tdub303/E+ via Getty Images

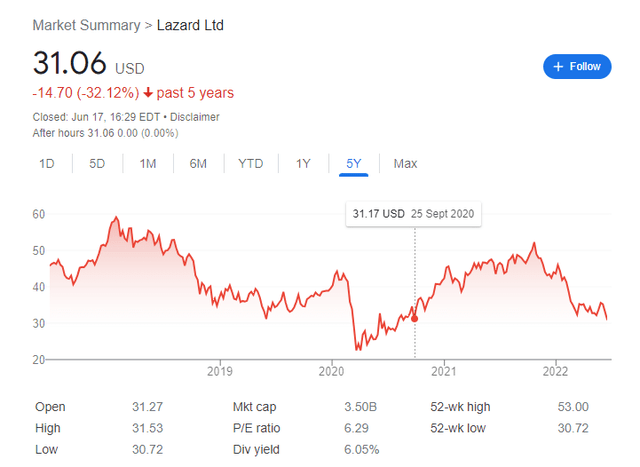

Lazard (NYSE:LAZ) is a stock that we covered back in 2020 together with the rest of the financial advisory businesses on the market. The company is pretty easy to understand, and we can see what direction the businesses are going in. With rising rates and general peaking even before the hammer officially came down, the M&A boom was bound to turn. Now with markets coming down hard, we can expect some meaningful financial outflows, and with nowhere really to hide in asset markets, and with crypto perhaps impairing consumer savings, these outflows may become more lasting than they were with COVID-19, where opportunities were still ample. Nonetheless, a restructuring franchise and other countercyclical elements to LAZ make it a story to follow, especially with the price so heavily retreated.

A Reminder Of Lazard’s Model

Let’s remind ourselves quickly of what LAZ actually does. It does financial advisory services, which encompasses M&A and typical capital market fundraising work, as well as asset management which includes mainly actively managed funds across the usual asset classes.

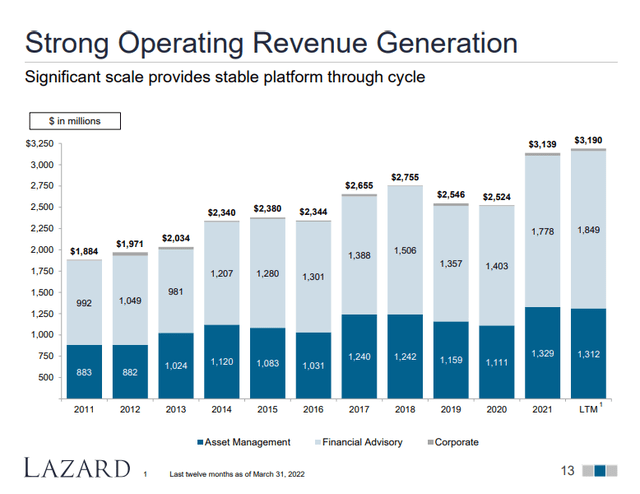

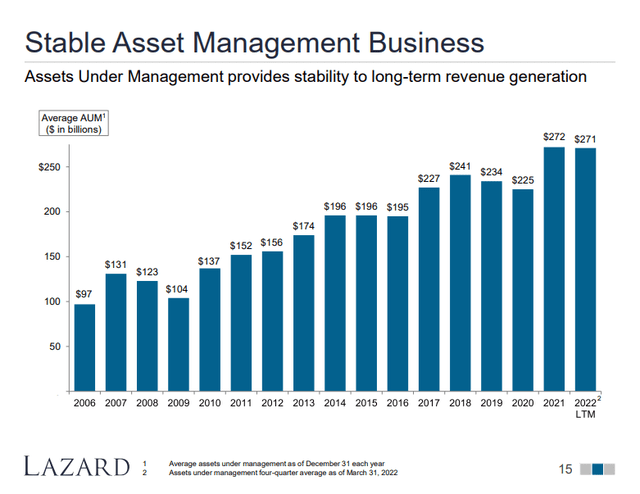

Traditionally we’ve called the split between these businesses pretty much 50:50, but because of the extraordinary M&A boom, financial advisory have moved ahead quite a bit. The asset management business is typically where we expect less cyclicality, and LAZ is focused on this in its investor materials.

The LTM figures show that on the FA side, revenue growth has decelerated, which is expected given the liquidity hose offered by monetary authorities during the pandemic, while in AM, which is a less levered business to all the liquidity, has declines somewhat, but lies meaningfully ahead of even 2019 levels.

What Could Come Next?

The issue is that there is nowhere to hide in the markets as we transition from inflation with higher rates. Cash and fixed income are still trash, even rolling over MM funds, because of rising rates or at least because of inflation. Equities are also quite trash because of the breaking of the TINA conditioning, the consumption risk from leverage and rising rates, and of course the corporate leverage too which will impact earnings. Where do you put funds to work? It’s difficult to say, and with crypto wiping out quite a bit of retail money, maybe those funds don’t get put to work, and they go into the household or liquid savings due to consumer uncertainty.

The FA segment will of course be affected by the current conditions, but where AM is usually more stable, it will also be substantially affected. Comparatively, we believe more in the FA business thanks to restructuring at LAZ, which is a well-respected franchise, and also the various capital markets functions that are a bit less cyclical than M&A. Moreover, with structural issues in the market due to geopolitics, defensive M&A could have higher importance than for example in ’08 and ’09 when the issue was a total credit throttle. Here the issues are more connected to the productive frontier, meaning M&A might still be needed to improve position.

Conclusions

With AM having fallen in terms of AUM by about 10% in 2020, we think a repeat performance is due, except the recovery in 2021 will not happen. We forecast a 15%-20% decline in current AM revenue with lost management and performance fees from AUM outflows and weak overall market performance. With FA, we expect a bit more downside, around 25%, where M&A could collapse 50-60% with restructuring, now at all-time lows, picking up the slack along with mitigated drops in capital market activities. Operating leverage isn’t too bad with a company like this, so we think that net income could fall 33% on a run-rate basis, which would normalise the LTM 6.2x PE at about a 9x. The 6.2x comes from the aggressive declines in LAZ price lately.

A 9x multiple on a normalised basis means that even post declines, the current earnings yield is over 10%. From a valuation perspective, that would mean about a 6% risk premium over expected forward risk-free rates. The business profile probably doesn’t quite warrant this, as the cash flows are attractive from both AM and FA businesses. However, with the direction clearly being to the downside for sentiment in the markets, certainly those LAZ are connected to, we think we’ll stay on the sidelines here for now.

Be the first to comment