bjdlzx

Laredo Petroleum (NYSE:LPI) previously grew by using at least some debt to the point where finances were somewhat stretched. The new management has emphasized adequate cash flow along with free cash flow. The transition from the previous way of doing business will take some time. However, the evidence is already beginning to come in that the new emphasis is changing results.

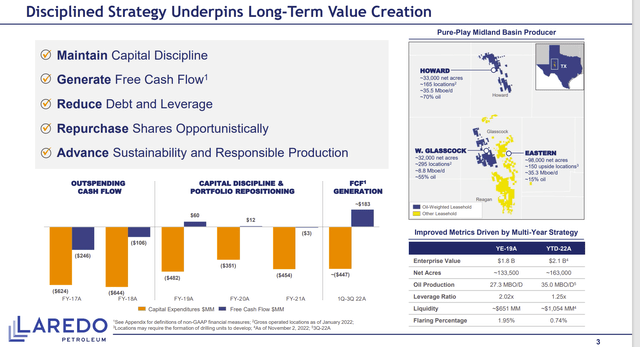

Laredo Petroleum Shift In Cash Flow Strategy Progression (Laredo Petroleum Third Quarter 2022, Corporate Conference Call Presentation)

Management began by acquiring the areas shown in blue because those areas have a higher percentage of oil production than the legacy areas. So far, those newly acquired areas have proven to be more profitable. That is pushing the cash flow from negative to positive as the percentage of oil produced climbs and as the amount of production from the more profitable leases also climbs.

That new acreage has been able to outperform the legacy acreage to the extent that the legacy acreage is reduced to maintenance for the time being. There are about 8 years of possible locations in the new acreage. That gives management plenty of time to decide how to proceed from the current situation. In the meantime, the new acreage is gradually lowering the company’s breakeven point as more new acreage production comes online.

This has led to positive cash flow for the first time (probably in the history of the company since the big oil price downturn in 2015). Mr. Market wants to see enough positive cash flow to repay debt at a decent pace before the stock breaks out of the current trading range. Management clearly has a pathway now for just that accomplishment. That is different from the recent past when free cash flow was negative; so management made debt reductions through things like one-time sales (of an owned pipeline for example). Mr. Market was less than happy with that strategy and the lending market was not impressed either. This led to a management change and a strategy change to the one shown above.

Robust commodity prices for oil and gas have also helped the cash flow situation. This company in effect got a double boost in profits. One boost came from the increasing oil percentage of production and the other profit boost came from rising commodity prices that aided profits on the very substantial natural gas production.

Nonetheless, the market has given a very cool reception to companies deemed to have too much debt for the next inevitable cyclical downturn. Despite the fact that this management does hedge to protect a minimum cash flow level, the market will likely wait to see lower debt levels no matter the level of better earnings reported in the current fiscal year. This appears to mirror a market response to any company that appears to have debt levels too high for the next cyclical downturn.

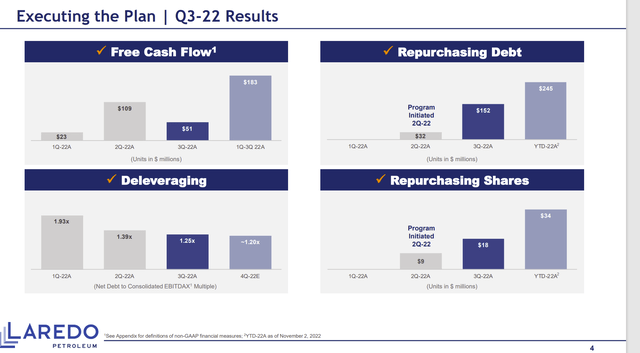

Laredo Petroleum Progress Made On New Strategy (Laredo Petroleum Third Quarter 2022, Earnings Conference Call Slides)

The company has had a long history of being cash constrained by operation priorities. Therefore, repaying debt is a relatively new idea to the market. Most likely the market will want to see more (probably a lot more) debt repaid before the stock price breaks out of its trading range.

