Scott Olson/Getty Images News

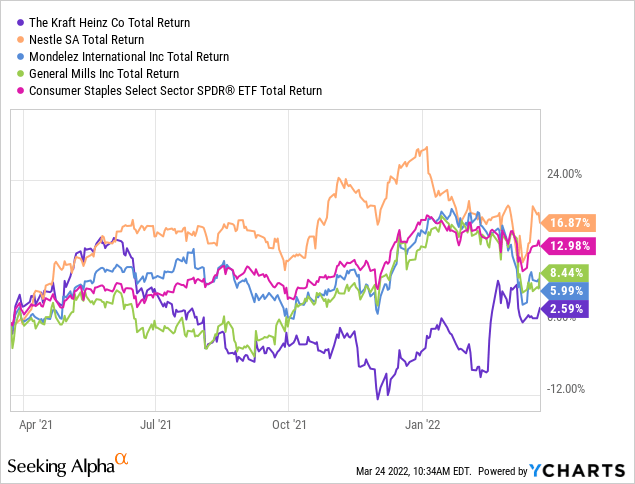

After one strong year in 2020, Kraft Heinz (NASDAQ:KHC) went back to being the lowest returning food company within its peer group of Nestle (OTCPK:NSRGY), Mondelez (MDLZ), and General Mills (GIS). All these companies, except Nestle, which has a culture of long-term wealth creation, underperformed the consumer staples sector as measured by Consumer Staples Select Sector SPDR ETF (XLP).

Kraft Heinz got a breath of fresh air during the pandemic as demand for non-perishable foods skyrocketed. The company has been suffering for years of slowing demand and changing consumer habits, which are favoring healthier foods and beverages.

On the positive side for KHC, the shift in consumer habits is a gradual process that allows the company to adapt its existing brands and acquire new ones into more appealing product categories. Moreover, KHC’s existing brands are exceptionally strong in their respective segments of the market, which results in high return on capital.

Trends in Top Line Growth

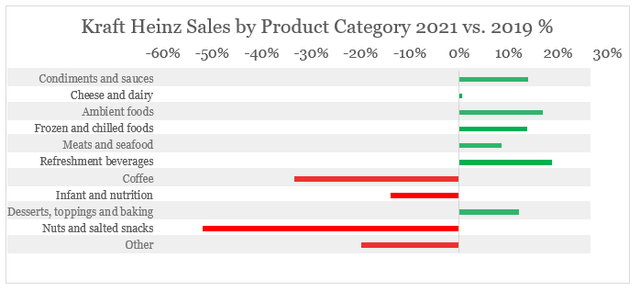

Most of KHC’s businesses are still doing quite well, relative to their pre-pandemic levels. More importantly, these are also the largest product categories in terms of revenue. In the graph below, the categories are ranked by size, starting from the largest ones at the top.

Prepared by the author, using data from SEC Filings

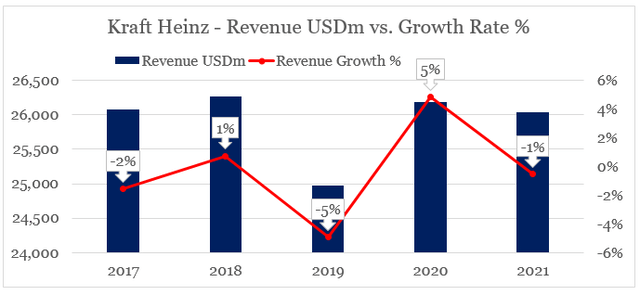

Other businesses, such as the struggling coffee unit that the management has unsuccessfully tried to sell, fell by more than 30%. As a result, the company’s top line has recovered to an extent in 2020 on the back of pandemic-related demand, but is once again experiencing top line headwinds as demand for many of its products is slowly waning.

Prepared by the author, using data from SEC Filings

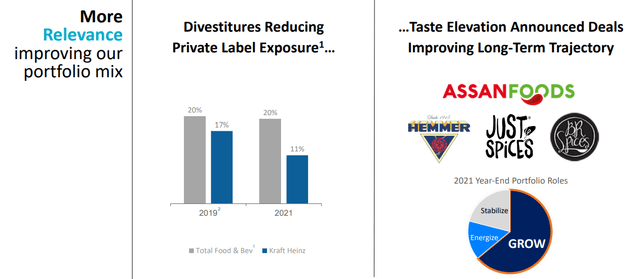

Kraft Heinz management has been slowly moving away from less attractive categories, such as cheese, and adding new fast-growth brands to its portfolio. It appears that the latest deals have also reduced the company’s exposure to private label which could be seen as a positive sign.

