AlexLMX

Introduction

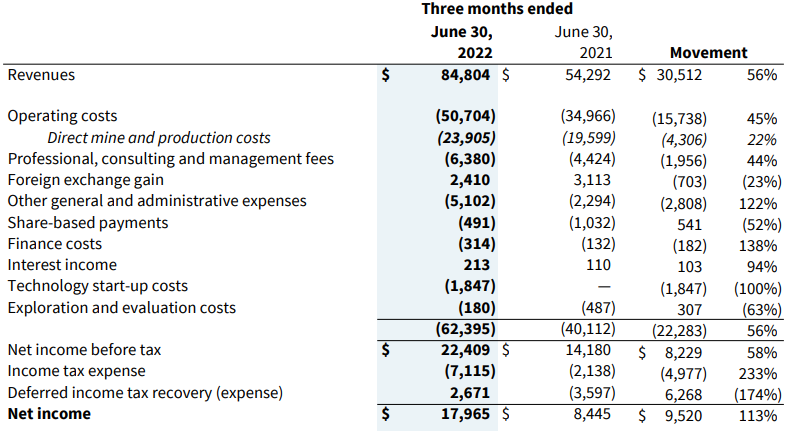

In June, I wrote a bullish article on SA about vanadium miner Largo (NASDAQ:LGO) in which I said that production was expected to improve over the remainder of 2022 and that vanadium demand was looking strong. Well, the company closed Q2 with a 56% annual jump in revenues and net income came in at $18 million.

However, Largo’s market valuation has been under pressure lately due to falling vanadium prices. The outlook for steel production in China for the coming months looks good and I expect this to lead to higher vanadium demand, which should lift the price of the metal. Let’s review.

