mmg1design

A Quick Take On LegalZoom

LegalZoom.com, Inc. (NASDAQ:LZ) went public in June 2021, raising approximately $535 million in gross proceeds from an IPO that priced at $28.00 per share.

The firm sells an array of legal & financial software, services and products in the United States.

Until the firm makes a meaningful move toward operating breakeven or growth multiples improve, I’m on Hold for LZ in the near term.

LegalZoom Overview

Glendale, California-based LegalZoom was founded to help individuals and small businesses obtain legal forms and agreement templates for various functions.

Management is headed by Chief Executive Officer Dan Wernikoff, who has been with the firm since October 2019 and was previously Executive Vice President and General Manager of the Consumer Tax Group at Intuit.

The company’s primary offerings include:

-

Business formation

-

Intellectual property

-

Estate planning

- Tax service.

The first customer touch point is usually at the business formation stage. The firm then tries to continue the relationship, seeking to upsell the customer into a subscription service offering.

Management has said that a significant majority of its customers purchased one year of one of its subscription services at the time of their initial formation purchase.

LegalZoom’s Market & Competition

Management views the serviceable addressable market size as at least $49 billion.

That amount comprises $18.3 billion in business formation services, $21.5 billion in additional small business services throughout a business’ life cycle and $8.8 billion in consumer estate planning services.

LZ seeks to continue its growth by launching into adjacent service areas, offer additional API access to third-party solution providers and provide higher-priced, higher value services.

Major competitive or other industry participants include:

-

BozFilings

-

LegalShield

-

MyCorporation

-

RocketLawyer

-

H&R Block

-

Jackson Hewitt

-

Law firms

-

Solo attorneys.