The deleveraging does help. But a lot of the deleveraging will be attributed to higher commodity prices. This market wants to see conservative leverage ratios at considerably lower commodity prices from a lot of companies in the industry.

Increasing cash flow will come from drilling on the newly acquired properties that have a more profitable production mix. This company does not have to increase overall production to gain more cash flow. But it does have to increase the percentage of oil produced.

That makes the increasing amounts of cash flow attributed to debt repayments believable as long as there is not a major decline in oil prices from current levels. This company has a fair amount of production hedged to protect a minimum amount of cash flow. Management has promised to continue to reduce the amount of production hedged as debt levels decline.

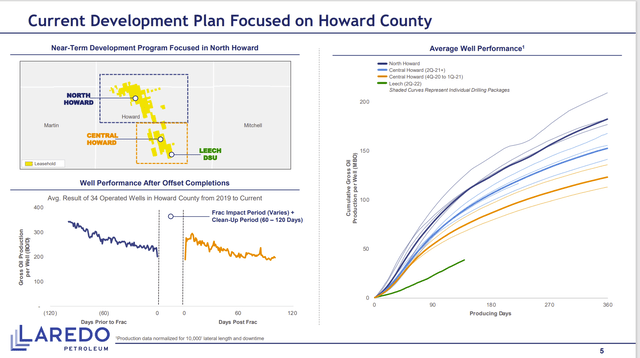

Howard County Well Performance And Well Locations (Laredo Petroleum Third Quarter 2022, Earnings Conference Call Slides)

The market became overly concerned with the well results of the one well group shown in green above. That well group is coming in below guidance on the graph. But there are enough locations doing better than expected to more than make up for this. Management may be able to get better results from that part of the acreage in the future with some adjustments. Right now, it is clear that at least some acreage has an issue in one interval.

However, that does not make all the acreage poor, nor does it diminish the long-term results. From the way the market reacted, one would have thought the cash flow goals were in danger because of one less than hoped-for result. Nothing could be further from the truth.

Actually, the opposite is true. As technology advances, more locations become commercial. There are intervals in the acreage and surrounding acreage that have not yet been explored. So, there is plenty of upside potential to more than offset any less-than-optimal results.

For as long as I have covered companies in this industry, management takes an occasional “stretch” that sometimes results in a below-average result like the one above. But that is usually followed by several relatively “safe” projects to bring average results back in line. It is how technology keeps advancing in the industry. Many times, service companies spread what works and what does not among operators.

Count on more calculated risks in the future. Some of those will succeed in extending the amount of commercial oil that can be produced. Sometimes it will be another interval. Other times the acreage derisked will be extended. Then, there is the third case which it is “back to the drawing board”.

Conclusion

The market has worried about one thing after another with this stock. If it was not the cash flow, then it was the well results. It seems like something was going to wreck the future and the market was determined to stay away until it happened.

But this management has set goals that appear to be met even with disappointments. The biggest change going forward should be the change in free cash flow. The previous management never had free cash flow.

The legacy acreage has a relatively high oil breakeven cost due to the very low pricing assumptions used for natural gas. That may change because the assumptions for natural gas prices are changing as more export capacity becomes available. Even though there are no assigned locations to the legacy acreage at the present time, that could change in the future with the ability to export natural gas.

In the meantime, the company has about 8 years of possible drilling locations on the newly acquired very profitable acreage. That cannot be all bad. There are additional intervals to explore for more upside potential.

The one group of wells was disappointing. But it appears that management will meet the overall guidance of well results. The market needs to remember that many times the guided well results are an average. It is rare for a whole package of wells to underperform (and management will have to further investigate the situation). But it happens in this business. Hopefully, management can resolve whatever issues have presented themselves in the future.

Also, management is likely to continue the acquisition strategy that served them so well on an opportunistic basis.

There has been a lot of operational improvement since the new management took over. Now let’s see what the future brings.

Be the first to comment