MicroStockHub

This article is part of a series that provides an ongoing analysis of the changes made to Larry Robbins’ 13F portfolio on a quarterly basis. It is based on Robbins’ regulatory 13F Form filed on 8/11/2022. Please visit our Tracking Larry Robbins’ Glenview Capital Management Portfolio article for an idea on his investment philosophy and our previous update for the fund’s moves during Q1 2022.

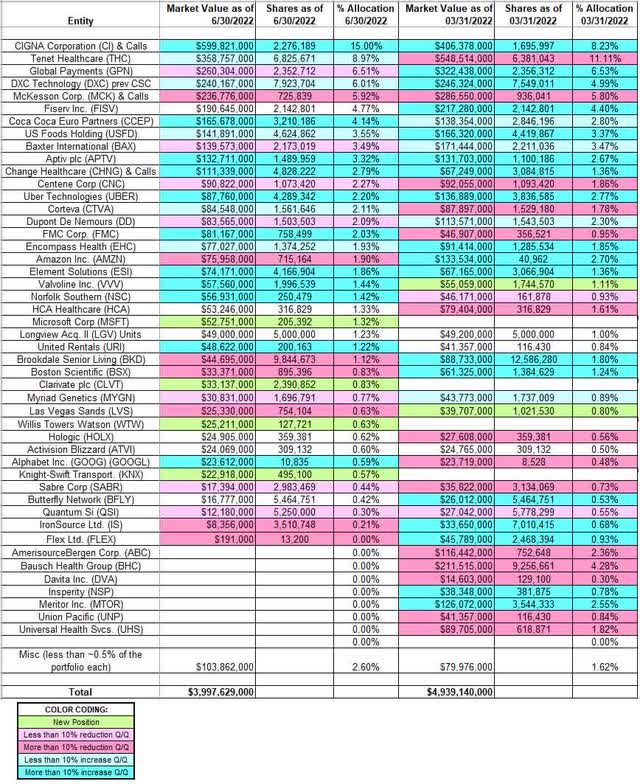

This quarter, Robbins’ 13F portfolio value decreased ~19% from $4.94B to $4B. The number of holdings decreased from 60 to 55. There are 40 positions that are significantly large. The focus of this article is on these larger positions. The top five stakes are Cigna, Tenet Healthcare, Global Payments, DXC Technology, and McKesson Corp. Together they are at ~42% of the 13F assets.

New Stakes:

Microsoft Corporation (MSFT), Clarivate Plc (CLVT), Willis Towers Watson (WTW), and Knight-Swift Transportation (KNX): These are small (less than ~1.5% of the portfolio each) new stakes established this quarter.

Stake Disposals:

Bausch Health Group (BHC): BHC was a 4.28% of the portfolio position established in Q3 2018 at prices between $20.50 and $27.50 and built over the next two quarters at prices between $17.50 and $28.50. H2 2019 saw a two-thirds stake increase at prices between $19 and $32. There was a ~50% reduction over the last two quarters at prices between ~$21.50 and ~$29.50. The disposal this quarter was at prices between ~$7 and ~$24. The stock is now at $7.26.

Meritor Inc.: The 2.55% Meritor stake was built during Q4 2021 and Q1 2022 at prices between ~$21 and ~$36. In February, Cummins (CMI) agreed to acquire Meritor in a $36.50 all-cash deal. The deal closed in August.

AmerisourceBergen Corp. (ABC): The 2.36% ABC position saw a ~30% stake increase in Q2 2020 at prices between $81 and $102. There was a stake doubling in Q1 2021 at prices between ~$96 and ~$119. Last two quarters saw a ~60% reduction at prices between ~$114 and ~$157. The remaining stake was sold this quarter at prices between ~$141 and ~$166. The stock currently trades at ~$148.