LegalZoom’s Recent Financial Performance

-

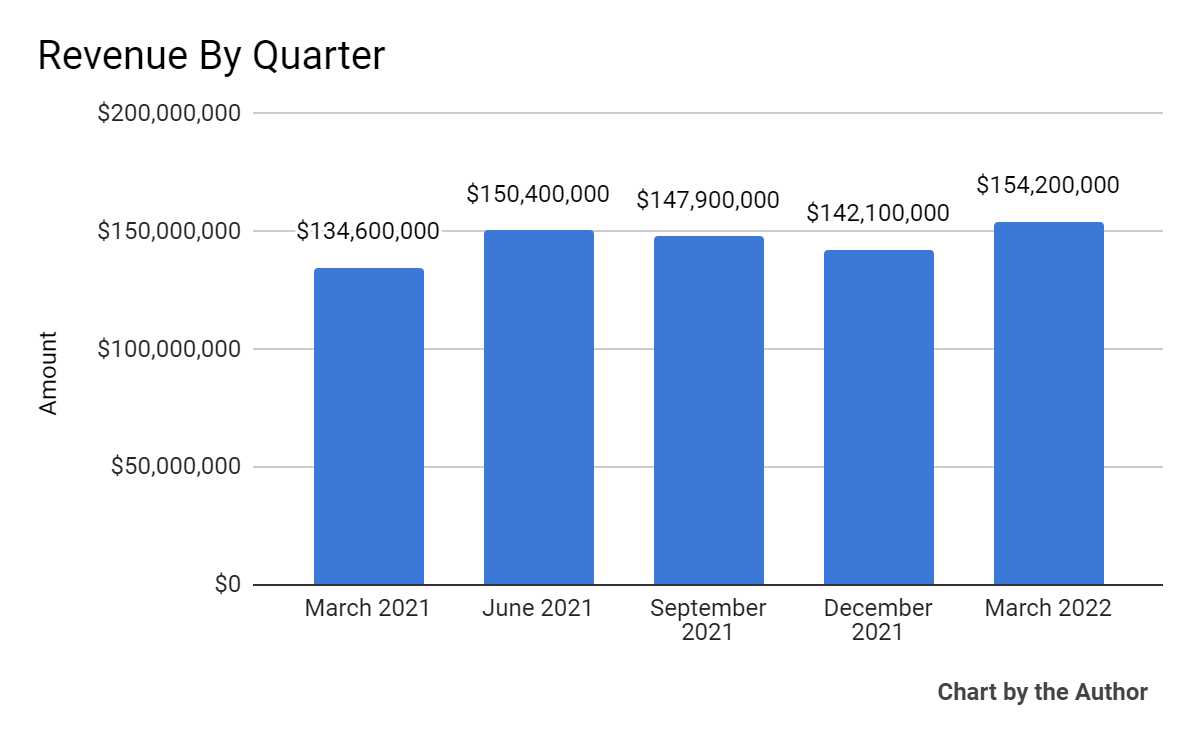

Total revenue by quarter has risen in recent quarters, albeit unevenly:

5 Quarter Total Revenue (Seeking Alpha)

-

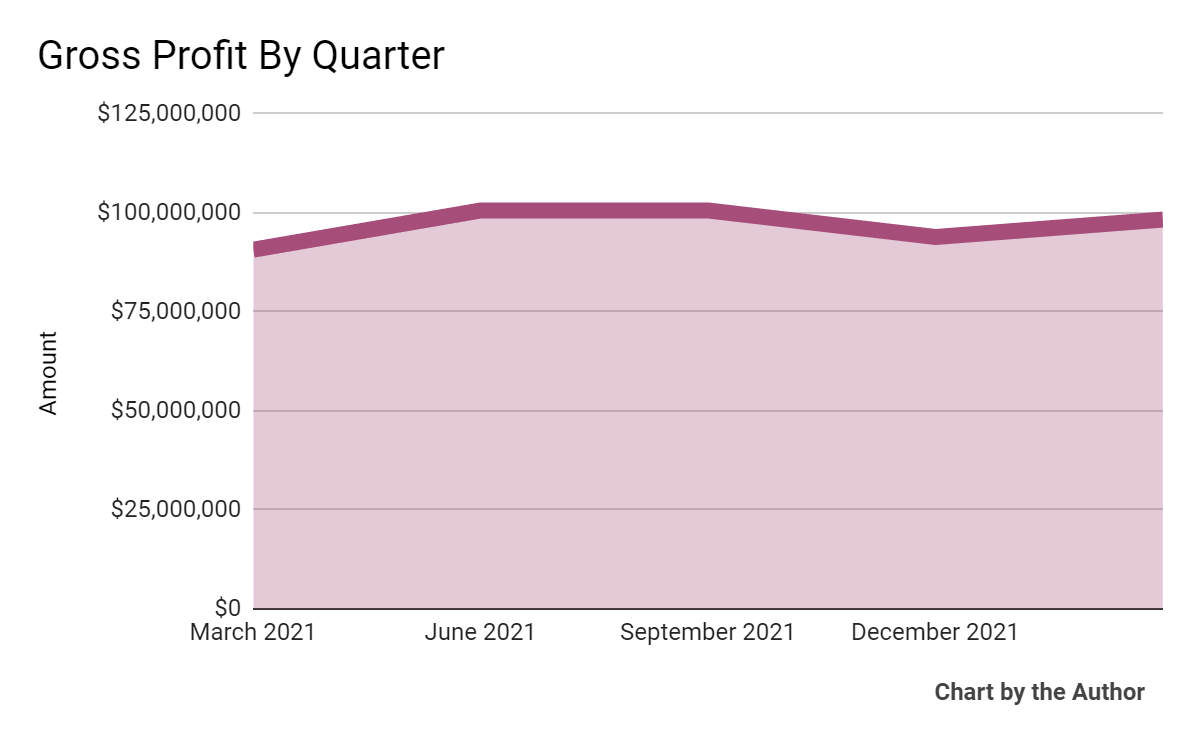

Gross profit by quarter has essentially plateaued:

