Lemon_tm

Legend Biotech’s (NASDAQ:LEGN) lead asset is Carvykti, a BCMA-targeted CAR-T cell therapy for the treatment of multiple myeloma. Carvykti is currently approved for fourth-line plus multiple myeloma in Europe and Japan and for fifth-line plus multiple myeloma in the United States, but with a broad development program that covers second and third lines of therapy in multiple myeloma as well as first-line therapy.

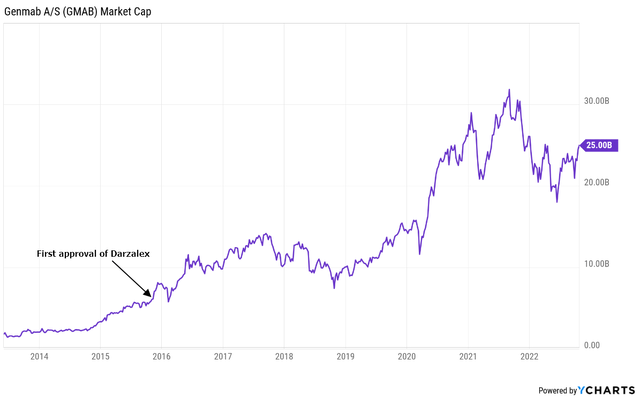

Carvykti is partnered with Johnson & Johnson (JNJ) but with very good terms for Legend – a 50:50 profit/loss split in all territories except China where the split is 70:30 in Legend’s favor. And J&J expects Carvykti to generate more than $5 billion in annual peak sales in the large multiple myeloma market. In terms of profitability, $5 billion in annual sales would be similar to what Darzalex’s $10 billion would be for Genmab (GMAB) because Genmab is receiving mid-teens royalties on net sales from the same partner – J&J, and Legend can generate a profit margin of at least 30% at scale.

I am mentioning Genmab and Darzalex because Legend is on a similar path of value creation – partnership with J&J for the lead asset, also in multiple myeloma, and also with significant peak sales potential.

And what is also similar to Genmab is that Legend also has a pipeline and platform behind the key asset Carvykti with the goal of developing additional autologous as well as allogeneic therapies for hematological malignancies and solid tumors.

Carvykti is off to a great start with $24 million and $55 million in net sales in the first two quarters on the market with demand exceeding supply due to the global lentivirus shortage, an issue Legend and J&J are actively working to resolve.

Carvykti and J&J deal overview

Legend and J&J signed a global collaboration agreement in 2017 and it covers the development and commercialization of Carvykti (which was also called LCAR-B38M, or ciltacabtagene autoleucel, or cilta-cel), for the treatment of multiple myeloma.

Carvykti is a chimeric antigen receptor (‘CAR’) T-cell product which specifically targets the B-cell maturation antigen (‘BCMA’). CAR T-cells are an innovative approach to eradicating cancer cells by harnessing the power of a patient’s own immune system. BCMA is a protein that is highly expressed on myeloma cells. By targeting BCMA with the CAR-T approach, CAR-T therapies have the potential to redefine the treatment paradigm for multiple myeloma and potentially advance toward cures for patients with the disease.

Under the terms of the agreement, the two companies are jointly developing and commercializing Carvykti. Janssen records worldwide net trade sales, except for sales made in Greater China. There is a 50/50 percent cost-sharing/profit-split arrangement, except in Greater China where the split is 70/30 in Legend’s favor. Janssen made a $350 million upfront payment and has committed to additional development, regulatory and sales milestones.

Since the signing of the deal, Legend has received $300 million in additional milestone payments from J&J and Legend is eligible to receive further milestone payments of up to $770 million in potential future milestones.

J&J is certainly the right partner for Legend considering its leadership position in multiple myeloma thanks to the blockbuster Darzalex and its overall strong position in hematological malignancies.

Impressive CARTITUDE-1 data secure approvals in the United States, Europe, and Japan

The CARTITUDE-1 results were nothing short of remarkable. In a patient population with a median of six prior lines of therapy, Carvykti managed to get a very high overall response rate of 97.9% (95 of 97 patients responded) with a 78.4% stringent complete response rate.

And the stringent response rate improves over time. Since the approval in February, Legend and J&J presented updated data with longer follow-up. After 27.7 months of follow-up, the stringent response rate rose to 82.4%.

And what was equally impressive is that the median duration of response was not reached after nearly 28 months of follow-up, and median progression-free survival (‘PFS’) was also not reached.

The PFS rate after 27 months is 54.9% (meaning 54.9% of patients are still progression-free) and the overall survival rate after 27 months is 70.4%.