Overview of the recent developments

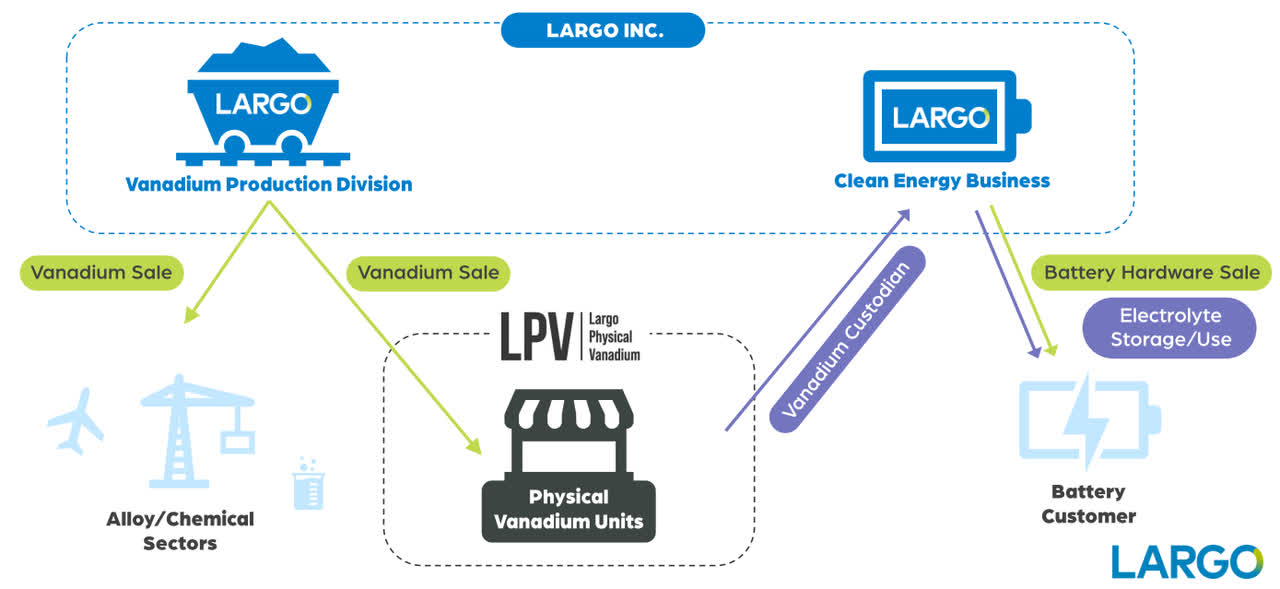

In case you haven’t read any of my previous articles on Largo, here’s a short description of the business. The company’s main asset is the high-grade Maracas Menchen vanadium mine in eastern Brazil. This is an open pit project with a life of mine of 20 years and its nameplate production capacity stands at 13,200 tonnes of vanadium pentoxide (V2O5).

Largo also has an early-stage U.S.-based clean energy business focused on vanadium redox flow batteries. Its first battery system is expected to be delivered in Q1 2023 and in April 2022, the company announced the creation of a listed physical vanadium company that is set to supply material for its batteries. Overall, I think that Largo’s clean energy business is at an early stage of development and it’s hard to estimate how much it could be worth at the moment.

Largo

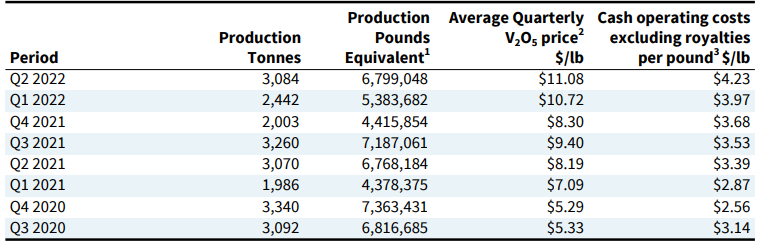

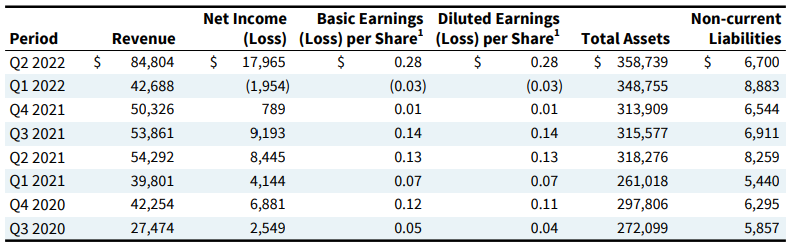

Turning our attention to the company’s Q2 2022 production and financial results, it was a strong period with an output of 3,084 tonnes of V2O5 as production rates recovered following high rainfall levels at the end of 2021 and a maintenance shutdown of the mine in February. Average selling prices improved by 3% quarter on quarter to $11.08 per pound and this boosted Largo’s revenues for the period to $84.8 million. Thanks to high vanadium prices, net income more than doubled year on year.

Largo Largo

However, the cash operating costs excluding royalties rose to $4.23 per pound from $3.39 per pound a year earlier despite similar production levels. The main reason behind this includes higher costs of critical consumables, such as HFO and diesel. It’s unclear when the prices of those could return to previous levels. Professional, consulting and management fees soared by 44% year on year to $6.4 million due to the creation of the clean energy and physical vanadium businesses. The clean energy business wasn’t fully operational yet in Q2 2021.

