Funtap/iStock via Getty Images

KKR Real Estate Finance Trust Inc. (NYSE:NYSE:KREF) invests 100% in floating rate senior secured loans to owners of developed real estate projects with positive tenant cash flow. That’s a lot to digest in a single sentence, so let’s break it down.

Investment Thesis

Interest rates continue to rise as the Fed battles inflation. We expect rates to rise into 2023 and not pull back until core inflation dips below 3% along with some sort of recession as measured by employment and GDP contractions.

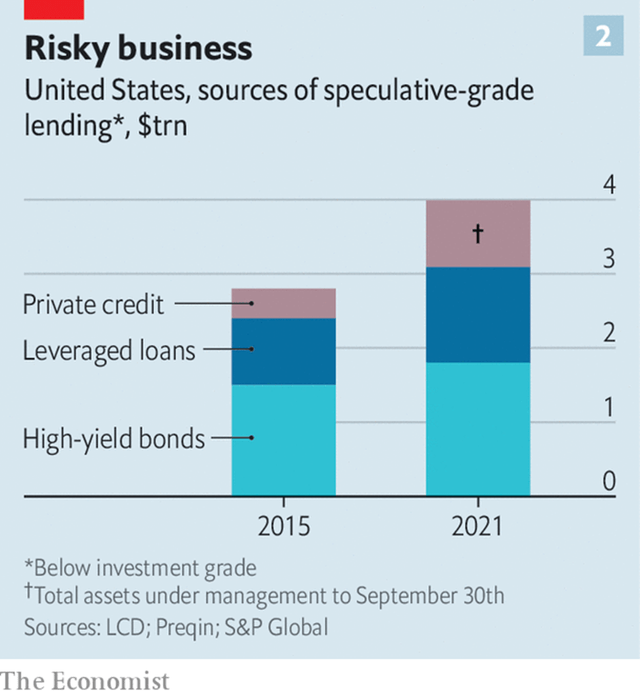

We are also aware that other corporate debt has grown at a high rate since the last recession. According to an Economist article this past July, US companies currently borrow about $12.2 trillion of which about $3 trillion comes from lightly regulated, non-banks like BDCs and Commercial Mortgage REITs (CMREITs), or syndicated loans floated off by banks who do not want to hold those loans for capital reserve reasons.

The article notes that while the 2008 Great Recession was primarily led by household overborrowing, they note corporate debt binging is the most likely bubble to burst this time.

We embrace the above as the most likely outcome in our probabilistic future and are analyzing KREF through this filter.

The KKR Real Estate Finance Trust portfolio is systematically less risky as a business than non-real estate CMREITs and BDCs. KREF holds senior debt in landlords. If being the landlord to corporate America is less risky than owning corporate America, then holding landlord senior secured debt must be a whole level safer on a business level.

That’s not to say the portfolio doesn’t carry risk. It’s relative risk which we are exploring, including an examination of how KREF finances its portfolio along with the all important Net Interest Margin that generates our distributable cash.

We examine KREF against three of its direct competitors, Ares Commercial Real Estate (ACRE), Apollo Real Commercial Estate Finance (ARI), and TPG RE Finance Trust (TRTX) for more relevant context. Finally, we conclude that while KREF yields less than its competitors today, it is also better positioned to outperform in 2023 and beyond.

Economic Environment

We accept that corporate borrowings have formed a credit bubble in which almost 25% escapes regulator scrutiny by non-bank lenders. Even worse, speculative grade private lending has exploded since 2015 according to The Economist:

With continued interest rate raises and predicted tougher corporate profits, we see non-real estate BDCs and CMREITs entering their toughest test since the early days of the Pandemic.

To date, these have been popular vehicles promoted as being more stable than Residential Mortgage REITs (RMREITs) because corporate lending and repayment behavior is easier to evaluate. BDCs and CMREITs have also been popular since banks’ capital reserves were materially increased for these types of loans after the 2008 Great Recession. As a result, many large, middle-market and small companies without natural lenders had to search for alternatives.

From our experience over many economic cycles, we predict BDCs and CMREITs will overstuff themselves until marginal opportunities disappear. We are talking about Wall Street style asset managers who passionately believe in maximizing wealth until there are no more deals.

That also means taking on risk that, when things work out, richly reward asset managers. When things go badly, however, those managers move to another shop without the capital losses their investors suffered. Thus, we look to reduce risk while still earning strong dividends with managers who view capital preservation as Job 1.

