lindsay_imagery

We see the potential that Kosmos Energy Ltd (NYSE:KOS) is making progress toward greater financial stability. It is a deepwater oil and gas exploration and production company.

In Q3 ’22, Kosmos reports more revenue, higher profits and EPS, and less debt. Management forecasts more of the same in Q4 ’22. We recommend holding shares and being cautious about taking a bullish position on one or two healthy quarters. Energy is a risky business and the current share price leaves us skittish.

World Problems Help Kosmos

We initiated a bullish position in April 2022. Over the last 12 months, the share price rose 104.5%. Kosmos reported excellent third-quarter results. It benefitted from higher energy global demand and prices this past year, and favorable sentiment. The consensus among analysts is a buy to strong buy of Kosmos shares. At the end of FY ’21, 15 funds held shares. By the end of Q2, 25 owned shares. The 52-week price reached $8.49.

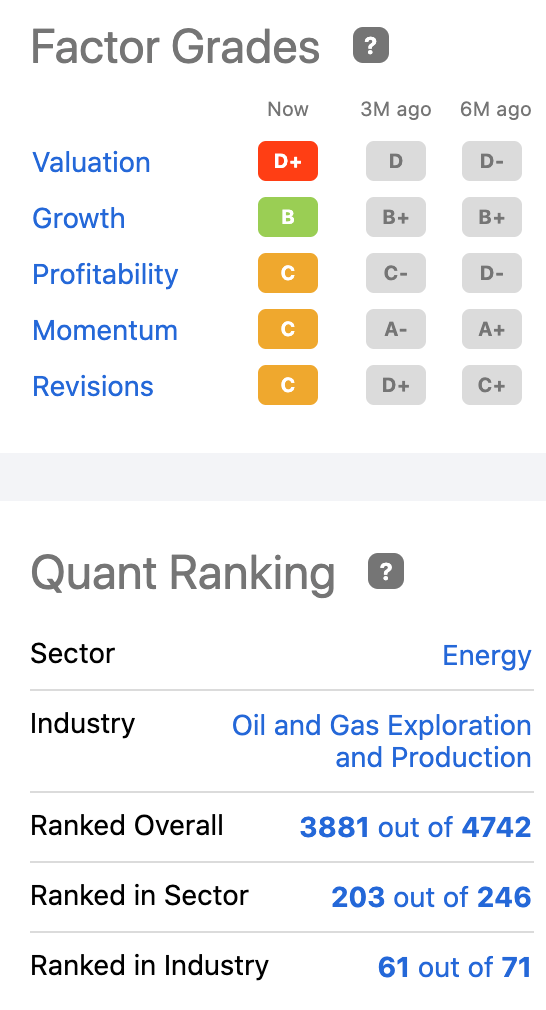

We recommend taking some profits. Wait for another dip in the share price before adopting an aggressive bullish position. Seeking Alpha’s Quant Rating on the stock remains a sell but tilts, since the beginning of November, toward a hold. The stock is volatile. Hedge funds began decreasing their holdings last quarter by +5M shares.

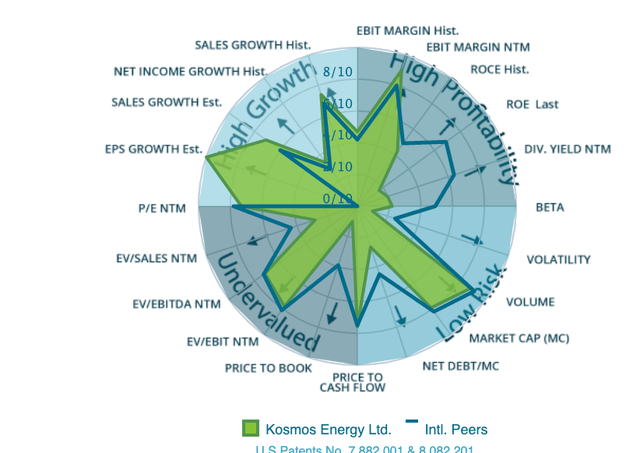

Kosmos Energy Assessment (infrontanalytics.com/fe-en/US5006881065/Kosmos-Energy-Ltd-/beta)

Risks

There are inimical risks for retail value investors in owning Kosmos Energy. The company is a minor player in a vast industry. It is more subject to global events and price fluctuations than big and diversified energy businesses. For example, the company has significant operations in some of the world’s poorest countries, Senegal, Guinea, and Ghana. Demand in Europe and Africa for LNG, oil, and natural gas, contracts are reportedly softening; demand is down 25% in parts of Africa.