Largo

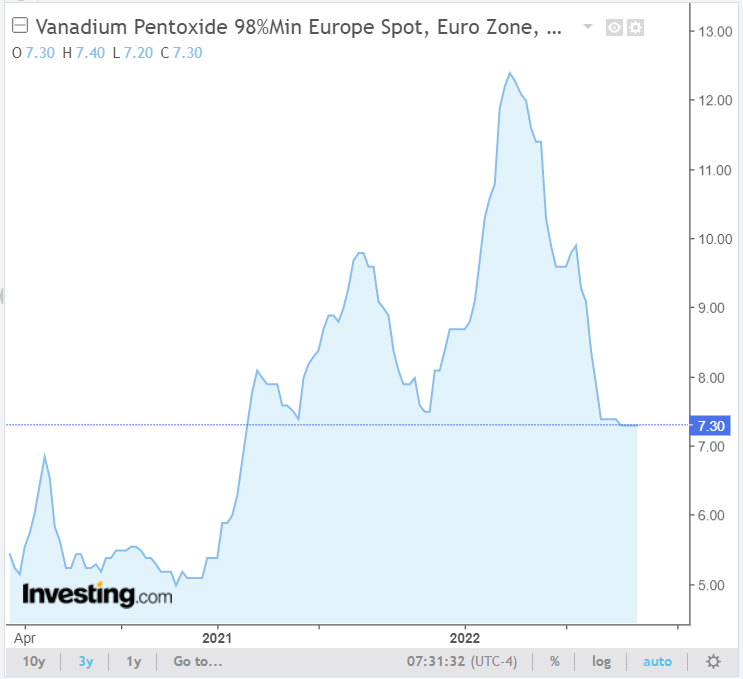

In addition, Largo revised its V2O5 production guidance for the year to 11,000-12,000 tonnes from 11,600-12,400 tonnes due to the operational challenges this year, while the cash operating cost excluding royalties guidance was increased to $4.10-4.50 per pound sold from $3.90-4.30 due to global inflationary pressures. What’s even worse is that V2O5 prices have been on a downward spiral since March as Chinese steel production declined due to high iron ore prices and limited demand from the troubled local property sector.

Investing.com

In my view, this could be a good time to invest in Largo shares as it seems that demand for vanadium is about to rebound in the coming months. China’s crude steel output rose by 2% month on month in August after two consecutive months of declines and demand is usually strong in September and October. According to S&P Global, market sources said that the government was unlikely to order steel output cuts in the coming months and finished steel inventories at steel mills and spot markets monitored by the China Iron and Steel Association fell by 7.2% month on month in August.

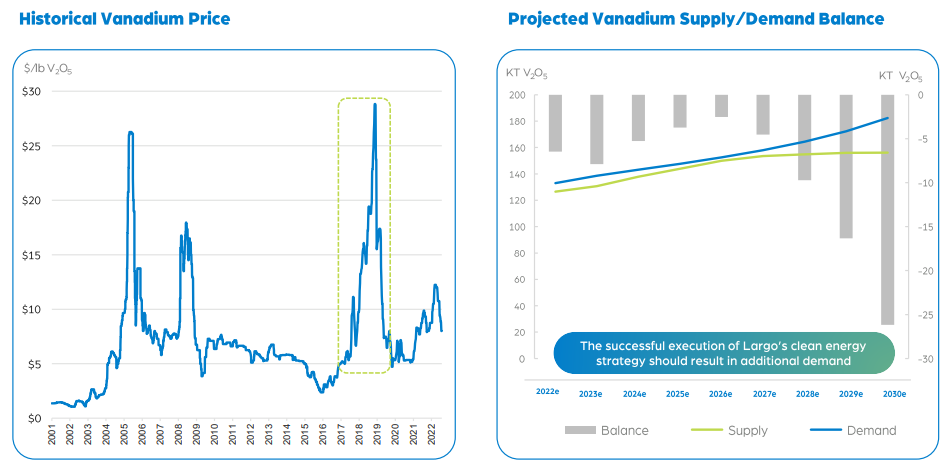

Considering that the vanadium market is expected to remain in a structural deficit for years to come, I expect average long-term prices to remain above the 25-year historical average of about $8 per pound.