Under the Hood

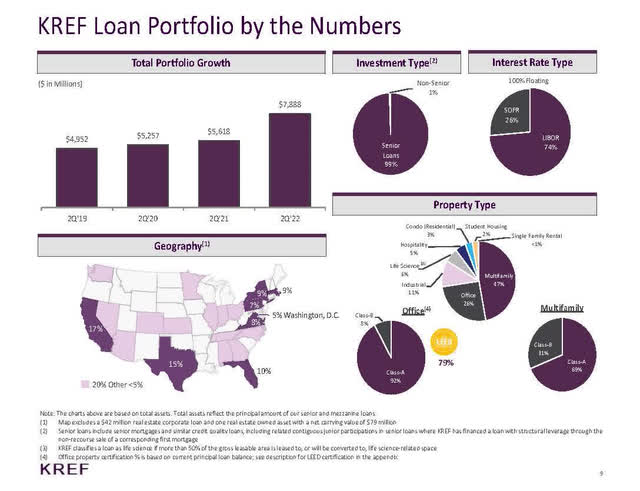

Let’s take a deeper dive into KKR Real Estate Finance Trust’s operations from their most recent quarter, 2022 Q2 form 10-Q about their loan portfolio:

KREF Loan Portfolio (KREF ’22 Q2 Form 10-Q)

Accounting for KREF’s various loans, joint ventures, CLO interests and securities held gets very complicated. It effectively all boils down to KREF’s claims on cash flows and capital in each set of loans no matter how they are held by the various entities.

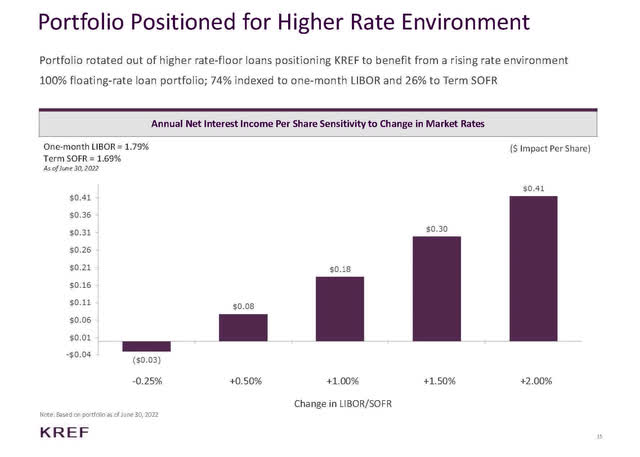

As the loan portfolio has grown more than 50% in three years, only one prior investment had to be taken back (it is a 2015 loan that was foreclosed and is now owned by KREF in 2022.) The rest floats on 30 day rate resets. With rates rising, the Net Interest Margin is expected to expand, too:

Rate Sensitivity for Loans (KREF ’22 Q2 Form 10-Q)

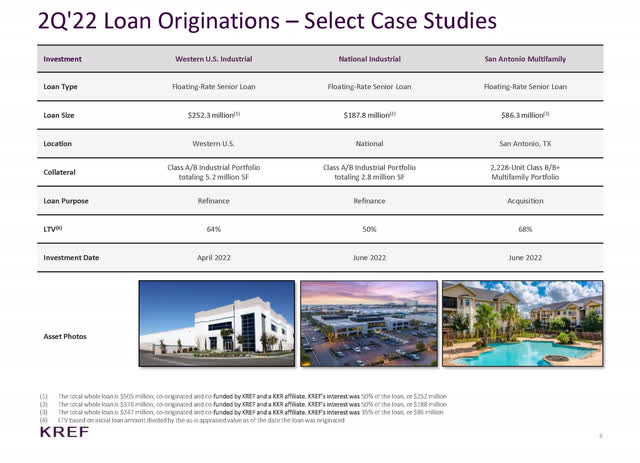

With Net Interest Margin well cared for, what is the loan quality and how will it surf the next couple of years? Let’s look at some of their most recent loans as reflecting the changing lending environment:

Loan Origination (KREF ’22 Q2 Form 10-Q)

Two industrial properties and a single multifamily complex are representative of a changing portfolio that is now 53% housing (mostly class A multifamily), 26% office, 11% industrial and 10% other. As the office market has become more risky, it makes sense to see more industrial and housing loans entering the portfolio.

As a group of assets, we really like the housing component as having relatively low competitive inventory and high demand. The rest is a solid mix without too much concentration other than office (which is decreasing).

