iamporpla

Dear readers/followers,

We’ll update on K+S here (OTCQX:KPLUY). The company, which was previously known as Kali Und Salz GMBH, is a Hesse-based fertilizer company – it’s in fact Europe’s leading supplier of the stuff at this time. The company also has a few other upsides that we’re going to be taking a look at throughout this piece. This company is a 133-year-old giant in the industry – and we’ll look at what upside it can bring for investors at this time.

Revisiting K+S

If you recall my last article on the company, because this isn’t all that common a company to cover, K+S is a chemical company founded in 1889. The company has, throughout its history, been a major player in potash as well as a player in salts. That’s also where the company is today. It even has part of legacy BASF (OTCQX:BASFY), which once upon a time had a potash division.

As mentioned, the company is by far the largest European potash supplier – and is also the largest producer of salt, in the entire world. It merged with Morton back a year ago or so, and now “owns” part of the market.

On a high level, and why the company is so attractive, is because the company is a fully vertically-integrated producer of both rock salt and potash, covering the entire value chain from A to Z. It does exploration, and does everything to S&M for various product applications.

In addition to already-existing assets, the company owns mining rights for over 1 billion tonnes of still-existing potash in Germany, as well as 1.5B tonnes of crude salt. The other resources outside of Germany are equally massive, and found in North America. The company acquired, aside from Morton, a comparatively smaller potash business following the crisis for €300M.

On a global scale in terms of Potash, K+S is the fourth-largest behind Canpotex (Nutrien/Mosaic), the Belarus BPC, a former soviet-era potash producer, though it’s unclear what the current macro does of that, and the Russian Uralkali (Source: AlphaValue). Again though, when you look at anything out of Russia or Belarus today, you really have to consider what value or what exports those businesses can really bring to the market today – due to ongoing sanctions and situations.

K+S still has no credit rating – it’s B+ rated due to all of the M&As and issues, but this does not reflect its relatively low debt, which is no higher than 2x.

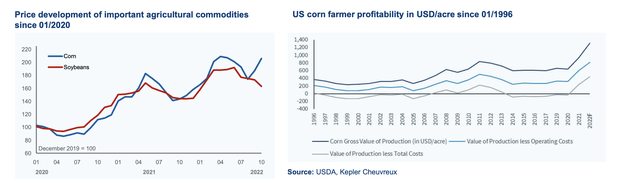

On a high level, K+S is currently enjoying some extreme profitability due to the underlying pricing of commodities related to agriculture.

Sharp increases in crop prices increase current input costs, of which Potash is no more than 5%, and leading to excellent flows for the company. For the 9M22 period, the company’s sales revenues are more than twice as much as 9M21, despite sales volume being more or less the same in terms of raw product, showcasing just how successful K+S has been in driving sales prices.

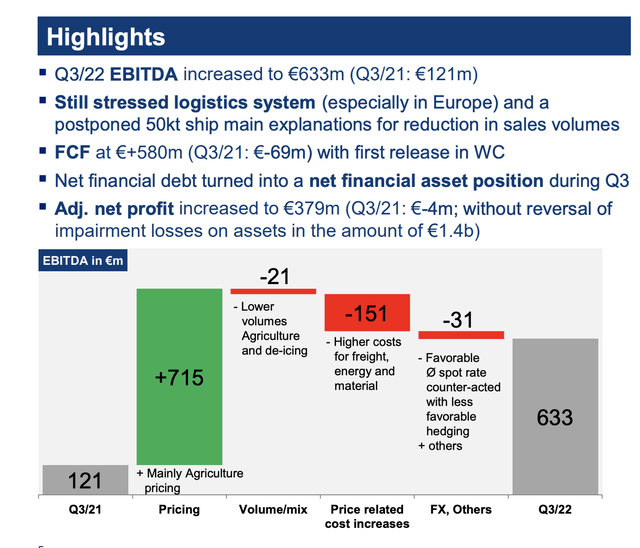

EBITDA is no joke. Take a look.

Even if this is all pricing, and input cost increases are no joke, these are very good trends, and they create what is the underlying current reality for the company which forms, no matter how you slice it, a very positive 2022E. The company’s current 9M22 EBITDA already exceeds the best-ever recorded full-year EBITDA back in 2008.

And there’s still one quarter left.

World potash supplies are falling due to macro, and even with positive and optimistic scenarios, Potash supplies worldwide will not recover until 2026E. And that is including a recovery for both Russia and Belarus starting in 2022E.

K+S remains a very “German” company, in that 60% of the company’s shareholders are German, and around 20% in the US. 55% of the company’s share ownership is from institutional investors. This makes it a bit of a “sleeper” pick outside of Germany, and there are reasons for its attractiveness abroad. The dividend yield, or lack thereof, currently, is definitely one of these reasons.

It’s also wrong to say the company is “just” farming – it’s not. K+S runs two divisions in its business – and these are neither geographical nor product-based, but end-product based. Agriculture comes in at 46% of sales, and Industry comes in with 3 sub-segments. Agriculture holds the global production of potassium chloride and the fertilizer specialties business. Industrial activities see sales of chlorine alkali processes and isocyanates, as well as food processing sales and sales to Animal nutrition (such as feed/lick stones). The company also has a partnership in Waste Management through REKS, a JV between K+S and Remodis REMEX. The combination of these segments create through-cyclic attractiveness to what the company does – at least in theory.

Salts and Potash aren’t going anywhere. In fact, with the continuing war and sanctions in the east, the markets for potash from Belarus and Russia have become extremely difficult. This is also why we’ll see the company bouncing like a rubber ball – as we’ll look at in valuation. It seems doubtful that these issues wind down in the very near future, giving this company an upside. It’s also why I’m surprised that we’ve not seen an even higher overall upside to K+S than we’ve been seeing.