Kraft Heinz Q4 2021 Earnings Presentation

Although this strategy could work in the long term, it poses significant risks for shareholders since the company is forced to reduce its dependence on product categories where historically it had some of the strongest brands. Brands, such as Kraft, Philadelphia, and Oscar Mayer, have all been characterized with exceptionally high awareness, preference, and customer loyalty. It remains highly uncertain whether the newly acquired brands, although experiencing a high growth at the moment, will be able to substitute Kraft Heinz’s legacy trademarks.

What About Margins and Free Cash Flow?

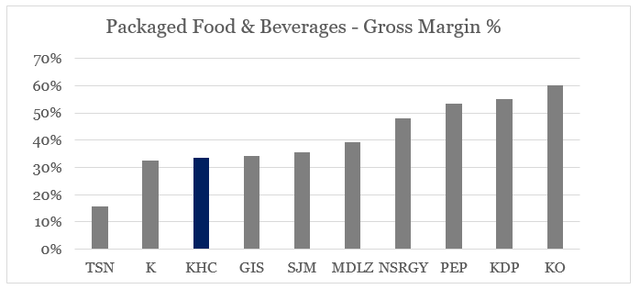

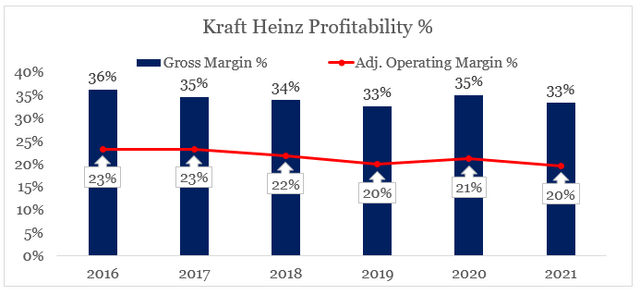

Gross margins are usually used as a good proxy for the price premium achieved by the brand portfolio. In that regard, Kraft Heinz has one of the lowest gross margins in its broader peer group.

Prepared by the author, using data from Seeking Alpha

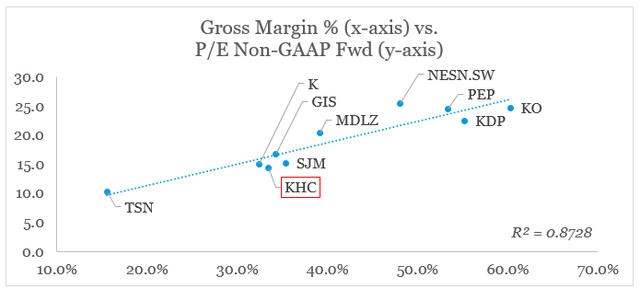

Gross profitability is also less subject to discretionary management decisions, which often leads to companies with low gross margins to compensate for that by lowering their fixed costs. That is why gross profitability is also one of the most important drivers of valuations on a cross-sectional basis.

Prepared by the author, using data from Seeking Alpha

As far as extreme cost-cutting is concerned, in order to improve overall return on capital, KHC is getting close to becoming a case study on how extreme budgeting could potentially destroy brand value, which takes years of investments to build back.

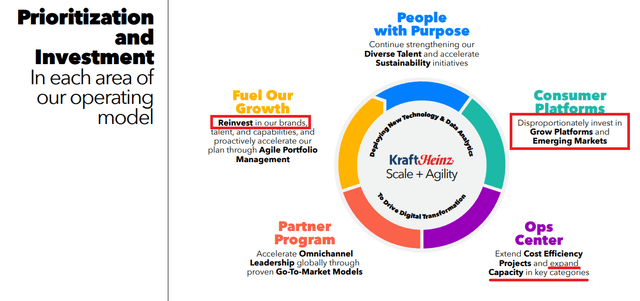

The strategy seems to be focused on increased reinvestment into the business, with the aim of expanding capacity in order to sustain future growth.

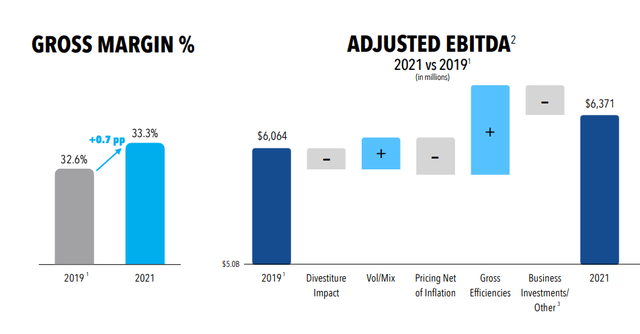

Kraft Heinz Investor Presentation

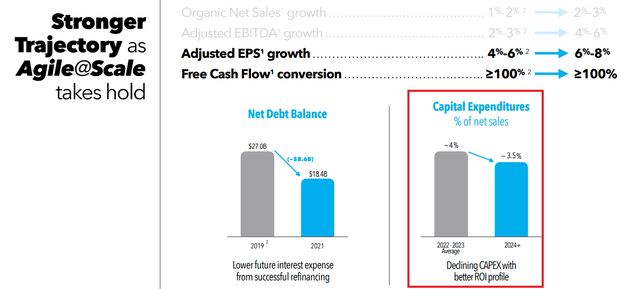

At the same time, however, the free cash flow growth is expected by reducing capital expenditure relative to sales from around 4% to roughly 3.5%.