Universal Health Services (UHS): UHS was a 1.82% of the portfolio position built in H1 2020 at prices between $85 and $111. Q1 2021 saw a ~85% stake increase at prices between ~$125 and ~$143. There was a ~45% selling over the last four quarters at prices between ~$122 and ~$160. The disposal this quarter was at prices between ~$101 and ~$156. The stock is now at ~$106.

DaVita Inc. (DVA), Insperity (NSP), and Union Pacific (UNP): These very small (less than ~1% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Cigna Corporation (CI): CI is currently the largest position at ~15% of the portfolio. It is a long-term stake that has been in the portfolio since 2007. Recent activity follows: The two quarters through Q1 2021 had seen a ~43% increase at prices between ~$163 and ~$228 while next quarter saw a roughly one-third reduction at prices between ~$232 and ~$267. There was a ~15% trimming in Q4 2021 while the last two quarters saw a stake doubling at prices between ~$218 and ~$272. The stock is now at ~$294.

Tenet Healthcare (THC): THC is currently the second largest position at ~9% of the portfolio. It was established in 2012 at a cost basis in the low-$20s. The original position saw a ~40% increase in Q4 2013 at around $44. Recent activity follows. Last five quarters had seen a two-thirds selling at prices between ~$40 and ~$91. The stock currently trades at $63.81. This quarter saw a ~7% increase.

Note 1: Glenview still controls ~6.4 % of the business.

Note 2: In August 2017, Glenview’s two directors resigned from THC’s board citing irreconcilable differences. In March 2018, Tenet’s board reached an agreement with Glenview whereby they agreed to vote in favor of the board’s nominees in return for bylaw amendments.

DXC Technology (DXC), previously Computer Sciences Corp: DXC is a large (top five) ~6% of the portfolio stake. The position was established in Q1 2016 at prices between $27 and $34. The four quarters through Q3 2018 had seen a combined ~38% selling at prices between $75 and $96 while next quarter the stake was almost doubled at prices between $50 and $94. Q1 2019 also saw a ~20% stake increase at prices between $53 and $69. There was a ~53% selling over the three quarters through Q4 2021 at prices between ~$30 and ~$43 while last quarter saw a similar increase at prices between ~$29 and ~$39. The stock is now at $28.36. There was a minor ~5% stake increase this quarter.

Note: Computer Sciences Corporation and Hewlett Packard Enterprise (HPE) had announced a spin-merger transaction whereby HPE’s Enterprise Services business was to be spun-off and merged into CSC to form a new business DXC Technology. That transaction closed in April 2017. Terms called for CSC shareholders to receive one share of DXC for each CSC share held.

Coca-Cola Europacific Partners (CCEP): The 4.14% of the portfolio CCEP stake was built in H1 2021 at prices between ~$45 and ~$63. Last three quarters saw a ~45% stake increase at prices between ~$43 and ~$60. The stock currently trades at ~$50.

US Foods Holding (USFD): The 3.55% of the portfolio USFD position was purchased over the last two quarters at prices between ~$30 and ~$39 and it is now near the low end of that range at $31.96. There was a minor ~5% stake increase this quarter.

Aptiv PLC (APTV): The 3.32% of the portfolio APTV stake was built over the four quarters through Q3 2021 at prices between ~$94 and ~$170. There was a one-third selling next quarter at prices between ~$149 and ~$178 while the last two quarters saw a ~175% stake increase at prices between ~$86 and ~$174. The stock currently trades at $99.75.

Change Healthcare (CHNG): The current 2.79% CHNG stake was built over the last two quarters at prices between ~$19 and ~$24 and the stock currently trades at $25.46.

Uber Technologies (UBER): The 2.20% UBER stake was built in Q3 2021 at prices between ~$38.50 and ~$52. There was a ~70% stake increase over the last two quarters at prices between ~$20.50 and ~$44.40. The stock is now at $32.50.

