Marc Dufresne/iStock via Getty Images

During the COVID-19 pandemic, many companies across many industries were significantly negatively affected. But this is not true of every industry, nor every company within every industry. One market that fared particularly well during the pandemic and since then has been the recreational vehicle, or RV, market. Driven by the need for social distancing, combined with the shutdown of the economy, many people were driven to acquire RVs for the first time. Naturally, one of the companies to benefit from this is a firm called Lazydays Holdings (NASDAQ:LAZY). Having said that, there now appears to be some concerns over the company in the eyes of investors. After all, while demand in the market still remains strong, even management acknowledges that there is no knowing how much longer demand will remain robust like it has been. So there seems to be some concern that demand will eventually weaken. This is not an unreasonable way of thinking. Having said that, even if financial performance for the company were to revert back to what we saw during the firm’s 2020 fiscal year, shares might offer some reasonable upside.

A look at recent developments

Back in early November of 2021, I wrote an article detailing the positives and negatives associated with investing in Lazydays Holdings. At that time, I acknowledged that shares of the company were rather cheap. I pointed out the company’s improving top and bottom lines, particularly throughout the first nine months of its 2021 fiscal year. Having said that, I also pointed out that the company’s historical track record, namely on its bottom line, had been rather volatile and that risk existed because of that. To me, those things more or less evened one another out, leading me to rate the company a ‘buy’ prospect. Since then, the market seems to have disagreed with me to some extent. While the S&P 500 has experienced a decline in value of 4.2%, investors buying into Lazydays Holdings would have seen a loss of 9%.

Author – SEC EDGAR Data

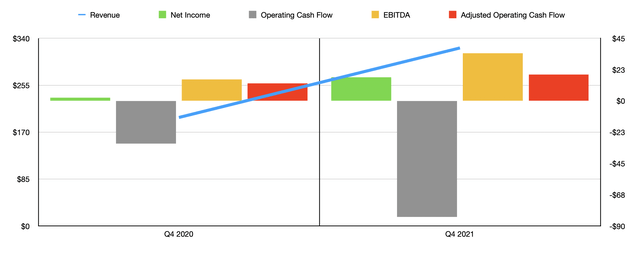

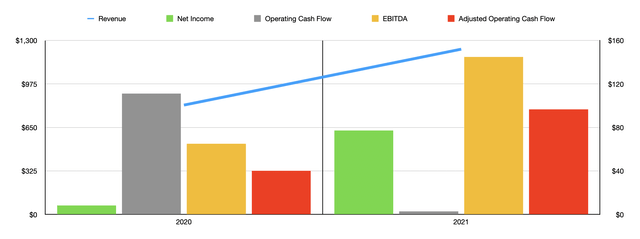

If you look at the picture from a purely fundamental perspective, this decline in value makes no sense. Consider, for instance, how the company fared in the final quarter of its 2021 fiscal year, the only quarter for which data was not available at the time of my last writing, but is available today. Overall revenue for the company during this time frame was $322.54 million. That implies a year-over-year growth rate of 64.1% compared to the $196.57 million the company reported one year earlier. As a result of this, overall revenue for the company came in at $1.24 billion. That is 51.1% higher than the $817.1 million in revenue the company generated in 2020.

Management attributed a significant portion of this increase to a couple of different factors. For instance, revenue for the firm’s new vehicles sold increased by 51.2% for the year, due to a combination of an increase in the number of new vehicle units sold from 6,151 to 8,932 (aided by the purchase of three additional dealerships in 2021), and as a result of a rise in the average unit selling price for new units of 6.3%. Even stronger was the increase in revenue associated with pre-owned vehicles. The growth rate here was 54.6%. Excluding wholesale sales, the rise in units was from 3,869 to 5,338. The company also saw average unit selling price grow by 15%. During the 2021 fiscal year, the company also experienced a 41.1% increase in revenue associated with the sale of parts, accessories, and related services, which also involves finance and insurance revenues.

Author – SEC EDGAR Data

Due to the strong performance on its top line, particularly the favorable price increases the company realized, overall profitability for the business came in strong. In the final quarter of 2021, net profits were $16.9 million. That compares favorably to the $2.2 million generated one year earlier. Overall net profits for the company totaled $77.2 million. This is after stripping out non-controlling interests for the company. This compares to the $8.3 million generated just one year earlier. Other profitability metrics for the company came in strong. Adjusted operating cash flow, which strips out changes in working capital and removes non-controlling interests from the equation, totaled $96.6 million. That compares to the $40 million generated in 2020. Meanwhile, EBITDA for the company expanded from $59 million to $144.9 million.