5 Quarter Gross Profit (Seeking Alpha)

-

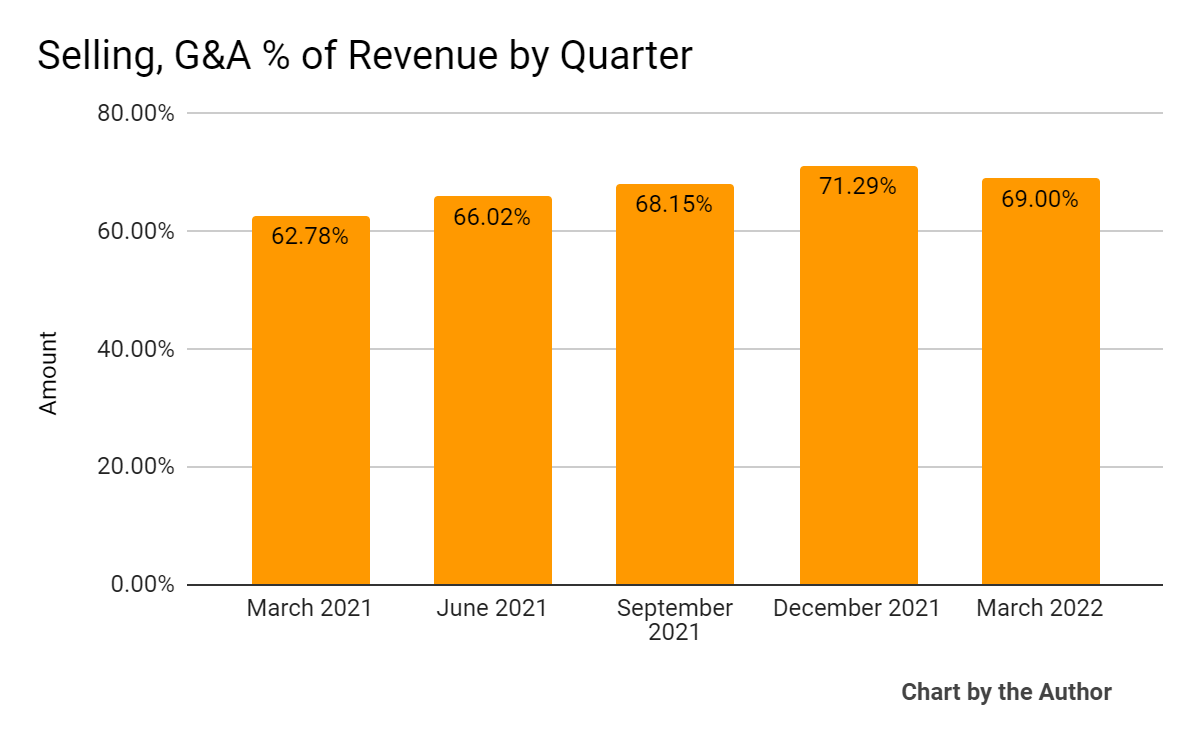

Selling, G&A expenses as a percentage of total revenue by quarter have generally trended higher in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