Encompass Health (EHC): EHC is a 1.93% of the portfolio stake established in Q3 2021 at prices between ~$75 and ~$84. Last two quarters saw a ~220% stake increase at prices between ~$52 and ~$74. The stock is now near the low end of their purchase price ranges at $53.62. This quarter also saw a ~7% increase.

Alphabet Inc. (GOOG) (GOOGL), Corteva (CTVA), Element Solutions (ESI), FMC Corporation (FMC), Norfolk Southern (NSC), United Rentals (URI), and Valvoline (VVV): These small (less than ~2% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Global Payments (GPN): GPN is a top-three 6.51% of the portfolio position built over the last six quarters at prices between ~$120 and ~$218 and it is now at ~$136. There was marginal trimming this quarter.

McKesson Corp. (MCK): The large (top five) ~6% MCK stake was established during the five quarters through Q4 2017 at prices between $124 and $167. The position has wavered. Recent activity follows. Q3 2021 saw a ~28% increase at prices between ~$188 and ~$209 while in the last two quarters there was a ~60% reduction at prices between ~$245 and ~$336. The stock is now at ~$364.

Baxter International (BAX): The 3.49% of the portfolio stake in BAX was built over the three quarters through Q3 2021 at prices between ~$74 and ~$88. The stock currently trades below that range at $59.78. Last three quarters have seen only minor adjustments.

Centene Corp. (CNC): CNC is a 2.27% of the portfolio position purchased in Q2 2021 at prices between ~$59.50 and ~$74.50. The position was sold down by ~50% over the last two quarters at prices between ~$62 and ~$88. The stock currently trades at $92.90. This quarter saw a minor ~2% trimming.

DuPont de Nemours (DD): DD is a ~2% of the portfolio position that saw the stake almost doubled in Q2 2021 at prices between ~$75 and ~$86. Next quarter also saw a ~22% stake increase at prices between ~$67 and ~$79.50. The stock is now below the low end of those ranges at ~$59.55. Last three quarters have seen only minor adjustments.

Amazon.com (AMZN): AMZN is a 1.90% of the portfolio stake established over the last two quarters at prices between ~$136 and ~$185 and the stock currently trades at the low end of that range at ~$136. There was a ~10% trimming this quarter.

Boston Scientific (BSX), Brookdale Senior Living (BKD), Flex Ltd. (FLEX), ironSource (IS), Las Vegas Sands (LVS), Myriad Genetics (MYGN), Quantum-Si (QSI), and Sabre Corp. (SABR): These small (less than ~1.20% of the portfolio each) stakes were reduced this quarter.

Note: They have a ~7% ownership stake in Brookdale Senior Living.

Kept Steady:

Fiserv, Inc. (FISV): The 4.77% FISV position was primarily built last quarter at prices between ~$93 and ~$110 and the stock currently trades at ~$109.

Butterfly Network (BFLY): Longview Acquisition, a $345M SPAC sponsored by Larry Robbins did a ~$1.5B EV deal to merge with Butterfly Network (BFLY) in November 2020. The deal closed last February. The stock peaked at ~$27 per share and currently trades at $6.58. Butterfly Network pioneered a handheld portable ultrasound machine. Glenview’s stake is at 0.42% of the portfolio. Last quarter saw a ~10% stake increase.

Longview Acquisition II (LGV): LGV is a $600M SPAC sponsored by Larry Robbins. It had an IPO last March. The stock currently trades at $9.82, slightly below trust value.

Note: Regulatory filings show them owning 22.675M shares (26.3% of the shares outstanding) of Longview Acquisition II. ~17.2M shares in sponsor units which they got for $25K and the rest (5M units) purchased at IPO for $10 per share. Overall, their cost basis is less than $2 per share.

HCA Healthcare (HCA) and Hologic (HOLX): These very small (less than ~1.5% of the portfolio each) stakes were kept steady this quarter.

The spreadsheet below highlights changes to Robbins’ 13F stock holdings in Q2 2022:

Larry Robbins – Glenview Capital’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment