real444

Lam Research (NASDAQ:LRCX) announced FQ1 2023 (ending Sept. 25, 2022) financials on October 19, 2022. CEO Tim Archer and CFO Doug Bettinger made several comments about Memory and China sanctions:

1. “We see memory bit shipments tracking below end demand for the next few quarters. In our normal cadence, we would provide our first view of 2023 WFE on our January earnings call.”

2. “Deferred revenue was $2.8 billion and grew in the September quarter by approximately $550 million. With macro conditions weakening and wafer fab equipment spending declining, I expect deferred revenue and backlog levels will come down as we exit the December quarter.”

3. “For calendar year 2023, we estimate the total revenue impact from these restrictions to be in the range of $2 billion to $2.5 billion.”

My focus in this article is how Lam guided that revenues for the F2Q 2023 quarter, which will end on December 24, 2023, will grow from $5.07 billion in the recent quarter to $5.10 billion. But it will also show how Lam revenue stands to drop 30% in CY2023 on China sanctions and a cyclical WFE (wafer front end) downturn.

Vague Guidance Without Granularity

Memory Meltdown

In the recent earnings call, CEO Archer noted:

“We see memory bit shipments tracking below end demand for the next few quarters. In our normal cadence, we would provide our first view of 2023 WFE on our January earnings call.”

Where’s the beef? We have to wait until 2023 to be told of impact when Guidance was given for this current quarter (F2Q 2023).

It is common knowledge that the memory chip sector is going through a down cycle, brought on by macroeconomic forces, which I discussed in my October 12, 2022 Seeking Alpha article entitled “Memory Collapse And China Sanctions: Equipment Companies Most Impacted.”

For Micron (MU), President and CEO Sanjay Mehrotra reported:

“Our technology and manufacturing leadership in both DRAM and NAND, deep customer relationships, diverse product portfolio, and strong balance sheet put Micron on solid footing to navigate the weakened near-term supply-demand environment. We are taking decisive steps to reduce our supply growth including a nearly 50% wafer fab equipment capex cut versus last year, and we expect to emerge from this downcycle well positioned to capitalize on the long-term demand for memory and storage.”

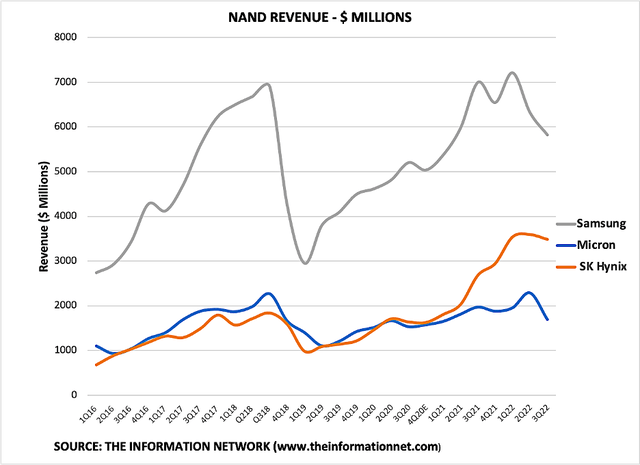

Chart 1 shows NAND revenue for Micron, Samsung Electronics, and SK Hynix (OTC:HXSCL). It illustrates the memory meltdown for the three companies. It shows the significant drop of DRAM revenue, in Q3 2022, even before the announcement discussed above.

The Information Network

Chart 1

China New Sanctions

The U.S. government has announced additional restrictions on the Chinese semiconductor industry, prohibiting the export of production equipment related to 18nm DRAM and 128-layer or higher 3D NAND.

AMAT immediately revised its estimates after market close on October 12 that the new regulations will reduce its fourth-quarter net sales by approximately $400 million, plus or minus $150 million. The revised net sales outlook reflects the impact of the new export regulations partially offset by supply chain performance improvements. More can be learned from my October 18, 2022 Seeking Alpha article entitled “Applied Materials: China Sanctions Can Cost Significantly More Than $1.1 Billion With IP Theft.”

From Lam, CEO Archer said in the earnings call:

“We expect next year’s WFE to be down more than 20% with memory investments accounting for a large portion of that decline.”

Again, the vague guidance and lack of granularity tells us nothing about the current F2Q 2023 quarter.

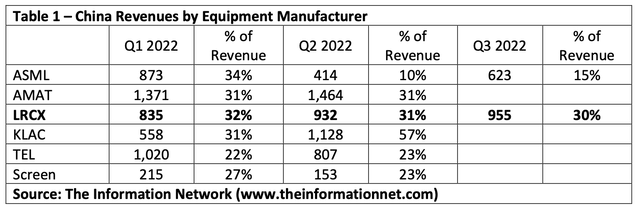

Table 1 shows revenues for LRCX and other equipment companies from customers in China as a percentage of total revenues, according to The Information Network’s report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.”

Only LRCX and ASML have reported so far this quarter. But note these revenues are a lagging indicator, since China sanctions were not announced until October 7, 2022, which is after CQ3 earnings for all but Applied Materials (AMAT).

The Information Network

Investor Takeaway

Can LRCX Recover Lost Markets?

Stacy Rasgon, an analyst from Bernstein Research, asked the question during the conference call:

“All right. Yes, I’ll take that. For my follow-up. If I look at the WFE guidance for next year, again, down 20% or more from the low 90s, puts at about $70 billion. You said it includes the China sanctions, would it have been higher without those China sanctions? Are you assuming that some of that China capacity gets redeployed to other players? Like is that — what do those puts and takes look like?”

