wildpixel

Somewhat appropriately, cryptocurrency prices are largely driven by U.S. monetary policy over the medium-term. And of course, over the past four months Fed policy tightening has taken a historic shift to combat entrenched energy inflation. The FOMC raised the target federal funds rate by .50% at the beginning of May, followed by two .75% increases in June and July. For perspective, there has only been one .75% or larger raise since 1990.

The Committee has also instituted an ongoing, large scale reduction in the Fed’s balance sheet, which will generally further tighten financial conditions and raise interest rates. In September, the potential and likely monthly balance sheet roll-off of Treasury securities is $60 billion, with mortgage backed securities at $35 billion. One way to think about this plan is that it represents the reversal of the prior monetization of these debts; this will tend to make government debt service more expensive and may reduce funds availability in the banking system for loans, including mortgages.

Over this short time, Bitcoin (BTC-USD), Ethereum (ETH-USD) and the midcap altcoins have on average traded down 40%-60%. Likewise, the Nasdaq Composite is down about 8% over this same period. But a question does remain. Will this correction continue and what is the near-term outlook for risk-on, interest rate sensitive assets going forward?

Interestingly, this important moment in monetary policy comes during a pivotal point for the crypto space. In the coming weeks Ethereum will shift from a proof-of-work mechanism for verifying and tracking transactions, to a proof-of-stake consensus. This switch lays the ground for future optimizations and its importance can’t be overstated because of the size, complexity and storied history of the Ethereum platform. So how does the upcoming seminal moment for cryptocurrency with The Merge fit with the most recent monetary policy news?

The article below first updates The Merge progress and where things stood with the FOMC following the July meeting. In the middle section, the surprising and somewhat hard to understand remarks of Chair Powell at the recent Jackson Hole symposium are considered along with the August jobs report. As conclusion, a price scenario for Ethereum and the crypto market more broadly post The Merge is given; this is coupled with a low confidence outlook for Fed policy actions at the September FOMC meeting that is set to fall less than a week following the Ethereum shift to proof-of-stake.

Practicing for Proof-Of-Stake and the July FOMC Meeting

At the beginning of July, the Ethereum platform got an important rehearsal for The Merge on the mainnet with a successful merger on the key Sepolia testnet. Once fully reviewed, the Sepolia practice and follow-up work gave good indications that there would be a near-term merge on the mainnet following another, last test in August. This growing optimism was closely followed by more supportive news out of the Fed.

Through May and June, Chair Powell struck a strong hawkish tone. But in his press conference following the FOMC meeting at the end of July, Powell presented a more balanced policy outlook for the remainder of the year. A few dovish statements jumped out in contrast to the overall tenor of resolve to fight inflation.

And it’s also worth noting that these rate hikes have been large and they’ve come quickly. And it’s likely that their full effect has not been felt by the economy. So, there’s probably some additional tightening, significant additional tightening in the pipeline.

We’re not trying to have a recession. And we don’t think we have to.

…now that we’re at neutral, as the process goes on, at some point, it will be appropriate to slow down. And we haven’t made a decision when that point is, but intuitively that makes sense, right? We’ve been front-end loading these very large rate increases, and now we’re getting closer to where we need to be.

As I mentioned in my remarks, I think you pretty clearly do see a slowing now in demand in the second quarter. Consumer spending, business fixed investment, housing, places like that.

There’s some evidence that wages, if you look at average hourly earnings, they appear to be moderating.

But the slowdown in the second quarter is notable. And we’re going to be watching that carefully.

Source: Transcript of Chair Powell’s Press Conference, federalreserve.gov, 7/27/2022

And in the days following Powell’s remarks, the U.S. 10 Year Treasury yield was at 2.61%, a three-month low.

