genkur/iStock via Getty Images

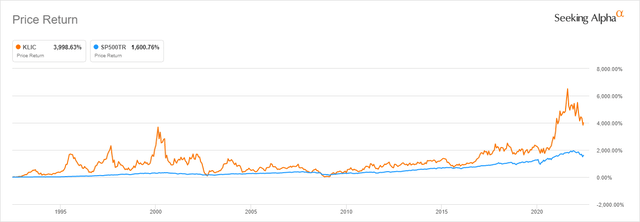

Kulicke And Soffa Industries (NASDAQ:NASDAQ:KLIC) is a semiconductor equipment maker, founded in 1951. Historically the stock has been outperforming the S&P500 index, indicating a strong business performance in good and bad times. Accompanied by increasing dividends and enormous buybacks, this rather unknown company can compound further into the next decade. Moreover, the firm has positioned itself on the cutting edge of the automotive, industrial and advanced display industry. The risk-reward balance is weighing heavily on the reward side, making KLIC a consideration for your portfolio.

Business overview

Kulicke And Soffa Industries designs, manufactures and sells capital equipment and tools used to assemble semiconductor devices. The company also service, maintain, repair and upgrade their equipment, and sell consumable aftermarket tools for their equipment and for peer companies’ equipment. Customers of the company consist of semiconductor device manufacturers, integrated device manufacturers IDMs, outsourced semiconductor assembly and test providers OSATs and automotive electronics suppliers.

Industry growth in favor of KLIC

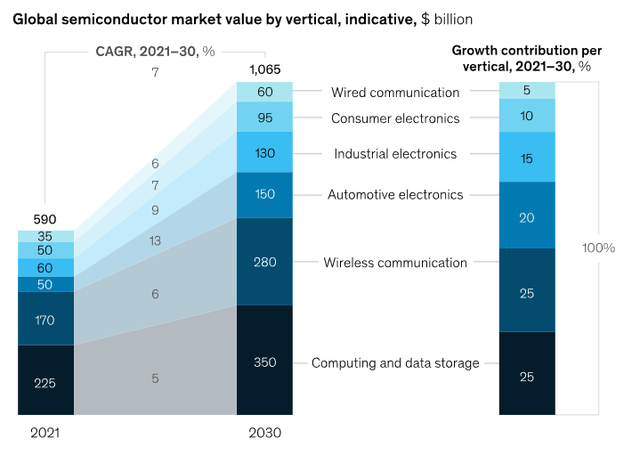

Smart devices are loved more than ever before, creating an increasingly demand for chips. The global semiconductor industry is poised to reach a market value of more than $1 trillion by 2030, according to an expert at McKinsey & Company. The automotive electronics section is expected to be the biggest growth driver with a compound annual growth rate of 13%. Industrial electronics section comes second with a CAGR of 9%.

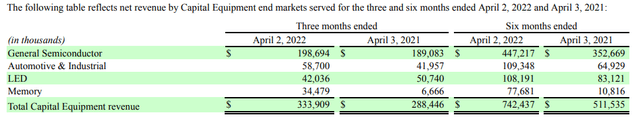

The different markets served by KLIC can be found in the latest quarterly SEC-filling (10-Q). General Semiconductor is their core business, which has been growing 26% over the last 6 months compared to a year ago. Furthermore, the automotive & industrial segment has seen a lot of positive momentum lately, which is proven by the 68% revenue growth over the last 6 months in comparison to a year ago. This segment is in the right place to benefit from additional growth in the next decade. Although the memory business only accounts for 10% of the total capital equipment revenue, it is growing at the fastest speed and definitely worth keeping an eye on.

Q2 reveals profitability boost

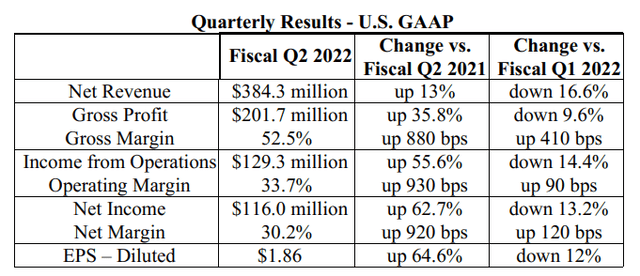

KLIC beat earnings and revenue estimates in their latest quarter while global challenges are limiting industry growth. On top of that, the management team is confident in their business and bought back almost 3 million shares (worth $146m).

The company reported revenue of $384 million and net income of $116 million, representing a 13% growth rate year over year on a revenue basis. However, the 62% net income growth year-over-year is much more remarkable. The company has increased their profitability and efficiency by a great margin. Earnings per share increased even more than net income due to buybacks. Fewer shares outstanding result into more earnings per share.

When comparing the results with those of last quarter, a revenue decrease can be seen in the table. Even so, the firm still proves to be profitable by the increase in gross margins and operating margins.