Of the 97 evaluable patients, 61 were evaluable for minimal residual disease (‘MRD’), and 92% were MRD-negative. Achieving MRD negativity is associated with improved PFS and overall survival, and that was the case in the CARTITUDE-1 trial as patients who had sustained MRD negativity for at least 12 months had a 27-month PFS rate of 78.8% versus 54.9% for the whole population and an overall survival rate of 90.8% versus 70.4% for the whole population.

To put these results into perspective, here is what the recently approved products can achieve in this patient population (with the caveat of this being compared across trials):

- Bristol Myers Squibb’s (BMY) Abecma is the most direct competitor, as it is also a CAR-T cell therapy. Abecma’s ORR was 72% with a stringent CR rate of 28% and an MRD-negativity rate of 21%. The median duration of response was 11 months, median progression-free survival was 11.1 months and median overall survival was 24 months. These are the best data after Carvykti.

- J&J’s teclistamab (brand name Tecvayli), a BCMA x CD3 bispecific antibody, achieved a 63% ORR, and a 39.4% complete response or better (so, not a stringent CR rate in this case). The median duration of response was 18.4 months, the median PFS was 11.3 months, and the median overall survival was 18.3 months. Tecvayli received FDA approval this week, and the press release notes a 62% ORR and a 28% complete response or better, so, slightly worse than previously reported.

- J&J’s talquetamab, a GPRC5D x CD3 bispecific antibody, was studied in patients with at least four prior lines of therapy and it achieved an ORR rate of 70% and a stringent CR rate of 23.3%. The follow-up was shorter than the other trials and it is behind the other products and candidates, so the data are more limited.

- Two additional novel agents were also fairly recently approved but have achieved modest results in patients who received at least four prior lines of therapy. Karyopharm’s (KPTI) Xpovio (selinexor) and GlaxoSmithKline’s (GSK) Blenrep (belantamab mafodotin) achieved an ORR of 21% and 34%, respectively, stringent CR rates of 1% and 2%, respectively, and median PFS was 2.8 months and 3.7 months, respectively.

Overall, the efficacy of Carvykti so far appears unmatched. And the added advantage of Carvykti to other therapies other than Abecma is the one-and-done nature (single administration) versus chronic treatment with bispecifics like teclistamab and talquetamab, and other treatments like Xpovio and Blenrep.

On the safety side, all products have safety issues. The most prominent safety concerns for Carvykti that are covered by the black box warning in the label are:

- Cytokine release syndrome (‘CRS’). Nearly all patients develop CRS several days after Carvykti administration and in most cases, these are limited to grade 1 and 2 CRS. The grade 3 or higher CRS rate is 4.1% and one patient in the CARTITUDE-1 trial died as a result of CRS.

- Neurotoxicity. The all-grade rate in the trial was 21.3% and the grade 3/4 rate was 11.3%. Neurotoxicity was addressed by the implementation of patient management strategies and Legend notes that the incidence of movement and neurocognitive disorders such as parkinsonism has decreased across the rest of the CARTITUDE program compared to the CARTITUDE-1 trial.

- Prolonged and/or recurrent cytopenias.

Even considering these side effects, the risk-benefit profile of Carvykti remains outstanding compared to competitors:

- Abecma has similar issues since it is in the same class and carries the same black box warnings as Carvykti for CRS, neurotoxicity, and cytopenias. CRS occurred in the majority of patients and the grade 3 or higher rate was 9% and one patient died. All-grade neurotoxicity was 28% with 4% of patients having grade 3/4.

- Teclistamab’s most common side effects are CRS (72% all-grade, 0.6% grade 3), neurotoxicity (15%, all low-grade), anemia and infections.

- Talquetamab’s most common side effects also include CRS (77% all-grade, 3.3% grade 3/4), cytopenias, and infections.

- Xpovio’s main grade 3/4 adverse events include thrombocytopenia, anemia, and fatigue.

- Blenrep has ocular toxicity issues along with other common side effects in multiple myeloma patients.

Overall, Carvykti seems to have the best risk-benefit profile in multiple myeloma patients that have failed four or more lines of prior therapy, and the data were enough to secure approvals in the United States, Europe, and Japan.

The trial in China is ongoing as the regulators there requested additional data. Based on the company’s comments, it is unclear when Carvykti will receive approval in China.

Carvykti’s launch and supply problems

J&J has previously guided for a scaling launch of Carvykti as time was needed to set up administration sites and because there is a global lentivirus shortage. J&J and Legend have sought to address this global shortage, and they do not expect supply to be an issue in the medium and long term, and that includes the potential approval and launch for earlier lines of multiple myeloma.

