jcrosemann

Introduction

I’ve covered vanadium miner Largo (NASDAQ:LGO) several times on SA, the latest of which was in September when I said that it could be a good time to invest in the company as vanadium demand could improve over the coming months thanks to rising steel output in China.

Well, Chinese steel output is still low due to Covid-19 lockdowns, and this has led to a decline in vanadium prices. In addition, Largo had a challenging quarter. I think that the company’s Q4 financial results are unlikely to improve and that it could be best for investors to avoid the stock for the time being. Let’s review.

Overview of the recent developments

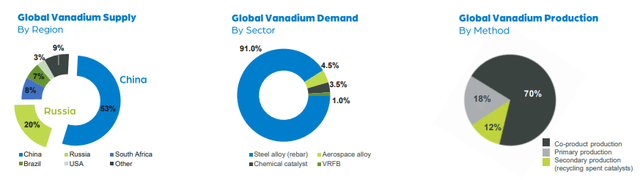

In case you haven’t read any of my previous articles about Largo, here’s a brief description of the business. The company owns the Maracas Menchen vanadium mine in eastern Brazil, which accounts for almost half of the primary global supply with an annual output of about 11,500 tonnes of vanadium pentoxide (V2O5). The nameplate capacity of the mine is 13,200 tonnes and the mine life is 20 years.

As you can see from the charts below, the majority of global vanadium comes as a co-product from Chinese steel mills. This means that vanadium supply is inelastic and this makes prices volatile.

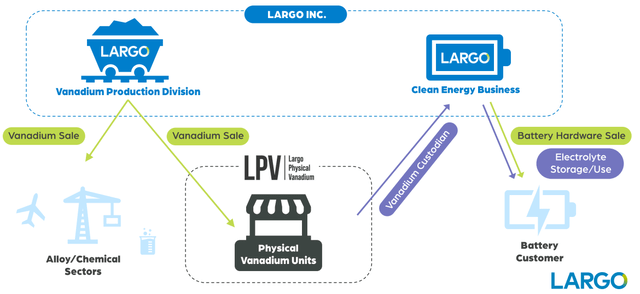

Largo also has a small U.S.-based clean energy arm focused on vanadium redox flow batteries, whose first project is a 6.1 MW energy system in Spain that is set to be delivered in Q1 2023. In addition, the company created a small physical vanadium company that is set to supply material for its batteries. The latter is named Largo Physical Vanadium (VAND:CA) and is listed on the Canadian Venture Exchange.

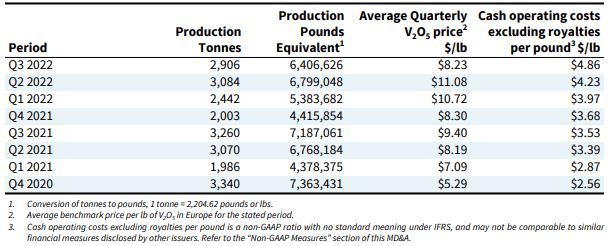

Turning our attention to the company’s Q3 2022 production and financial results, I think it was a weak quarter. Production declined to 2,906 tonnes of V2O5 as output was negatively impacted by a refractory refurbishment in the kiln and cooler in July as well as a low ore mining volume in September due to the transition to a new mining contractor. This pushed cash operating costs excluding royalties to $4.86 per pound. It seems that Q4 is also starting on a weak note as October production was just 804 tonnes. (see page 9 here).

Largo

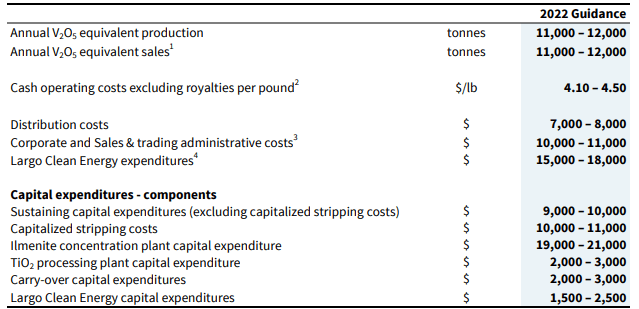

Considering this, I was surprised that the company kept its production guidance for the full year unchanged. Largo still expects to produce 11,000-12,000 tonnes with cash operating costs excluding royalties of $4.10-$4.50 per pound. In my view, this guidance seems too optimistic.