Cheapest in the industry, despite growth ahead

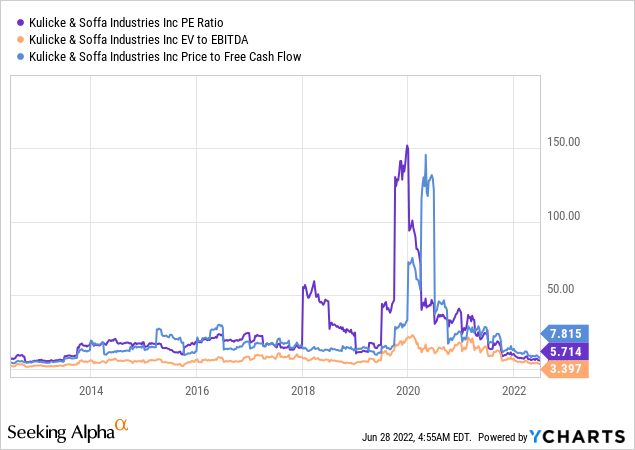

A low valuation for a good business does positively impact the risk-reward balance. Historically, the stock is trading at 10 year lows. Some would argue that the semiconductor industry is cyclical and that peak profitability is near. In that case, it is important to understand that profitability could recede. As a result, these metrics could be misleading. Nevertheless, there is incremental growth in the demand of chips caused by impactful technology transitions.

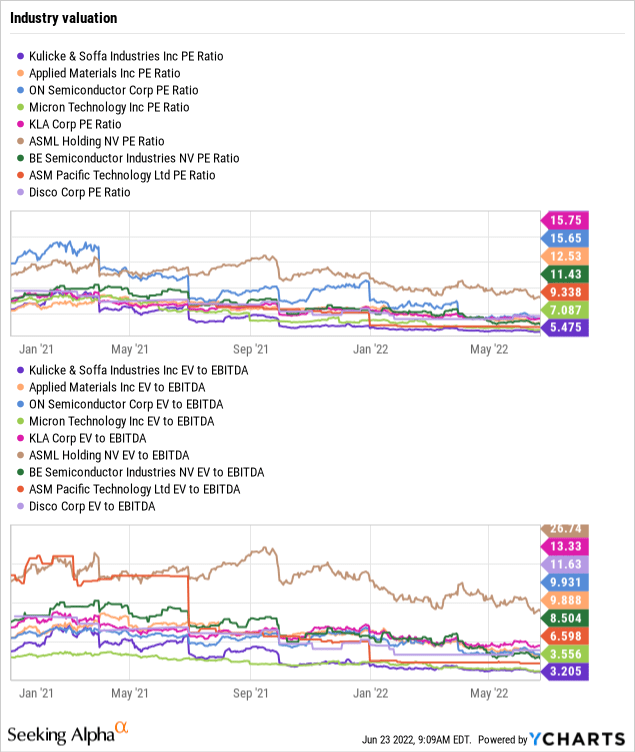

In the graph below, I have compared competitors of KLIC and other peers in terms of PE ratio and EV to EBITDA. The two companies that stand out the most are Micron Technology (MU) and Kulicke And Soffa Industries. Both trade well-below the industry average and seem to be overlooked by investors. An EV-to-EBITDA below 10 is commonly interpreted as healthy.

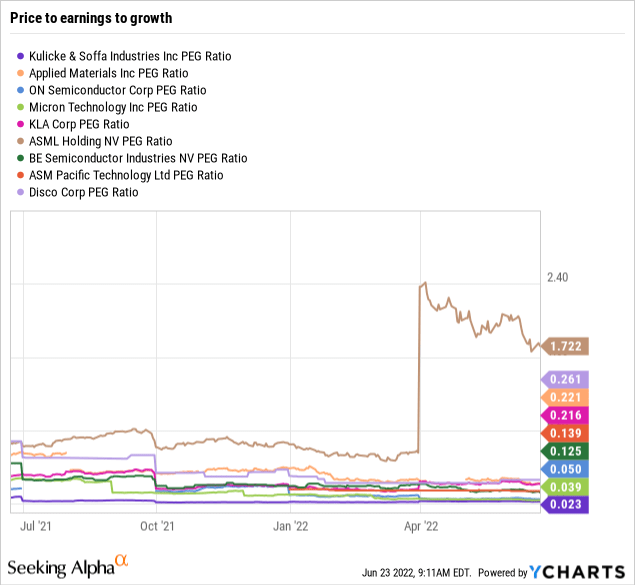

In addition, KLIC’s prospects in terms of price-to-earnings-to-growth are superior compared to the others on the list. Take these numbers with a grain of salt, as PEG is focused around analyst estimates.