Despite these challenges, Carvykti’s net sales were $24 million in Q2 and $55 million in Q3. J&J sees Carvykti as a product capable of generating more than $5 billion in annual peak sales, but that is unlikely to be achieved in the existing fourth-line-plus or fifth-line-plus indications since this is a smaller addressable market.

However, this is still a sizable market for Carvykti with Legend estimating there are 22,000 patients who could receive Carvykti across major geographies – United States, Europe, and Japan (and excluding China).

But getting to second line-plus should get them to those levels because the addressable market would almost triple to approximately 57,000 patients (excluding China).

Frontline treatment of multiple myeloma will likely be a bonus in terms of expected peak sales of Carvykti as the hurdles for adoption are higher for frontline patients – Carvykti needs to generate strong efficacy with acceptable safety against the current standard of care for frontline patients. There are approximately 64,000 newly diagnosed patients in the United States, Europe, and Japan, but not all will be eligible to receive Carvykti. Legend estimates the addressable market to be approximately 30,000 for transplant-ineligible patients (autologous stem cell transplant) and up to 20,000 for transplant-eligible patients who could choose Carvykti as an alternative.

I believe that the uptake in later lines of therapy will be much faster (pending the resolution of supply issues) and that it will take longer to penetrate frontline and second and third-line markets. However, even high penetration in later lines of therapy could be sufficient for Carvykti to generate several billion in annual sales. Based on an estimated net price per patient of approximately $400,000 (the list price is $465,000), the fourth and fifth-line-plus indications represent an addressable market of nearly $9 billion.

Broad development program in place to secure the broadest possible label for Carvykti

Legend and J&J have a very broad development program in an effort to secure a label that covers all lines of therapy.

The most important clinical catalyst in the near term is the readout of the CARTITUDE-4 trial. It is an event-driven trial, so it is harder to pinpoint the timing, but J&J said on the Q3 earnings call that it is possible we see the results by the end of the year.

CARTITUDE-4 is a trial comparing a single administration of Carvykti to the available standard of care in patients who have received one to three prior lines of therapy. As covered in the prior section, this would nearly triple the global addressable market for Carvykti.

And we are not going blind into this readout as Legend and J&J have already tested a smaller cohort of earlier line patients in the CARTITUDE-2 trial.

Cohort A of the CARTITUDE-2 trial enrolled patients who have received one to three prior lines of therapy and who are refractory to lenalidomide (Revlimid). 20 patients were enrolled, and ORR was once again very high at 95% (19 of 20 patients responded) and the response deepened over time with a stringent CR rate reaching 85%. The median duration of response and median PFS were not reached and the 15-month PFS rate was 70%.

Safety was manageable and one patient was treated in the outpatient setting (a potential long-term trend that could improve uptake). All grade CRS was 95% and grade 3 or higher CRS was 10%. All grade neurotoxicity was 30% with grade 3/4 neurotoxicity at 5%. Four deaths occurred in the study with two due to progressive disease (days 426 and 550), one due to sepsis (not treatment-related, day 394), and there was one treatment-related death due to COVID-19 on day 100 (patients receiving Carvykti are at an increased risk of infections).

Cohort B of the CARTITUDE-2 trial tested Carvykti in patients who have relapsed within 12 months after initial therapy. Patients who relapse early are at higher risk of poor outcomes. There were 19 patients in this cohort and the ORR was 100% with a stringent CR of 63%. The median duration of response and median PFS were not reached and the 12-month PFS rate was 89.5%.

Safety in cohort B was similar to cohort A with grade 3 or higher CRS and neurotoxicity rates of 5%. There was one death in this cohort due to progressive disease on day 158.

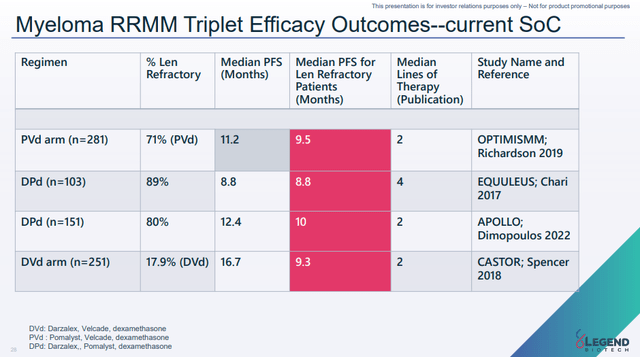

Given the efficacy Carvykti achieves across all lines of therapy, the efficacy bar for the CARTITUDE-4 trial is not that high. The available second-line-plus therapies have achieved a median PFS between 11.2 and 16.7 months with lenalidomide-refractory patients not getting above a median PFS of 10 months (see presentation slide below). DVd (Darzalex, Velcade, and dexamethasone) did the best in this setting, but this combination also had the least lenalidomide-refractory patients in the trial.