Largo

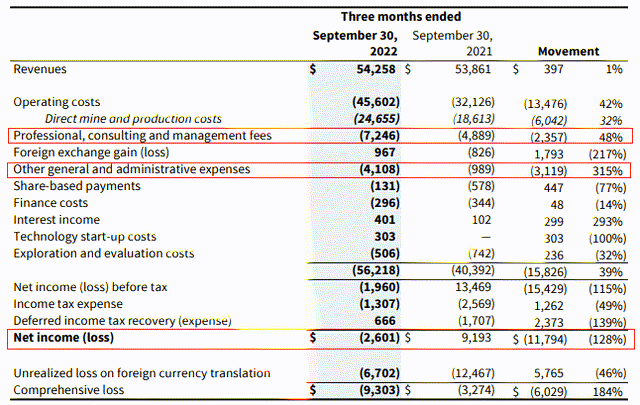

Looking at the financial results, Largo is still experiencing logistical challenges and elevated transport costs. Combined with the lower output, global vanadium prices continuing to fall and Largo Clean Energy boosting professional, consulting and management fees as well as other general and administrative expenses during the quarter, the company slipped into the red.

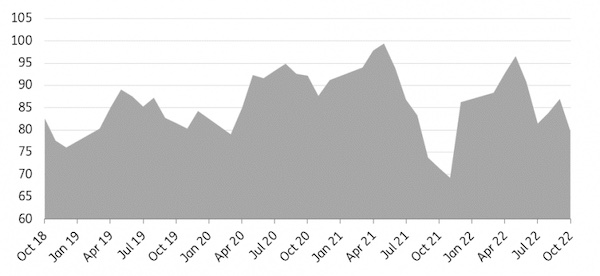

In my view, the Q4 financial results are unlikely to improve as vanadium prices are under severe pressure at the moment. You see, Covid-19 lockdowns in China have slashed both steel demand and supply over the past few months and negative margins have pushed several local steel producers to speed up annual year-end maintenance. According to Hellenic Shipping News Worldwide, Chinese steelmakers have already shut off at least 100,000 tonnes of daily output.

Largo

China monthly crude steel output in million tonnes:

WSA, ING Research

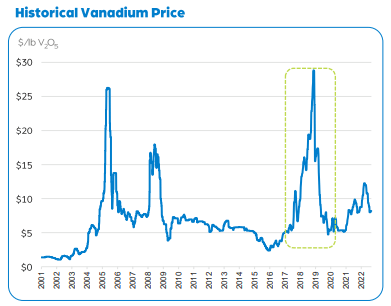

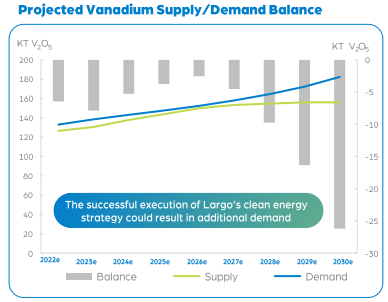

Looking at the long-term prospects, the picture is starting to look grim too. You see, the real estate market in China accounts for close to 40% of the country’s steel consumption. With a global recession looming, demand for steel and therefore vanadium is likely to be at depressed levels. The vanadium market was already in trouble from a pricing standpoint as the structural supply deficit was expected to almost disappear by 2026.

Largo

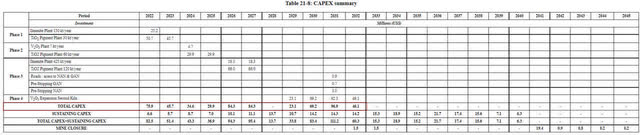

The main issue here is that Largo needs high vanadium prices over the coming years to fund its ambitious growth plans. In late 2021, the company released an updated life of mine plan for Maracas Menchen that showed an after-tax net present value (NPV) of $2 billion at around $8 per pound for the majority of the mine life. However, the total CAPEX was projected to come in at over $350 million by 2027. As of September 2022, Largo’s cash and cash equivalents were down to just $62.7 million. In addition, the company has to repay a $15 million credit facility in April 2023.

Overall, I just think vanadium prices are unlikely to increase over the next few months due to low steel production in China. Considering Largo’s October production was low, it seems this is going to be another weak quarter for the company. Looking at the long-term prospects, a global recession could put further pressure on the market, and considering the company has high CAPEX requirements over the coming few years, this could lead to significant stock dilution. That being said, I might be missing out here as vanadium prices are notoriously volatile. For example, they reached a low of $2.25 per pound in 2015 before soaring to $29 per pound just three years later. I might consider opening a position if vanadium prices slide to those depressed levels once again.

Investor takeaway

I continue to look at Largo as a value play considering Maracas Menchen has an after-tax NPV of $2 billion. In my view, this is the best vanadium mine in the world. However, 2022 isn’t shaping up as a good year for the company due to production issues and low vanadium prices. With the global economy expected to slow down in 2023, I think this is the wrong time to open a position. I’m changing my stance on the company to neutral.

Be the first to comment