metamorworks/iStock via Getty Images

Company Snapshot

Lee Enterprises, Incorporated (NASDAQ:LEE) is a media company with exposure to both the traditional print and digital news markets (although it is in the midst of transforming from a print-centric to a digital-centric company). LEE also generates revenue through advertising and marketing services. The company is noted for its news, digital content, and marketing expertise in the local markets of America.

I am neutral over LEE’s prospects but will touch upon the good and bad facets of this story.

What’s To Like?

When you think about the addressable market in the digital space, the sky is the limit, as last year, LEE was able to attract 50 million unique visitors across all their digital platforms. The goal now is to try and convert a lion’s share of those unique visitors into paid digital subscribers over time.

LEE’s immediate goal is to get to 900,000 digital subs in 4 years’ time, and so far, one can have few complaints as the execution has been better than expected. LEE was on course to finish this year with 495,000 digital subs, but they crossed this in Q3 itself, hitting 501,000 subs back then!

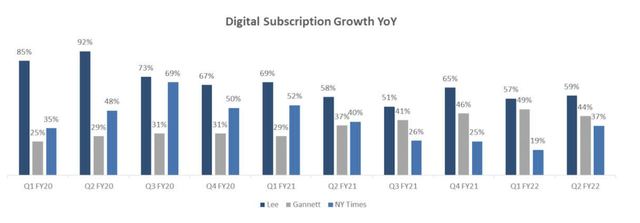

It isn’t just the absolute landmarks that have caught the eye; also note the relentless pace of growth you’re getting, despite tough comps. Towards the end of last year, digital subscriber additions were coming in at 65% YoY growth. Despite a high base effect, the impressive run rate continues to persist, with subs growth coming in at 57% and 59% over the last two quarters. Crucially, the pace of growth has been well ahead of its close peers – NY Times and Gannett – for quite a while now (for 10 straight quarters to be more specific).

LEE isn’t just adding subs, it’s also attracting higher dollars from this growing base; in Q3, they implemented a 7% hike in subscription rates for their digital-only base (this follows a mid-20% hike in Q2). You don’t get to grow your user base at 50%+ rates and implement hikes of 7-25% unless you have a subscription package worth signing up for. In recent periods, LEE has been keen to push forward dynamic video and graphic content whilst also deepening its presence with new channels such as apps, podcasts, etc. All in all, whilst digital revenues for LEE will likely grow at a CAGR of 16% until 2026, subscription-related digital revenue will likely grow at a much superior pace of 29% during the same period.

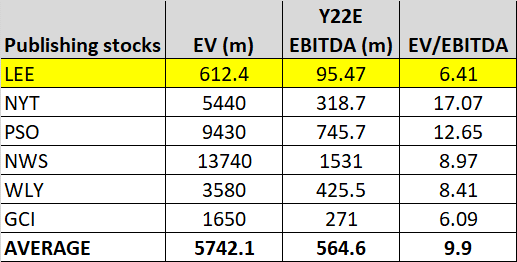

Given the company’s rapid pace of growth in the digital space, I believe its valuations are somewhat misplaced. On a forward EV/EBITDA basis, the stock only trades at a multiple of 6.4x; this represents a massive ~35% discount to the average multiple of comparable companies in this space.

YCharts, Seeking Alpha

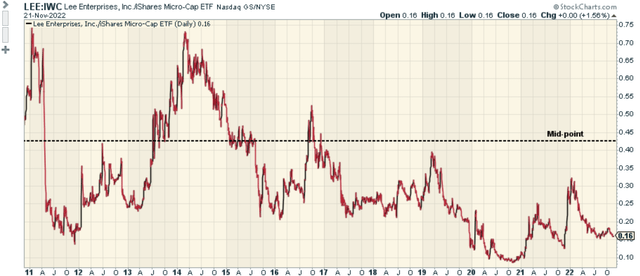

In addition to that, if you’re looking for rotational opportunities within the broad micro-cap space, I reckon LEE should be on your watchlist; the relative strength ratio which gauges LEE’s positioning relative to other micro-caps is currently trading 2.7x lower than the midpoint of its decade-long range.