Going forward, K+S expects continuing improvements in EBITDA and sales, offsetting the cost inflation and logistical issues around the world.

The company recently and very significantly expanded its storage and basin capacity, meaning it can, if needed, wait for things to improve on the cost side before selling if necessary.

And as mentioned, until 2026E, we’re not going to see improvements on the supply side, which means that K+S can probably keep things relatively high-priced/elevated.

Risks do, of course, exist. Everything having to do with agriculture is a volatile place to be in. I should know, I’ve invested in the area for years. It’s up and down, and the best time to “get in” is when the area is being crushed on the market. While generally speaking we do have cheap valuation, it’s not a result of the market being pressed to any major degree, but a supposed upside due to commodity pricing upsides.

While the products/services the company provides are essential to living (they allow the growing of food), they’re also not as hassle-free as you might expect. I’ve been in three different mines in two countries – and the operations are neither clean, easy nor cheap. The company requires significant investments in mining capacity, not only tools & machines but automation – so CapEx is a worry going forward as well. The anti-ESG arguments for the company’s operations also expand to the salt sector, where road salt contaminates groundwater, kills wildlife, and is considered to be a fairly major problem in certain areas.

So consider some of the impacts prior to investing in K+S.

Let’s take a look at the company valuation.

K+S Valuation

Let’s put it simply. If we assume that the company has an equity value of €6.2B in book value and with the corresponding recoverable amount of product, including the value due to the company’s new Werra Site, then the share price for the company should, technically, be twice what we’re seeing here today.

Of course, it’s not as simple as all that. K+S is notoriously volatile and a company that goes up and down, with extensive periods of very poor trading patterns. From 2016 all the way to COVID-19, the company provided negative RoR – only since COVID-19 has the company been able to sort of turn that around, and those valuation spikes seem inherent to the way the stock trades.

The right time to pick it up is on the cheap – which I did not do with my initial shares.

However, at current levels, I do believe the company, for the current macro and where the company is going, is significantly undervalued. Dividends aren’t why you invest in the business – at least it’s not the biggest reason. There will be dividends to K+S here and attractive ones in context, but the valuation is really why you should go for the company.

Analysts are slowly waking up to what people are missing here. A year ago the PT was €13/share – today it’s more than twice that, with 15 analysts averaging around €27.14, and 9 of them at a “BUY” or equivalent rating, showcasing an upside of nearly 30% conservatively. And if you look at the above calculation of fair value, you’ll see how conservative that still is.

While K+S might capture sales market shares from its eastern counterparts, I cap sales growth at 3.5-4% with a 1.5-2% EBITDA growth rate in outlying periods with a steady CapEx/sales ratio over the coming years. At a WACC of around 8% with a cost of debt below 6%, the company, at a normalized long-term growth rate of 3%, adjusted upward since my last article, gives us a target price range of €19.8-€24.5/share.

The reason K+S trades at these multiples today isn’t that people believe this growth rate is indicative for the long term, but rather the current situation in fertilizers.

K+S has always been a cheap business in terms of its multiples, owing to the recent few years of weakness. Its peers include Yara International (OTCPK:YARIY), Wacker (OTC:WKCMF), Symrise (OTCPK:SYIEY), and to some extent, BASF. Compared to these chemical companies and this group of comps, the company is actually undervalued even with a discount of 10-15%, which I would apply across the board due to the company’s low fundamentals.

The company, given its reporting structure, is simple to value at NAV level. All you need to decide on is what multiple to use. I use a range of 9-10X EV/EBITDA, which net of debt and commitments comes to a current NAV/share of between €23-€26.6 – closer to the company’s current share price.

So you see how I end up reaching my target of around, at least, €26.5 per share for where I see K+S being valued here.

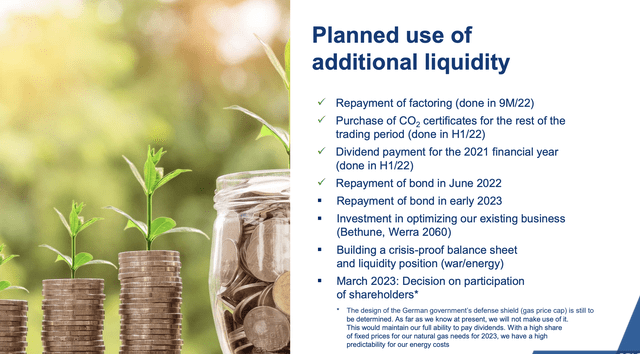

K+S has just instituted a new dividend policy, to a floor of at least €0.15/share per year, plus a discretionary premium based on annual performance. This turns, finally, this lackluster payor into a reliable dividend company. The company also confirmed FY22 guidance, expecting upwards of €800M in adjusted free cash flow, paving the way for a positive 2022.

For that reason, here is my thesis on K+S.

Thesis

- K+S is one of the largest players in Potash remaining after Russia and Belarus are sanctioned off to most of the modern world. This makes this German fertilizer and salt giant an attractive play, and a good time for the company to flex its expansionary muscles. Despite a lack of an IG rating, I view this as an interesting play.

- In the right environment, which we have today, it’s not inconceivable that the company could rise closer to its fair-value , which I view as being valid close to €40/share.

- I give the company a conservative €26.5 PT based on conservative growth rates, mixed NAV/peer valuations, and conservative multiples and forecasts.

- I, therefore, view it as a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment