JHVEPhoto

Intro

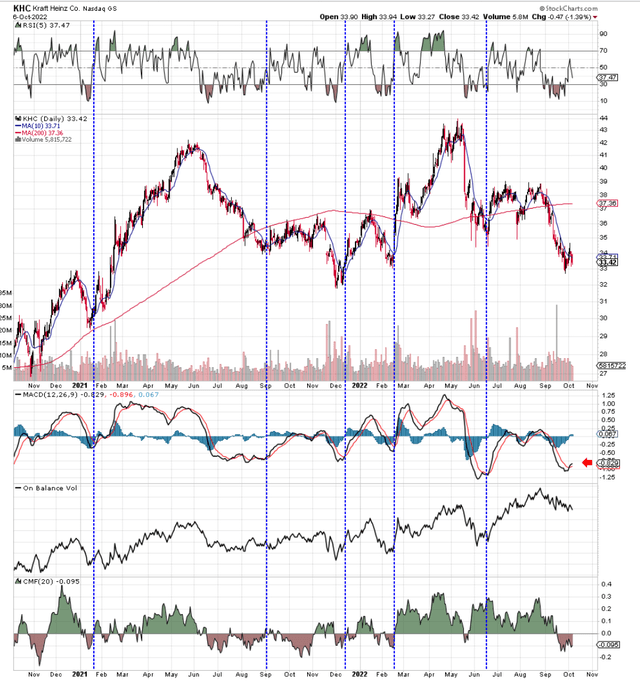

If we look at a 2-year chart of The Kraft Heinz Company (NASDAQ:KHC), we can see that shares have been making higher highs and higher lows, which is encouraging. Furthermore, shares have just given a buy signal through the popular MACD indicator, which is a solid read of both KHC’s momentum and its trend. As we can see from the chart, practically every time over the past 24 months when we have had a bullish MACD crossover in Kraft Heinz, a bullish rally to the upside ensued thereafter. Therefore a convincing move above $34 and the 10-day moving average ($33.85) would stack the odds in favor of a bullish move playing itself out once more.

Remember, chart patterns are essentially a study of human psychology which usually does not change. When shares are perceived to be oversold, investors tend to step in while, on the contrary, when the price is deemed to be overbought, participants begin to liquidate their holdings. Suffice it to say, regarding liquid plays such as Kraft Heinz where there is plenty of participants looking at the same share-price action, history tends to repeat itself far more often than many may believe.

Probably the biggest proponents of the above are dividend investors, and with inflation running at almost a double-digit clip, the hunt for yield has never been as important. Straight off the bat, when dividend growth stocks fall, their respective dividend yields rise. Kraft Heinz is now yielding 4.7%+ and its payout ratio currently comes in at 57%. Although the payout ratio offers us the fastest way of ascertaining whether the payout is sustainable, KHC’s profitability metrics in general as well as its valuation point to limited downside risk at this present moment in time.

KHC Technical Chart (Stockcharts.com)

Profitability

Although gross margins have slipped slightly over the past five years (34.3% 5-year average as opposed to 31.8% trailing twelve-month average), KHC’s net profit margin exceeds the industry average and has actually grown over the past 5 years (5.92% present trailing average compared to a 5 year average of 3.13%). Although a company’s gross margin metric is a crucial indicator as it usually demonstrates whether the company in question has a moat or not, Kraft Heinz’s share price will essentially move off its earnings growth. Therefore, seeing a higher net profit margin off a lower gross margin print means the company is getting its costs in order. This bodes well when growth will resume meaningfully at the firm.

Kraft Heinz Valuation

All of Kraft Heinz’s valuation multiples are trading below their 5-year comparables, as we can see below.

| Multiple | Current | 5-Year Average |

| Price To Earnings | 12.71 | 14 |

| Price To Sales | 1.60 | 1.98 |

| Price To Book | 0.85 | 0.94 |

| Price To Cash Flow | 12.71 | 13.91 |

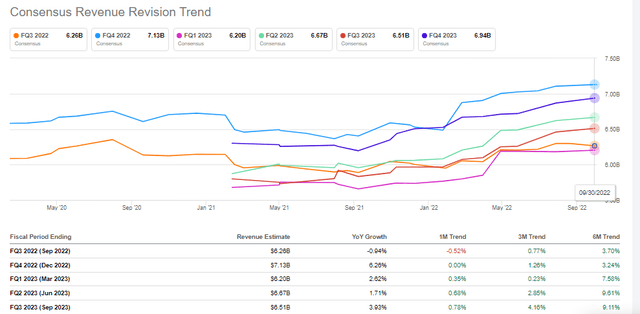

The company’s sales in particular have been revised up in recent sessions which is obviously bullish for bottom-line earnings given the company´s margin trends. As we can see below, forward-looking sales expectations continue to be revised to the upside. Cheap sales (Forward Sales multiple of 1.60) which are set to grow definitely should move the share price if indeed these projections can be met.

KHC Revenue Revisions Trend (Seeking Alpha)

Strategy

Implied volatility in Kraft Heinz comes in presently around the 33% mark for the November cycle, meaning it is trading well above its 12-month average. Since third-quarter earnings are expected to be announced on the 26th of this month, there is every possibility that implied volatility will keep increasing the closer we get to the announcement. Therefore, to take KHC´s binary event out of the equation, one could buy a regular October (Expiration on the 21st) debit spread (a combination of a long call and a further out-of-the-money call spread) once as mentioned, we see price rally above that $34 handle. This strategy in theory should take advantage of rising volatility as we head into earnings.

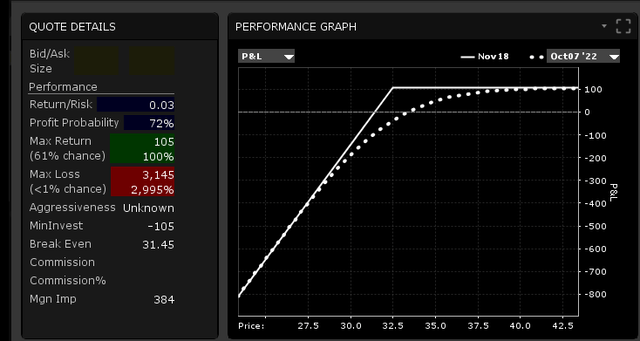

If one likes the stock, however, the play here would be to sell the stock’s rich volatility through earnings via something like a naked put. As we can see below, the $32.50 regular November 37 delta put option is trading for approximately $1.05 per contract and has a 72% chance of being profitable. Furthermore, this strategy lowers downside risk to $31.45 per share and would also enable the trader to defend the position by rolling down and out if needs be.

KHC Quote Details For Naked Put Sale In November Cycle (Interactive Brokers)

Conclusion

Kraft Heinz has registered a short-term buy signal through the MACD indicator, although we have yet to see the share price follow suit. Given that the phycology of dividend investors rarely changes where there is a deal on the table, we intend to ride this upward trend with them when indeed we confirm a bottom. We look forward to continued coverage.

Be the first to comment