In the short term, the most important catalyst will likely be the FY results which could be announced over the next two weeks (Yahoo Finance has it down on the 30th of November, but there is no official confirmation on Lee’s site). It’s worth noting that consensus is currently a little cautious, with an expected FY EBITDA of $95.4m. This is closer to the lower end of management’s guidance of $95-98m, and there’s an outside chance that we could see some upward readjustments to that number. In the Q3 call, the management highlighted some cost-cutting measures they had put in place which could potentially generate $20m of cost reductions for the last 2 quarters of the current fiscal.

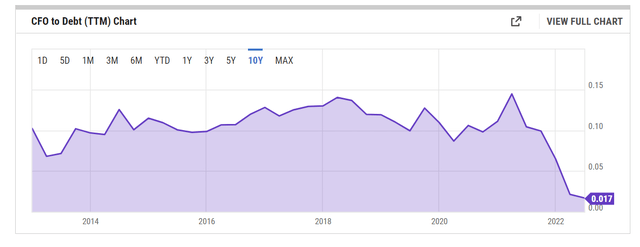

Crucially, I think we could see some improvements on the cash flow front, which was not quite the case as of the first 9 months of 2022. Last year, during the first nine months, LEE had managed to generate close to 43m of operating cash flow; this year so far, it has only managed to generate less than a million worth of operating cash! One of the biggest drivers of cash outflow this year has been towards pension contributions (this sucked out close to 14bn of cash). Their pension plans are fully funded in aggregate, and the company won’t have to make any contributions to its pension trust for the rest of 2022. It’s vital that LEE starts improving its cash generation, as recently, the debt coverage by operating cash flows dropped to its lowest level in a decade!

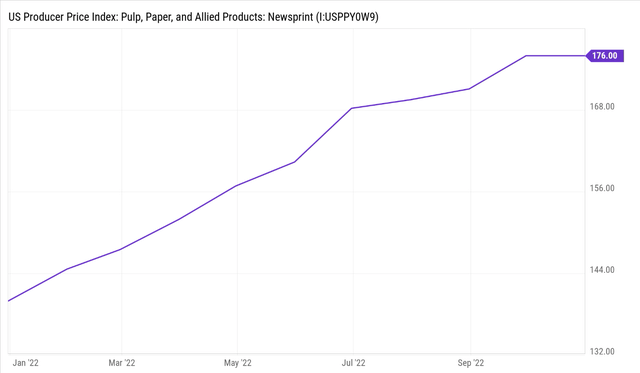

Then, whilst LEE’s print division will likely have to contend with yet another quarter of elevated newsprint costs, I suspect things could begin to ease as we close the year. Reports suggest that a few newsprint producers would likely have restarted previously idle machines, which would have appeased the adverse supply/demand position. After nine successive months of gains, the newsprint producer price index appeared to have plateaued in October and could pivot from here.

What’s Not To Like?

LEE’s peers – Garnett and NYT have called out weak conditions in the advertising market. Under ordinary circumstances, one could have felt fairly optimistic about LEE’s current December quarter, as it typically witnesses a bump from holiday and seasonal-related advertising, but this year, it could be a bit of a stretch to expect those trends to play out given how vulnerable ad budgets are to a recession. In fact, NYT expects its digital ad revenues to decline by 10% in the December quarter.

I also suspect that LEE may have missed a trick by not coming to a takeover agreement with the hedge fund – Alden Global Capital last year, who were willing to offer $140m or $24 per share; that price would have represented a ~34% premium to current levels, and given the state of advertising, naysayers may question if the stock will hit those levels any time soon. Even if you want to talk up the prospects of the digital strategy, note that over 70% of the estimated $435m of digital revenue in 2026, will still come from digital ads and marketing (only 30% will come from subs).

In the previous section, I covered how attractively positioned the LEE stock looks compared to other alternatives, but if one pays attention to the chart’s own price imprints, I wouldn’t be overly enthused at this juncture. We basically have something akin to a falling wedge pattern, and whilst investors can always position themselves to exploit a potential breakout above the upper boundary of the wedge, I don’t believe that is the most optimal setup. The preferable option would be to wait for a pullback somewhere closer to the $17 levels (lower boundary of the wedge) which had previously served as a useful pivot point; the risk-reward at those levels would look a lot more attractive.

Be the first to comment