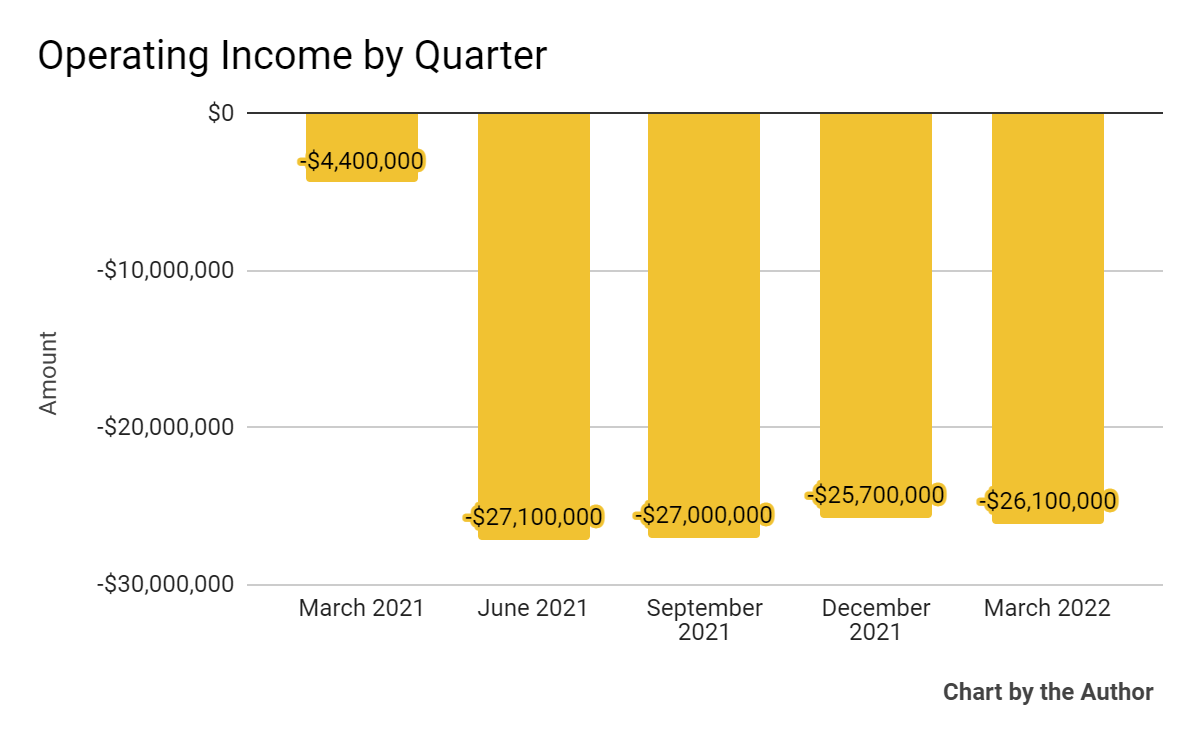

Operating income by quarter has remained heavily negative, with no obvious path to breakeven:

5 Quarter Operating Income (Seeking Alpha)

-

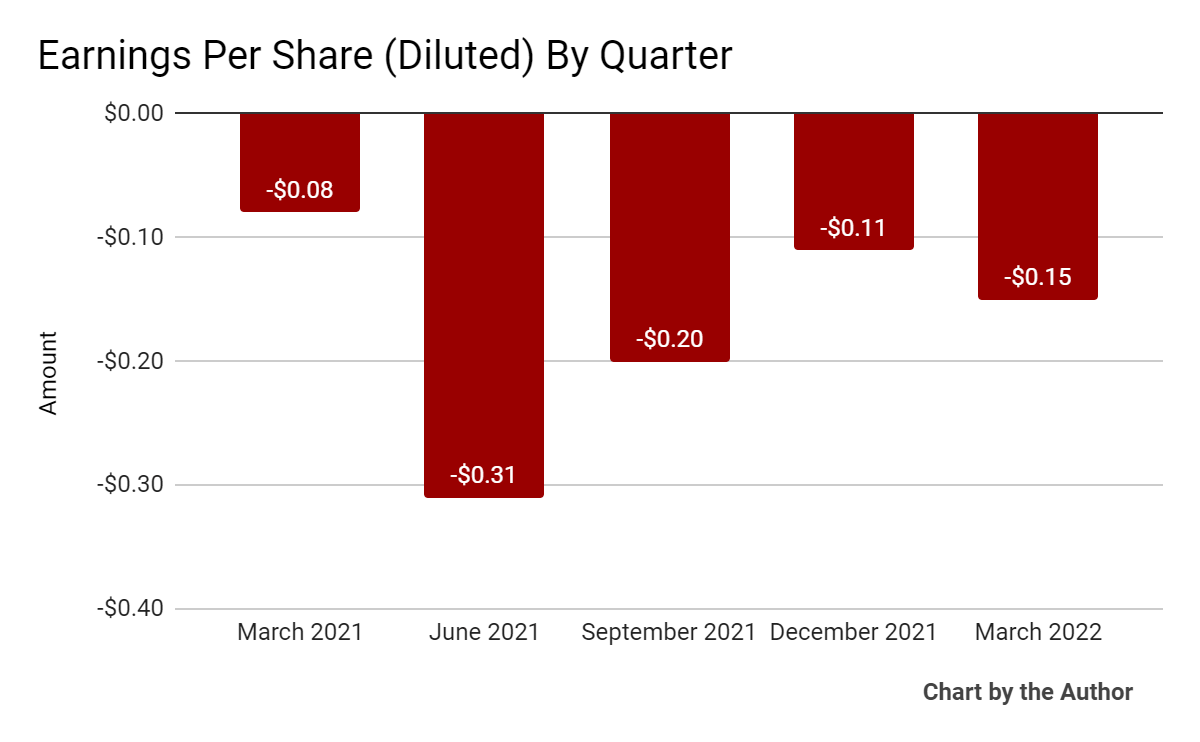

Earnings per share (Diluted) have also remained materially negative in the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

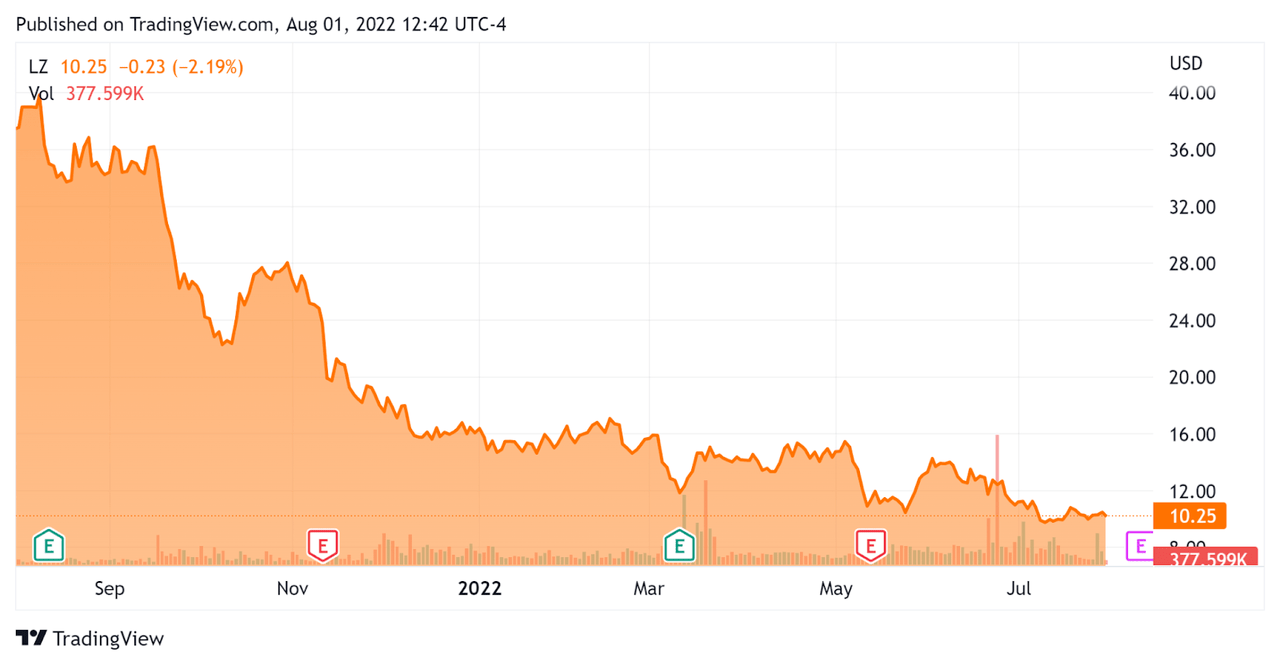

In the past 12 months, LZ’s stock price has fallen 72.7% vs. the U.S. S&P 500 index’ drop of around 5.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For LZ