Legend Biotech investor presentation

So, on efficacy, I believe it is a question of the magnitude of difference between Carvykti and other lines of therapy. The risk is on the safety side, as it is possible that we see adverse events that were not seen before. However, the safety profile of Carvykti now appears increasingly well characterized as there is safety data in several hundred patients.

Moving on to frontline (newly diagnosed) multiple myeloma, Legend and J&J have two shots on goal.

The CARTITUDE-5 trial is testing Carvykti in newly diagnosed patients who are not intended or not eligible to receive a transplant. 50% to 60% of newly diagnosed multiple myeloma patients are ineligible for transplant and another third of eligible patients end up not receiving the transplant.

The CARTITUDE-5 trial will compare Carvykti to Velcade, Revlimid, and dexamethasone. Both arms of the trial will receive the induction cycle of the triple combination, followed by Carvykti in the treatment arm and Revlimid and dexamethasone maintenance in the control arm (patients receiving Carvykti will receive no further treatment).

The CARTITUDE-6 trial will directly compare Carvykti to an autologous stem cell transplant and both arms will continue on Revlimid maintenance for two years.

It will be very interesting to see the data from these trials, but it will take a while for the trials to report data. The CARTITUDE-5 trial was initiated in August 2022 and the CARTITUDE-6 trial is expected to start by the end of this year.

Financial overview

Legend Biotech is in strong financial shape, especially after the recent follow-on offering. The company had $796 million in cash and equivalents, it should receive additional milestone payments from J&J in the next few years, and once Carvykti’s supply issues are addressed, it should not take long before the collaboration is profitable. Additional dilution is possible, but it should be modest, and it may not be required if Carvykti’s uptake is as expected.

Risks

The high level of innovation in the multiple myeloma market is the main long-term risk to the thesis. The treatment landscape is evolving rapidly, and we have seen several new mechanisms of action enter the market in later lines of therapy, from bispecifics and antibody-drug conjugates (‘ADCs’) to cell therapies like Abecma and Carvykti. In addition to monotherapy approaches, some of these therapies could be combined to generate better responses than each can do on their own.

Execution and manufacturing are other potential risks. It is not a certainty that J&J and Legend will solve the supply issues and that Carvykti can successfully scale to meet the growing demand, especially if the label is expanded to include first, second, and third lines of therapy.

And finally, being a biotech company from China adds another layer of risk to the thesis. Legend is still among the companies that are on the HFCAA list (an issuer utilizing an auditor restricted from Public Company Accounting Oversight Board inspection), but the situation has improved on the de-listing side due to the recent United States and China agreement, and Legend has been proactive and has appointed a United States-based auditor after being put on the list. However, removal from this list cannot happen until it files the 2022 annual report that will be audited by the US-based Ernst & Young in the first half of 2023.

Conclusion

Carvykti has the benefit-risk profile that could lead to it generating more than J&J’s annual peak sales guidance of $5 billion. The fourth and fifth-line plus market is large enough to support at least $2-3 billion in annual sales and the second-line-plus market could add another $3-4 billion. I believe these numbers are achievable, assuming no additional safety issues surface in the CARTITUDE-4 trial, and would translate to 33% market share in the fourth and fifth line-plus market and mid-teens global market share in the second line-plus market. For the time being, I am not including the first-line market as I want to see more data, and the estimates also exclude the contribution from China, but I do not believe China will contribute more than 15% to global peak sales.

If my assumptions are correct, Legend Biotech could follow the value creation path of Genmab which owes most of its success to blockbuster Darzalex, and, as mentioned, Legend stands to earn more on Carvykti than Genmab is getting from Darzalex. I estimate the ratio is approximately 2 to 1 or better as Genmab is generating royalties on Darzalex in the mid-teens and I believe Legend’s profit could exceed 30% at scale, and possibly 35% if China is added to the mix (the profit-loss split goes from 50-50 globally to 70-30 in Legend’s favor in China).

And while this article focuses solely on Carvykti, Legend also has a cell therapy platform and early-stage pipeline focused on autologous and allogeneic cell therapies for hematological malignancies and solid tumors. However, we are yet to see clinical data from any of these programs and I would treat the rest of the pipeline as long-term upside optionality and additional monetization opportunity as Legend can also partner some of these other programs.

Be the first to comment