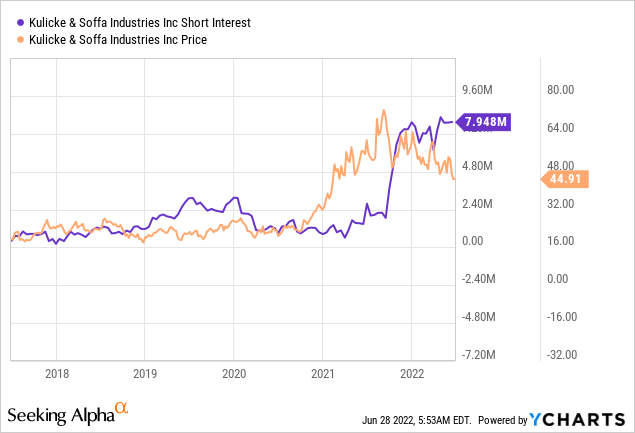

Short interest might be the culprit of the lower valuation compared to the industry. Short interest has increased along with the price level and this might slowdown the reach of new highs for now. On the other hand, it can be an opportunity to build up a position as the price trades sideways.

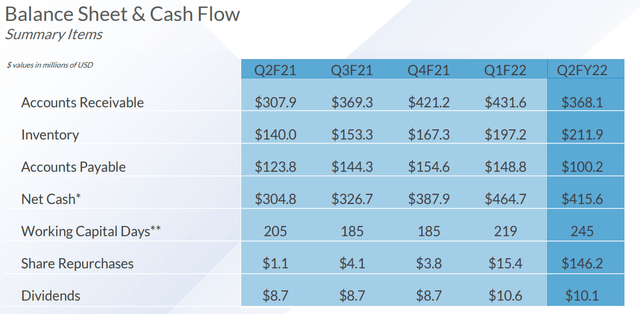

Bullet-proof balance sheet unlocks enormous amount of buybacks

KLIC ended the quarter with almost $700 million in cash and cash equivalents, which represents 26% of their current market cap. The company is loaded with cash, this makes it possible to reinvest in the business, pay back debt, pay out dividends and do buybacks. Since the firm has no debt it can fully focus on the others. Thereby, KLIC bought back 2.9 million shares worth around $146 million in Q2, which is equal to 5,4% of value for shareholders. The company has 340 million dollars left to do buybacks under their current buyback program, which represents another 12,8% of value. The management team has decided to do more and more buybacks as they feel the stock is currently undervalued. Consequently, it is certain that they will opportunistically execute the buyback program.

Research and development is the key to growth

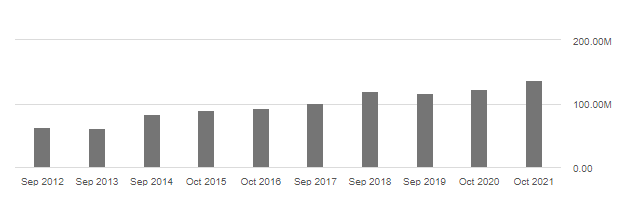

The company uses outsourced parts in their equipment manufacturing, allowing them to minimize fixed costs and capital expenditures. Therefore, spending on research and development is needed to keep up with the innovation of technology. The firm takes a more conservative approach towards R&D spending. There is no aggressive spending in exuberant times and no underspending in gloomy times, resulting in more financial room when the tides turn.

Seeking Alpha

Risks

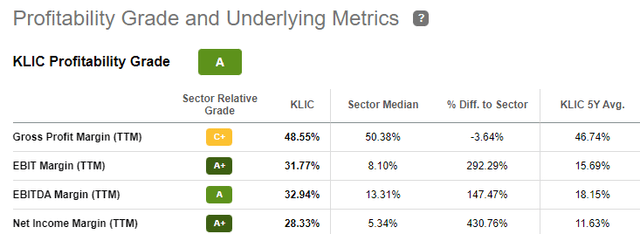

The short sellers are cheering for a cyclical downtrend, leading the stock to more exposure to downside risk. Even so, the stock is in a long-term upside trend since 1982. In a cyclical downtrend, net income margins could fall back to the 5 year average of 11,63%. Anyhow, it would still outperform the sector median at the current time. Additionally, KLIC’s product mix has been improving over the last 5 years due to more advanced technology demand (5G, EV, micro led display).

Another risk to keep in mind is the geographically concentration of KLIC’s customer base. Approximately 55% of their revenue in 2021 was from shipments to customers located in China. Although the high sales concentration in China can be a risk, it could also be an opportunity. China is behind the curve in the semiconductor space and is trying to catch up at a fast pace. This can break the cyclical cycle and make the company benefit a bit longer from higher margins.

Takeaway

Kulicke And Soffa Industries is well-positioned for the future with a proven track record that supports their business performance. The stock is a great pick for value investors that love to pile into (misleading) bad sentiment. Furthermore, the company is grossly undervalued compared to its peers and has the balance sheet to survive a cyclical downtrend. For these reasons, I assign a Buy rating on Kulicke And Soffa Industries.

Be the first to comment