The company has little to buffer it from the vicissitudes arising from internal chaos, climate issues like those delaying the company’s Greater Tortue Ahmeyim energy project, vagaries in global demand, price fluctuations, transportation costs, and supply chain issues that loom over the industry. Reports are circulating that China’s natural gas consumption is in decline as is its import quantities of LNG.

Gulf of Mexico drilling is at risk from political decision-makers. The Biden administration took office threatening environmentally dangerous oil and gas operations. The President recently reiterated his intent to ban new sites for offshore drilling. Change in momentum can happen that negatively affect current drilling and transport if a disaster occurs at any of the 6,000 drilling platforms in the Gulf.

Another risk to owning the stock is its historical volatility. The Beta is 1.23 meaning the shares a more volatile than the stock market. One year ago, Kosmos was ladened with debt and had no earnings. The stock underperformed for 5 years. The price fell 11.7%. Shares sold for $9.71 in September ’18 then dived to below $1 in 2020. We wondered if the company can stay in business even with a market cap pegged at $3B. It reported a $79M loss in FY ’21. The debt-to-equity ratio was +2x. The company’s price-to-book (TTM) earlier this year was 4.58, while the energy sector median is 2.02.

Quant & Factor Ratings (seekingalpha.com/symbol/KOS/ratings/quant-ratings)

Healthy Q3 and Outlook

Management stuck to their plans and produced healthy Q3 ’22 results. A summary from Seeking Alpha reports a Q3 Non-GAAP EPS of $0.19;revenue rose +127.4% Y/Y to $456.1M; the net capital expenditure for the third quarter of 2022 was approximately $203M. The company reports adjusted net income for Q3 of $90M or $0.19 per diluted share. This compares to -$0.11 EPS for the Q3 ’21. Free cash flow hit $32M and ~$320M in nine months. Management told shareholders it took advantage of the opportunity to pay down debt “falling to ~1.5x” or $2.1B of net debt. Available liquidity is today about $1B.

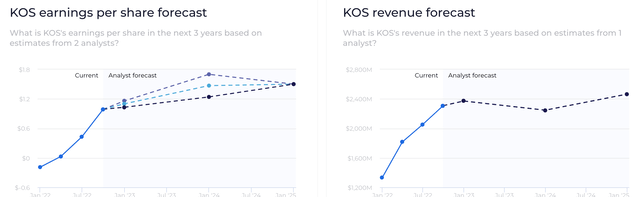

Earnings & Revenue KOS (wallstreetzen.com/stocks/us/nyse/kos/stock-forecast)

According to the CFO, the fourth quarter is going to be in line with Q3 results. We are cautious because of three caveats. The company has “floating debt costs” that potentially will eat at profits with higher interest rates. If the CFO is able to keep reducing the debt and cash flow holds as in Q3, interest costs will be flat in Q4.

A second concern is the status of the $4.8B Greater Tortue Ahmeyim Mauritania/Senegal offshore liquified natural gas project floating platform. It was damaged by a typhoon but is set for sail at the end of 2022.

Kosmos anticipates first gas around nine months post-sailaway…in the first half of 2023, with the first LNG set to follow around the back end of 2023,” Offshore-mag reports.

The third caveat for investors is that the short interest rate is creeping higher. It is 6.26% with about four days to cover. That needs to be watched.

Drill Down

Kosmos Energy seems like a potential opportunity since its turnaround. But one or two good quarters do not keep the light on in the attic. There is a potential opportunity for the average target share price to reach $10 if everything falls in the company’s favor in the next four months. Energy prices have to hold up. The global economy has to turn around. China has to free itself from COVID-19 lockdowns. Russia’s gas and oil supplies will affect what happens.

Kosmos management is planning to grow production by 50% by 2024. Progress depends on smooth sailing at three development projects. The sentiment is high among African energy ministers and Kosmos Energy is partnering with one of the big sisters. There is the potential a working relationship turns a partner into a suitor. Like love, there are risks but there are potential rewards that keep us interested in Kosmos Energy.

Be the first to comment