Kraft Heinz Investor Presentation

While this could be achieved by higher efficiency and production outsourcing to third parties, Kraft Heinz needs to invest higher amounts in advertising and marketing in order to support its growing brand portfolio. At the same time, the company has spent significantly less on advertising in recent years when compared to some of its major peers.

At the same time, Kraft Heinz will need to focus on higher gross margin categories, where it could also have significant pricing power through strong brands in order to improve its declining margins.

Prepared by the author, using data from SEC Filings

Although gross profitability did improve slightly in 2021 (see below), when compared to 2019, higher inflationary pressures in 2022 will likely put further pressure on margins. More importantly, lower gross margin consumer staple businesses would be in a worse position to cope with rising raw material prices which will have implications for overall return on capital.

Kraft Heinz Investor Presentation

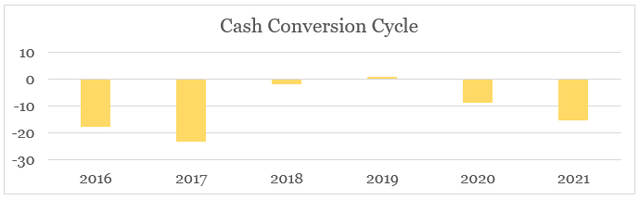

Lastly, the above 100% free cash flow conversion will likely be achieved by keeping capital expenditures low by outsourcing more manufacturing to third parties and by marginal improvements in working capital. Cash conversion cycle of the company has worsened significantly over the course of 2018 and 2019 but has been improving since the pandemic began and certain parts of the business were divested.

Prepared by the author, using data from SEC Filings

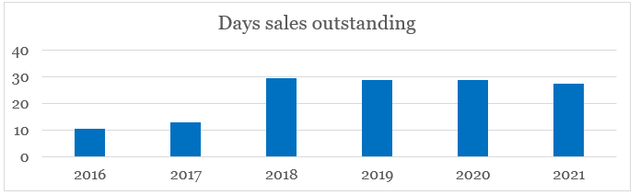

If we break down the cash conversion cycle on its components, we could see that days sales outstanding have improved (decreased) only slightly since 2018.

Prepared by the author, using data from SEC Filings

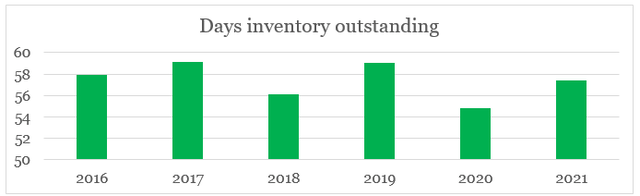

Inventories fluctuated since 2016, with days inventory outstanding remaining largely the same as it was back six years ago. Over the coming years, inventory turnover will likely experience headwinds as Kraft Heinz management continues to add new brands to its portfolio.

Prepared by the author, using data from SEC Filings

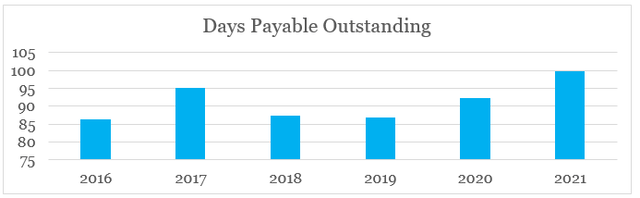

We could see that by far the largest contributor to working capital efficiency has been improvement (increase) of days payable outstanding, which went up from mid-80s to 100 in 2021.

Prepared by the author, using data from SEC Filings

The high level of DPO would likely be sustained, given the large size of Kraft Heinz and its significant bargaining power with suppliers, however, it is hardly a unique competitive advantage of Kraft Heinz.

Conclusion

Kraft Heinz’s low valuation relative to peers appears fully justified at this point in time. In recent years, management has pivoted towards new and higher growth product segments, while at the same time is divesting the underperforming parts of the business. Although this is likely the right step forward, it brings in additional risks for shareholders. The strategy to improve profitability and increase free cash flow does not provide any sustainable long-term solutions to improving gross margins and building new global brands in attractive product segments.

Be the first to comment