Largo

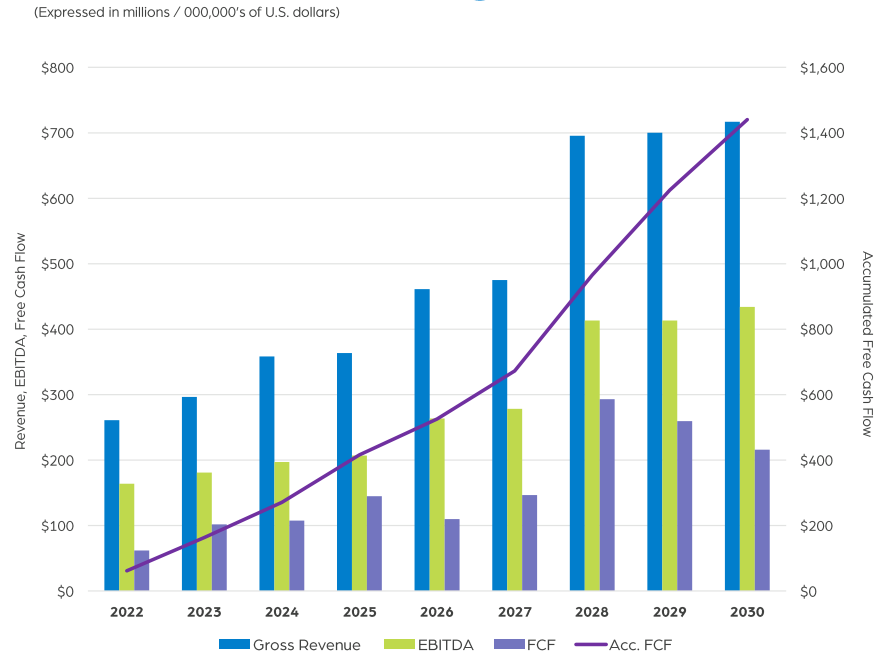

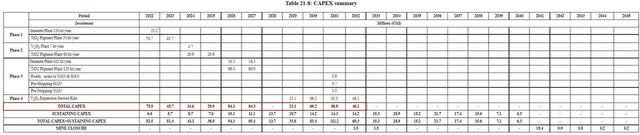

In view of the bright short-term and long-term prospects for vanadium prices, I think that Largo looks cheap at the moment. In late 2021, the company released an updated life of mine plan for Maracas Menchen which showed an after-tax net present value (NPV) of $2 billion at around $8 per pound for the majority of the life of mine. The new mine plan envisages titanium dioxide pigment as a by-product from 2024 and annual EBITDA is expected to top $200 million by 2025.

Largo

Largo has an enterprise value of $317 million as of the time of writing, which means that it’s trading at below 0.2x NAV. This is cheap for an intermediate mining company as they are usually valued in the 0.5-1.2x NAV range. Unfortunately, there are no peers in the vanadium mining space to compare with Largo as the only other pure play producer in this market is a small and unprofitable South African company named Bushveld Minerals (OTCPK:BSHVF).

So, what are the major risks for the bull case? Well, I think the main one is high vanadium price volatility. As the majority of global vanadium comes as co-product from Chinese steel mills this means that supply is inelastic, and prices are notoriously volatile. For example, vanadium prices hit a low of $2.25 per pound in 2015 before soaring to $29 per pound just three years later. In my view, the most likely scenario for low vanadium prices over the coming years includes a global recession as this is likely to lead to a weak property market. Depressed vanadium prices could be devastating for Largo’s expansion plans as the latest technical report for Maracas Menchen envisages total CAPEX of over $350 million by 2027.

Investor takeaway

Largo’s vanadium production rates have recovered to normal levels, but the company has cut its 2022 guidance due to recent operational challenges. In addition, inflationary pressures have led to an increase in the full year cash operating cost excluding royalties guidance.

On a positive note, I think that vanadium prices could start to recover soon as Chinese steel output seems to be increasing and this is set to lead to an increase in vanadium demand. Unless the world is about to enter a major recession, the vanadium market is likely to remain in a structural deficit over the coming years which should support high prices.

However, vanadium prices have been notoriously volatile historically and this is why I view Largo as a speculative buy. The company plans to invest over $350 million in Maracas Menchen over the next few years and a prolonged period of low vanadium prices could lead to funding issues and high stock dilution.

Be the first to comment