OLGA Zhukovskaya/iStock via Getty Images

In this modern age, the clothes that we wear have a significant impact on how we are perceived and, to some people, how we feel. Love it or hate it, this can have a lasting effect on the outcomes of our lives. One company dedicated to providing some popular brands of lifestyle apparel is Kontoor Brands (KTB). In recent years, however, the financial performance achieved by the firm has been somewhat lackluster. Revenue has suffered over an extended period of time and profits and cash flows have been volatile. Whether or not the company will prove to be an attractive prospect is something that only time will tell. But the good news is that, even in the event that financial performance does not improve as management is currently anticipating, shares are trading at levels that probably are not any worse off than being fairly valued. This results in limited downside should investors be wrong about this opportunity, so long as sales don’t resume their long-term decline.

A play on two key brands

Though the name Kontoor Brands may not enter your everyday lexicon, it’s likely that the two key lifestyle apparel brands the company owns are ones that you have heard of. One of these is Wrangler, and the other is Lee. The Wrangler brand has a history that is rooted in the western lifestyle of all things Americana. Products sold that bear this brand include, but are not limited to, denim jeans for both men and women, as well as denim and other tops. Other accessories are also sold that bear this brand name. Lee is also another American denim and apparel brand with an even longer operating history of 133 years. These also include a variety of denim products. But they also include T-shirts, khaki shorts, and more.

Although the brands owned by Kontoor Brands are largely focused on the American identity, they are sold to more than 70 countries across the globe. Combined, these brands sold around 152 million units of apparel during the company’s 2021 fiscal year. These sales took place largely through wholesale networks, as well as the company’s growing digital ecosystems. However, the business also does have some of its own branded brick-and-mortar locations that it operates.

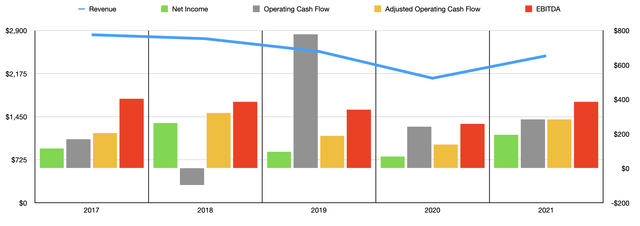

Over the past few years, the financial performance achieved by Kontoor Brands has been rather disappointing. Revenue dropped each year between 2017 and 2020, declining from $2.83 billion to $2.10 billion. Although some of this was attributable to the COVID-19 pandemic, nothing changes the fact that sales between 2017 and 2019 plunged by 9.9%. Fortunately for investors, the firm did post something of a recovery during the 2021 fiscal year. Overall revenue for the business jumped by 18%, climbing to $2.48 billion. Even with this increase, however, the firm does look to be on a steady path down. But management does not expect that to be permanent. In fact, for the 2022 fiscal year, the company is forecasting sales of around $2.7 billion. Much of this growth should be frontloaded into the first half of the current fiscal year, with the second half being somewhat weaker.

Just as revenue has been less than ideal, the same can be said of profitability. After seeing net income jump from $116.2 million in 2017 to $263.1 million in 2018, it then plunged to $67.9 million by 2020. In 2021, however, net profits came in at $195.4 million. Similar volatility can be seen when looking at cash flow for the business. Operating cash flow has been all over the map, ranging from a low point of negative $96.3 million in 2018 to a high point of $777.8 million in 2019. In 2021, it came in at $283.9 million. If we adjust for changes in working capital, the volatility dies down some. But it is still volatile nonetheless. After peaking at $320.8 million in 2018, it plunged to $138.3 million in 2020 before recovering to $283.6 million last year. Even EBITDA for the business has been volatile, with a low point over the past five years of $258.2 million and a high point of $404.1 million. Last year, this metric came in at $386.8 million.

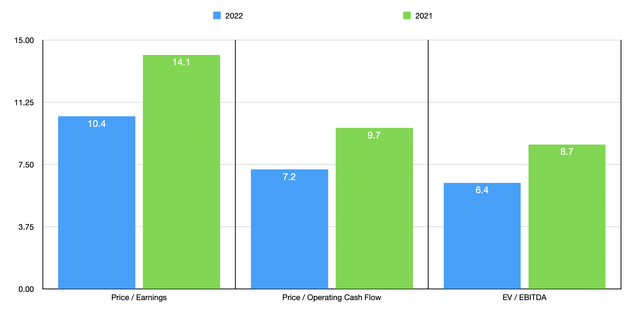

For the 2022 fiscal year, management anticipates earnings per share of between $4.65 and $4.75. At the midpoint, this would imply net profits of $264.1 million. Management provided no guidance when it came to other cash flow metrics. But if we assume that they will grow at the same rate that profits will grow, then operating cash flow should be around $383.3 million, while EBITDA should total around $522.8 million for the 2022 fiscal year. Taking this data, we can price the business. Using the 2022 estimates, shares are trading at a price to earnings multiple of 10.4. The price to adjusted operating cash flow multiple is even lower at 7.2. And the EV to EBITDA multiple is 6.4. At first glance, this all makes the company look rather cheap. However, if financial performance were to revert back to what we saw in 2021, these multiples would be slightly higher, coming in at 14.1, 9.7, and 8.7, respectively.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 7.5 to a high of 30.5. Two of the five prospects were cheaper than Kontoor Brands, while another was tied with it. This is all based on the 2021 comparison. The price to operating cash flow approach yielded a range of 6.5 to 15.3. In this case, two of the five prospects were cheaper than our target. Meanwhile, using the EV to EBITDA approach, the range was from 5.1 to 13.3. Here, three of the five companies were cheaper than Kontoor Brands.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Kontoor Brands | 14.1 | 9.7 | 8.7 |

| Canada Goose Holdings (GOOS) | 30.5 | 15.3 | 13.3 |

| Capri Holdings Limited (CPRI) | 15.4 | 10.8 | 12.9 |

| Oxford Industries (OXM) | 15.2 | 6.5 | 8.5 |

| Carter’s (CRI) | 12.1 | 15.1 | 6.7 |

| G-III Apparel Group (GIII) | 7.5 | 6.7 | 5.1 |

Takeaway

Truth be told, Kontoor Brands is a bit more complex than I would like to admit. At first glance, shares of the business look rather cheap. But then investors need to take into consideration the downward trend that revenue has experienced in recent years. If this were all we were dealing with, I would make the case that shares look to be more or less a value trap. But at the same time, we also see management guidance for a stronger 2022 fiscal year. If the firm can deliver on this and if they can prove that financial performance can at least remain flat thereafter, shares might offer some nice upside. Nobody knows what the future holds, but while some investors may be optimistic, I believe the best approach here is to be slightly cautious. Fortunately, the good thing is that, even if financial performance were to level off with what the company saw in 2021, shares are still trading at levels that would be considered generally appealing. It’s just that the company would likely not offer significant upside in that event. But it likely would not experience meaningful downside either. At the end of the day, this makes it a favorable risk to reward opportunity for cautious, value-oriented investors.

Be the first to comment