FG Trade

One of the downsides to being a value investor is that the search for value can often lead to underestimating the prospects of companies that don’t look particularly cheap. One really good example that I can point to when it comes to this is the case of Lamb Weston Holdings (NYSE:LW), a business focused on the production, distribution, and marketing of value-added frozen potato products. To remove any question of precisely with the company provides, its primary product is the portfolio of frozen French fries that it makes available to its customers. Because of how shares were priced months ago, I felt rather neutral about the company. But since then, shares, profits, and cash flows have all roared higher. Add on top of this the fact that management recently increased guidance, and it’s difficult to remain anything other than bullish on the company moving forward.

Continued improvements

The last time I wrote an article about Lamb Weston was back in June of 2022. In that article, I acknowledged that the company had performed exceptionally well over the prior few months. That performance had sent shares of the company soaring. Despite this, I felt as though shares of the company were looking rather lofty. Though in my defense, I was also influenced by the fact that management warned investors about the second half of the 2022 fiscal year and what that might look like. That rhetoric, combined with my assessment of how shares were priced, led me to rate the company a ‘hold’ to reflect my view at the time that shares should generate upside or downside that would more or less match what the broader market would achieve. So far, that call has proven to be something of a flop. While the S&P 500 is down 2.9%, shares of Lamb Weston have generated upside of 34.5%.

This massive return disparity can be explained only by looking at the fundamental performance of the company. To start with, we should touch on how the company performed during the second quarter of its 2023 fiscal year. This is the most recent quarter for which data is available and it was just released on January 5th. During that quarter, sales came in at $1.28 billion. That’s 26.8% higher than the $1.01 billion generated the same time last year. In addition to coming in far higher than what the company achieved last year, it also beat the expectations set by analysts to the tune of $130 million. Although the company experienced growth across the board, most of the growth came from a 34% increase in both the Global segment of the company and its much smaller Retail segment. Under the Global segment, price and product mix changes added 31% to the company’s revenue, while volume increased by 3%. On the volume side, growth in international shipments, an acquisition, and strength in the domestic QSR (quick service restaurant) category, all contributed to the company’s top line expansion. The increase in price and product mix was largely driven by management’s ability to pass inflationary pressures onto its customers. Under the Retail segment, the company benefited from a 43% contribution in growth from price and product mix, some of which was offset by a 9% decline in volume. Despite this volume decline, management asserted that consumer demand for frozen potato products remained strong and that the supply chain disruptions and issues of the company’s production facilities were largely responsible for the weakness in the quantity of products sold.

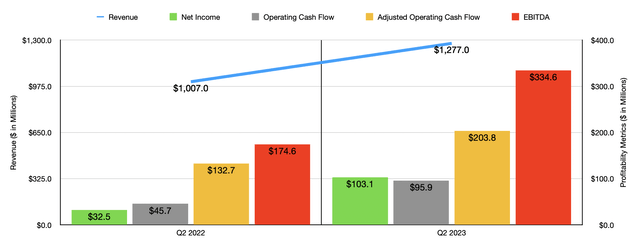

This rise in revenue brought with it increased profitability. Net income of $103.1 million dwarfed the $32.5 million reported the same time one year earlier. On a per-share basis, using non-GAAP figures, profits came in at $1.28. This beat the expectations set by analysts in the amount of $0.54 per share. Operating cash flow more than doubled from $45.7 million to $95.9 million. If we adjust for changes in working capital, meanwhile, it would have grown from $132.7 million to $203.8 million. And over that same window of time, we also saw EBITDA increase from $174.6 million to $334.6 million. Although the increase in sales certainly helped, what was more instrumental was the 86% surge in gross profit as price increases more than offset inflationary pressures. In short, the company is proving itself to be a tremendous beneficiary of current economic malaise.