Multifamily housing has had such a good run, we do not perceive much downside risk. Only recent refinancings dependent on recently increased rents face the most downside risk if rents fall in a recession.

KKR Strength

KREF leverages the depth and experience of KKR’s (KKR) industry knowledge and expertise. Unusual in the industry, KKR operates on a co-head strategy rather than charging a single manager with a business to oversee. Since every investment has to clear the investment committee, a co-head strategy seems more likely to build consensus than the traditional model of one manager per P&L. Consensus is hard and KKR does it better than most organizations because it has been that way for so long. In our view a strong consensus culture reduces investing risk when done properly.

While everyone uses some form of this, we present KREF’s loan quality grading system from their most recent Form 10-Q, ” Based on a five-point scale, KREF’s loans are rated ‘1’ through ‘5,’ from less risk to greater risk, which ratings are defined as follows:

“1—Very Low Risk—The underlying property performance has surpassed underwritten expectations, and the sponsor’s business plan is generally complete. The property demonstrates stabilized occupancy and/or rental rates resulting in strong current cash flow and/or a very low loan-to-value ratio (<65%). At the level of performance, it is very likely that the underlying loan can be refinanced easily in the period’s prevailing capital market conditions.

“2—Low Risk—The underlying property performance has matched or exceeded underwritten expectations, and the sponsor’s business plan may be ahead of schedule or has achieved some or many of the major milestones from a risk mitigation perspective. The property has achieved improving occupancy at market rents, resulting in sufficient current cash flow and/or a low loan-to-value ratio (65%-70%). Operating trends are favorable, and the underlying loan can be refinanced in today’s prevailing capital market conditions. The sponsor/manager is well capitalized or has demonstrated a history of success in owning or operating similar real estate.

“3—Average Risk—The underlying property performance is in-line with underwritten expectations, or the sponsor may be in the early stages of executing its business plan. Current cash flow supports debt service payments, or there is an ample interest reserve or loan structure in place to provide the sponsor time to execute the value-improvement plan. The property exhibits a moderate loan-to-value ratio (<75%). Loan structure appropriately mitigates additional risks. The sponsor/manager has a stable credit history and experience owning or operating similar real estate.

“4—High Risk/Potential for Loss—A loan that has a risk of realizing a principal loss. The underlying property performance is behind underwritten expectations, or the sponsor is behind schedule in executing its business plan. The underlying market fundamentals may have deteriorated, comparable property valuations may be declining or property occupancy has been volatile, resulting in current cash flow that may not support debt service payments. The loan exhibits a high loan-to-value ratio (>80%), and the loan covenants are unlikely to fully mitigate some risks. Interest payments may come from an interest reserve or sponsor equity.

“5—Impaired/Loss Likely—A loan that has a very high risk of realizing a principal loss or has otherwise incurred a principal loss. The underlying property performance is significantly behind underwritten expectations, the sponsor has failed to execute its business plan and/or the sponsor has missed interest payments. The market fundamentals have deteriorated, or property performance has unexpectedly declined or valuations for comparable properties have declined meaningfully since loan origination. Current cash flow does not support debt service payments. With the current capital structure, the sponsor might not be incentivized to protect its equity without a restructuring of the loan. The loan exhibits a very high loan-to-value ratio (>90%), and default may be imminent.”

Please find below KREF’s ’22 Q2 scored portfolio from the Form 10-Q:

| Risk Rating | Loans |

Loan Amount (in $ Thousands) |

| 1 | 0 | 0 |

| 2 | 3 | 415,670 |

| 3 | 71 | 6,739,319 |

| 4 | 2 | 318,112 |

| 5 | 1 | 0 |

You can see the KREF portfolio scores well, but we are very dependent on KKR’s ability to see macro trends for the KREF lending strategy and deal flow. These are both traditional strengths for KKR that we conclude is a net positive even though some marginal deals may be stuffed here.