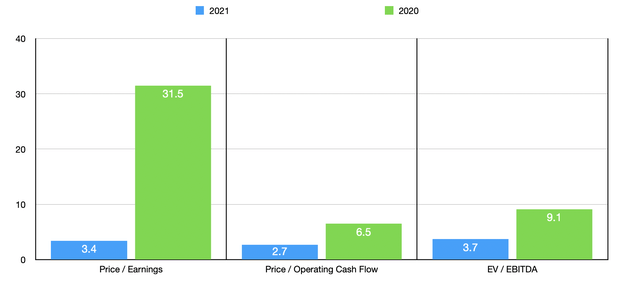

Taking this data, we can easily value the business. On a price-to-earnings basis, using the company’s 2021 results, we can see that shares are trading at a multiple of just 3.4. This compares to the 31.5 reading that we would get using the company’s 2020 results. The price to adjusted operating cash flow multiple of the company comes in at 2.7. This stacks up against the 6.5 reading that we get if we rely on 2020 figures. Another way to approach the company is to look at it through the lens of the EV to EBITDA multiple. This comes in at 3.7. By comparison, if we use the 2020 results for the company, this figure would rise to 9.1.

Author – SEC EDGAR Data

As I mentioned already, management is uncertain how long demand for the company’s products will remain robust. I think it would be a mistake for investors to buy into this business based on the notion that its multiples will remain as low as they are. At a minimum, investors should anticipate revenue and profits eventually declining back to what the company experienced in 2020. Some investors might want to look at data from years prior to that even. But it is important to note that the company has expanded by acquiring other dealerships, which means that some of its expansion is likely here to stay. Given all of this, I don’t see much of an issue in valuing the company based on its 2020 figures.

Stacking these numbers up against other automotive retailers, we end up seeing some interesting results. On a price-to-earnings basis, five similar firms that I looked at with a focus on the general automotive retail market as opposed to just the RV space, traded at multiples ranging from 4.9 to 23.4. In this scenario, using our 2021 results for Lazydays Holdings, our prospect was the cheapest of the group. If we use the price to operating cash flow approach, the range should be from 2.1 to 15.8. Lazydays Holdings was the second cheapest of the group. When we looked at the company through the lens of the EV to EBITDA multiple, it was cheaper than any of its peers as well. These five firms traded between a multiple of 4.2 and a multiple of 15.4.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lazydays Holdings | 3.4 | 2.7 | 3.7 |

| Sonic Automotive (SAH) | 4.9 | 5.6 | 6.7 |

| Advance Auto Parts (AAP) | 22.8 | 12.6 | 12.2 |

| O’Reilly Automotive (ORLY) | 23.4 | 15.8 | 15.4 |

| AutoZone (AZO) | 19.6 | 13.0 | 12.8 |

| Group 1 Automotive (GPI) | 5.0 | 2.1 | 4.2 |

It’s also worth noting that Lazydays Holdings does also have an interesting catalyst at this point in time. That is because, earlier this year, management announced that it received a proposal from B.Riley whereby that company would acquire Lazydays Holdings in a transaction valued at $25 per share. That represents an increase of 26.1% over the company’s current trading price. However, management swiftly rejected the offer, believing that the transaction significantly undervalued the business. I would happen to agree with this assessment. This is because, even using the company’s 2020 results, it would imply a price to adjusted operating cash flow multiple of just 8.2. Having said that, this could open the door for a higher offer or for other suitors to come in.

Takeaway

Based on the data provided, I will say that I am still quite bullish on Lazydays Holdings and its prospects. I do believe that fundamentals will eventually pull back since there’s only so much possible demand for RVs. Having said that, even if we revert back to levels of profitability experienced in 2020, shares of the business are trading at levels that are fundamentally appealing. From a price-to-earnings perspective, the stock does admittedly look pricey. It is also expensive relative to its peers when looking at it from a cash flow perspective. But on an absolute basis, using both cash flow and EBITDA, the company does look fundamentally appealing and affordable at this time. Add on the aforementioned catalyst and shares could experience a nice bit of upside before too long.

Be the first to comment