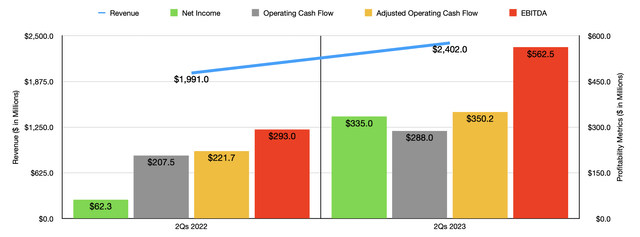

The second quarter of 2023 was not the only time in which the company experienced nice upside. For the first half of 2023 as a whole, revenue came in at $2.40 billion. That’s 20.6% higher than the $1.99 billion reported one year earlier. Net income shot up from $62.3 million to $335 million. Operating cash flow expanded from $207.5 million to $288 million, while the adjusted figure for this increased from $221.7 million to $350.2 million. And finally, EBITDA nearly doubled from $293 million to $562.5 million. Thanks to this robust financial performance, particularly in the second quarter, management decided to increase guidance for the 2023 fiscal year in its entirety. Sales should now come in at between $4.8 billion and $4.9 billion. This compares to the prior expected range of between $4.7 billion and $4.8 billion. The firm is also forecasting net income of between $580 million and $620 million. By comparison, prior guidance had this number at between $485 million and $535 million. And finally, EBITDA should total somewhere between $1.05 billion and $1.10 billion. Previously, management pegged this number at between $840 million and $910 million. The firm has not provided any guidance when it comes to operating cash flow. But if we assume that it will increase at the same rate that EBITDA is expected to, then we should anticipate a reading on an adjusted basis of $746.6 million.

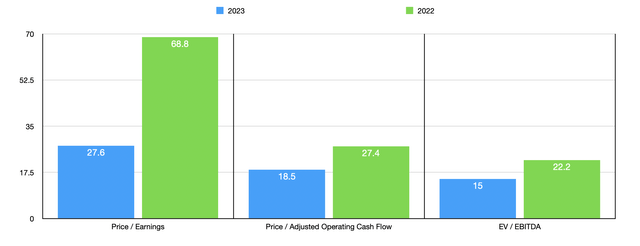

Based on these numbers, the company is trading at a forward price-to-earnings multiple of 27.6. The forward price to adjusted operating cash flow multiple comes in at 18.5, while the forward EV to EBITDA multiple should be 15. By comparison, using the data from 2022, these numbers should be 68.8, 27.4, and 22.2, respectively. When it comes to valuing the company, we are left with a rather tricky situation. Given the rapid improvement in bottom line results, the company looks to be priced significantly differently for 2023 than for 2022. As part of my analysis, I decided to compare the company to five similar firms. But in this case, I’m using recent data as opposed to forward estimates. If we compare the company’s numbers for 2023 to how these firms are valued, then we end up with shares looking more or less fairly valued relative to the competition, with three of the five competitors trading cheaper than it on a price-to-earnings basis and on an EV to EBITDA basis, while when it comes to the price to operating cash flow approach, only two are cheaper. But as the table below illustrates, if we use the data from 2022 for Lamb Weston, we can see that it is the most expensive of the group on a price-to-earnings basis while being cheaper than only one of its peers using the other two approaches.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lamb Weston Holdings (2023 Data) | 27.6 | 18.5 | 15.0 |

| Lamb Weston Holdings (2022 Data) | 68.8 | 27.4 | 22.2 |

| Campbell Soup (CPB) | 21.4 | 15.7 | 13.6 |

| Cal-Maine Foods (CALM) | 9.9 | 8.4 | 5.5 |

| Hormel Foods (HRL) | 25.2 | 22.3 | 17.1 |

| McCormick & Company (MKC) | 33.0 | 32.3 | 23.9 |

| Flowers Foods (FLO) | 28.1 | 19.1 | 14.8 |

Takeaway

Depending on how you value Lamb Weston, shares could either look fairly valued or pricey on a relative basis. On an absolute basis, shares are definitely a bit lofty. Having said that, there is no denying that the fundamental picture for the company has improved at a rapid pace. Although volume declines could be a sign of weakness ahead, management seems to think otherwise. And if the company can continue increasing its margins by passing costs on to its customers, then I see little reason to be pessimistic. For sure, the company is not a value prospect. But given recent fundamental performance, I do think that an upgrade to a soft ‘buy’ it is not unreasonable.

Be the first to comment