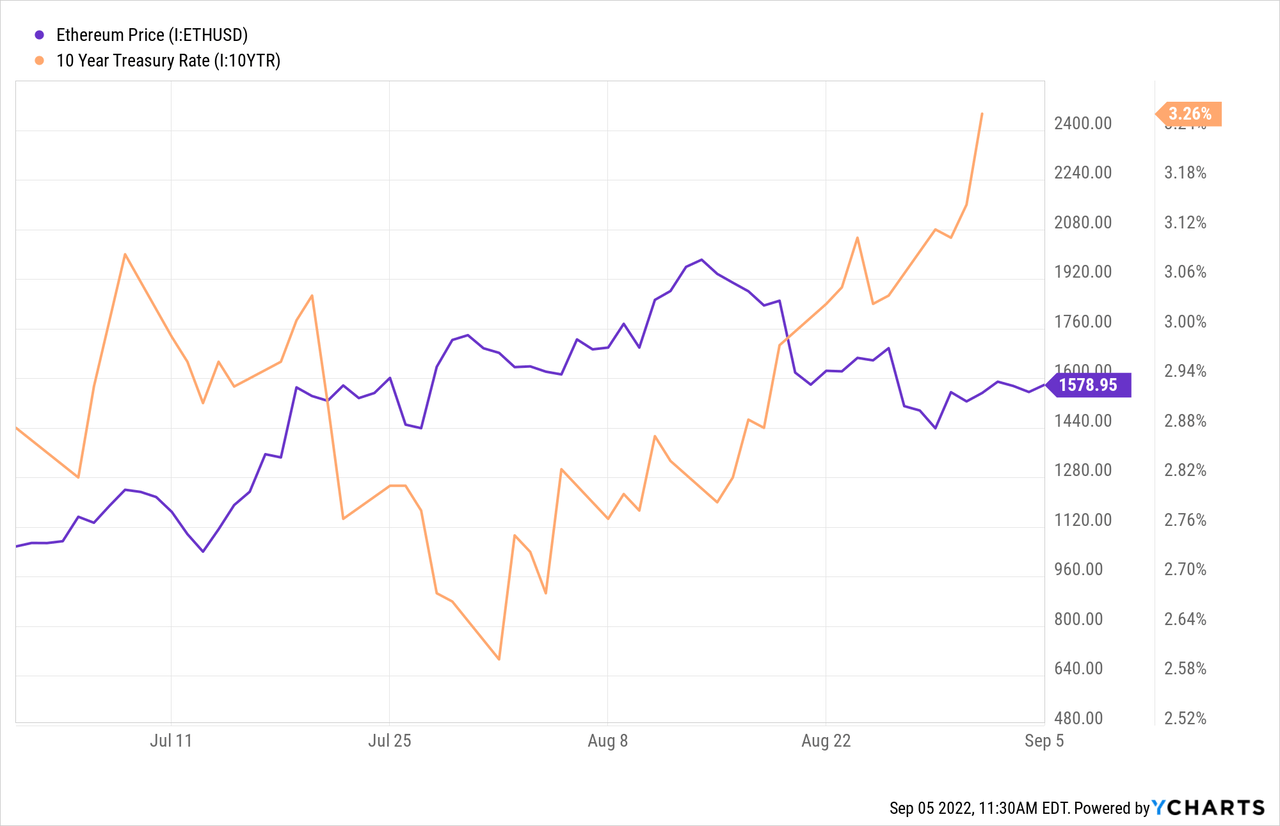

Looking to the graphic below for the last two months, there is not an exact inverse correlation between rate expectations as represented by the yield on the 10 Year Treasury and the price of Ethereum. However it is somewhat characterized by Ethereum generally wanting to press higher with positive news on progress toward The Merge, but under pressure when rate expectations increase from an “unfavorable” economic release or strong hawkish Fedspeak.

Bookending the July FOMC meeting was the merge on the final public testnet called Goerli which occurred during the first two weeks of August. Similar to Sepolia discussed above, the test was generally successful and adequate to move on to The Merge. Within of few days of the merge on Goerli, the date for the beginning of the The Merge on the mainnet was set for September 6th, with the final transition now estimated for September 14th or 15th. A link to track The Merge’s approach can be found here.

Powell’s Jackson Hole Speech and August Jobs Report

The building excitement, and to some degree prices, ran into Jerome Powell’s Jackson Hole speech on August 26th. The speech was remarkable and astonishing, both for what was said and what was left out. Above are listed a number of substantial, softening caveats Powell made during his July FOMC press conference. These caveats were all but gone from the more recent Jackson Hole speech. Below are the highlights of the renewed hawkish stance. To quickly paraphrase, Powell said the focus was solely on inflation, there would be pain, strong action will have to continue for some time, and it is better to err on the tighter side.

Today, my remarks will be shorter, my focus narrower, and my message more direct. The Federal Open Market Committee’s overarching focus right now is to bring inflation back down to our 2 percent goal.

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.

While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.

In current circumstances, with inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause.

History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting.

Source: Monetary Policy and Price Stability, Jerome Powell/Jackson Hole, federalreserve.gov, 8/26/2022

Friday’s August jobs report slightly softened the outlook for Fed policy tightening. The headline number was weak as the unemployment rate increased to 3.7% from 3.5% in July. As important, the labor force participation rate grew by 0.3 percentage points, a sharp uptick. This is an indicator that the labor shortage pressure on wages and inflation could abate.

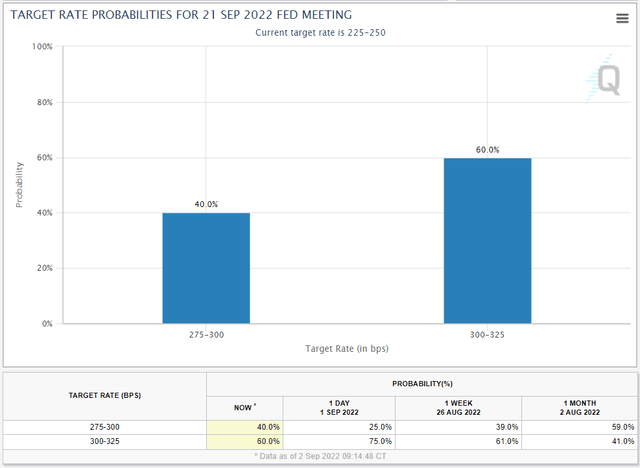

In the days following Powell’s Jackson Hole speech, CME futures placed a 75% chance of a .75% rate hike at the September FOMC meeting. Though it rebounded this week, this chance fell to 60% following Friday’s August jobs report. The data at the bottom of the following graphic tracks the change in these expectations over time. A link to the site is here and note that target rate probabilities for other months’ meetings are available as well.

CME Group

Prediction for Post The Merge Prices and the September FOMC

Surprisingly, Ethereum has not shown decupling from Bitcoin or the broader market sentiment during the recent period of increased certainty of The Merge. This could change over the following week and I am expecting Ethereum to outperform Bitcoin by low double digits.

On September 13th just prior to The Merge, August CPI figures will be released. If these numbers come in close to consensus, they likely won’t have a significant effect on the crypto sector. My estimate is for a flat headline number at 8.5% for the 12-month change alongside a moderate .3% rise for the one-month change.

The first two to three days post The Merge will be volatile. There will inevitably be issues which will take time to determine the significance of and to rectify. At the end of this period of volatility I am targeting $1715-$1800. This could be characterized as a “sigh of relief” rally without an immediate “sell the news” effect.

Quick on the heels of the aftermath of The Merge, the FOMC meets September 20th and 21st. Despite Powell’s strong talk at Jackson Hole and the unexpected strength of the FOMC’s summer hawkishness, there are two reasons to believe this meeting will see a small but meaningful pivot to only a .5% increase in the federal funds rate.

Beyond the general weakening in economic indicators, the Fed has a history of avoiding political implications. The September meeting will set the stage for the U.S. midterm election season and members likely wish to project a more balanced and calm tone. And another “unusual” .75% rate hike could further spook markets just as the yield on the 10 Year Treasury is already setting fresh four-year highs. Put slightly differently, FOMC members may be unlikely to convey heightened consternation concerning inflation if they believe it could be used politically.

The Fed is also well ahead of the ECB in tightening and European policy makers have maintained lower rates for longer. Though there is uncertainty, the dollar’s strengthening and the recently staunch U.S. rate policy may tend to worsen the energy crisis in Europe. The FOMC recognizes this possible dynamic and a new “natural gas” mention and a yield deferential quote could be found in the same paragraph of the July FOMC minutes.

Investors’ concerns about global economic growth intensified amid weaker-than-expected data on economic activity and uncertainty about the supply of natural gas from Russia to Europe…

The dollar appreciated somewhat further against most currencies and particularly against the euro as yield differentials between the United States and the euro area widened.

Source: Minutes of the Meeting of July 26–27, 2022, federalreserve.gov, 8/17/2022

While natural gas reserves are now high across Western Europe and above 81% of capacity, supplies may be constrained going into the new year. This is especially true if the Russian stoppage continues. Substantial energy and gas price hikes, such as the 80% cap raise in Britain, are already set for the coming winter in a number of countries. Interestingly, consumer interest in wood for heating has reportedly shot up in Germany and Poland. The FOMC may, on balance with other factors, consider their effects on general global stability in the September rate decision.

If these two factors play out to soften the Fed stance, it would generally be supportive of Ethereum and the crypto sector during the period of waning interest following The Merge. This could prove important because despite the transition to proof-of stake, staked Ethereum will remain locked until an upgrade in the weeks following The Merge. And it is generally thought institutional investors may stay on the sidelines until the staking mechanism allows withdraws.

My new marketplace service is coming soon. Complete Crypto Analytics is launching in the near future and will have in-depth, dedicated macro coverage. Please keep reading my articles here for updates so you can reserve your spot as a Legacy Discount Member. There will be a generous introductory price for early subscribers. Thank you for following my work.

Be the first to comment