Doug Bettinger, Lam CFO responded:

“No, we that — that makes an assumption that the vast majority of that China WFE just comes out of — and I don’t — if your question is, could somebody else spend what those customers were going to spend to put the same equipment or capacity in place. Our view right now, I mean, is that, that probably wouldn’t take place in 2023.”

OK this is an ad-libbed Q&A, but let me translate – LRCX won’t make up lost sales to China through 2023. Archer noted:

“For calendar year 2023, we estimate the total revenue impact from these restrictions to be in the range of $2 billion to $2.5 billion. That’s inclusive of both systems and spares and service for those customers in China that are impacted by the restrictions.”

The $2.5 billion, according to Lam, won’t be replaced by sales to other companies. This $2.5 billion loss equates to 12.5% of revenues based on 2022 values. Lam includes this number in its expectations for a WFE drop of 20% in 2023, which would be an 8.5% cyclical drop in 2023.

I expect this total to be higher than 8.5% based on high levels of capex spend to foundries in 2021 and the drop in memory. I expect the hit on LRCX to be at least 30% in 2023, not 20%.

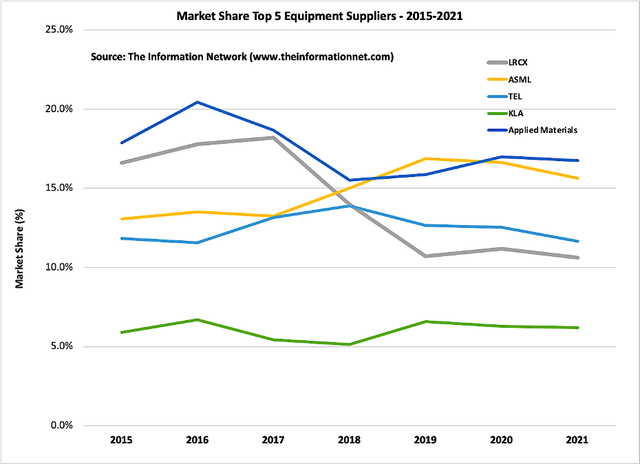

Why is this important? Chart 2 shows Market Share of the Top 5 equipment suppliers between 2015 and 2021. This includes market share of the Total Equipment Market. There are two takeaways:

- Lam lost significant share in 2018 due to the drop in the memory market as a result of its high exposure to memory. One can see that this drop in share correlates with the drop in memory revenues I show in Chart 1 above.

- But Lam’s market share didn’t recover in 2019 like the memory revenues, due to excessive equipment installed at memory fabs and the judicious approach to capex spend by memory companies.

The Information Network

Chart 2

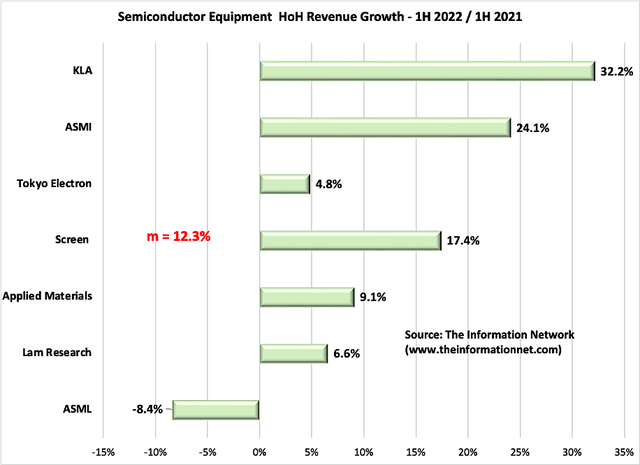

Chart 3 shows 1H 2022 versus 1H 2021 revenue growth for the top 7 companies for equipment only. The mean value of these companies is -12.3%, and Lam’s +6.6% indicates further degradation in market share in the equipment sector.

The Information Network

Chart 3

Overall Takeaways

There are two headwinds facing equipment suppliers over the next few years.

The first is currently impacting suppliers due to a macro-induced meltdown that started in consumer electronics products such as PCs, and is also affecting memory demand in other applications such as automotive and data center. LRCX has the greatest exposure to a memory slowdown based on percentage of overall sales while AMAT’s large exposure is based on memory revenue.

The second, China sanctions, has been ongoing for several years, but is now expanding. Lam’s customers NAND maker Yangtze Memory Technologies (YMTC) and DRAM maker ChangXin Memory Technologies, (CXMT) both of which are now toast with respect to Lam equipment.

There are two takeaways from this call:

- Lam expects WFE (wafer front end) to be -20% in CY2023 because of China sanctions, and although management responses to questions were vague and opaque with not much granularity.

- AMAT already indicated it could lose $1.1 billion from China sanctions in the next two quarters. Lam has not quantified its possible losses in the current quarter.

- Micron announced the 50% cut in WFE equipment a month ago. Lam has not quantified its possible losses in the current quarter.

- Management neglected to mention that its Logic segment will also be down, particularly with capex cuts of 20% from Taiwan foundry TSMC (TSM) to $36 billion from planned $40-$44 billion just announced last week.

2. Lam in the December quarter is offsetting Memory and China losses with significant deferred revenue and order backlog. In other words, all the supply-chain problems Lam was beset with in the past year to the tune of $2.8 billion.

I noted these supply-chain disruptions in my July 26 Seeking Alpha article entitled “Lam Research: What To Expect On Fiscal Q4 Earnings Call”

I have expressed my concerns about LRCX and its supply-chain management for the past year. What wasn’t expressed in the earnings call is that the supply-chain problems have been alleviated primarily because of macroeconomic factors, and Lam is lucky that this positive news coincides with negative news on Memory and China. But Lam will not have such fortunes in CY2023. I maintain my Hold on the company.

Be the first to comment