Real Estate Owned (REO)

REO happens when the borrower gives the lender back the property. In the commercial sector, REO can range from a profitable second bite at the asset to absolute disaster. Over the years, only one loan has come back to KREF and it’s been fully reserved for:

“In 2015, KREF originated a $177.0 million senior loan secured by a retail property in Portland, Oregon. The loan had a risk rating of 5 and was placed on non-accrual status in October 2020, with an amortized cost and carrying value of $109.6 million and $69.3 million, respectively, as of September 30, 2021. On December 17, 2021, KREF took title to the retail property. Such acquisition was accounted for as an asset acquisition under ASC 805. Accordingly, KREF recognized the property on the Condensed Consolidated Balance Sheets as REO with a carrying value of $78.6 million, which included the estimated fair value of the property and capitalized transaction costs. In addition, KREF assumed $2.0 million in other net assets of the REO. As a result KREF recognized an $8.2 million benefit from the reversal of credit losses, representing the difference between the carrying value of the foreclosed loan and the fair value of the REO’s net assets.”

Whether REO grows is the heart the entire BDC/CMREIT universe. In the 2008 meltdown, residential REO brought down many large mortgage originators and a good swath of Wall St.

Let’s consider an imaginary build-to-suit hub for a transport company as an example of investments BDC/CMREITs make. If the company goes away or the best place to locate a hub changes, the company will seek to leave the property. If the property has no value to anyone else, a fight will ensue between landlord and tenant. Even if there are new tenants, but they want a big discount – fights ensue. No BDC or CMREIT wants REO on the balance sheet – it means their loans are failing and our capital values are getting cut.

As much as anything, we keep a steely eye on REO as KREF’s value could crater quickly.

Peer Group Comparison

We look at three other CMREITs – Apollo Commercial Real Estate, Ares Commercial Real Estate and TPG RE Finance – to see how KREF stacks it up.

| Ticker |

NAV/ Mkt. Cap. |

% of 52-week high |

Market Cap. ($BN) |

Yield (‘FWD’) |

Net Income Margin |

| KREF | 91% | -16.5% | 1.36 | 8.77% | 78.36% |

| ACRE | 93% | -18.44 | 0.730 | 9.84% | 58.83% |

| ARI | 70% | -28.79 | 1.600 | 12.30% | 69.58% |

| TRTX | 48%* | 34.56% | .690 | 10.76% | 85.66% |

*large loan repayments returned almost 50% of TRTX’s capital to be redeployed, most of which has been subsequently lent out without details disclosed. This skewed at least the NAV/Mkt. Cap. measure and also increases risk.

As you can see, both KREF and ACRE trade closest to their Net Asset Value, or tangible assets less total debt. We use the NAV/Market Capitalization ratio for valuation because current loan value is the key measure as opposed to the cash flow multiples we use in other industries. Makes sense when you see BDCs and CMREITs are just specialty banks without much regulation.

Further, KREF and ACRE also have both the lowest forward yields and kept their stock prices relatively higher as interest rate rises hit their portfolios. To us, that is illustrative of asset quality. We would expect a dividend yield between 8-9% on a healthy portfolio today given the net interest margins these companies are holding, which we see in two cases.

KREF-Specific Risks

We can see that KREF is performing well both in terms of its stock price and its loan portfolio, but there are risks and issues to examine a bit further.

KREF is externally managed like most CMREITs that are part of much larger asset managers. KKR recently lessened it direct ownership from 21% to 14% by selling KREF stock as part of a secondary stock issue by KREF a few months ago. Not a vote of confidence and not a dumping either.

Despite KKR having a little less skin in the KREF game, how KREF finances itself is critical to its ability to thrive. Most CMREITs use about 70% leverage to finance their portfolios to optimize returns where portfolios are solid (shaky portfolios must use far more equity).

Most CMREITs use overnight rates through repurchase agreements to fund 30 day rate term loans they hold. As long as the overnight rates stay lower than 30-day rates, CMREITs make a positive net interest spread beyond the credit spread. The flatter the difference over maturity intervals (or yield curve), the riskier a CMREIT portfolio becomes.

Since June, the difference between overnight costs and 30-day interest rates has closed from about 70 basis point to almost flat. That could get even worse, which would not affect the loan performance, but could squeeze and potentially wipe CMREIT equity values. It’s a very rare event, but it happens.

We judge KREF to be more opportunity than a reach for yield and currently rate it a Buy based on its relatively conservative management.

Conclusion

KKR Real Estate Finance Trust has surfed tough markets through a better positioned loan portfolio (multifamily assets have outperformed this past year) and prudent management, in our estimation.

With a current yield of 8.77% that is in line with performing CLO portfolios today and with rates set to continue to rise, we see KREF as a superior way to invest in the real estate financing stack superior to rent obligations (where REITs typically collect their revenues).

We also like ACRE, but not enough to issue a Buy rating at the current price.

Be the first to comment