Roberto Galan/iStock Editorial via Getty Images

Earnings of Lakeland Financial Corporation (NASDAQ: LKFN) will likely increase this year on the back of strong topline growth. Economic factors will likely drive loan growth this year, which will lift revenues. Additionally, the margin will likely significantly expand this year as a large part of the loans and investments will re-price soon after an interest rate hike. Overall, I’m expecting Lakeland Financial to report earnings of $3.83 per share in 2022, up 3% year-over-year. The year-end target price suggests a significant downside from the current market price. Based on the total expected return and the earnings outlook, I’m adopting a Hold rating on Lakeland Financial Corporation.

Indiana’s Economic Recovery to Drive Loan Growth

After declining sharply in the first nine months of 2021, the loan portfolio finally turned around in the last quarter of the year. Most of the loan decline in the earlier part of last year was attributable to Paycheck Protection Program (“PPP”) loan forgiveness. PPP loans declined from $412.0 million at the end of December 2020 to $26.2 million at the end of December 2021. The remaining PPP loans outstanding made up just 0.6% of total loans at the end of last year. As the PPP portfolio is now so small, the remaining forgiveness will barely have any effect on the total loan portfolio size.

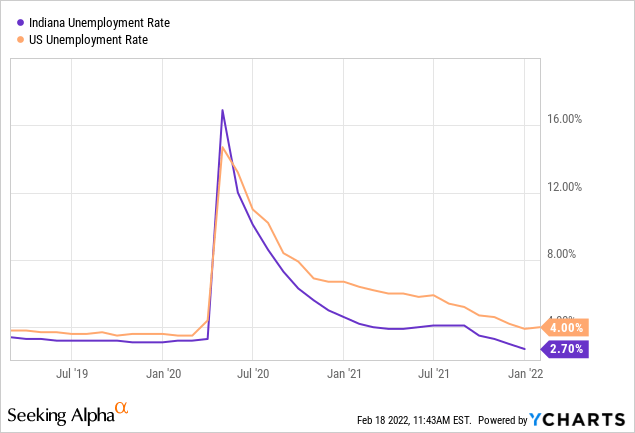

Further, the economic recovery will likely play a pivotal role in the growth of loan origination. Lakeland Financial is based in Indiana, whose unemployment rate is far better than the national average. The state reported an unemployment rate of only 2.7% in December 2021, which shows that the economy is doing quite well.

Boosting loan growth should not be too difficult for management because there are existing lines of credit that are being underutilized. As mentioned in the earnings presentation, the average line utilization at the end of December 2021 was 42%. In comparison, line utilization hovered between 48% to 54% before the pandemic. If the economy lets the utilization rise to the pre-pandemic range, then loans can grow substantially this year.

Considering these factors, I’m expecting the loan portfolio to increase by around 4% by the end of December 2022 from the end of 2021. Meanwhile, deposits will likely grow in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 3,771 | 3,866 | 4,015 | 4,588 | 4,220 | 4,391 |

| Growth of Net Loans | 10.0% | 2.5% | 3.9% | 14.3% | (8.0)% | 4.1% |

| Other Earning Assets | 591 | 626 | 657 | 922 | 2,037 | 2,120 |

| Deposits | 4,009 | 4,044 | 4,134 | 5,037 | 5,735 | 5,968 |

| Borrowings and Sub-Debt | 182 | 276 | 170 | 75 | 75 | 78 |

| Common equity | 469 | 522 | 598 | 657 | 705 | 762 |

| Book Value per Share ($) | 18.3 | 20.3 | 23.2 | 25.7 | 27.5 | 29.7 |

| Tangible BVPS ($) | 18.1 | 20.1 | 23.0 | 25.5 | 27.3 | 29.5 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Loan and Investment Portfolios are Flexible Enough to Significantly Benefit from Higher Rates

Throughout last year, management shifted the funds freed from the forgiveness of PPP loans into short-term investments. These short-term investments surged to $631.4 million at the end of December 2021 from $175.5 million at the end of December 2020 and $30.8 million at the end of December 2019. Although this action hurt the margin last year, the build-up of short-term investments is a good strategy ahead of the federal funds rate hike. Soon after the interest rates increase, management can easily shift funds from short-term investments into higher-yielding long-term investments and loans.

Moreover, Lakeland Financial Corporation’s loan mix is well-positioned for a rising interest-rate environment. Around 68% of loans were tied to variable rates at the end of the last quarter, as mentioned in the presentation. Therefore, the majority of the portfolio will re-price soon after a rate hike. Moreover, every 25 basis points increase in the federal funds rate can improve the net interest margin by three to five basis points, according to management’s estimates. In other words, a 100-basis points increase in the interest rate can boost the net interest income by 6.86%.

Considering these factors, I’m expecting the margin to remain mostly stable in the first half of the year from 2.98% in the last quarter of 2021. For the second half of the year, I’m expecting the margin to increase by 10 basis points.

