers strong profitability. The company generated EPS [Normalized] of $1.59, which beat analyst estimates by $0.03 and popped 4.6% year over year.

Leidos generated strong Free Cash Flow of $19 million in the quarter and is on a path to deliver ~$1 billion in Operational Cash Flow in 2022.

The company has cash and short-term investments of $339 million. The business does have high total debt of ~$5.2 billion, but the good news is that only $623 million is current portion of long-term debt, which seems manageable.

Advanced Valuation

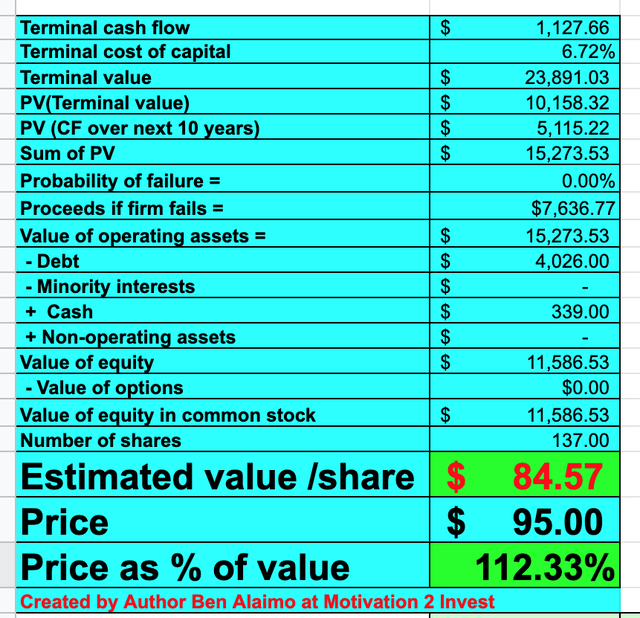

In order to value Leidos, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted an optimistic 6% revenue growth per year over the next 5 years, due to the large contracts won.

Leidos Stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted its operating margin to increase to 9% over the next 3 years, driven by an improvement in profitability from the large contract wins.

Leidos stock Valuation 2 (Created by author Ben at Motivation 2 Invest)

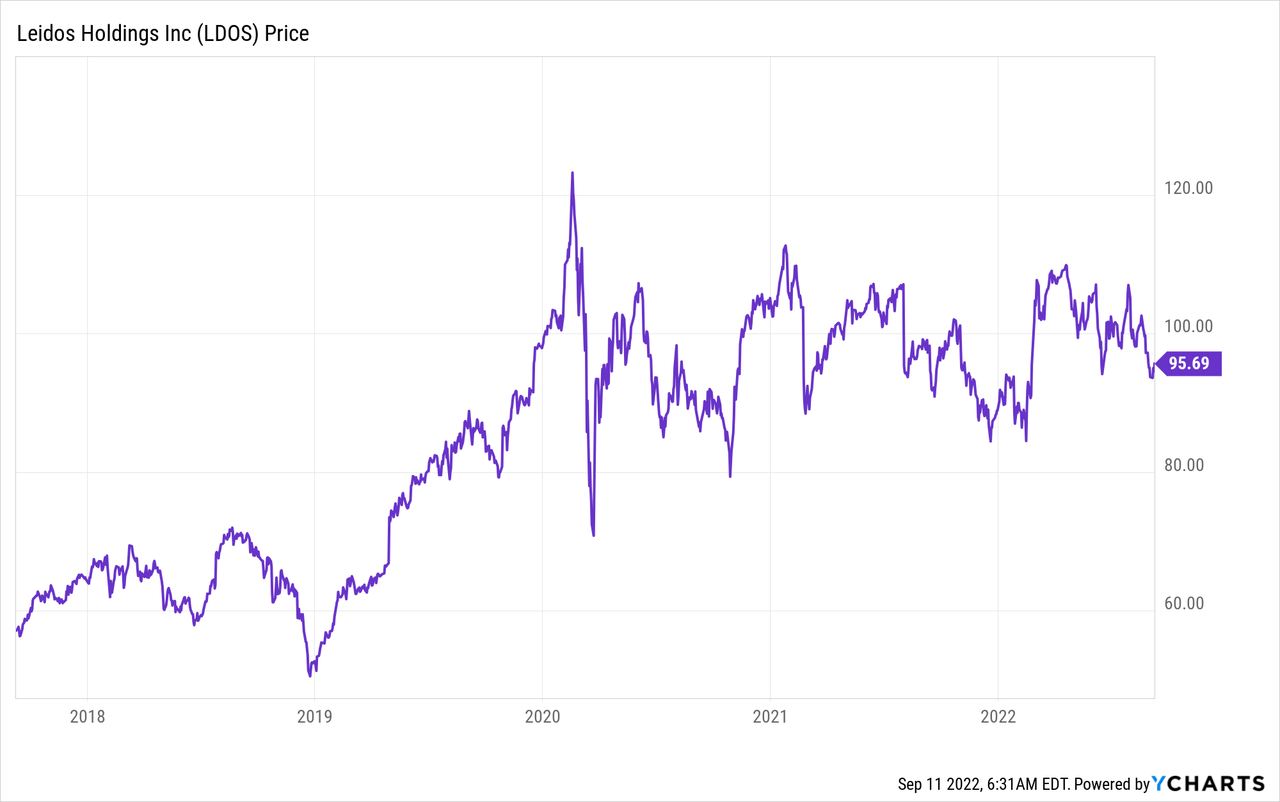

Given these factors, I get a fair value of $84/share. The stock is currently trading at ~$95 per share and thus is ~12% overvalued at the time of writing.

