VioletaStoimenova

Published on the Value Lab 10/7/22

Whatever you might believe about what should be done, the labor market is peaking right now, with monetary authorities seeming sure that economic decline is better than inflation. Employment is at unsustainable levels at the moment, and those numbers are going to need to come down. In fact, we are already seeing the symptoms of a labor market top, and we don’t expect that companies that do professional and executive search like Korn Ferry (NYSE:KFY) are well positioned for the market reality. While their multiple is already quite rational, the direction looks rough. We’d stay on the sidelines instead of making a call about whether a fall in price is still coming.

Labor Market

The labor market is seeing still very low rates of unemployment. There are too many salaries being paid, and by Phillips Curve logic, long since thought dead, unemployment is needed to bring spending down and take pressure off a pained supply side. We have our thoughts about this, with unemployment being a difficult spiral to control making this move by monetary authorities ill-advised and likely a reaction to populist criticism. Nonetheless, unemployment is going to happen, and it’ll likely get somewhat out of control to the upside. We are already seeing some symptoms of that labor market top now.

Hiring freezes are happening to start the top-down move of reducing employment. In some sectors, especially those that have been particularly benefited from the pandemic, like technology and digital, layoffs are starting. Coinbase Global (COIN) is one of them, although that could be called a red herring where crypto markets are very correlated to the stock market. But other companies are also considering or have done layoffs. Gaming companies that have benefited from the pandemic are doing their layoffs, and bonus cuts are coming into the financial services industries as M&A activity subsides as well as ECM activity. Jobs continue to be added in the economy, but that could change in the next month.

Korn Ferry

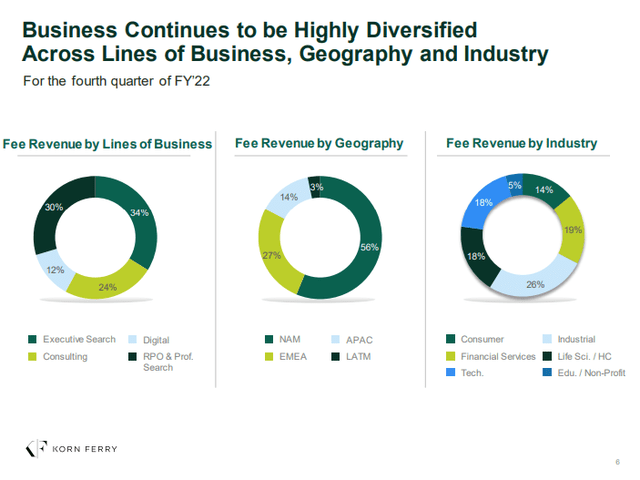

Korn Ferry is heavily exposed to hiring activity through its professional search segment in particular. Perhaps when you’ve applied for jobs recently, you’ve gone through Korn Ferry’s platform for digital interviews or aptitude tests as initial screening.

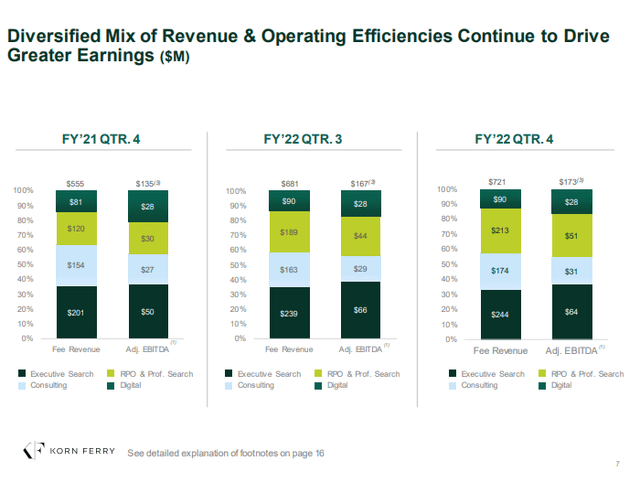

This RPO revenue and prof search revenue is important in the mix at 30%, with the other major category being executive search. While executive search might be a little more stable in a recession, there is still going to be less emphasis on hiring in this period, with the major RPO and prof search category at risk of giving out. This was the segment that saw the largest EBITDA growth YoY as of the lately reported Q4.

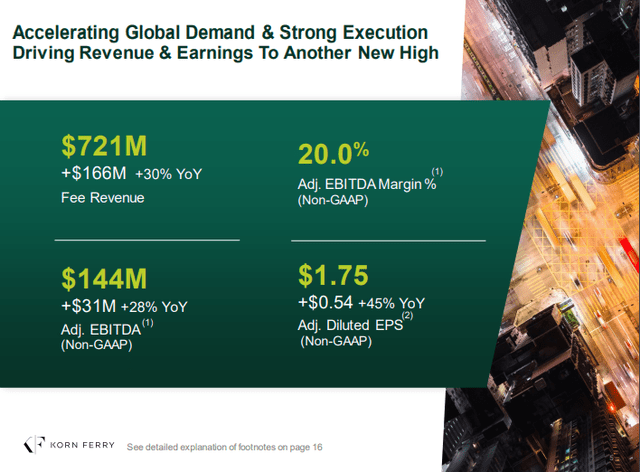

The Korn Ferry growth has been indeed impressive. However, these growth rates are coming from a full year of operation, where the Q4 still ended in a period where the economy was ebullient. It is only a small portion of the year where the rest was during one of the largest hiring sprees, especially in financial services which is a major KF market, in years if not decades.

KFY Financial Highlights (Q4 2022 Pres)

With the labor market at a top, we think that the KFY results could easily start turning around, too.

Conclusions

While the KFY stock price has come off highs as much as 20% from late 2021 highs, the recent convergence of factors making a recession rather inevitable is somewhat of a recent development that doesn’t seem to be taken into account as far as the KFY stock direction goes, as price performance since the beginning of 2022 has been relatively flat.

At 10x P/E does indicate a relatively rational multiple already, with some companies that work on a consulting basis and have similar economics as well as macroeconomic exposure are trading at much higher valuations. The consulting category as a whole trading at least 15x if not more.

However, the concern is in market direction. We would not like to weather a reversal in KFY fundamentals, since it is unsure if they are expected by current investors and a reversal is also rather likely. We don’t want to take a position where sentiment could turn meaningfully. Moreover, even if the multiple is already accounting for macro declines, it is unclear whether the vicious cycle of unemployment spiral would be considered by markets, it being inherently difficult to predict. Finally, with the multiple being at least fair, we don’t see the upside even if it does turn out to be a safe place to park money. We see no reason to risk capital here.

Be the first to comment