Expecting Earnings to Increase by 3% This Year

The anticipated mid-single-digit loan growth and margin expansion will likely drive earnings growth this year. On the other hand, higher provision expense will likely restrict the earnings growth. Loan additions will likely drive higher provision expenses this year. However, I’m expecting the provisioning to remain below normal as releases of loan loss reserves are likely because these reserves appear excessive. Reserves made up 1.58% of total loans while non-performing loans made up just 0.35% of total loans at the end of last year. Overall, I’m expecting the provision expense, net of reversals, to make up 0.09% of total loans in 2022, which is below the average provision expense of 0.11% of total loans from 2017 to 2019.

Also, the non-interest income will likely be lower this year because Lakeland Financial cannot repeat last year’s mortgage banking performance amid this year’s rising interest-rate environment. Overall, I’m expecting the company to report earnings of $3.83 per share in 2022, up 2.6% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Income Statement | ||||||

| Net interest income | 136 | 151 | 155 | 163 | 178 | 192 |

| Provision for loan losses | 3 | 6 | 3 | 15 | 1 | 4 |

| Non-interest income | 36 | 40 | 45 | 47 | 45 | 40 |

| Non-interest expense | 79 | 86 | 89 | 91 | 104 | 105 |

| Net income – Common Sh. | 57 | 80 | 87 | 84 | 96 | 98 |

| EPS – Diluted ($) | 2.23 | 3.13 | 3.38 | 3.30 | 3.74 | 3.83 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing of an interest rate hike.

Price Downside, Earnings Outlook Justify a Hold Stance

Lakeland Financial is offering a dividend yield of 2.0% at the current quarterly dividend rate of $0.40 per share. The earnings and dividend estimates suggest a payout ratio of 42% for 2022, which is higher than the five-year average of 35%. Therefore, I’m not expecting another dividend hike this year.

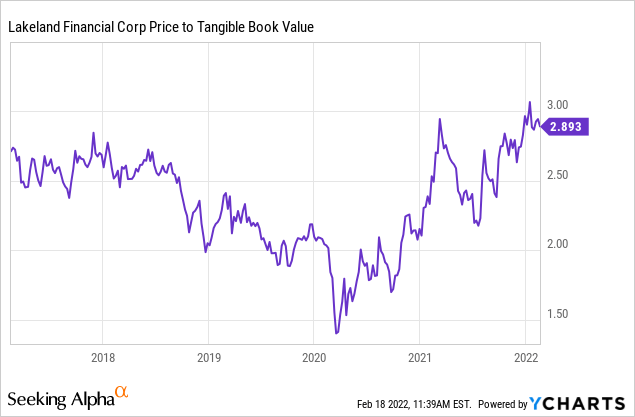

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Lakeland Financial. The stock’s P/TB ratio has tended towards 2.5 in the past, as shown below.

Multiplying the P/TB multiple of 2.5 with the forecast tangible book value per share of $29.50 gives a target price of $73.90 for the end of 2022. This price target implies a 7.0% downside from the February 17 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 2.30x | 2.40x | 2.50x | 2.60x | 2.70x |

| TBVPS – Dec 2022 ($) | 29.5 | 29.5 | 29.5 | 29.5 | 29.5 |

| Target Price ($) | 68.0 | 70.9 | 73.9 | 76.8 | 79.8 |

| Market Price ($) | 79.5 | 79.5 | 79.5 | 79.5 | 79.5 |

| Upside/(Downside) | (14.5)% | (10.7)% | (7.0)% | (3.3)% | 0.4% |

| Source: Author’s Estimates |

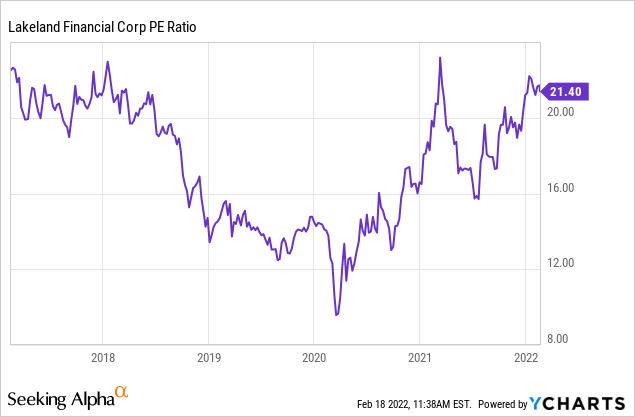

The stock’s P/E ratio has tended towards 17.0x in the past, as shown below.

Multiplying the P/E multiple of 17.0 with the forecast earnings per share of $3.83 gives a target price of $65.20 for the end of 2022. This price target implies an 18.0% downside from the February 17 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 15.0x | 16.0x | 17.0x | 18.0x | 19.0x |

| EPS 2022 ($) | 3.83 | 3.83 | 3.83 | 3.83 | 3.83 |

| Target Price ($) | 57.5 | 61.3 | 65.2 | 69.0 | 72.8 |

| Market Price ($) | 79.5 | 79.5 | 79.5 | 79.5 | 79.5 |

| Upside/(Downside) | (27.6)% | (22.8)% | (18.0)% | (13.2)% | (8.3)% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $69.50, which implies a 12.5% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 10.5%.

The significant price downside calls for a sell rating. However, due to the earnings outlook, a sell stance won’t be appropriate. Hence, I am adopting a hold rating on Lakeland Financial Corporation. I’m going to stay away from this stock unless its market price corrects substantially by more than 20% from the current level.

Be the first to comment