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$1,830,000,000 |

|

Market Capitalization |

$2,080,000,000 |

|

Enterprise Value / Sales [TTM] |

3.08 |

|

Revenue Growth Rate [TTM] |

19.06% |

|

Operating Cash Flow [TTM] |

$36,470,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.77 |

(Source – Seeking Alpha)

Although the company is not a pure software as a service (“SaaS”) firm, the Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

LZ’s most recent GAAP Rule of 40 calculation was 2% as of Q1 2022, so the firm needs improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

19% |

|

GAAP EBITDA % |

-17% |

|

Total |

2% |

(Source – Seeking Alpha)

Commentary On LegalZoom

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted subscription revenue growth of 29% year-over-year, generating $84 million in revenue (which is 55% of total revenue) driven by its LZ Tax system during the busy tax season quarter in the U.S.

However, business formations were down 2% during the quarter, which affects its related service offering revenues.

The company saw significant cross selling between its new business formation segment and its new LZ Tax offering, increasing its customer lifetime value.

Notably, management focused on its operating leverage while stating that it has ‘reduced margins in the near term to accelerate growth over the longer term.’

CEO Wernikoff said that less than ⅓ of its operating expenses are fixed due to its asset-light model, so the company can be nimble as market conditions change.

As to its financial results, total revenue grew by 15% year-over-year, above the top end of its previous guidance range.

Sales and marketing expenses were 47% of revenue, which was essentially flat from what I can glean from management comments.

For the balance sheet, the firm finished the quarter with $248 million in cash and equivalents and no outstanding debt.

Looking ahead, management guided for Q2 revenue to grow at 8% at the midpoint of the range. The company is scheduled to report Q2 after the close on August 11.

Regarding valuation, the market is valuing LZ at an EV/Revenue multiple of around 3.1x.

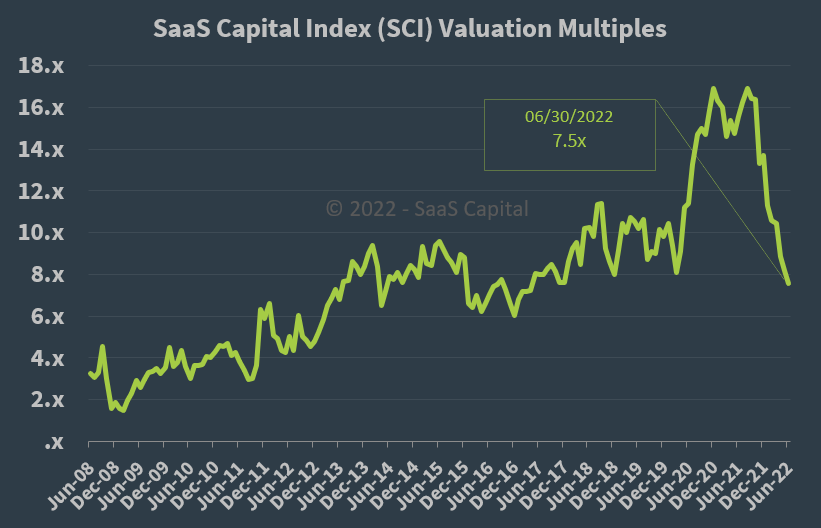

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

While LZ is only partially a SaaS company, by comparison, it is currently valued by the market at a discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

A potential upside catalyst to the stock could include a pause or reduction in interest rate hikes, reducing pressure on its valuation multiple as well as improved business formation numbers.

It appears management intends to continue to spend SG&A at high rates to ‘invest in the long term,’ although the market is punishing the stock in the short term due to its high operating losses in a rising cost of capital environment.

Until the firm makes a meaningful move toward operating breakeven or growth multiples improve, I’m on Hold for LZ in the near term.

Be the first to comment