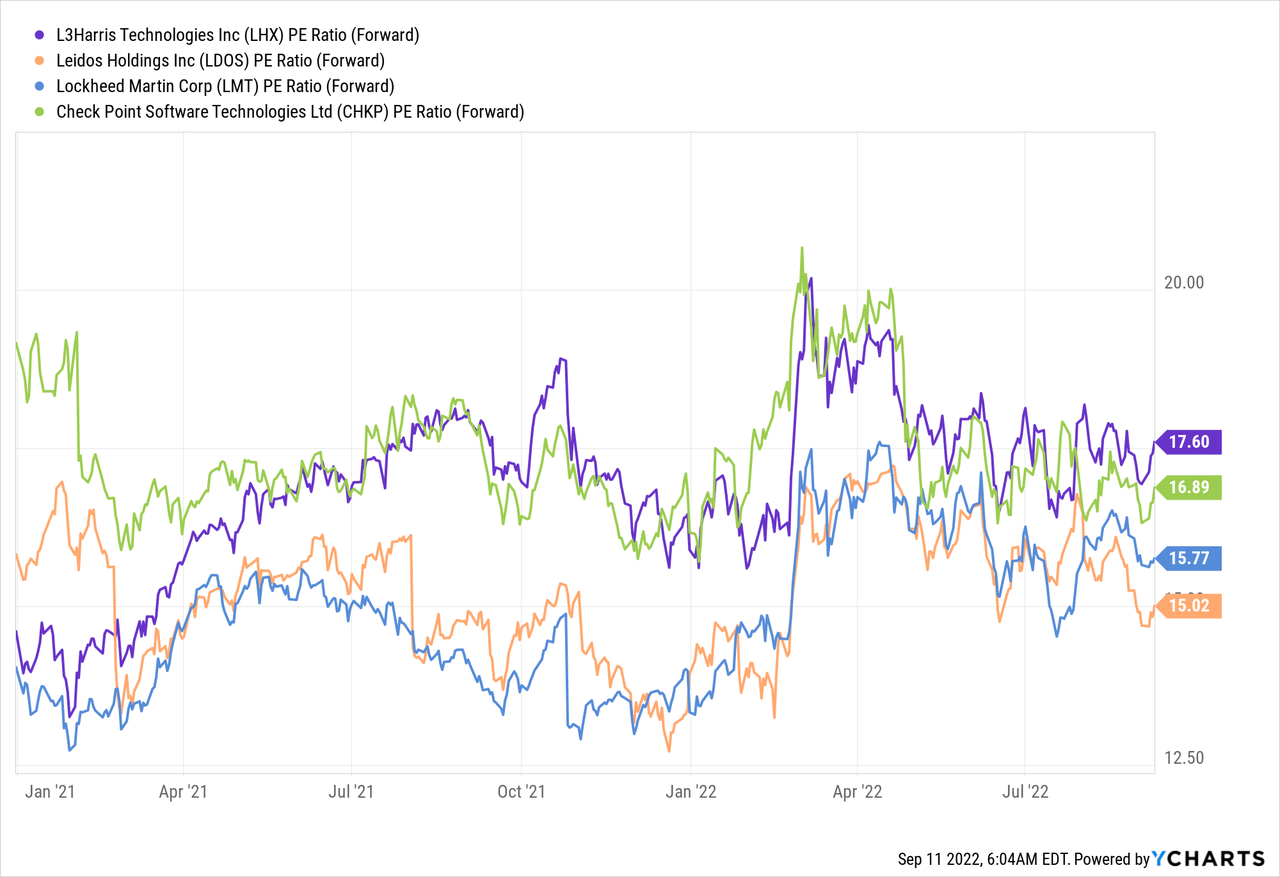

As an extra datapoint, Leidos trades at a P/E forward ratio = 15, which is ~5% cheaper than its 5-year average.

In terms of competition, Leidos competes across a variety of industries due to its diverse IT, tech, and Cyber services. As the majority of the business’s revenue comes from Defense, I will compare it to a few companies in this industry. For instance, Leidos trades at the cheapest forward PE ratio (orange line) of 15. Major defense contractor Lockheed Martin (LMT) trades at a slightly more expensive P/E Ratio = 15.77. In addition, L3Harris (LHX) trades at a P.E Ratio = 17.6. For extra information, I have also included a legacy cybersecurity company Check Point (CHKP) which trades at a more expensive P/E Ratio = 16.89.

Risks

Competition

The defense contracting space is highly competitive. Leidos has recently been caught up in a “protest” from rival Peraton after it had thought it won a major $800 million contract for IT work for social security. Peraton now gets a second chance at winning the major contract, if they win that is $800 million Leidos has missed out on.

Recession/IT Spending Slowdown

As mentioned prior many analysts are forecasting a recession due to the high inflation and rising interest rate environment. This may cause companies to delay IT spending as they aim to cut costs. I do believe this will be an issue in the short term, but long term not a major issue due to the secular tailwinds mentioned in the introduction.

Final Thoughts

Leidos is a leading technology company that provides essential security and IT services to large organizations. The company is poised to benefit from secular growth across a multitude of trends from IT to cybersecurity. Leidos has extremely secure revenue and a strong backlog of orders. I believe the stock trades at a premium intrinsically due to the consistency of revenue. However, the stock is trading cheaper than industry peers and thus I will still label the stock a “buy” for the long term.

Be the first to comment